Crime

Dept. of Justice Sues Banks for Mortgage Fraud

The Department of Justice has announced that it is suing Bank of America for lying to investors regarding $850 million dollars worth of worthless mortgage back securities in 2008.

Bank of America is also embroiled in a lawsuit filed by New York Attorney General Eric Schneiderman, head of the Mortgage Crisis Task Force for lying to homeowners and taking their homes.

Affidavits by Bank of America employees are substantiating that B of A trained employees to systematically violate deadlines and push people into foreclosure by telling them they had not received the homeowner’s paperwork.

Hundreds of violations have been uncovered. Bank of America Customer Service Representative, Erica Brown says that, “During my time at Bank of America, I saw well over a hundred cases in which a Bank of America ‘analyst’ canceled loan modifications and stated ‘non-payment’ as a reason for the cancellation, when the computer system revealed that the homeowner had actually made the required payments.”

Simone Gordon, Senior Collector for Bank of America states that,“We were told to lie . . . We were asking for documents that we already had.”

In another suit, the Securities Exchange Commission, Department of Justice and the Consumer Financial Protection Bureau (CFPB) are investigating PNC Financial and SunTrust regarding allegations that they discriminated against protected borrowers based on race, color and religion.

Additionally, PNC has been subpoenaed for claims made for foreclosure expenses related to the loans insured or guaranteed by Fannie Mae or Freddie Mac. Sun Trust is being investigated for irregularities in their processing of mortgage-modifications and regulators are alleging that Sun Trust failed to properly process loan modification application of mortgages owned by Fannie Mae and Freddie Mac.

Sun Trust is accused of misleading borrowers with regard to timelines and other features of the HAMP modification procedure.

Last week, JPMorgan Chase & Co disclosed that it faces investigation by the Department of Justice (DOJ) and the Securities Exchange Commission (SEC) over the sale of risky residential mortgage backed securities (RMBS).

Bank misconduct has resulted in thousands of homeowners illegally losing their homes without banks facing sanctions. Attorney General Eric Holder informed the banks and the public in March that the banks are too big to prosecute.

Without fear of facing legal repercussion for their actions, new evidence reveals the nation’s largest banks continue to fabricate documents and illegally kick people out of their homes, even after inking a series of settlements over the same abuses.

Unfortunately the Attorney General’s settlement over foreclosure fraud was so weakly written that it still allows misconduct to occur.

Diane Thompson, a mortgage lawyer with the National Consumer Law Center said banks profit by cutting corners on documents. “Banks have tremendous monetary incentive not to comply with standard legal procedures. They have been doing it sloppily and illegally for a long time, and they have a sense of entitlement.”

Activism

Oakland Post: Week of April 24 – 30, 2024

The printed Weekly Edition of the Oakland Post: Week of April 24 – 30, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

Alameda County

DA Pamela Price Stands by Mom Who Lost Son to Gun Violence in Oakland

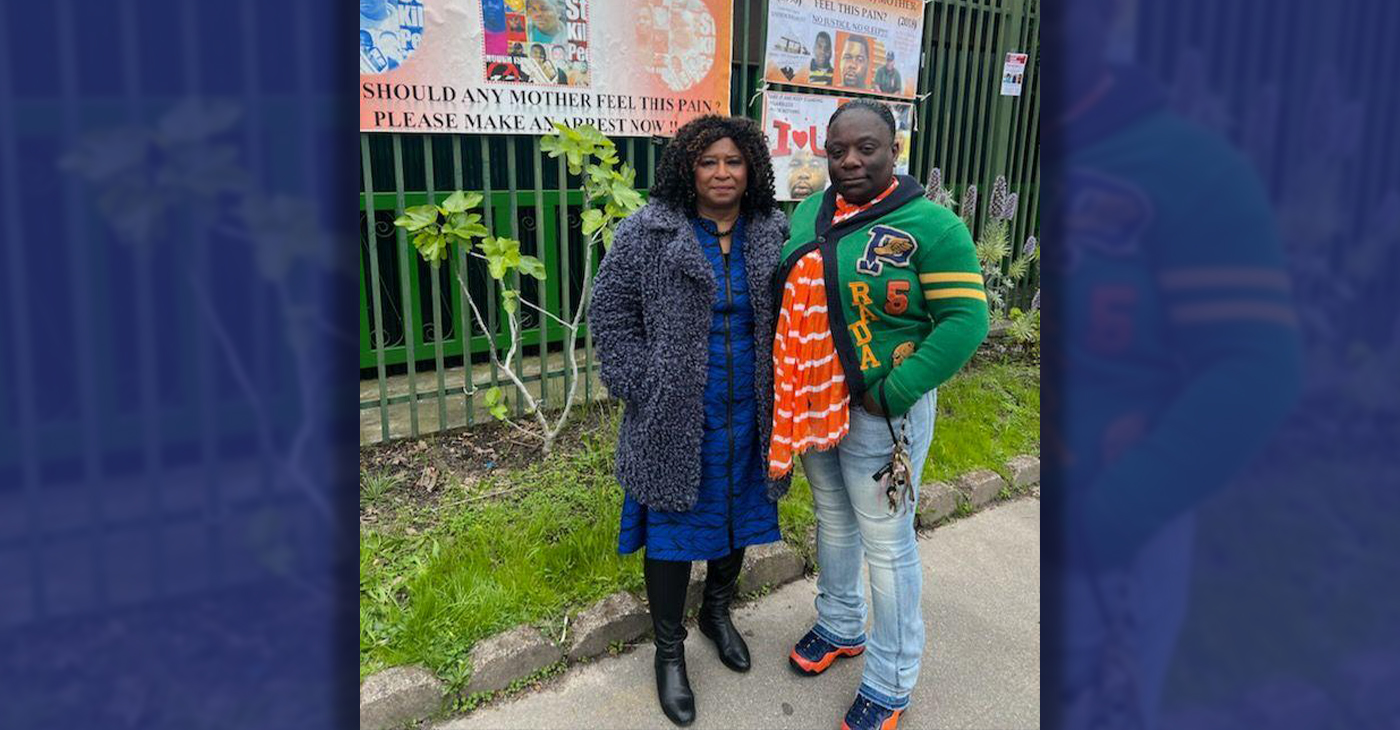

Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018.

Publisher’s note: Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018. The photo was too small for readers to see where the women were and what they were doing. Here we show Price and Jones as they complete a walk in memory of Scott. For more information and to contribute, please contact Carol Jones at 510-978-5517 at morefoundation.help@gmail.com. Courtesy photo.

California Black Media

Anti-Theft Bill with Jail-Time Requirement Gets Wide Ranging Support

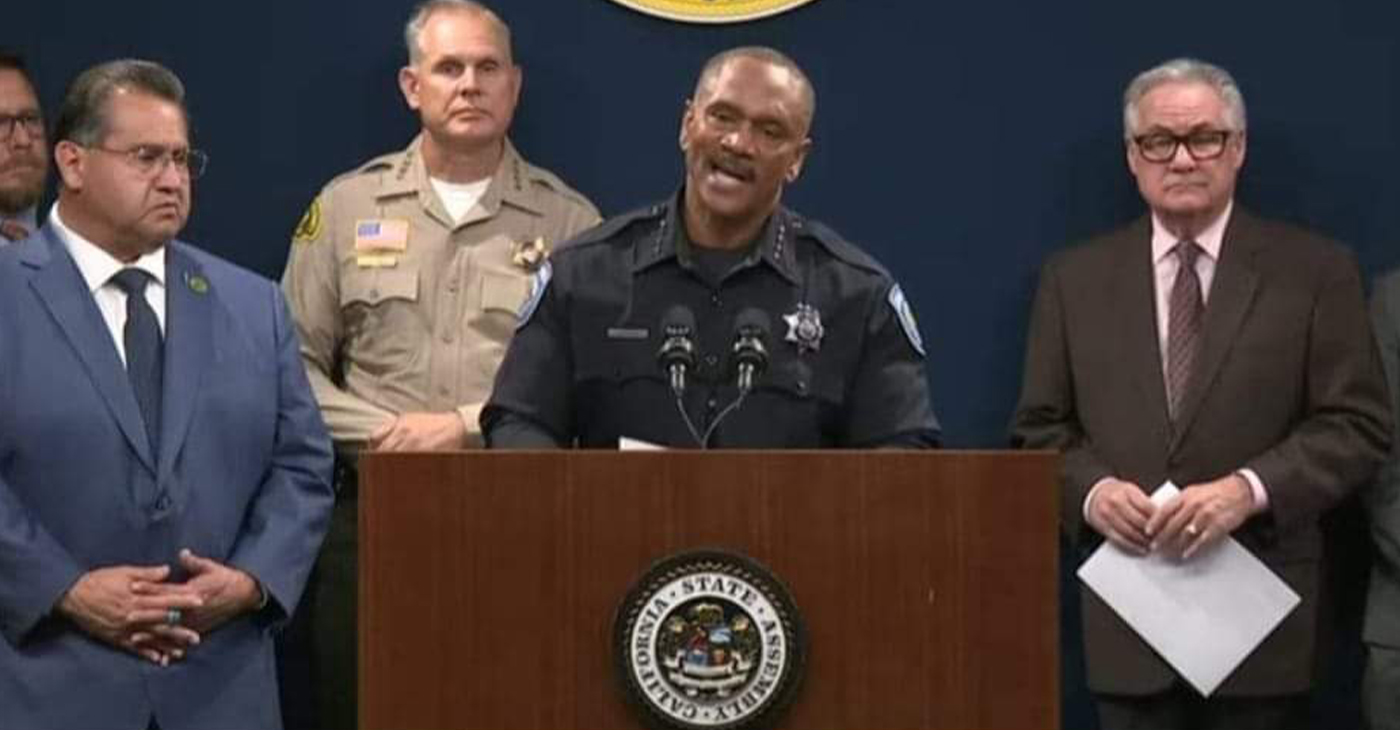

Fed up with the alarming frequency of retail theft across California, including smash and grabs, a diverse group of business leaders, law enforcement officials, policymakers and public safety advocates joined their efforts in Sacramento on Jan. 24. Their purpose: to increase public support for Assembly Bill (AB) 1772, a bill that would make jail time mandatory for repeat theft offenders.

By California Black Media

Fed up with the alarming frequency of retail theft across California, including smash and grabs, a diverse group of business leaders, law enforcement officials, policymakers and public safety advocates joined their efforts in Sacramento on Jan. 24.

Their purpose: to increase public support for Assembly Bill (AB) 1772, a bill that would make jail time mandatory for repeat theft offenders.

Co-authored by Assemblymembers James C. Ramos (D-San Bernardino), Avelino Valencia (D-Anaheim) and Devon Mathis (R-Tulare), AB 1772 would require jail time “of one to three years for theft crimes depending upon the circumstances.

“Offenses would include grand theft, theft from an elder or dependent adult, theft or unauthorized use of a vehicle, burglary, carjacking, robbery, receiving stolen property, shoplifting or mail theft,” the bill language reads.

Ramos said the need to act is urgent.

“It’s time for us to reverse the spikes in theft crimes since the pandemic. Our law enforcement members and district attorneys need additional tools such as AB 1772. We must reverse the trend before the problem grows worse. Last year I requested a state audit of the impact of Prop 47 on Riverside and San Bernardino counties,” said Ramos.

Prop 47 is the California initiative, approved by voters in 2014, that reclassified some felonies to misdemeanors and raised the minimum amount for most misdemeanor thefts from $400 to $950.

According to a Public Policy Institute of California (PPIC) report, the rate of occurrence of petty crimes like shoplifting and commercial burglaries have increased by double digits over the last four years.

In Orange County alone, commercial burglaries have spiked by 54%.

“Our communities are experiencing an increase in retail crime and deserve appropriate action from their legislators,” Valencia said.

San Bernardino County Sheriff Shannon Dicus thanked Ramos.

“This bill, designed to impose stricter penalties on serial retail theft suspects, responds urgently to the escalating consequences of shoplifting and related crimes on our communities,” he said.

AB 1772 supporters who spoke at the gathering included Sacramento Sheriff Jim Cooper and San Bernardino Chief of Police Darren Goodman. Listed as supporters are the California State Sheriff’s Association, City of Riverside Police Chief Larry Gonzalez and Redlands Chamber of Commerce.

-

Community2 weeks ago

Community2 weeks agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 3 – 6, 2024

-

Business2 weeks ago

Business2 weeks agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Community2 weeks ago

Community2 weeks agoAG Bonta Says Oakland School Leaders Should Comply with State Laws to Avoid ‘Disparate Harm’ When Closing or Merging Schools

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 10 – 16, 2024

-

Community1 week ago

Community1 week agoOakland WNBA Player to be Inducted Into Hall of Fame

-

Community1 week ago

Community1 week agoRichmond Nonprofit Helps Ex-Felons Get Back on Their Feet

-

City Government2 weeks ago

City Government2 weeks agoLAO Releases Report on Racial and Ethnic Disparities in California Child Welfare System