Bay Area

Opinion: Recovering from Covid-19 With Public Banking

The response to COVID-19 has laid bare, once again, the glaring economic inequalities we live with every day. An essential new institution is public banking — new to most of us in America, but a proven institution globally for the past few hundred years.

If cities had public banks, they would be able to multiply their impact by leveraging the bank’s capital. This would allow cities to quickly and efficiently deploy recovery efforts, distribute assistance and make low-interest loans to small- and medium-sized businesses to help them get back on their feet.

The COVID-19 crisis is likely to last for many months or years, bringing about profound changes to our society. While many may wish for a rapid return to “normal,” let us remember what has been “normal” in the past:

• People drowning in debt to pay medical bills, fund college educations, and simply survive;

• Global climate crisis glaring at us with rapidly melting glaciers, fires, droughts and tumultuous floods;

• Rampant numbers of unhoused living on the streets;

• Thousands at risk of losing their homes to evictions and foreclosures;

• 40 million Americans living below the poverty line, with 40% unable to weather a $400 financial emergency.

In 2019, the California Public Banking Alliance ushered through the California Legislature historic legislation, AB 857, the Public Banking Act. This law allows municipalities across the state to set up public banks in their communities. What does this have to do with COVID-19 or other disasters that may strike?

If public banks existed today, they would be a ready source of funds in our communities to help people and businesses sustain themselves through these hard times and rebuild. Public banks, like all banks, are able to multiply the impact of the dollars on deposit through making multiple loans. They provide the most efficient means of expeditiously deploying scarce funds into the community. If cities had public banks, they would be able to multiply their resources quickly to help with recovery efforts.

Public banks offer other important benefits Wall Street banks are unable to deliver. Public bankers are local and accountable to the people that live in their communities. They are more responsive to those most in need following disasters. If there were public banks in our communities today, rescue funds from the Federal Reserve Bank would be distributed through them focused on rebuilding communities rather than rebuilding astronomical profits of Wall Street banks.

Public banks will invest funds into making communities more resilient to disasters. They will be obligated to fund affordable housing minimizing the number of unhoused who are most vulnerable. Public banks will be responsive to community demands for capital improvements such as hospitals and community clinics to provide accessible healthcare for daily needs, as well as for disaster preparedness.

Public banking will enable a return to conservative banking practices focused on realistic projects that build communities, rather than risky, remote projects, like drilling for oil in the Arctic, that may reap huge financial profits but entail enormous environmental costs and entail huge financial risk.

Financing investments for sustainable energy production, conservation and delivery may not be sexy with extraordinary returns, but it is financially secure and environmentally sound. Political leaders must use emergency powers to rapidly create public banks able to rebuild resilient communities capable of thriving in a “new normal” future.

Alameda County

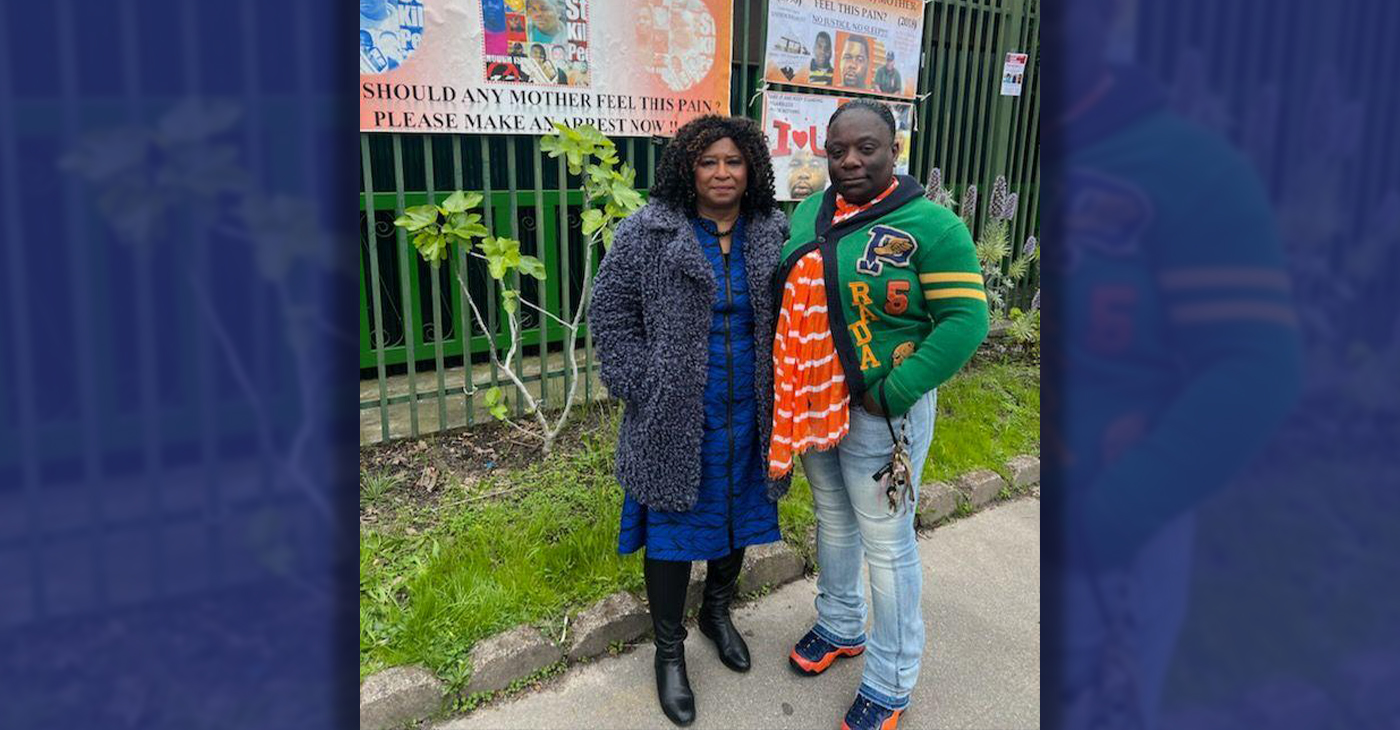

DA Pamela Price Stands by Mom Who Lost Son to Gun Violence in Oakland

Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018.

Publisher’s note: Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018. The photo was too small for readers to see where the women were and what they were doing. Here we show Price and Jones as they complete a walk in memory of Scott. For more information and to contribute, please contact Carol Jones at 510-978-5517 at morefoundation.help@gmail.com. Courtesy photo.

Bay Area

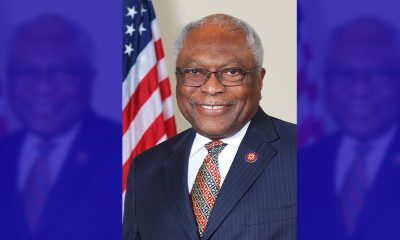

State Controller Malia Cohen Keynote Speaker at S.F. Wealth Conference

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco. The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

By Carla Thomas

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco.

The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

“Our goal is to educate Black and Brown families in the masses about financial wellness, wealth building, and how to protect and preserve wealth,” said ABWA San Francisco Chapter President LaRonda Smith.

ABWA’s mission is to bring together businesswomen of diverse occupations and provide opportunities for them to help themselves and others grow personally and professionally through leadership, education, networking support, and national recognition.

“This day is about recognizing influential women, hearing from an accomplished woman as our keynote speaker and allowing women to come together as powerful people,” said ABWA SF Chapter Vice President Velma Landers.

More than 60 attendees dined on the culinary delights of Chef Sharon Lee of The Spot catering, which included a full soul food brunch of skewered shrimp, chicken, blackened salmon, and mac and cheese.

Cohen discussed the many economic disparities women and people of color face. From pay equity to financial literacy, Cohen shared not only statistics, but was excited about a new solution in motion which entailed partnering with Californians for Financial Education.

“I want everyone to reach their full potential,” she said. “Just a few weeks ago in Sacramento, I partnered with an organization, Californians for Financial Education.

“We gathered 990 signatures and submitted it to the [California] Secretary of State to get an initiative on the ballot that guarantees personal finance courses for every public school kid in the state of California.

“Every California student deserves an equal opportunity to learn about filing taxes, interest rates, budgets, and understanding the impact of credit scores. The way we begin to do that is to teach it,” Cohen said.

By equipping students with information, Cohen hopes to close the financial wealth gap, and give everyone an opportunity to reach their full financial potential. “They have to first be equipped with the information and education is the key. Then all we need are opportunities to step into spaces and places of power.”

Cohen went on to share that in her own upbringing, she was not guided on financial principles that could jump start her finances. “Communities of color don’t have the same information and I don’t know about you, but I did not grow up listening to my parents discussing their assets, their investments, and diversifying their portfolio. This is the kind of nomenclature and language we are trying to introduce to our future generations so we can pivot from a life of poverty so we can pivot away and never return to poverty.”

Cohen urged audience members to pass the initiative on the November 2024 ballot.

“When we come together as women, uplift women, and support women, we all win. By networking and learning together, we can continue to build generational wealth,” said Landers. “Passing a powerful initiative will ensure the next generation of California students will be empowered to make more informed financial decisions, decisions that will last them a lifetime.”

Bay Area

MAYOR BREED ANNOUNCES $53 MILLION FEDERAL GRANT FOR SAN FRANCISCO’S HOMELESS PROGRAMS

San Francisco, CA – Mayor London N. Breed today announced that the U.S. Department of Housing and Urban Development (HUD) has awarded the city a $53.7 million grant to support efforts to renew and expand critical services and housing for people experiencing homelessness in San Francisco.

FOR IMMEDIATE RELEASE:

Wednesday, January 31, 2024

Contact: Mayor’s Office of Communications, mayorspressoffice@sfgov.org

***PRESS RELEASE***

MAYOR BREED ANNOUNCES $53 MILLION FEDERAL GRANT FOR SAN FRANCISCO’S HOMELESS PROGRAMS

HUD’s Continuum of Care grant will support the City’s range of critical services and programs, including permanent supportive housing, rapid re-housing, and improved access to housing for survivors of domestic violence

San Francisco, CA – Mayor London N. Breed today announced that the U.S. Department of Housing and Urban Development (HUD) has awarded the city a $53.7 million grant to support efforts to renew and expand critical services and housing for people experiencing homelessness in San Francisco.

HUD’s Continuum of Care (CoC) program is designed to support local programs with the goal of ending homelessness for individuals, families, and Transitional Age Youth.

This funding supports the city’s ongoing efforts that have helped more than 15,000 people exit homelessness since 2018 through City programs including direct housing placements and relocation assistance. During that time San Francisco has also increased housing slots by 50%. San Francisco has the most permanent supportive housing of any county in the Bay Area, and the second most slots per capita than any city in the country.

“In San Francisco, we have worked aggressively to increase housing, shelter, and services for people experiencing homelessness, and we are building on these efforts every day,” said Mayor London Breed. “Every day our encampment outreach workers are going out to bring people indoors and our City workers are connecting people to housing and shelter. This support from the federal government is critical and will allow us to serve people in need and address encampments in our neighborhoods.”

The funding towards supporting the renewal projects in San Francisco include financial support for a mix of permanent supportive housing, rapid re-housing, and transitional housing projects. In addition, the CoC award will support Coordinated Entry projects to centralize the City’s various efforts to address homelessness. This includes $2.1 million in funding for the Coordinated Entry system to improve access to housing for youth and survivors of domestic violence.

“This is a good day for San Francisco,” said Shireen McSpadden, executive director of the Department of Homelessness and Supportive Housing. “HUD’s Continuum of Care funding provides vital resources to a diversity of programs and projects that have helped people to stabilize in our community. This funding is a testament to our work and the work of our nonprofit partners.”

The 2024 Continuum of Care Renewal Awards Include:

- $42.2 million for 29 renewal PSH projects that serve chronically homeless, veterans, and youth

- $318,000 for one new PSH project, which will provide 98 affordable homes for low-income seniors in the Richmond District

- $445,00 for one Transitional Housing (TH) project serving youth

- $6.4 million dedicated to four Rapid Rehousing (RRH) projects that serve families, youth, and survivors of domestic violence

- $750,00 for two Homeless Management Information System (HMIS) projects

- $2.1 million for three Coordinated Entry projects that serve families, youth, chronically homeless, and survivors of domestic violence

In addition, the 2023 CoC Planning Grant, now increased to $1,500,000 from $1,250,000, was also approved. Planning grants are submitted non-competitively and may be used to carry out the duties of operating a CoC, such as system evaluation and planning, monitoring, project and system performance improvement, providing trainings, partner collaborations, and conducting the PIT Count.

“We are very appreciative of HUD’s support in fulfilling our funding request for these critically important projects for San Francisco that help so many people trying to exit homelessness,” said Del Seymour, co-chair of the Local Homeless Coordinating Board. “This funding will make a real difference to people seeking services and support in their journey out of homelessness.”

In comparison to last year’s competition, this represents a $770,000 increase in funding, due to a new PSH project that was funded, an increase in some unit type Fair Market Rents (FMRs) and the larger CoC Planning Grant. In a year where more projects had to compete nationally against other communities, this represents a significant increase.

Nationally, HUD awarded nearly $3.16 billion for over 7,000 local homeless housing and service programs including new projects and renewals across the United States.

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 27 – April 2, 2024

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoFrom Raids to Revelations: The Dark Turn in Sean ‘Diddy’ Combs’ Saga

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: Lady Day and The Lights!

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBaltimore Key Bridge Catastrophe: A City’s Heartbreak and a Nation’s Alarm

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBaltimore’s Key Bridge Struck by Ship, Collapses into Water

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBeloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87