Bay Area

Community Banking to Community Building

At the heart of our business is the local community bank branch. But a local bank branch, especially in underserved neighborhoods, can be successful only when it fits the community’s needs. That’s why, over the last several years, we have shifted our approach from community banking to “community building” – a boots on the ground approach to better serve the needs of our local communities.

Activism

Oakland Post: Week of February 25 – March 3, 2026

The printed Weekly Edition of the Oakland Post: Week of – February 25 – March 3, 2026

Activism

Chase Oakland Community Center Hosts Alley-Oop Accelerator Building Community and Opportunity for Bay Area Entrepreneurs

Over the past three years, the Alley-Oop Accelerator has helped more than 20 Bay Area businesses grow, connect, and gain meaningful exposure. The program combines hands-on training, mentorship, and community-building to help participants navigate the legal, financial, and marketing challenges of small business ownership.

Activism

Oakland Post: Week of February 18 – 24, 2026

The printed Weekly Edition of the Oakland Post: Week of – February 18 – 24, 2026

-

Activism4 weeks ago

Activism4 weeks agoLife Expectancy in Marin City, a Black Community, Is 15-17 Years Less than the Rest of Marin County

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of January 28, 2025 – February 3, 2026

-

Activism3 weeks ago

Activism3 weeks agoCommunity Celebrates Turner Group Construction Company as Collins Drive Becomes Turner Group Drive

-

Business3 weeks ago

Business3 weeks agoCalifornia Launches Study on Mileage Tax to Potentially Replace Gas Tax as Republicans Push Back

-

Activism3 weeks ago

Activism3 weeks agoDiscrimination in City Contracts

-

Arts and Culture3 weeks ago

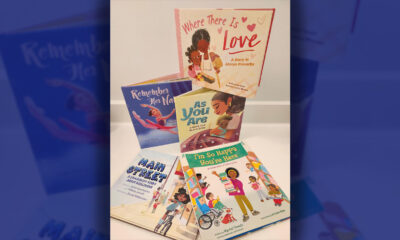

Arts and Culture3 weeks agoBook Review: Books on Black History and Black Life for Kids

-

Activism4 weeks ago

Activism4 weeks agoMedi-Cal Cares for You and Your Baby Every Step of the Way

-

Activism3 weeks ago

Activism3 weeks agoCOMMENTARY: The Biases We Don’t See — Preventing AI-Driven Inequality in Health Care