Featured

BOOK REVIEW: Lose Your Final 15

By Terri Schlichenmeyer

The Bookworm Sez

Somebody passed you a plate of cookies.

It was the holidays so, of course, you had to take one. Or three, because they were good; and when the fudge came around, you had that, too. And some pie, cheesecake, punch, homemade candy, now your pants are tight, you feel lazy, and your bathroom scale is screaming.

Yep, it’s time to step back and step toward “Lose Your Final 15” by Rovenia M. Brock, PhD.

When she was just 9 years old, growing up in Washington, DC, Rovenia Brock had a dual life-changing experience: she lost her mother to cancer and she met her mother’s friend, a dietitian who taught Brock the “relationship between diet and health.”

Remembering the woman’s words, Brock went to college to be a “nutrition educator” but, like many women of color, she “worried that men wouldn’t find me attractive unless I put a little more meat on my bones.” That was unhealthy and she knew it, so she created her Final 15 program.

To begin, take the “Self-Assessment Test” and put yourself in the “F-15 Mindset.” This will help you make better choices when faced with cravings. Also, remember that some hunger is emotional, and that you can understand the difference.

In the planning phase of the Final 15, Brock recommends that you eliminate sugar, sodas, and alcohol. Eat breakfast early, and then “eat often.” Get lots of sleep, and “take special care” if you’re a nightshift worker. Understand that buying dairy products, vegetables, fruits, and fish is not merely a matter of going to the grocery store.

Phase 1 teaches readers the basics of eating and exercise. Phase 2 adds more choices to both. Phase 3 of the Final 15 diet is the “Coast and Maintain” phase for lifelong health, but that doesn’t mean letting your guard down.

“You can’t declare victory,” Brock says, “and then return to your old habits.”

Those last fifteen pounds, as they say, are the hardest to lose when you’re dieting. But “Lose Your Final 15” helps the first pounds go, the last pounds go, and every ounce in between.

It won’t be easy, but author Rovenia M. Brock offers step-by-step handholding and useful advice, as well as fat-burner exercises. There are lots of charts inside this book, but nothing too scientific; you’ll also find simple recipes that don’t require a Food PhD to make. For a little added encouragement, “Dr. Ro” includes success stories from people who’ve shed their poundage and kept it off.

Readers, however, should know that some chapter sub-headings may seem misleading: you shouldn’t, for instance, “Drink Half Your Body Weight in Water,” but you should read the section. The actual page on eating snacks “That Are No Larger Than Your Closed Fist” has more succinct meaning.

Read. Carefully.

You might read a little repetition while you do, but it will underscore what’s inside this book. If those holiday cookies went from lips to hips and you’re walking them off now, “Lose Your Final 15” is a book you shouldn’t walk past.

“Lose Your Final 15” by Rovenia M. Brock, PhD, c. 2016, Rodale, $26.99; 285 pages.

“Lose Your Final 15” by Rovenia M. Brock, PhD, c. 2016, Rodale, $26.99; 285 pages.

Activism

Oakland Post: Week of April 24 – 30, 2024

The printed Weekly Edition of the Oakland Post: Week of April 24 – 30, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

Alameda County

DA Pamela Price Stands by Mom Who Lost Son to Gun Violence in Oakland

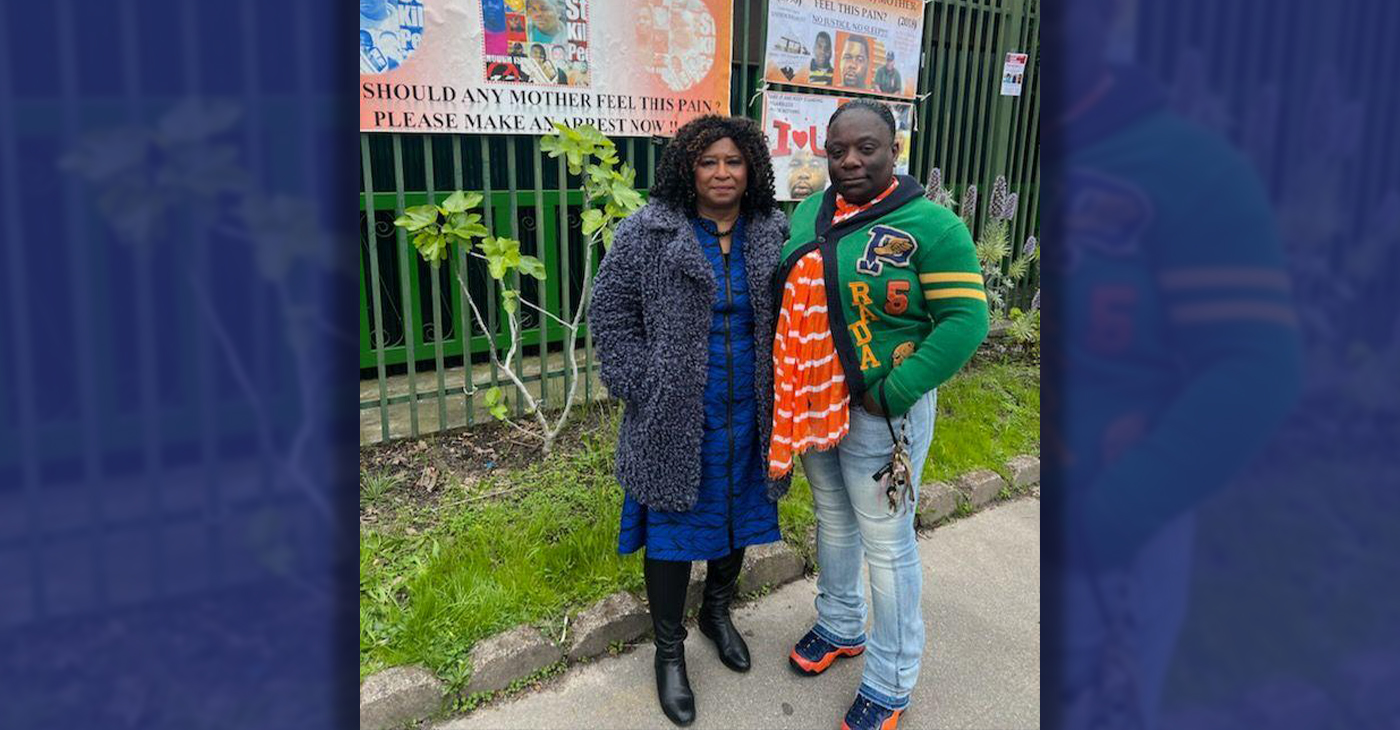

Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018.

Publisher’s note: Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018. The photo was too small for readers to see where the women were and what they were doing. Here we show Price and Jones as they complete a walk in memory of Scott. For more information and to contribute, please contact Carol Jones at 510-978-5517 at morefoundation.help@gmail.com. Courtesy photo.

City Government

Vallejo Welcomes Interim City Manager Beverli Marshall

At Tuesday night’s Council meeting, the Vallejo City Council appointed Beverli Marshall as the interim city manager. Her tenure in the City Manager’s Office began today, Wednesday, April 10. Mayor Robert McConnell praised Marshall’s extensive background, noting her “wide breadth of experience in many areas that will assist the City and its citizens in understanding the complexity of the many issues that must be solved” in Vallejo.

Special to The Post

At Tuesday night’s Council meeting, the Vallejo City Council appointed Beverli Marshall as the interim city manager. Her tenure in the City Manager’s Office began today, Wednesday, April 10.

Mayor Robert McConnell praised Marshall’s extensive background, noting her “wide breadth of experience in many areas that will assist the City and its citizens in understanding the complexity of the many issues that must be solved” in Vallejo.

Current City Manager Michael Malone, whose official departure is slated for April 18, expressed his well wishes. “I wish the City of Vallejo and Interim City Manager Marshall all the best in moving forward on the progress we’ve made to improve service to residents.” Malone expressed his hope that the staff and Council will work closely with ICM Marshall to “ensure success and prosperity for the City.”

According to the Vallejo Sun, Malone stepped into the role of interim city manager in 2021 and became permanent in 2022. Previously, Malone served as the city’s water director and decided to retire from city service e at the end of his contract which is April 18.

“I hope the excellent work of City staff will continue for years to come in Vallejo,” he said. “However, recent developments have led me to this decision to announce my retirement.”

When Malone was appointed, Vallejo was awash in scandals involving the housing division and the police department. A third of the city’s jobs went unfilled during most of his tenure, making for a rocky road for getting things done, the Vallejo Sun reported.

At last night’s council meeting, McConnell explained the selection process, highlighting the council’s confidence in achieving positive outcomes through a collaborative effort, and said this afternoon, “The Council is confident that by working closely together, positive results will be obtained.”

While the search for a permanent city manager is ongoing, an announcement is expected in the coming months.

On behalf of the City Council, Mayor McConnell extended gratitude to the staff, citizen groups, and recruitment firm.

“The Council wishes to thank the staff, the citizens’ group, and the recruitment firm for their diligent work and careful consideration for the selection of what is possibly the most important decision a Council can make on behalf of the betterment of our City,” McConnell said.

The Vallejo Sun contributed to this report.

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 27 – April 2, 2024

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBeloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87

-

Community1 week ago

Community1 week agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 3 – 6, 2024

-

Business1 week ago

Business1 week agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 10 – 16, 2024