Advice

Pandemic Takes Heavy Toll on Children’s Mental Health

Michelle Cabrera, executive director of the County Behavioral Health Directors Association (CBHDA), spotlighted the health needs of minority youth. She explained that all over the nation — and in California — youth are suffering from a mental health crisis, leading to increasing numbers of suicide and high levels of anxiety in schools.

By Charlene Muhammad | California Black Media

The COVID-19 pandemic is taking a heavy toll on the health, finances, and mobility of people around the world, affecting almost everyone on the planet.

Youth, in particular, have been experiencing an uptick in mental health cases, including depression, in a trend U.S. Surgeon General Vivek Murthy is calling an emerging crisis.

On December 7, Murthy released a 42-page health advisory drawing the country’s attention to the “urgent” need to help youth facing mental health problems. He said 1 in 3 students in the U.S. say they experience sustained periods of sadness and hopelessness. That number represents a 40% increase from 2009 to 2019.

The pandemic has made those conditions worse.

“The future wellbeing of our country depends on how we support and invest in the next generation,” said Murthy. “Especially in this moment, as we work to protect the health of Americans in the face of a new variant, we also need to focus on how we can emerge stronger on the other side. This advisory shows us how we can all work together to step up for our children during this dual crisis.”

Recently, a panel of experts tackled the issue during a news briefing organized by Ethnic Media Services titled “The Pandemic’s Heavy Toll on Teen Mental Health.”

Michelle Cabrera, executive director of the County Behavioral Health Directors Association (CBHDA), spotlighted the health needs of minority youth. She explained that all over the nation — and in California — youth are suffering from a mental health crisis, leading to increasing numbers of suicide and high levels of anxiety in schools.

“The numbers of children and youth in acute mental health crises shot up two and sometimes three-fold. We have had children as young as 8 years old who have been hospitalized due to suicidal ideation,” stated Cabrera.

Behavioral health experts say transitioning students back to in-person learning results in higher rates of children and youth experiencing mental health crises, she said.

According to Cabrera, existing programs lack support for youth in Black and Native populations, and records show that major disparities are also present among professionals within the behavioral health field.

“For example, the access to services and programs that may be used in white communities to combat mental health problems are not made available in Black communities,” she said.

Cabrera mentioned that there is also a career crisis in behavioral health, and that by 2022, these benefits will be put in place to help abate the employment crisis in California and all over the nation.

“The pandemic has also changed the statistics about drug and substance abuse in America,” Cabrera continued. “Data has shown an increase in alcohol and opioid consumption in young people, who are also experiencing a lot more overdoses because of their consumption of fentanyl in the drugs that are used,” she said.

Youth also struggle with returning to school physically, bullying, and a lack of programs to address their mental health issues.

Dr. Latonya Wood is the director of clinical training at Pepperdine University in Malibu. She delved specifically into the data about Black children who are suffering from mental health-related issues. She explained that depression is being expressed and understood differently among Blacks.

For example, young Black males interpret their emotions and mental conditions differently. They may not act in ways that are typically associated with depression, such as sadness or melancholy. Black youth typically translate those emotions into aggression and more physical reactions.

In addition, the pandemic has amplified some of the disconnections in the Black community, said Dr. Wood. She explained that there has not been consistent help in public health organizations that serve Black communities.

“Seldomly, there is relatability to the Black community. So African Americans are going to be lacking resources because they don’t know how to reach them,” she said.

Wood said, historically, Black people have not had a reason to fully trust mental health providers. A recent survey asked a group of Black youth about mental health care during COVID. It found that Black youth do not feel like mental healthcare providers care for them, that they only want money, and they do not understand the lived experiences, according to Dr. Wood.

“I think that really reflects the lack of culturally informed and trauma-informed care and really understanding the experiences of Black youth in some ways were traumatic during COVID,” said Wood.”

More Black people are seeking Black providers, but they number just short of about 4% of the psychologists in America, according to a 2020 Workforce Study, completed by the American Psychological Association, she continued.

As a result, Black people suffer usually long wait times to even be seen by a therapist or to receive care. Wood stressed that finding the right care for people dealing with mental disorders in the Black community is very important.

Solutions for these issues were suggested at the level of community-based care provided at places where people congregate like school, church, and the barbershop, among others. Those spaces can serve as supportive venues where mental health care or interventions can be accessible.

“The youth need support systems in place in order to help guard against the extreme negatives that come with poor mental health,” said Wood.

Activism

Leading with Action, Love and Data Points: Six Questions for the California Black Women’s Collective

“Black Women in California have always had to be active participants in the labor market, but this report showcases the need for fair and just wages even for those of us with higher educational attainment,” said Kellie Todd-Griffin, President and Chief Executive Officer of the California Black Women’s Collective.

By Edward Henderson | California Black Media

The California Black Women’s Collective (CABWC) is a sisterhood of women from different professional backgrounds aiming to uplift and address the issues impacting Black women and girls in the state. They approach problem-solving with a range of expertise — from politics, business, and community advocacy to the arts, entertainment, social justice activism, and more.

Earlier this month, the organization released a wage report focused on Black women’s earnings in California titled “Pay Me What I am Worth.”

“Black Women in California have always had to be active participants in the labor market, but this report showcases the need for fair and just wages even for those of us with higher educational attainment,” said Kellie Todd-Griffin, President and Chief Executive Officer of the California Black Women’s Collective.

“Black Women in California wages are below the state mean wage and make less than most of their female counterparts in every category,” continued Todd-Griffin. “We must take action now.”

CABWC’s Black Girl Joy Festival is an event designed to uplift Black Women and Girls in a safe space while learning and having fun. The festival includes free workshops that prepare women for college, dancing, self-defense training, health screenings, yoga, arts & crafts, and food vendors.

The Collective’s Empowerment Institute, launched in collaboration with the Los Angeles-based research firm EVITARUS, produces the annual California Black Women’s Quality of Life Survey.

California Black Media spoke with Todd-Griffin about the organization’s impact, challenges it faces and some of its near-term plans.

What does your organization do to improve the lives of Black people in California?

The California Black Women’s Collective Empowerment Institute’s uplifts the issues and voices of Black Women and Girls in California through our programming. That includes the Black Women’s Worker Initiative that helps Black Women prepare for public section and non-traditional careers. Other initiatives are the CA Black Women’s Leadership Development Certificate program at CSU Dominguez Hills; Black Girl Joy Festival for middle and high school students; Conversations for Black Women, etc. Our targeted research also uncovers solutions to the toughest challenges Black women and girls face.

What was your greatest success over the course of the last year?

We released the first-ever California Black Women’s Quality of Life Survey. This study collected insights from 1,258 Black women voters across California to understand their economic state, most pressing concerns, their attitudes toward policymakers, and their experiences and issues in California.

In your view, what is the biggest challenge Black Californians face?

Black Californians, especially Black Women, continue to be left out of the conversation when it comes to building meaningful change to improve the lives of those who struggle the most.

What was your organization’s biggest challenge?

Our biggest challenge over the last year was transitioning from a volunteer driven entity, the California Black Women’s Collective, to creating a non-profit organization, the California Black Women’s Collective Empowerment Institute.

Does your organization support or plan to get involved in the push for reparations in California?

Absolutely!

How can more Californians of all backgrounds get involved in the work you’re doing?

We are on all the social media channels. They can also visit our website, www.CABlackWomensCollective.org.

Activism

The Silent Struggle of Pregnancy Loss

It is a tragedy that Black women’s odds of pregnancy loss are much higher than the general population. It’s even more tragic that there is a Black woman reading this article who has experienced pregnancy loss and has suffered in silence. There are an array of feelings associated with pregnancy loss, and women often feel alone and isolated in these feelings believing that no one understands what they are going through.

By Narissa Harris, LMFT

The topic and contents of this article may be difficult for some readers. Yet, it is of paramount importance to shed light on the silent struggle of pregnancy loss experienced by countless women.

During the holiday season, we often assume everyone is in a festive, happy mood. However, this time of year is filled with mixed emotions and can be especially difficult for Black women, who are 2-3 times more likely to experience a pregnancy loss compared to other women. Pregnancy loss (the death of an unborn baby/fetus during pregnancy) is experienced by 10-15% of women and doubles to 20-30% for Black women. Additionally, Black women are 3 times more likely to have a stillbirth in comparison to other women.

It is a tragedy that Black women’s odds of pregnancy loss are much higher than the general population. It’s even more tragic that there is a Black woman reading this article who has experienced pregnancy loss and has suffered in silence. There are an array of feelings associated with pregnancy loss, and women often feel alone and isolated in these feelings, believing that no one understands what they are going through.

Whether you are aware that someone has experienced pregnancy loss, or you have experienced pregnancy loss yourself, we must be sensitive and supportive to the women in our lives during this time of year. I encourage the following:

#1 – Don’t ask a woman about her uterus!

Yes, I know this is blunt and harsh, but it is important to be mindful of the trauma that may be triggered when asking a woman when she plans to have a baby. I will never forget being at a holiday party when a family member asked me when I was planning on having kids, unaware that I experienced my 3rd pregnancy loss just 6 weeks prior. It was triggering, upsetting, and annoying. While my husband and I were eventually blessed with 2 healthy children, I share my experience to reiterate the immediate and long-term harm caused by these types of invasive inquiries.

#2 – Connect with a supportive community!

If you are someone who has experienced a pregnancy loss or know a woman who has, it is vital to connect with a safe and supportive community even when everything is telling you (or that woman) to isolate. While no one in the chapter knew that I was dealing with pregnancy loss at the time, my connection with the Bay Area Chapter of the Association of Black Psychologists (Bay-ABPsi) served as a healing and uplifting space for my grief/loss. I learned from Baba Dr. Wade Nobles, who describes babies as divine and the closest beings to God. I want you to remember that connecting with our spiritual community and ancestors can offer healing and support.

#3 – Never lose hope!

To the women who have experienced pregnancy loss, it’s easy to believe that a successful pregnancy will not happen but keep the hope. Take the time you need to grieve and release the baby (or babies), allowing your womb to heal. View the lost pregnancy in terms of a spirit with a Divine purpose, even if it was short-lived, with you being the vessel for that Divine purpose. Believe and prepare for your baby, who will survive and succeed beyond the womb to fulfill their Divine purpose!

Bay ABPsi is a healing resource committed to providing the Post Newspaper readership with monthly discussions about critical issues in Black Mental Health. Readers are welcome to contact us at bayareaabpsi@gmail.com and join us at our monthly chapter meetings every 3rd Saturday via Zoom.

Advice

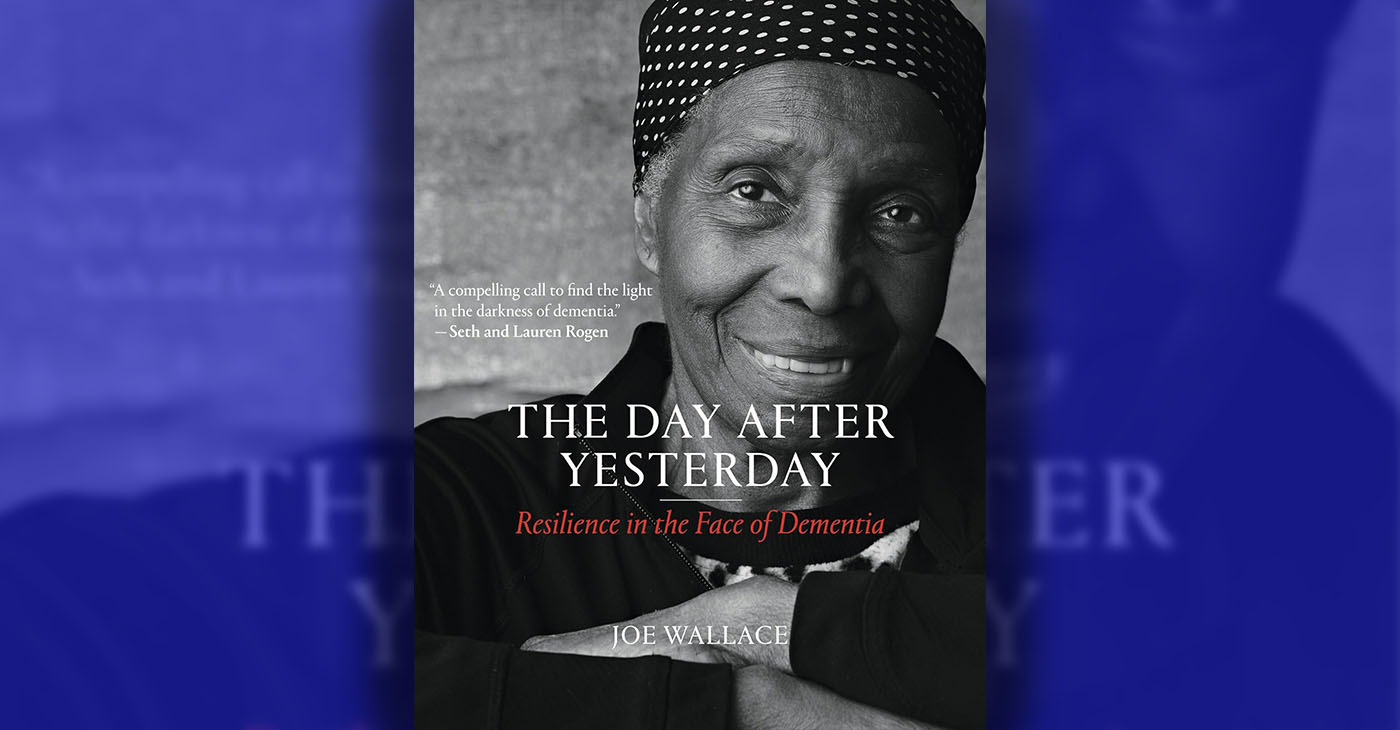

BOOK REVIEW: “The Day After Yesterday: Resilience in the Face of Dementia”

Well into his twenties, Joe Wallace was asked to sit with his “Granddaddy Joe” while Wallace’s mother and grandmother ran errands. His grandfather was once a vibrant man, and he’d been Wallace’s “hero,” but Alzheimer’s had put a curtain of sorts between them, and Wallace was “so frightened to be left alone with him.” It didn’t take long for him to realize that day that his grandfather was full of stories, and it was “magical.” He applied the same kind of patience when his grandmother began to experience dementia, too, and this spurred Wallace to tell a story of his own with his camera.

By Terri Schlichenmeyer

Sometimes, Mom talks a lot of nonsense.

She talks in random syllables, half-jokes, thoughts that come out of her mouth backwards or mixed up. You try, she laughs, you laugh, pretending that you understand but you don’t. Mom has dementia and there’s nothing that’ll fix it, but you can read “The Day After Yesterday” by Joe Wallace and change the conversation.

Talk about your awkward encounters.

Well into his twenties, Joe Wallace was asked to sit with his “Granddaddy Joe” while Wallace’s mother and grandmother ran errands. His grandfather was once a vibrant man, and he’d been Wallace’s “hero,” but Alzheimer’s had put a curtain of sorts between them, and Wallace was “so frightened to be left alone with him.”

It didn’t take long for him to realize that day that his grandfather was full of stories, and it was “magical.” He applied the same kind of patience when his grandmother began to experience dementia, too, and this spurred Wallace to tell a story of his own with his camera.

The portraits he captured eventually became an exhibit, and this book.

“In the United States,” Wallace says, “one in three seniors suffers with Alzheimer’s or another dementia at the time of their death.” Nearly $700 billion dollars annually is spent caring for people with dementia. Alzheimer’s, as one of Wallace’s subjects points out, affects Black seniors more often than it does whites. For that matter, people with dementia need not be seniors: early-onset Alzheimer’s can affect someone in their early 20s.

Listen, Wallace’s subjects almost always say, and don’t hide a diagnosis of dementia. There’s no shame in it. Reach out to others who’ve received the diagnosis. Ask for help. Watch for suicidal thoughts and depression. Ask for stories, before they’re lost, and be honest about what’s going on. You can’t change the diagnosis, but you can change your attitude toward it.

It’s called The Long Goodbye for a reason – and yet, your loved one with dementia is still on this side of the sod and you know there’s still some there there. In “The Day After Yesterday,” you’ll get a new point-of-view, for both of you.

In his introduction interview, author Joe Wallace explains how he came to understand that “we could all do so much better” for those with cognitive disabilities, including Alzheimer’s, and why eliminating fear and awkwardness is essential. Readers will be quite taken by the then-and-now pictures and by the conversations Wallace captured.

But beware: this isn’t a book on caregiving or advice-giving. It’s a delightful, heartbreaking, tearful, surprising collection of profiles of everyday people in their own words, people who go with the flow and deal with tomorrow when it comes. Yes, you’ll find advice here, but it pales in comparison to the presence that Wallace’s subjects and their families exhibit.

This powerful book is great for someone with a new dementia diagnosis; it proves that life is not over yet. It’s likewise great for a caregiver, gently ushering them toward grace.

Get “The Day After Yesterday. It’s time for a talk.

“The Day After Yesterday: Resilience in the Face of Dementia” by Joe Wallace

c.2023, The MIT Press. $34.95; 157 pages.

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 20 – 26, 2024

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoCOMMENTARY: Lady Day and The Lights!

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoFrom Raids to Revelations: The Dark Turn in Sean ‘Diddy’ Combs’ Saga

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoBaltimore Key Bridge Catastrophe: A City’s Heartbreak and a Nation’s Alarm

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoBaltimore’s Key Bridge Struck by Ship, Collapses into Water

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of March 27 – April 2, 2024