Economics

Lending Practices Jeopardize Black Homeownership

While historical barriers that excluded Black America from the homeowner market for decades have crumbled, there are signs that emerging types of racial inequality are making homeownership an increasingly risky investment for African-American home seekers.

A new study from sociologists at Rice University and Cornell University found that African-Americans are 45 percent more likely than whites to switch from owning their homes to renting them.

The study, “Emerging Forms of Racial Inequality in Homeownership Exit, 1968-2009,” examines racial inequality in transitions out of homeownership over the last four decades. The authors used longitudinal household data from the Panel Study of Income Dynamics for the period 1968 to 2009, with a study sample of 6,994 non-Hispanic whites and 3,158 black homeowners.

The research revealed that despite modest gains in attaining homeownership over time, the racial gap in the likelihood of changing from ownership to renting began to widen in the 1990s. During the next two decades, African-American homebuyers were consistently over 45 percent more likely than whites to transition out of homeownership.

The authors claim that their findings point to a historical shift in racial stratification in American housing markets, from a system of overt market exclusion to, more recently, one of market exploitation.

“The 1968 passage of the Fair Housing Act outlawed housing market discrimination based on race,” said Gregory Sharp, a postdoctoral fellow in Rice’s Department of Sociology and the study’s lead author. “African-American homeowners who purchased their homes in the late 1960s or 1970s were no more or less likely to become renters than were white owners.

However, emerging racial disparities over the next three decades resulted in black owners who bought their homes in the 2000s being 50 percent more likely to lose their homeowner status than similar white owners.”

Sharp noted that these inequalities in homeownership exit held even after adjusting for an extensive set of life-cycle traits, socioeconomic characteristics, characteristics of housing units and debt loads, as well as events that prompt giving up homeownership, such as going through a divorce or losing a job.

Sharp said the deregulation of the mortgage markets in the 1980s – when Congress removed interest rate caps on first-lien home mortgages and permitted banks to offer loans with variable interest rate schedules – and subsequent emergence of the subprime market are likely reasons blacks were at an elevated risk of losing their homeowner status.

In 2000, African-Americans were more than twice as likely as whites with similar incomes to sign subprime loans; among lower-income blacks, more than half of home refinance loans were subprime.

“African-American homeowners’ heightened subprime rates were not only due to their relatively weaker socioeconomic position, but also because lenders specifically targeted minority neighborhoods,” Sharp said.

Sharp and his coauthor hope the research will prompt further analysis of additional factors that potentially contribute to racial disparities in homeownership exit, such as household wealth and residential location.

The study will appear in the August edition of Social Problems and was coauthored by Matthew Hall, a demographer and assistant professor of public policy at Cornell University. A National Institutes of Health grant from Pennsylvania State University’s Population Research Institute Center funded the research, which is available online at http://bit.ly/1rDgkmL.

Business

Black Business Summit Focuses on Equity, Access and Data

The California African American Chamber of Commerce hosted its second annual “State of the California African American Economy Summit,” with the aim of bolstering Black economic influence through education and fellowship. Held Jan. 24 to Jan. 25 at the Westin Los Angeles Airport Hotel, the convention brought together some of the most influential Black business leaders, policy makers and economic thinkers in the state. The discussions focused on a wide range of economic topics pertinent to California’s African American business community, including policy, government contracts, and equity, and more.

By Solomon O. Smith, California Black Media

The California African American Chamber of Commerce hosted its second annual “State of the California African American Economy Summit,” with the aim of bolstering Black economic influence through education and fellowship.

Held Jan. 24 to Jan. 25 at the Westin Los Angeles Airport Hotel, the convention brought together some of the most influential Black business leaders, policy makers and economic thinkers in the state. The discussions focused on a wide range of economic topics pertinent to California’s African American business community, including policy, government contracts, and equity, and more.

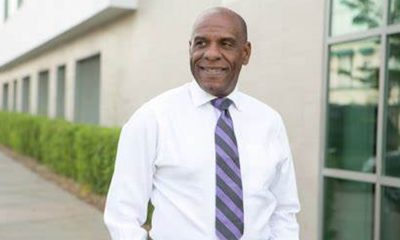

Toks Omishakin, Secretary of the California State Transportation Agency (CALSTA) was a guest at the event. He told attendees about his department’s efforts to increase access for Black business owners.

“One thing I’m taking away from this for sure is we’re going to have to do a better job of connecting through your chambers of all these opportunities of billions of dollars that are coming down the pike. I’m honestly disappointed that people don’t know, so we’ll do better,” said Omishakin.

Lueathel Seawood, the president of the African American Chamber of Commerce of San Joaquin County, expressed frustration with obtaining federal contracts for small businesses, and completing the process. She observed that once a small business was certified as DBE, a Disadvantaged Business Enterprises, there was little help getting to the next step.

Omishakin admitted there is more work to be done to help them complete the process and include them in upcoming projects. However, the high-speed rail system expansion by the California High-Speed Rail Authority has set a goal of 30% participation from small businesses — only 10 percent is set aside for DBE.

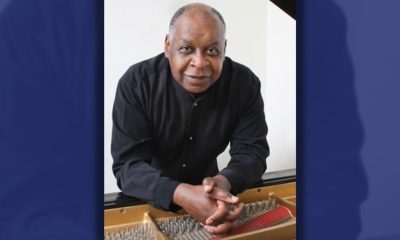

The importance of Diversity, Equity and Inclusion (DEI) in economics was reinforced during the “State of the California Economy” talk led by author and economist Julianne Malveaux, and Anthony Asadullah Samad, Executive Director of the Mervyn Dymally African American Political and Economic Institute (MDAAPEI) at California State University, Dominguez Hills.

Assaults on DEI disproportionately affect women of color and Black women, according to Malveaux. When asked what role the loss of DEI might serve in economics, she suggested a more sinister purpose.

“The genesis of all this is anti-blackness. So, your question about how this fits into the economy is economic exclusion, that essentially has been promoted as public policy,” said Malveaux.

The most anticipated speaker at the event was Janice Bryant Howroyd known affectionately to her peers as “JBH.” She is one of the first Black women to run and own a multi-billion-dollar company. Her company ActOne Group, is one of the largest, and most recognized, hiring, staffing and human resources firms in the world. She is the author of “Acting Up” and has a profile on Forbes.

Chairman of the board of directors of the California African American Chamber of Commerce, Timothy Alan Simon, a lawyer and the first Black Appointments Secretary in the Office of the Governor of California, moderated. They discussed the state of Black entrepreneurship in the country and Howroyd gave advice to other business owners.

“We look to inspire and educate,” said Howroyd. “Inspiration is great but when I’ve got people’s attention, I want to teach them something.”

Activism

Oakland Post: Week of April 17 – 23, 2024

The printed Weekly Edition of the Oakland Post: Week of April 17 – 23, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

Activism

Oakland Post: Week of April 10 – 16, 2024

The printed Weekly Edition of the Oakland Post: Week of April 10 – 16, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 27 – April 2, 2024

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress4 weeks ago

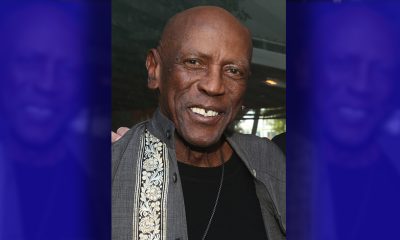

#NNPA BlackPress4 weeks agoBeloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87

-

Community1 week ago

Community1 week agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 3 – 6, 2024

-

Business1 week ago

Business1 week agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 10 – 16, 2024