Bay Area

Chase Bank Executive Reveals Ways Bank Supports Black Community

In 2020, [JP Morgan] Chase announced its $30 billion racial equity commitment, a five-year plan that includes assisting entrepreneurs in historically underserved areas to access coaching, technical assistance and capital. Chase has also provided 15,000 loans to small businesses in diverse communities.

Honoring Black Achievement and Doubling Down on the Work to be Done During Black History Month and Beyond

February is Black History Month – an annual commemoration of the achievements of Black Americans and their remarkable impact on history. It’s a time to celebrate the cultural heritage shaped by generations of Black Americans, who for many decades have fought for equity – a fight that continues today.

Though advancements have been made, there is still so much work to be done in our communities in the pursuit of racial equity. For more on how JPMorgan Chase is honoring Black History Month, and how you can too, we sat down with Myesha Brown, Oakland Community Manager from the branch at 3005 Broadway, to discuss some impactful ways to celebrate and support the Black community, not just this month – but all year long.

Oakland Post: What type of investments is Chase making to bolster the financial health of its Black customers and communities?

Brown: Let’s first talk about Black History Month. We’re committed to driving real and sustainable change for the Black community here at Chase and around the world. We’re using this time to both reflect on the past, aswell as our commitment to build a more equitable future for all people.

From the way we do business to the policies we advocate for, our commitments are part of a continued effort to bring an enhanced equity lens to JPMorgan Chase’s businesses and how we serve all customers, clients, communities and employees.

And so, our work to support the Black community goes beyond banking. By providing growth opportunities for diverse-owned small businesses, increasing homeownership rates, providing better access to affordable housing and more, Chase is committed to helping close the racial wealth gap and driving economic inclusion. We’re also giving underbanked communities better access to the necessary resources to improve financial health.

But the work doesn’t stop there. Every day we collaborate with community partners, policymakers, customers and employees to continue improving the financial health of underrepresented communities.

Oakland Post: How is Chase helping to accelerate Black-owned businesses?

Brown: In 2020, Chase announced its $30 billion racial equity commitment, a five-year plan that includes assisting entrepreneurs in historically underserved areas to access coaching, technical assistance and capital. Chase has also provided 15,000 loans to small businesses in diverse communities.

Additionally, Chase offers a suite of helpful tools for Black and diverse-owned businesses. For example, we offer one-on-one counseling with a business banking professional, access to the Chase for Business Resource Center and membership to the JPMorgan Chase Supplier Diversity Network (SDN).

Oakland Post: What are some ways people can support the economic growth of the Black community?

Brown: Black History Month is a great reminder that, while some advancement has been made, there is room for improvement.

In February 2019, JPMorgan Chase launched Advancing Black Pathways (ABP) to strengthen the economic foundation of the Black community. ABP focuses on four key areas where there are racial and economic disparities that can create barriers to long-term financial success: careers and skills, business development, financial health and wealth creation, and community development.

These four key areas acknowledge the power and importance that entrepreneurship plays in the Black community Unfortunately, the racial wealth gap widened during the COVID-19 pandemic, with only 5% of Black Americans holding business equity — a key driver of wealth — compared to 15% of white Americans.

There are many impactful ways to support economic growth of Black Americans on local and national levels, during Black History Month and all year long. Consider these opportunities:

- Purchase a product from, or solicit the services of, a Black-owned business.

- Spread the word about your favorite Black-owned brands.

- Donate to a nonprofit that is working to advance racial equity.

- Follow a Black business on social media and engage with their posts to help build their online presence.

We know that owning a business represents the best path to the middle class. So, if we are to make meaningful progress in closing the racial wealth divide, entrepreneurship must be a key part of the equation. We can never lose sight of that dream.

Sponsored content from JPMorgan Chase & Co. To learn more about how Chase can guide your business to the right resources, please visit the following sites: Chase’s new program to empower diverse small businesses: https://www.chase.com/businessconsultant and Advancing Black Pathways: https://www.jpmorganchase.com/impact/people/advancing-black-pathways.

Activism

Oakland Post: Week of April 24 – 30, 2024

The printed Weekly Edition of the Oakland Post: Week of April 24 – 30, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

Alameda County

DA Pamela Price Stands by Mom Who Lost Son to Gun Violence in Oakland

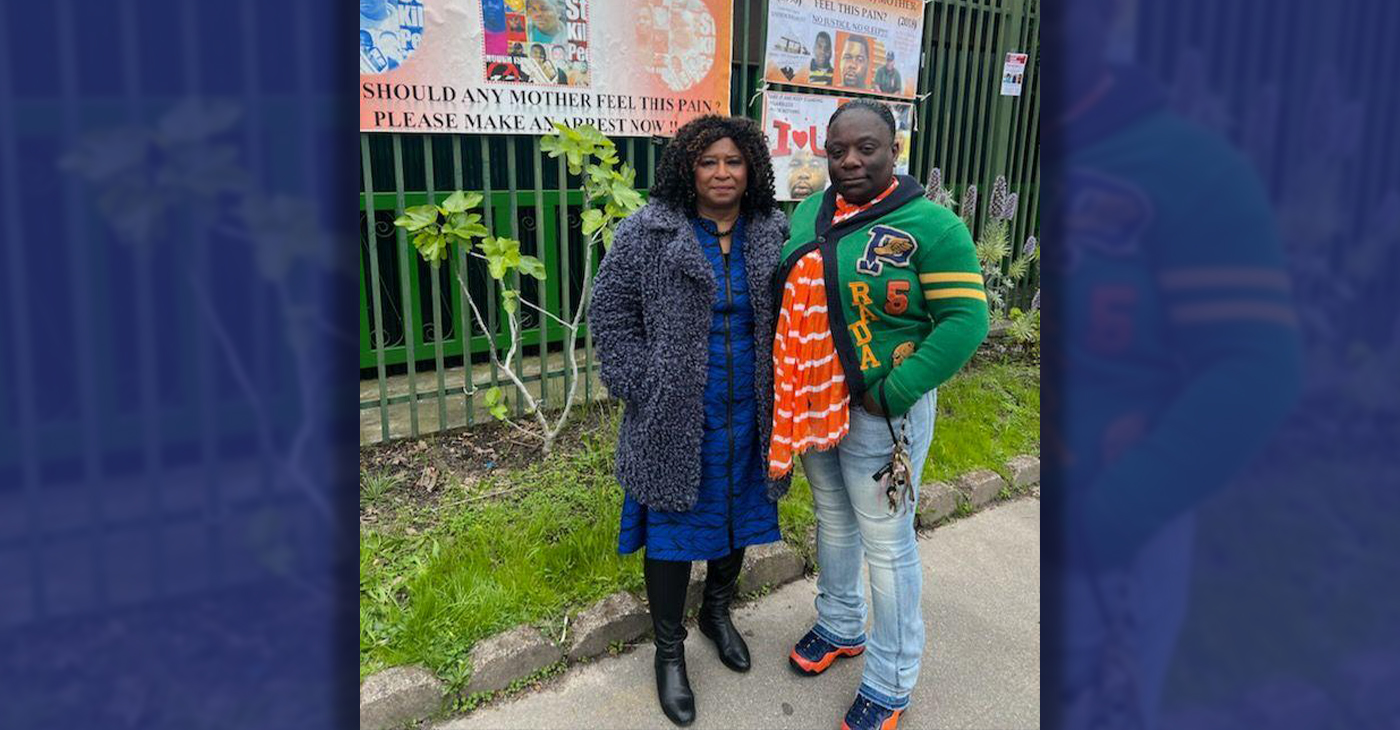

Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018.

Publisher’s note: Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018. The photo was too small for readers to see where the women were and what they were doing. Here we show Price and Jones as they complete a walk in memory of Scott. For more information and to contribute, please contact Carol Jones at 510-978-5517 at morefoundation.help@gmail.com. Courtesy photo.

Bay Area

State Controller Malia Cohen Keynote Speaker at S.F. Wealth Conference

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco. The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

By Carla Thomas

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco.

The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

“Our goal is to educate Black and Brown families in the masses about financial wellness, wealth building, and how to protect and preserve wealth,” said ABWA San Francisco Chapter President LaRonda Smith.

ABWA’s mission is to bring together businesswomen of diverse occupations and provide opportunities for them to help themselves and others grow personally and professionally through leadership, education, networking support, and national recognition.

“This day is about recognizing influential women, hearing from an accomplished woman as our keynote speaker and allowing women to come together as powerful people,” said ABWA SF Chapter Vice President Velma Landers.

More than 60 attendees dined on the culinary delights of Chef Sharon Lee of The Spot catering, which included a full soul food brunch of skewered shrimp, chicken, blackened salmon, and mac and cheese.

Cohen discussed the many economic disparities women and people of color face. From pay equity to financial literacy, Cohen shared not only statistics, but was excited about a new solution in motion which entailed partnering with Californians for Financial Education.

“I want everyone to reach their full potential,” she said. “Just a few weeks ago in Sacramento, I partnered with an organization, Californians for Financial Education.

“We gathered 990 signatures and submitted it to the [California] Secretary of State to get an initiative on the ballot that guarantees personal finance courses for every public school kid in the state of California.

“Every California student deserves an equal opportunity to learn about filing taxes, interest rates, budgets, and understanding the impact of credit scores. The way we begin to do that is to teach it,” Cohen said.

By equipping students with information, Cohen hopes to close the financial wealth gap, and give everyone an opportunity to reach their full financial potential. “They have to first be equipped with the information and education is the key. Then all we need are opportunities to step into spaces and places of power.”

Cohen went on to share that in her own upbringing, she was not guided on financial principles that could jump start her finances. “Communities of color don’t have the same information and I don’t know about you, but I did not grow up listening to my parents discussing their assets, their investments, and diversifying their portfolio. This is the kind of nomenclature and language we are trying to introduce to our future generations so we can pivot from a life of poverty so we can pivot away and never return to poverty.”

Cohen urged audience members to pass the initiative on the November 2024 ballot.

“When we come together as women, uplift women, and support women, we all win. By networking and learning together, we can continue to build generational wealth,” said Landers. “Passing a powerful initiative will ensure the next generation of California students will be empowered to make more informed financial decisions, decisions that will last them a lifetime.”

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 27 – April 2, 2024

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBeloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87

-

Community1 week ago

Community1 week agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 3 – 6, 2024

-

Business1 week ago

Business1 week agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 10 – 16, 2024