Community

Mayor London Breed Announces SFPD Tourism Deployment Plan as San Francisco Readies for Reemerging Travel Season

SFPD continues showcasing community policing reforms in deployment of 26 additional officers on bicycle and foot patrols to City’s high-traffic, iconic travel destinations

Mayor London N. Breed announced details from San Francisco’s new community policing and tourism deployment plan to support and safeguard a re-emergent travel season that is forecast to exceed 15.3 million visitors by year’s end.

Outlining operational elements at a press conference on July 19 at Chinatown’s iconic Dragon’s Gate this morning, Breed and Police Chief Bill Scott highlighted how the San Francisco Police Department’s Tourism Deployment Plan will provide high-visibility and welcome support to an economic sector that is vitally important to San Francisco as travelers worldwide emerge from COVID-19 lockdowns.

“Tourism has long been an economic powerhouse in our city, bringing not just local tax revenue to fund vital city services but also jobs and economic opportunities for generations of San Franciscans,” said Breed. “San Francisco has done an incredible job managing this pandemic, and with one of the highest vaccination rates of anywhere in the country, we are working hard to reopen our city. That means bringing more officers to our tourist areas, as well as other efforts like our recently funded efforts to add more ambassadors and performances throughout Downtown, the Waterfront, and Mid-Market areas. We are committed to doing everything we can to reopen our businesses, put our residents back to work, and welcome travelers back to all of our city’s unforgettable destinations.”

The San Francisco Police Department’s Tourism Deployment Plan draws heavily from a community policing strategy that is among the pillars of SFPD’s groundbreaking 21st century police reforms. Under the plan, SFPD will deploy 26 additional police officers on bicycle and foot patrols to an array of high-traffic and highly sought-after travel destinations in five of the City’s 10 police districts:

- Central Police District’s new deployments will feature 14 additional officers on bike and foot patrols that include: Union Square, Market Street, Powell Street, Chinatown and Lower Grant Avenue, Pier 39 and Fisherman’s Wharf, North Beach and the crooked portion of Lombard Street.

- Mission Police District’s new deployments will feature two additional officers on bike and foot patrols in the Castro and Upper Market.

- Northern Police District’s new deployments will feature six additional officers on bicycle patrols around the Palace of Fine Arts, Alamo Square and Japantown.

- Park Police District’s new deployments will feature two additional officers on bicycle patrols along the Haight Street commercial corridor.e

- Richmond Police District’s new deployments will feature two additional officers on bicycle patrols in Golden Gate Park.

In addition to this Tourism Deployment Plan, the Mayor’s proposed budget, which the Board of Supervisors has come to an agreement on, includes funding for the Downtown Recovery Plan. The Downtown Recovery Plan includes an expansion of the number of ambassadors in the downtown and Union Square areas; a series of events and activations throughout Downtown, at the site of the temporary Transbay Terminal, and along the waterfront; and improvements at Hallidie Plaza, the entrance to the Powell Street BART Station and site of the Cable Car turnaround.

Outlook for Tourism Sector

Although there is renewed uncertainty about effects from COVID-19 variants in many parts of the world, a San Francisco Travel Association analysis released in March forecast that overall visitation to the City would reach 15.3 million in 2021, with $3.5 billion in overall visitor spending projected by year’s end. The study by San Francisco’s official destination marketing organization said that total visitation was not anticipated to return to pre-pandemic levels until 2023. Due to a slower recovery of international visitors and average rate in the City, San Francisco Travel concluded that overall visitor spending was unlikely to return to 2019 levels before 2025.

“Our market research shows a light at the end of the tunnel for destinations like San Francisco after a devastating year for the global tourism industry: there is huge pent-up demand for travel all over the world,” said San Francisco Travel President and CEO Joe D’Alessandro. “As San Francisco embarks on a multi-year recovery, we know that high-visibility, community-oriented patrols by San Francisco police officers provide a reassuring, welcoming presence for the visitors and conventions so essential to our city’s continued success.”

San Francisco Travel reported a total of 10.2 million visitors to the City in 2020, which was down 61 percent from a record high of 26.2 million in 2019. Total spending by visitors was $2.3 billion in 2020, representing a pandemic-driven drop of 77.7 percent from 2019’s record high of $10.3 billion in total visitor spending. Spending figures include expenditures on meetings and conventions in San Francisco.

The COVID-19 pandemic has similarly affected local employment related to the tourism sector, according to San Francisco Travel, which found that the number of jobs supported by tourism in San Francisco fell to 20,880 in 2020 — a 75.8 percent decline from 86,111 jobs tourism supported in 2019.

Expanded Community Policing at Visitor Destinations

The mission of officers detailed to the Tourism Deployment Plan is to provide high-visibility and preventative patrol in their assigned locations, while embodying the principles of a community policing strategy that is a centerpiece of the San Francisco Police Department’s comprehensive and voluntary Collaborative Reform Initiative. Officers are well trained to incorporate five goals into their community interactions and public guardianship, as detailed in SFPD’s Community Policing Strategic Plan. SFPD’s Community Policing principles include:

- Goal 1: Communication that is honest, transparent, empathetic and culturally and linguistically competent and respectful.

- Goal 2: Education that both teaches community members in safety awareness and learns from communities to serve more responsively.

- Goal 3: Problem-solving through collaborative working partnerships to identify and address safety issues and topics of concern.

- Goal 4: Relationship-building to forge trusting and respectful engagements with San Francisco’s residents and visitors alike.

- Goal 5: Organizational and operational approaches reflecting the guardian mindset that defines the promise of 21st century policing.

New deployments of police officers under the Tourism Deployment Plan announced on July 19 have already been implemented and will supplement existing patrols citywide, which will remain at current staffing levels.

Officers deployed under the plan will be on bicycle or on foot in frequently traveled areas, greeting and interacting with community members and guests. Assignments include fixed posts as well as patrols in commercial corridors, depending on deployments. Officers’ primary focus will be to engage with the public and provide aid when needed, and to take necessary enforcement action whenever identifying individuals involved in crime.

The San Francisco Mayor’s Office of Communications is the source for this story.

Activism

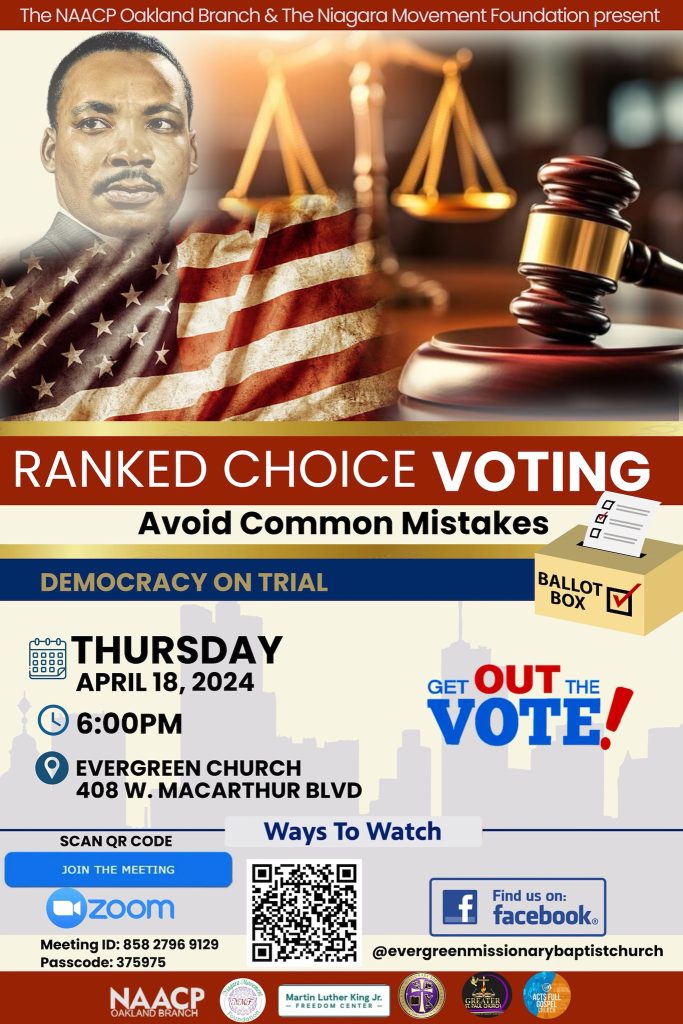

Oakland Post: Week of April 10 – 16, 2024

The printed Weekly Edition of the Oakland Post: Week of April 10 – 16, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

Activism

Oakland Post: Week of April 3 – 6, 2024

The printed Weekly Edition of the Oakland Post: Week of April 3 – 6, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

Activism

Oakland Post: Week of March 27 – April 2, 2024

The printed Weekly Edition of the Oakland Post: Week of March 27 – April 2, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 20 – 26, 2024

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoFrom Raids to Revelations: The Dark Turn in Sean ‘Diddy’ Combs’ Saga

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoCOMMENTARY: Lady Day and The Lights!

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoBaltimore Key Bridge Catastrophe: A City’s Heartbreak and a Nation’s Alarm

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoBaltimore’s Key Bridge Struck by Ship, Collapses into Water

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of March 27 – April 2, 2024