#NNPA BlackPress

OP-ED: Title Insurance Helps Homeownership for Black Americans and Others

NNPA NEWSWIRE — Often misunderstood, title insurance is a product that comprehensively protects homeowners’ property rights and their lenders’ financial interest in a property. It is vastly different than other types of insurance because it is a one-time fee and title professionals do the majority of the work upfront to both examine title issues and rectify any problems found. That is why many homeowners thankfully don’t experience the challenge of a claim that threatens their homeownership – but if they do, title insurance is paramount to protecting their biggest investment.

The post OP-ED: Title Insurance Helps Homeownership for Black Americans and Others first appeared on BlackPressUSA.

By Benjamin F. Chavis Jr., President and CEO, National Newspaper Publishers Association

During the State of the Union, President Joe Biden spoke eloquently and passionately about one of the Biden-Harris Administration’s key priorities: housing affordability. The President’s proposals included ideas that would boost housing supply and make homeownership more attainable for those that are currently being priced out of the market.

While the vast majority of President Biden’s new proposals would thoughtfully address some of the country’s most pressing issues, one idea that flew under the radar was a proposal about title insurance, a lesser known but vital part of the homebuying and refinancing process.

It was concerning to hear about the proposal – a new pilot program that would waive title insurance requirements for certain qualified homeowners – as one of the ideas being considered by the Administration to improve access to affordable housing. Given that the program – which was previously abandoned by Fannie Mae last year – only applies to higher-wealth individuals who are refinancing properties, should it be a top public policy priority now for The White House?

It is no secret that high interest rates and a low supply of affordable homes stand in the way of homeownership for low and middle-income families and people of color. According to the National Association of Realtors, the gap between Black and White homeownership is worse than it was a decade ago, with the Black homeownership rate at 44.1% compared to the White homeownership rate of 72%.

The National Association of Real Estate Brokers (NAREB) in its 2023 State of Housing in Black America reported that “In 2022, the Black homeownership stood at 45%, only modestly higher than the level at the passage of the 1968 Fair Housing Act. This disparity between Blacks and Whites has expanded over the past half-century.”

Additionally, data from Zillow shows that only 7.8% of Black non-home owning families have enough income to pay a typical mortgage payment in their area without being cost burdened. This is where the focus should be – on building more homes for those who need them. We commend the Biden Administration for its work through the Housing Supply Action Plan to do just that. By increasing the supply of affordable housing of all types in our communities, we can expand access to the housing market to those in our communities that are currently shut out and ensure the dream of homeownership is truly available all to Americans.

That is why, while well intentioned, the proposed title waiver pilot under consideration will cause unintended negative consequences in particular for African American, Latino American, and other communities of color across the nation. All communities should have access to fair housing opportunities and acquisitions.

Often misunderstood, title insurance is a product that comprehensively protects homeowners’ property rights and their lenders’ financial interest in a property. It is vastly different than other types of insurance because it is a one-time fee and title professionals do the majority of the work upfront to both examine title issues and rectify any problems found. That is why many homeowners thankfully don’t experience the challenge of a claim that threatens their homeownership – but if they do, title insurance is paramount to protecting their biggest investment.

Some may ask: why do I need to purchase title insurance when refinancing? When refinancing, a homeowner purchases a new loan, and title issues can arise between the old loan and the new loan. For example, if a homeowner does not pay their contractor for repairs to their roof, there could be a lien against the property. Lenders need assurance that if a homeowner defaults on their mortgage, they have first lien priority.

That is why the proposal to waive title insurance on refinancing is extremely risky. If a title issue arose, Fannie Mae and Freddie Mac would essentially turn into title insurers and would have to bear the risk of making lenders whole on those loans. These are the same companies that are under conservatorship due to their role in the 2008 financial crisis which cost taxpayers more than $200 billion and devastated minority communities by chasing profits for themselves. I don’t believe it is prudent to shift more risk to Fannie Mae or Freddie Mac, especially when the proposal at hand would not meaningfully address the nation’s housing affordability challenge.

This is not a partisan issue, nor is it a new proposal. This same pilot program was withdrawn last year after members of Congress from both sides of the aisle and industry experts criticized the idea. Ed DeMarco, Acting Director of the Federal Housing Finance Agency (the agency that oversees Fannie Mae and Freddie Mac) under President Obama, stated during a Congressional hearing last May, “It certainly is disturbing to think that Fannie Mae or Freddie Mac might displace title insurance by taking on this insurance itself.”

As the Administration continues to work towards improving housing affordability, first-time, low-income, and minority homebuyers should continue to be the focus. Waiving title insurance on a few refinancing transactions will not move the needle, and it could actually increase risk for little gain.

Homeownership is largest driver of wealth creation for all Americans. If we truly want to close the racial wealth gap, we must not only ensure that homeownership is available to communities of color, but we must also ensure those homes are protected for generations to come.

I urge the Administration, therefore, to reconsider its focus on removing the critical protections provided by title insurance and continue to work on solutions that will truly address the availability and affordability of homes in all communities in America, and in particular for underserved communities.

Dr. Benjamin F. Chavis Jr. is President and CEO of the National Newspaper Publishers Association (NNPA) and Executive Producer/Host of The Chavis Chronicles on PBS TV stations across the US and can be reached at dr.bchavis@nnpa.org

The post OP-ED: Title Insurance Helps Homeownership for Black Americans and Others first appeared on BlackPressUSA.

#NNPA BlackPress

IN MEMORIAM: Ramona Edelin, Influential Activist and Education Advocate, Dies at 78

NNPA NEWSWIRE — Born on September 4, 1945, in Los Angeles, California, activist Ramona Edelin’s early years were marked by a commitment to education and social justice. According to her HistoryMakers biography, after graduating from Fisk University with a Bachelor’s degree in 1967, she pursued further studies at the University of East Anglia in England. She earned her master’s degree before completing her Ph.D. at Boston University in 1981.

The post IN MEMORIAM: Ramona Edelin, Influential Activist and Education Advocate, Dies at 78 first appeared on BlackPressUSA.

By Stacy M. Brown, NNPA Newswire Senior National Correspondent

@StacyBrownMedia

Once upon a time, Black Americans were simply known as colored people, or Negroes. That is until Ramona Edelin came along. The activist, renowned for her pivotal roles in advancing civil rights, education reform, and community empowerment, died at her D.C. residence last month at the age of 78. Her death, finally confirmed this week by Barnaby Towns, a communications strategist who collaborated with Dr. Edelin, was attributed to cancer.

Born on September 4, 1945, in Los Angeles, California, Edelin’s early years were marked by a commitment to education and social justice. According to her HistoryMakers biography, after graduating from Fisk University with a Bachelor’s degree in 1967, she pursued further studies at the University of East Anglia in England. She earned her master’s degree before completing her Ph.D. at Boston University in 1981.

Edelin’s contributions to academia and activism were manifold. She was pivotal in popularizing the term “African American” alongside Rev. Jesse L. Jackson in the late 1980s.

Jackson had announced the preference for “African American,” speaking for summit organizers that included Dr. Edelin. “Just as we were called Colored, but were not that, and then Negro, but not that, to be called Black is just as baseless,” he said, adding that “African American” “has cultural integrity” and “puts us in our proper historical context.”

Later, Edelin told Ebony magazine, “Calling ourselves African Americans is the first step in the cultural offensive,” while linking the name change to a “cultural renaissance” in which Black Americans reconnected with their history and heritage.

“Who are we if we don’t acknowledge our motherland?” she asked later. “When a child in a ghetto calls himself African American, immediately he’s international. You’ve taken him from the ghetto and put him on the globe.”

The HistoryMakers bio noted that Edelin’s academic pursuits led her to found and chair the Department of African American Studies at Northeastern University, where she established herself as a leading voice.

Transitioning from academia to advocacy, Edelin joined the National Urban Coalition in 1977, eventually ascending to president and CEO. During her tenure, she spearheaded initiatives such as the “Say Yes to a Youngster’s Future” program, which provided crucial support in math, science, and technology to youth and teachers of color in urban areas. Her biography noted that Edelin’s efforts extended nationwide through partnerships with organizations like the National Science Foundation and the United States Department of Education.

President Bill Clinton recognized Edelin’s expertise by appointing her to the Presidential Board on Historically Black Colleges and Universities in 1998. She also co-founded and served as treasurer of the Black Leadership Forum, solidifying her standing as a respected leader in African American communities.

Beyond her professional achievements, Edelin dedicated herself to numerous boards and committees, including chairing the District of Columbia Educational Goals 2000 Panel and contributing to the Federal Advisory Committee for the Black Community Crusade for Children.

Throughout her life, Edelin received widespread recognition for her contributions. Ebony magazine honored her as one of the 100 Most Influential Black Americans, and she received prestigious awards such as the Southern Christian Leadership Award for Progressive Leadership and the IBM Community Executive Program Award.

The post IN MEMORIAM: Ramona Edelin, Influential Activist and Education Advocate, Dies at 78 first appeared on BlackPressUSA.

#NNPA BlackPress

Tennessee State University Board Disbanded by MAGA Loyalists as Assault on DE&I Continues

NNPA NEWSWIRE — Recent legislative actions in Tennessee, such as repealing police reform measures enacted after the killing of Tyre Nichols, underscore a troubling trend of undermining local control and perpetuating racist agendas. The new law preventing local governments from restricting police officers’ authority disregards community efforts to address systemic issues of police violence and racial profiling.

The post Tennessee State University Board Disbanded by MAGA Loyalists as Assault on DE&I Continues first appeared on BlackPressUSA.

By Stacy M. Brown, NNPA Newswire Senior National Correspondent

@StacyBrownMedia

Tennessee State University (TSU), the state’s only public historically Black college and university (HBCU), faces a tumultuous future as Gov. Bill Lee dissolved its board, a move supported by racist conservatives and MAGA Republicans in the Tennessee General Assembly, who follow the lead of the twice-impeached, four-times indicted, alleged sexual predator former President Donald Trump. Educators and others have denounced the move as an attack on diversity, equity, and inclusion (DE&I) and a grave setback for higher education.

Critics argue that TSU’s purported financial mismanagement is a manufactured crisis rooted in decades of underinvestment by the state government. They’ve noted that it continues a trend by conservatives and the racist MAGA movement to eliminate opportunities for Blacks in education, corporate America, and the public sector.

Gevin Reynolds, a former speechwriter for Vice President Kamala Harris, emphasizes in an op-ed that TSU’s financial difficulties are not the result of university leadership because a recent audit found no evidence of fraud or malfeasance.

Reynolds noted that the disbanding of TSU’s board is not an isolated incident but part of a broader assault on DE&I initiatives nationwide. Ten states, including Tennessee, have enacted laws banning DE&I policies on college campuses, while governors appointing MAGA loyalists to university trustee positions further undermine efforts to promote inclusivity and equality.

Moreover, recent legislative actions in Tennessee, such as repealing police reform measures enacted after the killing of Tyre Nichols, underscore a troubling trend of undermining local control and perpetuating racist agendas. The new law preventing local governments from restricting police officers’ authority disregards community efforts to address systemic issues of police violence and racial profiling.

The actions echo historical efforts to suppress Black progress, reminiscent of the violent backlash against gains made during the Reconstruction era. President Joe Biden warned during an appearance in New York last month that Trump desires to bring the nation back to the 18th and 19th centuries – in other words, to see, among other things, African Americans back in the chains of slavery, women subservient to men without any say over their bodies, and all voting rights restricted to white men.

The parallels are stark, with white supremacist ideologies used to justify attacks on Black institutions and disenfranchise marginalized communities, Reynolds argued.

In response to these challenges, advocates stress the urgency of collective action to defend democracy and combat systemic racism. Understanding that attacks on institutions like TSU are symptomatic of broader threats to democratic norms, they call for increased civic engagement and voting at all levels of government.

The actions of people dedicated to upholding the principles of inclusivity, equity, and justice for all will determine the outcome of the ongoing fight for democracy, Reynolds noted. “We are in a war for our democracy, one whose outcome will be determined by every line on every ballot at every precinct,” he stated.

The post Tennessee State University Board Disbanded by MAGA Loyalists as Assault on DE&I Continues first appeared on BlackPressUSA.

#NNPA BlackPress

Braxton Haulcy and the Expansion of Walker|West Music Academy

May 24, 2023 – Walker West Music Academy gets an early start on expansion. Join us for a Wednesday episode of The …

The post Braxton Haulcy and the Expansion of Walker|West Music Academy first appeared on BlackPressUSA.

May 24, 2023 – Walker West Music Academy gets an early start on expansion. Join us for a Wednesday episode of The …

The post Braxton Haulcy and the Expansion of Walker|West Music Academy first appeared on BlackPressUSA.

-

Community2 weeks ago

Community2 weeks agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 3 – 6, 2024

-

Business2 weeks ago

Business2 weeks agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 10 – 16, 2024

-

Community2 weeks ago

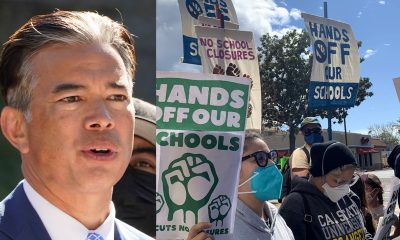

Community2 weeks agoAG Bonta Says Oakland School Leaders Should Comply with State Laws to Avoid ‘Disparate Harm’ When Closing or Merging Schools

-

Community1 week ago

Community1 week agoOakland WNBA Player to be Inducted Into Hall of Fame

-

Community2 weeks ago

Community2 weeks agoThe Year Ahead: Assembly Speaker Rivas Discusses Priorities, Problems

-

City Government2 weeks ago

City Government2 weeks agoLAO Releases Report on Racial and Ethnic Disparities in California Child Welfare System