Advice

Owning a Home: Guidance from Your Local Home Lending Advisor

Chase has developed a new role called “Community Home Lending Advisor,” which is designed to be in minority and low-to-moderate income communities. These are experts focused on local housing and down payment assistance programs and work closely with local housing nonprofits and other community organizations. To date, Chase has hired more than 100 Community Home Lending Advisors nationwide and will continue to expand.

Are you considering buying your first home, but unsure where to start? Purchasing a home is one of the biggest financial decisions a person can make, and the path to ownership may feel confusing for many first-time buyers. Thankfully, it doesn’t have to be. Chase bank can help you navigate the homebuying process, so getting the keys to your first home may be closer than you think.

Homeownership is more than just a dream for many Americans. In Chase Home Lending’s First-Time Homebuyer Study, 69% of respondents said they see homeownership as an important part of building wealth. The survey included more than 1,100 consumers who indicated that they are looking to purchase a home and are actively preparing to buy.

For Black communities, who have a significantly lower homeownership rate compared to other groups, the 2008 housing crisis and the COVID-19 pandemic continue to take a major toll. That’s why Chase is taking steps to play an active role in creating opportunities for minority communities, which includes offering affordable, low downpayment options with products and programs designed for Black families on their path to homeownership.

Dive in and uncover what you need to know about buying your first home, and how Chase can help make your dream a reality.

Working with a Home Lending Advisor

Chase’s Home Lending Advisors are responsible for helping you prepare for homeownership, find the financing solutions to fit your needs, and get all of the down payment/housing assistance for which you may qualify. Home Lending Advisors work very closely with many first-time homebuyers, helping them navigate this process for the first time. They also help customers who are looking to refinance, or who might be upsizing or downsizing their current home. Chase and its Home Lending team start by looking at each customer’s full financial picture in order to make the best recommendation for your successful path to homeownership. From prequalification to closing, we’re here to offer guidance, support and expertise along the way.

Applying for Home Loans

A few basic things first-time buyers should understand before starting this process are:

- Prepare your finances: Buying a home can be a big financial undertaking, which is why it will be important for you to get your finances in good shape. This involves things like continuing to pay bills on time, not taking on new debt and strengthening your credit score, which can help you secure a lower interest rate on your home loan. Chase is making it easier for customers to build up their credit score by supporting Project REACh, a program that increases chances of approval for applicants who have traditionally lacked access, so they can take that very first step.

- Plan for your down payment: It’s a well-known fact that you will most likely need to put money down up front to purchase a home. However, it’s a myth that you must put 20% down. Every case is different, and there are a variety of mortgages available that may require as little as 3% down, such as the Chase DreaMaker. There may also be local programs that could help with down payments and closing costs. It’s always a good idea to start saving, but it’s also important to get familiar with what products and assistance might be available to you. You can connect with a Home Lending Advisor to get started.

- Get pre-qualified: As you begin your homebuying journey, you should know upfront how much home you can afford. Getting pre-qualified through a lender like Chase allows you to see what you may be eligible for, and it also shows sellers and real estate agents that you’re a serious and competitive buyer.

Acknowledging the Resources Available to You

Chase’s Homebuyer Grant program offers up to $5,000 for eligible customers to help with closing costs and down payment assistance when buying a home in more than 6,700 minority communities nationwide. The Chase DreaMaker mortgage offers down payments as low as 3% and reduced mortgage insurance.

Chase also developed a new role called “Community Home Lending Advisor,” which is designed to be in minority and low-to-moderate income communities. These are experts focused on local housing and down payment assistance programs and work closely with local housing nonprofits and other community organizations. To date, Chase has hired more than 100 Community Home Lending Advisors nationwide and will continue to expand.

Getting Started Today

For those starting their journey toward homeownership, Chase’s financial goals hub is a great starting point. You start by picking a goal, which could be saving or building credit, and exploring advice, offerings and tools to help you track toward it and achieve it. The Grow Your Savings page, for example, offers an interactive calculator that maps out a timeline to reach savings goals and highlights how the Autosave tool can help you manage a regular savings schedule to stay on track and meet your goals. There are other great resources, too, like budget worksheets to monitor and track monthly spending, guidance on using the Credit Journey tool to build and protect credit, as well as background on low-cost checking accounts designed for those who have had trouble getting or keeping an account in the past.

Knowing When to Buy

Buying a home can be exciting, but it can also come with a lot of stress. Learning as much as you can about the homebuying process is the best thing you can do before you start shopping for properties or comparing mortgage options. Other questions you should consider before buying a home include:

- Do you have a steady income to rely on?

- How much home can you afford?

- Have you picked a location where you want to stay long-term?

- Are you comfortable managing debt?

If you think you’re ready to take the next step in purchasing a home, reach out to learn more about the tools, resources and capital available to help make your homeownership dream a reality.

Sponsored content from JPMorgan Chase & Co

Activism

Leading with Action, Love and Data Points: Six Questions for the California Black Women’s Collective

“Black Women in California have always had to be active participants in the labor market, but this report showcases the need for fair and just wages even for those of us with higher educational attainment,” said Kellie Todd-Griffin, President and Chief Executive Officer of the California Black Women’s Collective.

By Edward Henderson | California Black Media

The California Black Women’s Collective (CABWC) is a sisterhood of women from different professional backgrounds aiming to uplift and address the issues impacting Black women and girls in the state. They approach problem-solving with a range of expertise — from politics, business, and community advocacy to the arts, entertainment, social justice activism, and more.

Earlier this month, the organization released a wage report focused on Black women’s earnings in California titled “Pay Me What I am Worth.”

“Black Women in California have always had to be active participants in the labor market, but this report showcases the need for fair and just wages even for those of us with higher educational attainment,” said Kellie Todd-Griffin, President and Chief Executive Officer of the California Black Women’s Collective.

“Black Women in California wages are below the state mean wage and make less than most of their female counterparts in every category,” continued Todd-Griffin. “We must take action now.”

CABWC’s Black Girl Joy Festival is an event designed to uplift Black Women and Girls in a safe space while learning and having fun. The festival includes free workshops that prepare women for college, dancing, self-defense training, health screenings, yoga, arts & crafts, and food vendors.

The Collective’s Empowerment Institute, launched in collaboration with the Los Angeles-based research firm EVITARUS, produces the annual California Black Women’s Quality of Life Survey.

California Black Media spoke with Todd-Griffin about the organization’s impact, challenges it faces and some of its near-term plans.

What does your organization do to improve the lives of Black people in California?

The California Black Women’s Collective Empowerment Institute’s uplifts the issues and voices of Black Women and Girls in California through our programming. That includes the Black Women’s Worker Initiative that helps Black Women prepare for public section and non-traditional careers. Other initiatives are the CA Black Women’s Leadership Development Certificate program at CSU Dominguez Hills; Black Girl Joy Festival for middle and high school students; Conversations for Black Women, etc. Our targeted research also uncovers solutions to the toughest challenges Black women and girls face.

What was your greatest success over the course of the last year?

We released the first-ever California Black Women’s Quality of Life Survey. This study collected insights from 1,258 Black women voters across California to understand their economic state, most pressing concerns, their attitudes toward policymakers, and their experiences and issues in California.

In your view, what is the biggest challenge Black Californians face?

Black Californians, especially Black Women, continue to be left out of the conversation when it comes to building meaningful change to improve the lives of those who struggle the most.

What was your organization’s biggest challenge?

Our biggest challenge over the last year was transitioning from a volunteer driven entity, the California Black Women’s Collective, to creating a non-profit organization, the California Black Women’s Collective Empowerment Institute.

Does your organization support or plan to get involved in the push for reparations in California?

Absolutely!

How can more Californians of all backgrounds get involved in the work you’re doing?

We are on all the social media channels. They can also visit our website, www.CABlackWomensCollective.org.

Activism

The Silent Struggle of Pregnancy Loss

It is a tragedy that Black women’s odds of pregnancy loss are much higher than the general population. It’s even more tragic that there is a Black woman reading this article who has experienced pregnancy loss and has suffered in silence. There are an array of feelings associated with pregnancy loss, and women often feel alone and isolated in these feelings believing that no one understands what they are going through.

By Narissa Harris, LMFT

The topic and contents of this article may be difficult for some readers. Yet, it is of paramount importance to shed light on the silent struggle of pregnancy loss experienced by countless women.

During the holiday season, we often assume everyone is in a festive, happy mood. However, this time of year is filled with mixed emotions and can be especially difficult for Black women, who are 2-3 times more likely to experience a pregnancy loss compared to other women. Pregnancy loss (the death of an unborn baby/fetus during pregnancy) is experienced by 10-15% of women and doubles to 20-30% for Black women. Additionally, Black women are 3 times more likely to have a stillbirth in comparison to other women.

It is a tragedy that Black women’s odds of pregnancy loss are much higher than the general population. It’s even more tragic that there is a Black woman reading this article who has experienced pregnancy loss and has suffered in silence. There are an array of feelings associated with pregnancy loss, and women often feel alone and isolated in these feelings, believing that no one understands what they are going through.

Whether you are aware that someone has experienced pregnancy loss, or you have experienced pregnancy loss yourself, we must be sensitive and supportive to the women in our lives during this time of year. I encourage the following:

#1 – Don’t ask a woman about her uterus!

Yes, I know this is blunt and harsh, but it is important to be mindful of the trauma that may be triggered when asking a woman when she plans to have a baby. I will never forget being at a holiday party when a family member asked me when I was planning on having kids, unaware that I experienced my 3rd pregnancy loss just 6 weeks prior. It was triggering, upsetting, and annoying. While my husband and I were eventually blessed with 2 healthy children, I share my experience to reiterate the immediate and long-term harm caused by these types of invasive inquiries.

#2 – Connect with a supportive community!

If you are someone who has experienced a pregnancy loss or know a woman who has, it is vital to connect with a safe and supportive community even when everything is telling you (or that woman) to isolate. While no one in the chapter knew that I was dealing with pregnancy loss at the time, my connection with the Bay Area Chapter of the Association of Black Psychologists (Bay-ABPsi) served as a healing and uplifting space for my grief/loss. I learned from Baba Dr. Wade Nobles, who describes babies as divine and the closest beings to God. I want you to remember that connecting with our spiritual community and ancestors can offer healing and support.

#3 – Never lose hope!

To the women who have experienced pregnancy loss, it’s easy to believe that a successful pregnancy will not happen but keep the hope. Take the time you need to grieve and release the baby (or babies), allowing your womb to heal. View the lost pregnancy in terms of a spirit with a Divine purpose, even if it was short-lived, with you being the vessel for that Divine purpose. Believe and prepare for your baby, who will survive and succeed beyond the womb to fulfill their Divine purpose!

Bay ABPsi is a healing resource committed to providing the Post Newspaper readership with monthly discussions about critical issues in Black Mental Health. Readers are welcome to contact us at bayareaabpsi@gmail.com and join us at our monthly chapter meetings every 3rd Saturday via Zoom.

Advice

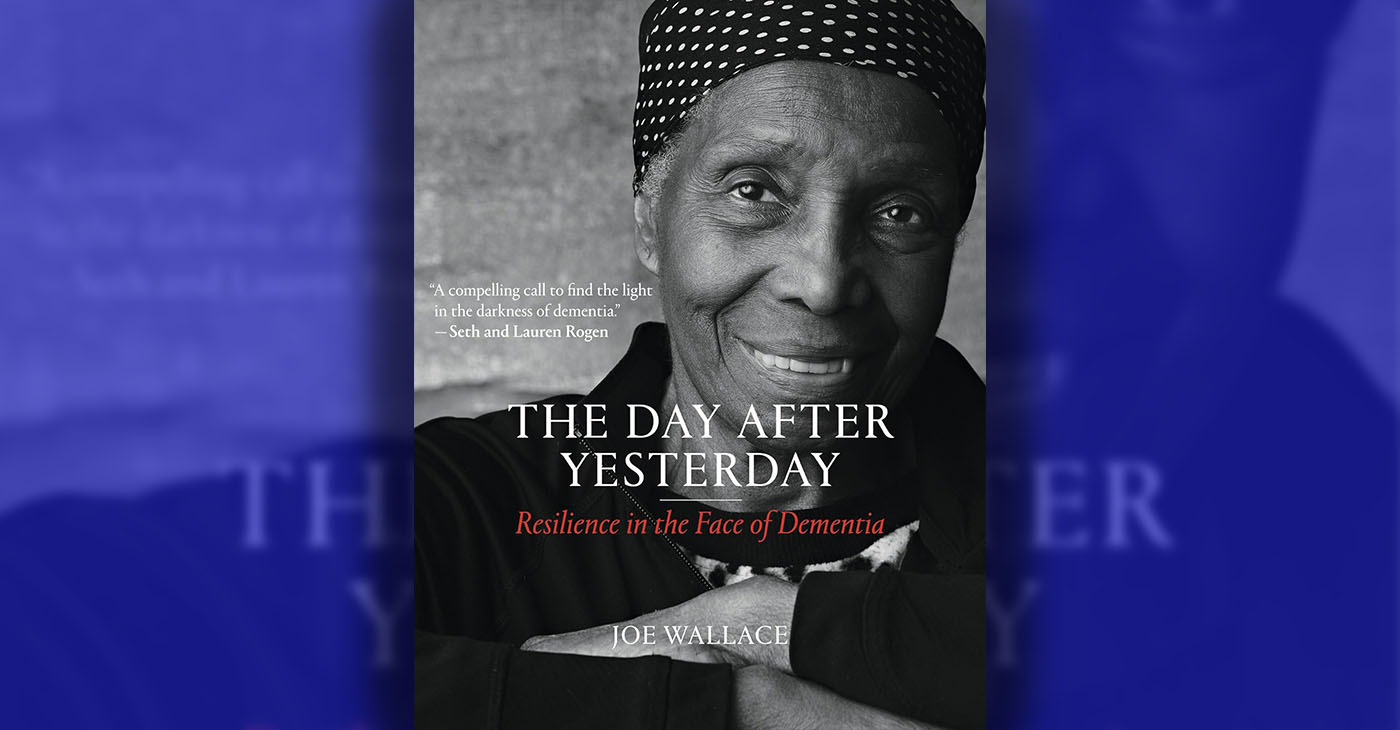

BOOK REVIEW: “The Day After Yesterday: Resilience in the Face of Dementia”

Well into his twenties, Joe Wallace was asked to sit with his “Granddaddy Joe” while Wallace’s mother and grandmother ran errands. His grandfather was once a vibrant man, and he’d been Wallace’s “hero,” but Alzheimer’s had put a curtain of sorts between them, and Wallace was “so frightened to be left alone with him.” It didn’t take long for him to realize that day that his grandfather was full of stories, and it was “magical.” He applied the same kind of patience when his grandmother began to experience dementia, too, and this spurred Wallace to tell a story of his own with his camera.

By Terri Schlichenmeyer

Sometimes, Mom talks a lot of nonsense.

She talks in random syllables, half-jokes, thoughts that come out of her mouth backwards or mixed up. You try, she laughs, you laugh, pretending that you understand but you don’t. Mom has dementia and there’s nothing that’ll fix it, but you can read “The Day After Yesterday” by Joe Wallace and change the conversation.

Talk about your awkward encounters.

Well into his twenties, Joe Wallace was asked to sit with his “Granddaddy Joe” while Wallace’s mother and grandmother ran errands. His grandfather was once a vibrant man, and he’d been Wallace’s “hero,” but Alzheimer’s had put a curtain of sorts between them, and Wallace was “so frightened to be left alone with him.”

It didn’t take long for him to realize that day that his grandfather was full of stories, and it was “magical.” He applied the same kind of patience when his grandmother began to experience dementia, too, and this spurred Wallace to tell a story of his own with his camera.

The portraits he captured eventually became an exhibit, and this book.

“In the United States,” Wallace says, “one in three seniors suffers with Alzheimer’s or another dementia at the time of their death.” Nearly $700 billion dollars annually is spent caring for people with dementia. Alzheimer’s, as one of Wallace’s subjects points out, affects Black seniors more often than it does whites. For that matter, people with dementia need not be seniors: early-onset Alzheimer’s can affect someone in their early 20s.

Listen, Wallace’s subjects almost always say, and don’t hide a diagnosis of dementia. There’s no shame in it. Reach out to others who’ve received the diagnosis. Ask for help. Watch for suicidal thoughts and depression. Ask for stories, before they’re lost, and be honest about what’s going on. You can’t change the diagnosis, but you can change your attitude toward it.

It’s called The Long Goodbye for a reason – and yet, your loved one with dementia is still on this side of the sod and you know there’s still some there there. In “The Day After Yesterday,” you’ll get a new point-of-view, for both of you.

In his introduction interview, author Joe Wallace explains how he came to understand that “we could all do so much better” for those with cognitive disabilities, including Alzheimer’s, and why eliminating fear and awkwardness is essential. Readers will be quite taken by the then-and-now pictures and by the conversations Wallace captured.

But beware: this isn’t a book on caregiving or advice-giving. It’s a delightful, heartbreaking, tearful, surprising collection of profiles of everyday people in their own words, people who go with the flow and deal with tomorrow when it comes. Yes, you’ll find advice here, but it pales in comparison to the presence that Wallace’s subjects and their families exhibit.

This powerful book is great for someone with a new dementia diagnosis; it proves that life is not over yet. It’s likewise great for a caregiver, gently ushering them toward grace.

Get “The Day After Yesterday. It’s time for a talk.

“The Day After Yesterday: Resilience in the Face of Dementia” by Joe Wallace

c.2023, The MIT Press. $34.95; 157 pages.

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 27 – April 2, 2024

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoFrom Raids to Revelations: The Dark Turn in Sean ‘Diddy’ Combs’ Saga

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: Lady Day and The Lights!

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBaltimore Key Bridge Catastrophe: A City’s Heartbreak and a Nation’s Alarm

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBaltimore’s Key Bridge Struck by Ship, Collapses into Water

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBeloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87