Bay Area

Oakland Organizations Champion Financial Literacy Empowering Residents with Vital Resources

Rising numbers of unbanked or underbanked individuals, largely due to unmet minimum balance requirements, have become a growing concern. However, organizations across Oakland are stepping up, waging a war against the financial illiteracy that’s plaguing some residents. Up to 4% of Alameda County’s residents lack access to basic banking services, with Black and Hispanic communities making up the majority of that unbanked or underbanked population.

By Magaly Muñoz

Rising numbers of unbanked or underbanked individuals, largely due to unmet minimum balance requirements, have become a growing concern. However, organizations across Oakland are stepping up, waging a war against the financial illiteracy that’s plaguing some residents.

Up to 4% of Alameda County’s residents lack access to basic banking services, with Black and Hispanic communities making up the majority of that unbanked or underbanked population. The term ‘unbanked’ describes people without a checking or savings account, while ‘underbanked’ describes people who have checking or savings accounts but often rely on alternative financial solutions like money orders and payday loans rather than conventional loans and credit cards.

Recently, the downtown Oakland Wells Fargo branch redesigned their bank to include a Hope Inside center in partnership with Operation HOPE, an organization centered around expanding economic opportunities for underserved communities.

The center features free access to financial coaches who work with individuals to gain financial assistance and guidance, such as helping improve credit scores.

Dr. Joaquin Wallace is one of the financial coaches at the Oakland branch who meets one-on-one with clients to provide credit money management solutions and develop strategic plans to assist them with reaching their financial goals.

He’s created a seven-step blueprint for attaining generational wealth. This includes acknowledging that your background and culture have significant influence on how you view finances, focusing on reprogramming financial trauma and gaining financial edification through literacy programs.

He shared that it can be difficult for some to accept their financial struggles because their environment might not allow for these immediate understandings because for many, money is not openly discussed in their communities.

“Money is a topic that is not communicated about — it’s taboo. And so first, you have to at least feel comfortable enough to have this conversation,” Wallace said.

Despite the initial roadblocks, the branch is seeing success with the program. Fifty-seven percent of the clients at the Hope Inside center have increased their credit score by an average of 19 points; 47% of the clients increased their savings by a median of $141; and 50% of clients have successfully reduced their debt by a median of $364.

Sonya Verdine, an Oakland resident of four years, is one of the success stories that Oakland Wells Fargo has helped since their soft launch in 2022.

Verdine’s life has been a rollercoaster of challenges including homelessness, mental health struggles and health scares that ultimately pushed her to improve her life, starting with attempting to correct the financial choices she’d made up to that point.

She was introduced to Wallace’s seven-step generational wealth method which provided her with a roadmap to get her on the right track to financial stability. Since visiting the Hope Inside center, Verdine has seen her credit score go up 200 points and she’s saving almost 10% of her income every month with a goal to someday buy her own home.

“You can take this program, you can start from literally nothing, and the program can help you build because they offer a variety of other services,” Verdine said. “It will be time well spent to participate in this program.”

Another organization that has long taken the reins to combat financial illiteracy and break the cycle of poverty is United Way Bay Area (UWBA), a program that assists families in the region to find financial stability.

Nicole Harden, Vice President of Economic Success at UWBA, says that their Sparkpoint program, which features centers scattered across the Bay Area that help low to middle income families establish financial goals, has grown tremendously since its inception in 2009. Anyone can come into one of their 23 centers to consult with a financial coach to receive guidance on how to increase their income, boost their credit, augment their savings, or reduce their debt.

She shared that it’s important for people to not feel embarrassed when talking about their financial struggles. Organizations like UWBA exist to help provide resources that they know are often inaccessible to underserved communities.

Harden explained that their centers not only cater to low-income families but see a significant number of women of color seeking assistance. As a result, they’ve taken the steps to ensure their programs are culturally competent to make conversations easier and more comfortable.

“We operate from the assumption that folks are creative, resourceful and whole. People have been making it all along, people aren’t broken. There’s systems that are broken, but this is an opportunity to work within the systems and help folks figure out how to navigate that,” she said.

Activism

Oakland Post: Week of April 24 – 30, 2024

The printed Weekly Edition of the Oakland Post: Week of April 24 – 30, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

Alameda County

DA Pamela Price Stands by Mom Who Lost Son to Gun Violence in Oakland

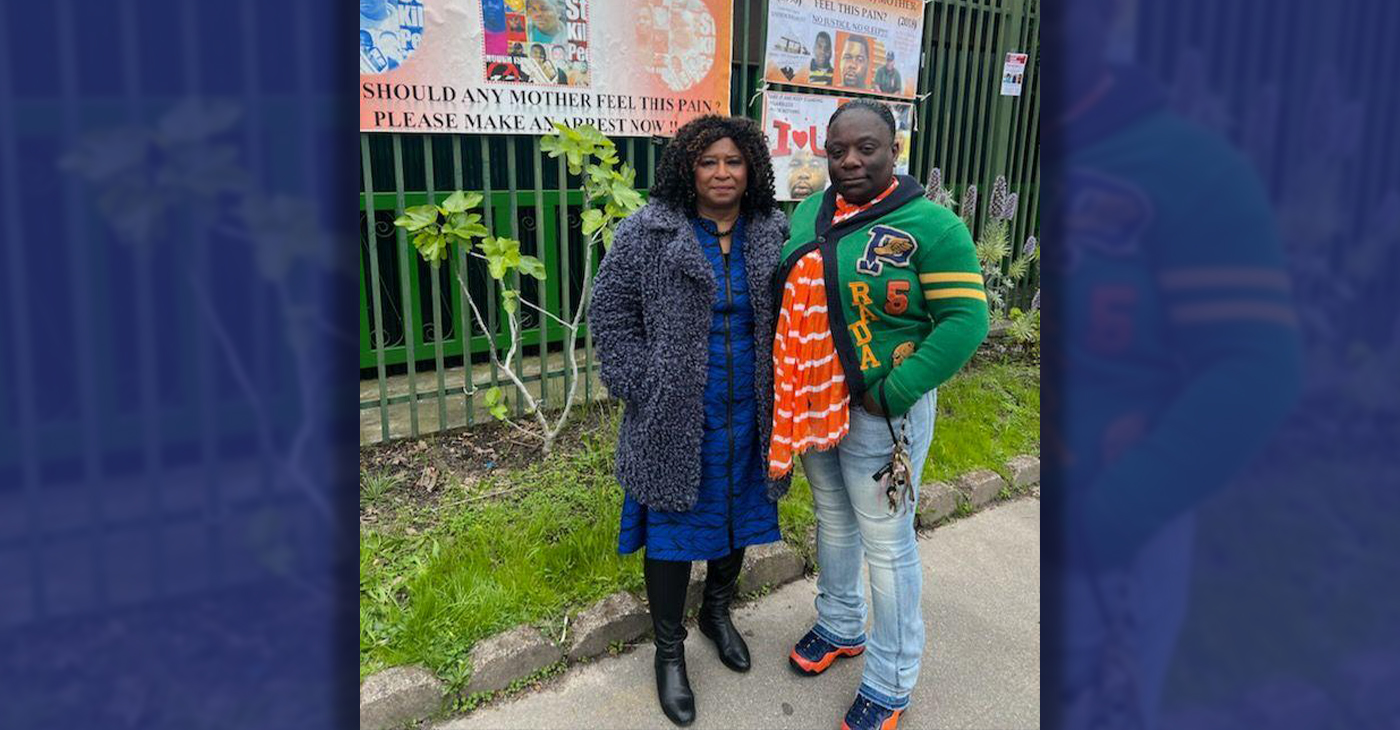

Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018.

Publisher’s note: Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018. The photo was too small for readers to see where the women were and what they were doing. Here we show Price and Jones as they complete a walk in memory of Scott. For more information and to contribute, please contact Carol Jones at 510-978-5517 at morefoundation.help@gmail.com. Courtesy photo.

Bay Area

State Controller Malia Cohen Keynote Speaker at S.F. Wealth Conference

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco. The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

By Carla Thomas

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco.

The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

“Our goal is to educate Black and Brown families in the masses about financial wellness, wealth building, and how to protect and preserve wealth,” said ABWA San Francisco Chapter President LaRonda Smith.

ABWA’s mission is to bring together businesswomen of diverse occupations and provide opportunities for them to help themselves and others grow personally and professionally through leadership, education, networking support, and national recognition.

“This day is about recognizing influential women, hearing from an accomplished woman as our keynote speaker and allowing women to come together as powerful people,” said ABWA SF Chapter Vice President Velma Landers.

More than 60 attendees dined on the culinary delights of Chef Sharon Lee of The Spot catering, which included a full soul food brunch of skewered shrimp, chicken, blackened salmon, and mac and cheese.

Cohen discussed the many economic disparities women and people of color face. From pay equity to financial literacy, Cohen shared not only statistics, but was excited about a new solution in motion which entailed partnering with Californians for Financial Education.

“I want everyone to reach their full potential,” she said. “Just a few weeks ago in Sacramento, I partnered with an organization, Californians for Financial Education.

“We gathered 990 signatures and submitted it to the [California] Secretary of State to get an initiative on the ballot that guarantees personal finance courses for every public school kid in the state of California.

“Every California student deserves an equal opportunity to learn about filing taxes, interest rates, budgets, and understanding the impact of credit scores. The way we begin to do that is to teach it,” Cohen said.

By equipping students with information, Cohen hopes to close the financial wealth gap, and give everyone an opportunity to reach their full financial potential. “They have to first be equipped with the information and education is the key. Then all we need are opportunities to step into spaces and places of power.”

Cohen went on to share that in her own upbringing, she was not guided on financial principles that could jump start her finances. “Communities of color don’t have the same information and I don’t know about you, but I did not grow up listening to my parents discussing their assets, their investments, and diversifying their portfolio. This is the kind of nomenclature and language we are trying to introduce to our future generations so we can pivot from a life of poverty so we can pivot away and never return to poverty.”

Cohen urged audience members to pass the initiative on the November 2024 ballot.

“When we come together as women, uplift women, and support women, we all win. By networking and learning together, we can continue to build generational wealth,” said Landers. “Passing a powerful initiative will ensure the next generation of California students will be empowered to make more informed financial decisions, decisions that will last them a lifetime.”

-

Community2 weeks ago

Community2 weeks agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 3 – 6, 2024

-

Business2 weeks ago

Business2 weeks agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Community2 weeks ago

Community2 weeks agoAG Bonta Says Oakland School Leaders Should Comply with State Laws to Avoid ‘Disparate Harm’ When Closing or Merging Schools

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 10 – 16, 2024

-

Community1 week ago

Community1 week agoOakland WNBA Player to be Inducted Into Hall of Fame

-

Community1 week ago

Community1 week agoRichmond Nonprofit Helps Ex-Felons Get Back on Their Feet

-

City Government2 weeks ago

City Government2 weeks agoLAO Releases Report on Racial and Ethnic Disparities in California Child Welfare System