Bay Area

Opinion: April 10 is Property Tax Day

Greg McConnell

As the Coronavirus pandemic grinds on, state and local jurisdictions have enacted legislation aimed at softening the economic blow to workers, renters, and families. Measures include shoring up pay for workers, eviction moratoriums, limitations on rent increases, debt reduction, deferment or elimination, and more. Given the harsh economic consequences brought on by COVID-19, we believe these measures are necessary and appropriate.

However, while some relief is provided to tenants and small businesses, there is a group that suffers without significant help from their county governments. Homeowners, and small and large businesses have made major concessions, and in the process have incurred substantial losses, yet they get very little relief from the government when it comes to taxes.

At a recent meeting called to discuss rent limitations and eviction moratoriums, I asked a city council member, “we support protections for tenants, but can you ask the county to delay property taxes while the rent limitations are in effect?” The response was predictable. “No, we cannot delay taxes,” said the Council Member. “We need that money so the city can operate.” I responded, “everyone needs money so they can operate. How can the city ask everyone else to sacrifice, but refuse to make sacrifices itself?”

I would call this cavalier attitude shocking, but it is what I have come to expect from local government. Our leaders talk in great passionate language about everyone else sacrificing, but they do not. Former Council President Ignacio De La Fuente, called me the other night and asked, “if everyone else is suffering, why don’t our elected officials agree to donate half their salaries to COVID-19 relief programs? They should help the laid-off restaurant workers, help the nurses and other low to mid-income workers,” he said. Half their salaries won’t go too far, but why not share the misery as examples of leadership?

Back to taxes. Most of the counties have declined to delay taxes. They hide behind the excuse that only the state can delay Tax Day. However, San Francisco, under the steady leadership of Mayor London Breed, has ruled that the county is closed and therefore taxpayers need not pay property taxes until May 3. Why cannot Alameda, Contra Costa and other jurisdictions follow San Francisco’s leadership and creatively find ways to delay Tax Day.

If it is true that the state has the ultimate authority, why are not the Governor and our legislature passing laws and regulations to delay Tax Day? While counties could delay taxes under the closure rationale until May, the state could use the time to pass laws to delay Tax Day.

Recently, the California Judicial Council issued an emergency rule that prevents residential evictions, no matter the reason, for 90 days after the state-of-emergency has been lifted. If 90 days is good reprieve time for tenants, then give taxpayers 90 days delay on their taxes.

Requiring tax payments while tenants and small businesses are not paying rent is especially problematic for small property owners who have little, or no, cash reserves, and even for larger property owners that may exhaust their reserves during the pandemic. We are greatly concerned that these people may be forced out of business, with the result that even when the virus has dissipated, there will be significantly fewer places for people to work and live.

To his credit, Alameda County Treasurer-Tax Collector, Henry Levy has indicated a preference to liberally apply relief from late fees and interest for Alameda County residents who cannot pay their taxes on April 10. But that is not good enough, we need clear rules that say that taxes are not due.

If everyone else must tighten their belts, so too must cities, counties and the state. April 10 should not be Tax Day!

Greg McConnell is the President and CEO ofThe McConnell Group.

Activism

Oakland Post: Week of April 24 – 30, 2024

The printed Weekly Edition of the Oakland Post: Week of April 24 – 30, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

Alameda County

DA Pamela Price Stands by Mom Who Lost Son to Gun Violence in Oakland

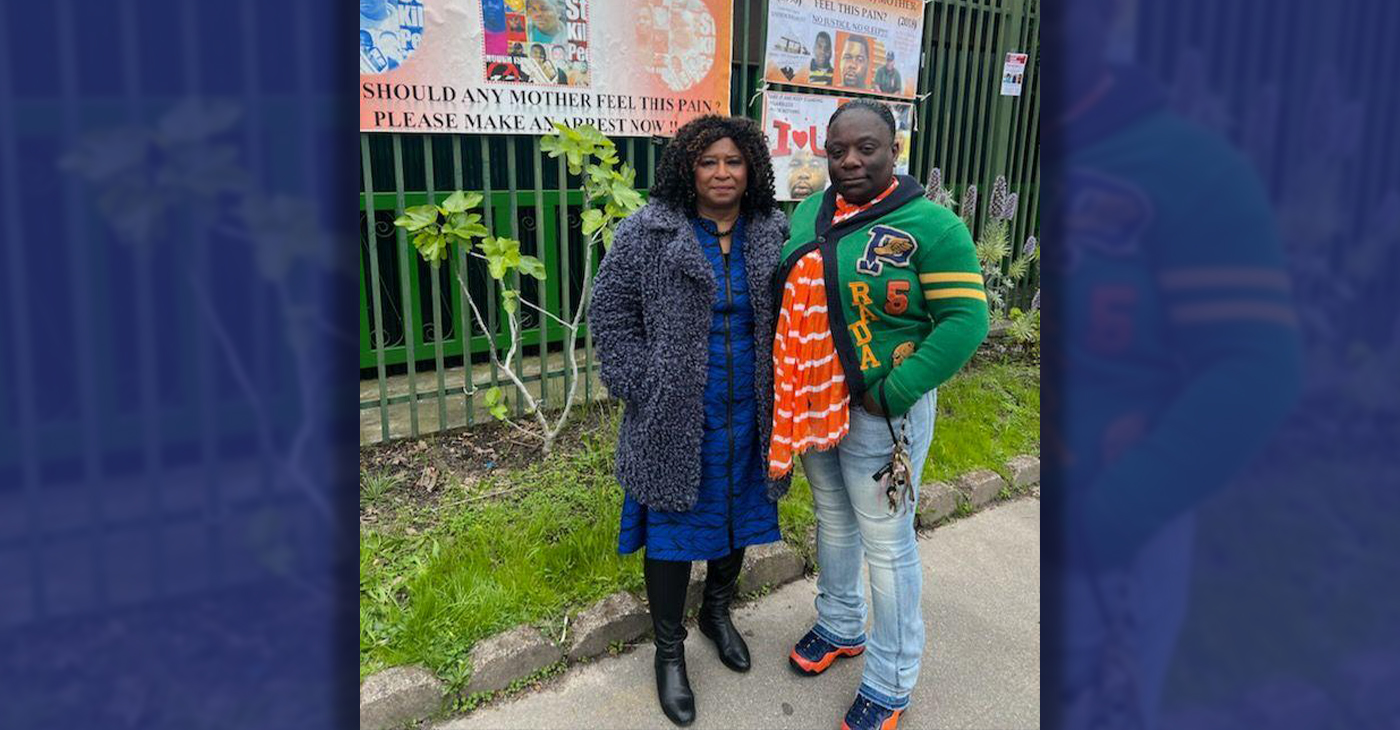

Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018.

Publisher’s note: Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018. The photo was too small for readers to see where the women were and what they were doing. Here we show Price and Jones as they complete a walk in memory of Scott. For more information and to contribute, please contact Carol Jones at 510-978-5517 at morefoundation.help@gmail.com. Courtesy photo.

Bay Area

State Controller Malia Cohen Keynote Speaker at S.F. Wealth Conference

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco. The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

By Carla Thomas

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco.

The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

“Our goal is to educate Black and Brown families in the masses about financial wellness, wealth building, and how to protect and preserve wealth,” said ABWA San Francisco Chapter President LaRonda Smith.

ABWA’s mission is to bring together businesswomen of diverse occupations and provide opportunities for them to help themselves and others grow personally and professionally through leadership, education, networking support, and national recognition.

“This day is about recognizing influential women, hearing from an accomplished woman as our keynote speaker and allowing women to come together as powerful people,” said ABWA SF Chapter Vice President Velma Landers.

More than 60 attendees dined on the culinary delights of Chef Sharon Lee of The Spot catering, which included a full soul food brunch of skewered shrimp, chicken, blackened salmon, and mac and cheese.

Cohen discussed the many economic disparities women and people of color face. From pay equity to financial literacy, Cohen shared not only statistics, but was excited about a new solution in motion which entailed partnering with Californians for Financial Education.

“I want everyone to reach their full potential,” she said. “Just a few weeks ago in Sacramento, I partnered with an organization, Californians for Financial Education.

“We gathered 990 signatures and submitted it to the [California] Secretary of State to get an initiative on the ballot that guarantees personal finance courses for every public school kid in the state of California.

“Every California student deserves an equal opportunity to learn about filing taxes, interest rates, budgets, and understanding the impact of credit scores. The way we begin to do that is to teach it,” Cohen said.

By equipping students with information, Cohen hopes to close the financial wealth gap, and give everyone an opportunity to reach their full financial potential. “They have to first be equipped with the information and education is the key. Then all we need are opportunities to step into spaces and places of power.”

Cohen went on to share that in her own upbringing, she was not guided on financial principles that could jump start her finances. “Communities of color don’t have the same information and I don’t know about you, but I did not grow up listening to my parents discussing their assets, their investments, and diversifying their portfolio. This is the kind of nomenclature and language we are trying to introduce to our future generations so we can pivot from a life of poverty so we can pivot away and never return to poverty.”

Cohen urged audience members to pass the initiative on the November 2024 ballot.

“When we come together as women, uplift women, and support women, we all win. By networking and learning together, we can continue to build generational wealth,” said Landers. “Passing a powerful initiative will ensure the next generation of California students will be empowered to make more informed financial decisions, decisions that will last them a lifetime.”

-

Community2 weeks ago

Community2 weeks agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of April 3 – 6, 2024

-

Business2 weeks ago

Business2 weeks agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Community2 weeks ago

Community2 weeks agoAG Bonta Says Oakland School Leaders Should Comply with State Laws to Avoid ‘Disparate Harm’ When Closing or Merging Schools

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 10 – 16, 2024

-

Community2 weeks ago

Community2 weeks agoOakland WNBA Player to be Inducted Into Hall of Fame

-

Community2 weeks ago

Community2 weeks agoRichmond Nonprofit Helps Ex-Felons Get Back on Their Feet

-

Community2 weeks ago

Community2 weeks agoRPAL to Rename Technology Center for Retired Police Captain Arthur Lee Johnson