Community

Mental Health Emphasized in Stockton’s Victor Community Support Services

Other programs offered include foster care and adoption services that match children with families; vocational and employment programs for youth and young adults, and special education schools for children with emotional and developmental challenges.

Stockton’s Victor Community Support Services (VCSS) was founded about 47 years ago by Dave Favor to offer mental health support to those struggling in San Joaquin County. With a strong focus on keeping families together, VCSS has a broad range of programs that address substance abuse and mental health issues, educational mental health development, and support services for juveniles who may be going down the wrong path.

The mental health outpatient program and the substance abuse programs use evidence-based practices (EBP), which entails research, clinical expertise, and a client’s individual preference and values. These issues are often the central cause of family breakdowns and VCSS provides a space where they are adequately addressed while also making sure the children are taken care of.

Other programs offered include foster care and adoption services that match children with families; vocational and employment programs for youth and young adults, and special education schools for children with emotional and developmental challenges.

A client in Victor, Calif., attests to the impact VCSS has on communities, not only in San Joaquin County, but across California;

“I am a success story. Before I came to Victor I was a mess, freaking out on people and making my family feel uncomfortable. I was untrusting and scared and needed help…now with VCSS I find myself making it through the day staying busy and occupied. Coming here has been many things for me and I have always had high expectations. Every day when I walked through the door I am greeted with a warm smile and good comments…this always brings my mood up. I give thanks for everyone who is helping me.”

VCSS is located at 2495 W. March Ln. #125, Stockton, 95207. Their hours are Monday through Friday from 8:00 a.m. through 5:00 p.m. For more information on programs and services, ways to donate, or get involved, contact their direct line at 209-465-1080 or visit their website. You can also follow their Facebook for updates and information.

All information directly sourced from https://www.victor.org/

The Stockton Post’s coverage of local news in San Joaquin County is supported by the Ethnic Media Sustainability Initiative, a program created by California Black Media and Ethnic Media Services to support community newspapers across California.

California Black Media

Expert Advice: How to Protect Yourself From Bias and Backlash at Work

As reports of antisemitic and Islamophobic threats and acts of hate and violence increase in California and across the country, the California Commission on the State of Hate (Commission) and California Civil Rights Department (CRD) continue to encourage Californians to take advantage of anti-hate resources available statewide, including the California vs Hate hotline and website. “The Commission on the State of Hate stands united in shared humanity with the people of California in denouncing violence and hate,” said Commission Chair Russell Roybal in a statement.

By Edward Henderson, California Black Media

As reports of antisemitic and Islamophobic threats and acts of hate and violence increase in California and across the country, the California Commission on the State of Hate (Commission) and California Civil Rights Department (CRD) continue to encourage Californians to take advantage of anti-hate resources available statewide, including the California vs Hate hotline and website.

“The Commission on the State of Hate stands united in shared humanity with the people of California in denouncing violence and hate,” said Commission Chair Russell Roybal in a statement.

“We recognize what is happening in the Middle East has devastated communities in California. Unfortunately, when these horrific events occur, instances of hate tend to rise as well. No person, whether they are Jewish, Muslim, Palestinian, Israeli, or perceived as members of any of these groups, should be subject to prejudice or violence,” he added.

“If you experience or witness hate in California, we encourage you to contact CA vs Hate to report the incident and get connected to support and resources.”

Title VII of the Civil Rights Act of 1964 prohibits discrimination in all aspects of employment, including hiring, firing, pay, job assignments, promotions, layoffs, training, fringe benefits, and any other term or condition of employment. This prohibition extends to discrimination based on religion, national origin, and race.

One form is the adverse treatment of an individual based on their actual or perceived religious practices or membership in a particular racial or national origin group.

Another form is adverse treatment based on the assumption that the individual holds certain beliefs because of their religion, national origin, or race. There can also be adverse treatment due to the individual’s actual or perceived association with, or relationship to, a person of a particular religion, national origin, or race.

The UCLA Center for Equity and Inclusion recommends four tactics to respond to workplace bias or hate.

Interrupt Early

Workplace culture largely is determined by what is or isn’t allowed to occur. If people are lax in responding to bigotry, then bigotry prevails.

Use or Establish Policies

Call upon existing policies to address bigoted language or behavior. Work with your personnel director or human resources department to create new policies and procedures, as needed. Also ask your company to provide anti-bias training.

Go Up the Ladder

If behavior persists, take your complaints up the management ladder. Find allies in upper management and call on them to help create and maintain an office environment free of bias and bigotry.

Band Together

Like-minded colleagues also may form an alliance and then ask the colleague or supervisor to change his or her tone or behavior.

CA vs Hate is a non-emergency, multilingual hate crime and incident reporting hotline and online portal. Reports can be made anonymously by calling (833) 866-4283, or 833-8-NO-HATE, Monday to Friday from 9 a.m. to 6 p.m. PT or online at any time. Hate acts can be reported in 15 different languages through the online portal and in over 200 languages when calling the hotline. For individuals who want to report a hate crime to law enforcement immediately or who are in imminent danger, please call 911. For more information on CA vs Hate, please visit CAvsHate.org.

California Black Media

Commentary: Finding the Right Balance — Addressing Organized Retail Theft While Upholding Civil Liberties

Organized retail theft is a significant issue that impacts both consumers and businesses. While it is crucial to address theft and protect businesses from losses, we should also be mindful of safeguarding individuals’ constitutional rights, particularly the right to due process. AB 1990 by Assemblymember Wendy Carrillo, also known as the STOP Act, raises concerns about the balance between addressing theft effectively and ensuring civil liberties are upheld.

By Assemblymember Tina McKinnor | Special to California Black Media Partners

Organized retail theft is a significant issue that impacts both consumers and businesses. While it is crucial to address theft and protect businesses from losses, we should also be mindful of safeguarding individuals’ constitutional rights, particularly the right to due process.

AB 1990 by Assemblymember Wendy Carrillo, also known as the STOP Act, raises concerns about the balance between addressing theft effectively and ensuring civil liberties are upheld. This bill allows law enforcement officers to make warrantless arrests for shoplifting offenses not witnessed by the officer, as long as there is reasonable cause to believe the individual committed the crime. This bill has a dangerous potential for overreach and infringes on civil liberties, particularly the right to due process.

While the stated intention behind the STOP Act is to combat organized retail theft and protect businesses, there are valid concerns that this bill is an overreach and that existing law works, if properly enforced by our partners in law enforcement. A petty theft involving property stolen valued at $950 or less may be charged as a felony or misdemeanor (called a wobbler) if the offender has the following prior convictions: 1) at least on prior petty or theft-related conviction for which a term of imprisonment was served, and 2) a prior conviction for a serious or violent offense, for any registerable sex offense, or for embezzlement from a dependent adult or anyone over the age of 65. A misdemeanor can result in a sentence of up to one year in jail, whereas a felon can mean incarceration for 16 months, two years or three years. Let’s look at shoplifting in California. It occurs when a suspect enters a store, while that establishment is open, intending to steal property worth less than $950. The crime is considered a misdemeanor, punishable by up to six months in the county jail.

Granting officers the authority to arrest individuals based on reasonable cause, without witnessing the crime firsthand, can lead to negative consequences and possible violations of individual rights. Probable cause is the legal standard by which police authorities have reason to obtain a warrant for the arrest of a suspected criminal and for the courts to issue a search warrant. A grand jury uses the probable cause standard to determine whether or not to issue a criminal indictment. The principle behind the probable cause standard is to limit the power of authorities to conduct unlawful search and seizure of a person or its property, and to promote formal, forensic procedures for gathering lawful evidence for the prosecution of the arrested criminal. Reasonable cause does not require any of this due process and only requires that an officer reasonably believes that a crime has been committed. It is essential to find a middle ground that effectively addresses organized retail theft without compromising the fundamental rights of individuals.

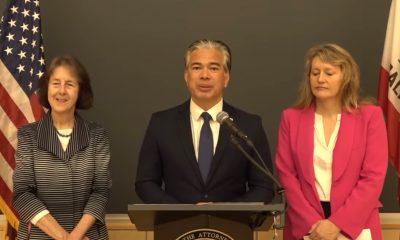

California’s current laws, including the use of witness statements and surveillance evidence are sufficient for addressing suspected shoplifting and organized retail theft. California Attorney General Rob Bonta recently prosecuted Michelle Mack, a suspected organized smash and grab ringleader who paid twelve women to travel around California and commit over $8 million in retail theft at 21 different stores. AG Bonta used California’s current laws to have the suspect arrested and brought to justice.

The State of California is also making significant investments to address retail theft. Just this past year California invested an additional $267 million to combat organized retail theft. It has been less than a year and our law enforcement partners should have the opportunity to address this recent spike in retail theft crime.

Los Angeles County recently applied for and received a grant for the State of California for $15.6 million dollars to address retail theft enforcement. LA District Attorney George Gascon also recently formed an organized retail task force that partners with LA County Sheriff’s Department, Glendale, Beverly Hills, Burbank, Torrance and Santa Monica Police Departments to integrate their response to retail theft across the region. These collaborative efforts, such as those seen in initiatives like the organized retail task force in LA County, demonstrate the importance of a united approach to tackling theft while maintaining a balance between enforcement and civil liberties.

As we move forward, it is essential for policymakers, law enforcement agencies, businesses and communities to work together in finding solutions that effectively address organized retail theft without encroaching on individual rights. Ongoing evaluation and a commitment to thoughtful consideration will be crucial in navigating this challenge and fostering a safe and prosperous environment for all. Balancing the scales of justice to protect businesses while upholding civil liberties demands a comprehensive and conscientious approach from all stakeholders involved.

I am confident we can find that balance.

About the Author

Assemblymember Tina McKinnor (D-Inglewood) represents the 61st District in Los Angeles County, which includes parts of the South Bay, Inglewood, Hawthorne and Lawndale.

Book Reviews

Book Review: Books for Poetry Month by Various Authors

Picture books for the littles are a great way to introduce your 3-to7-year-old to poetry because simple stories lend themselves to gentle rhymes and lessons. “See You on the Other Side” by Rachel Montez Minor, illustrated by Mariyah Rahman (Crown, $18.99) is a rhyming book about love and loss, but it’s not as sad as you might think.

c.2023, 2024, Various Publishers

$18.99 – $20.00

By Terri Schlichenmeyer

On your hands, you have lots of time.

You can make a song, or you can make a rhyme. Make a long story, make a short one, write what you like, make it simple and fun. Writing poetry uses your imagination: you play with words, paint a picture. There’s no intimidation. Creating poetry can be a breeze, or just reach for and read books exactly like these…

Picture books for the littles are a great way to introduce your 3-to7-year-old to poetry because simple stories lend themselves to gentle rhymes and lessons. “See You on the Other Side” by Rachel Montez Minor, illustrated by Mariyah Rahman (Crown, $18.99) is a rhyming book about love and loss, but it’s not as sad as you might think.

In this book, several young children learn that losing someone beloved is not a forever thing, that it is very sad but it’s not scary because their loved one is always just a thought away. Young readers who’ve recently experienced the death of a parent, grandparent, sibling, or friend will be comforted by the rhyme here, but don’t dismiss the words. Adults who’ve recently lost a loved one will find helpful, comforting words here, too.

Flitting from here to there and back again, author Alice Notley moves through phases of her life, locations, and her diagnosis and treatment of breast cancer in her latest poetry collection, “Being Reflected Upon” (Penguin, $20.00). From 2000 to 2017, Notley lived in Paris where she wrestled with breast cancer. That, and her life abroad, are reflected in the poetry here; she also takes readers on a poetic journey on other adventures and to other places she lived and visited. This book has a random feel that entices readers to skip around and dive in anywhere. Fans of Notley will appreciate her new-age approach to her works; new fans will enjoy digging into her thoughts and visions through poems. Bonus: at least one of the poems may make you laugh.

If you’re a reader who’s willing to look into the future, “Colorfast” by Rose McLarney (Penguin, $20.00) will be a book you’ll return to time and again. This, the author’s fourth collection, is filled with vivid poems of graying and fading, but also of bright shades, small things, women’s lives yesterday and today, McLarney’s Southern childhood, and the things she recalls about her childhood. The poems inside this book are like sitting on a front porch in a wooden rocking chair: they’re comfortable, inviting, and they tell a story that readers will love discovering.

If these books aren’t enough, or if you’re looking for something different, silly, or classic, then head to your favorite bookstore or library. The ladies and gentlemen there will help you figure out exactly what you need, and they can introduce you to the kind of poetry that makes you laugh, makes you cry, entices a child, inspires you, gives you comfort, or makes you want to write your own poems. Isn’t it time to enjoy a rhyme?

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 20 – 26, 2024

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoFrom Raids to Revelations: The Dark Turn in Sean ‘Diddy’ Combs’ Saga

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoCOMMENTARY: Lady Day and The Lights!

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoBaltimore Key Bridge Catastrophe: A City’s Heartbreak and a Nation’s Alarm

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoBaltimore’s Key Bridge Struck by Ship, Collapses into Water

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of March 27 – April 2, 2024