Bay Area

‘Godzilla Next Door’: How California Developers Gained New Leverage to Build More Homes

It’s hard to know just how many builder’s remedy projects have been filed across the state. YIMBY Law, a legal advocacy group that sues municipalities for failing to plan for or build enough housing, has a running count on its website of 46 projects, though its founder, Sonja Trauss, admits that it’s an imperfect tally.

By Ben Christopher

CalMatters

Late last fall, a Southern California developer dropped more than a dozen mammoth building proposals on the city of Santa Monica that were all but designed to get attention.

The numbers behind WS Communities’s salvo of proposals were dizzying: 14 residential highrises with a combined 4,260 units dotting the beachside city, including three buildings reaching 18 stories. All of the towers were bigger, denser and higher than anything permitted under the city’s zoning code.

City Councilmember Phil Brock attended a town hall shortly after the announcement and got an earful. A few of the highlights: “Godzilla next door,” “a monster in our midst” and “we’re going to never see the sun again.”

“‘Concerned’ would be putting it mildly,” Brock said of the vibe among the attendees. “A lot of them were freaked.”

As it turns out, freaking locals out may have been the point.

WS Communities put forward its not-so-modest proposal at a moment when it had extreme leverage over the city thanks to a new interpretation of a 33-year-old housing law. Santa Monica’s state-required housing plan had expired and its new plan had yet to be approved. According to the law, in that non-compliance window, developers can exploit the so-called builder’s remedy, in which they can build as much as they want wherever they want so long as at least 20% of the proposed units are set aside for lower income residents.

Over the last two years, local governments across California have had to cobble together new housing plans that meet a statewide goal of 2.5 million new units by 2030. At last count, 227 jurisdictions — home to nearly 12 million Californians, or about a third of the state population — still haven’t had their plans certified by state housing regulators, potentially opening them up to builder’s remedy projects.

That gives developers a valuable new bargaining chip.

WS Communities used its advantage in Santa Monica to broker a deal in which it agreed to rescind all but one of its 14 builder’s remedy projects in exchange for fast-tracked approval of 10 scaled-down versions.

“The builder’s remedy — the loss of zoning control, the ability of a developer to propose anything, Houston-style, whatever they want, no zoning regulations — that gets people’s attention,” said Dave Rand, the land-use attorney representing the WS Communities. “The builder’s remedy can be a strategic ploy in order to potentially leverage a third way.”

For the developer, the settlement — which still needs a final vote to fully be implemented — is a major win. But this use of a long-dormant law also represents a shift in the politics of housing in California, reflecting a new era of developer empowerment bolstered by the growing caucus of pro-building lawmakers in the Legislature.

“The old games of begging municipalities for a project and reducing the density to get there and kissing the ass of every councilmember and planning official and neighbor — that’s the old way of doing things,” said Rand. “Our spines are stiffening.”

It’s hard to know just how many builder’s remedy projects have been filed across the state. YIMBY Law, a legal advocacy group that sues municipalities for failing to plan for or build enough housing, has a running count on its website of 46 projects, though its founder, Sonja Trauss, admits that it’s an imperfect tally.

Some of the projects, like those in Santa Monica, are towers with hundreds of units. Others are more modest apartment buildings. Whatever the total, Trauss said it represents a significant uptake for a novel legal strategy.

“There were a lot of naysayers who were like ‘it’s too risky,’ ‘nobody knows what’s gonna happen,’ ‘nobody’s gonna do it,’ blah, blah, blah,” she said. “I feel vindicated. You know, people are trying it.”

But counting just the units proposed under the law misses its broader impact, said UC Davis law professor Chris Elmendorf.

Multiple cities rushed forward their housing plans this year, with city attorneys, city planners and councilmembers warning that failure to do so before a state-imposed deadline could invite a building free-for-all.

“All the action is in negotiation in the shadow of the law,” said Elmendorf. The law “may result in a lot of other projects getting permitted that never would have been approved because the developer had this negotiating chip.”

Rediscovering the California builder’s remedy

If it’s possible for someone to unearth a forgotten law, Elmendorf can rightly claim to have excavated the builder’s remedy.

The Legislature added the provision to the government code in 1990, but no one used it for decades. In the one case Elmendorf found where someone tried — a homeowner in Albany, just north of Berkeley, who wanted to build a unit in his backyard in 1991 without adding a parking spot — local planners shot down the would-be builder.

Elmendorf stumbled upon the long-ignored policy 28 years later while researching East Coast laws that let developers circumvent zoning restrictions in cities short on affordable housing.

He started tweeting about it. He even dubbed the California law the “builder’s remedy,” borrowing the coinage from Massachusetts.

“I think it’s fair to say that people in California had forgotten about the builder’s remedy almost completely until I started asking about it on Twitter,” he said. ” I think those twitter threads led some people to say, ‘huh.'”

Among those who noticed: staff at the state Housing and Community Development department who began listing the “remedy” as a possible consequence of failing to plan for enough housing.

Why was the builder’s remedy largely forgotten? The text of the law is complicated and it’s only relevant once every eight years, when cities and counties are required to put together their housing plan. Plus, though it allows developers to ignore a city’s zoning code, it’s not clear that it exempts them from extensive environmental review, making the cost savings of using it uncertain.

But more importantly, up until recently, invoking the builder’s remedy — the regulatory equivalent of a declaration of war — was bad for business.

Historically, local governments have had sweeping discretion over what gets built within their borders, where and under what terms and conditions. Developers and their lawyers hoping to succeed in such a climate had to excel at what one land use attorney dubbed the art of “creative groveling.”

But in recent years, as the state’s housing shortage and resulting affordability crisis have grown more acute, lawmakers have passed a series of bills to take away some of that local control. In many cases, cities and counties are now required to approve certain types of housing, like duplexes, subsidized housing apartments and accessory dwelling units, as long as the developer checks the requisite boxes.

That’s all led some developers to rethink their approach to dealing with local governments — one that is less concerned with building bridges and isn’t so afraid to burn a few.

Santa Monica makes a deal

Santa Monica’s city council voted unanimously for the deal with WS Communities early last month — but grudgingly.

In exchange for the developer pulling its original proposals, the city agreed to a streamlined approval process for the new plans. The council also agreed to pass an ordinance to give the developer extra goodies on the 10 remaining projects.

If the city doesn’t pass the ordinance, according to the settlement, WS Communities has the right to revive the builder’s remedy for all 14 towers.

Councilmember Brock, elected in 2020 along with a slate of development-skeptics, was hardly a fan of the deal. But as he saw it, the prospect of a lengthy legal battle that the city’s attorney insisted Santa Monica would lose gave the council little choice. That didn’t make what Brock viewed as a hard-knuckle negotiating tactic any easier to swallow.

“I don’t believe for a minute that they ever planned to build all those projects,” he said.

Councilmember Caroline Torosis, who was elected last fall, laid the blame on the prior council for failing to pass a timely housing plan. Even so, she said the city had no choice but to reclaim control over its own land use from the developer.

“We were put in a difficult situation,” she said. “I think that this was absolutely the best negotiated settlement that we could have reached, but of course, they had leverage.”

Both Scott Walter, the president of WS, and Neil Shekhter, the founder of the parent company, NMS Properties, refused a request to be interviewed through their lawyer, Rand.

But in true property kingpin fashion, WS was able to flip these builder’s remedy proposals into things of even greater value: ironclad plans that it can build out quickly or sell to another developer.

“The builder’s remedy projects were anything but fast and certain,” said Rand. “This has been parlayed into something with absolute certainty and front-of-the-line treatment.”

Affluent California cities fight back

About an hour’s drive northeast of Santa Monica, the foothill suburb of La Canada Flintridge recently rejected a builder’s remedy application.

During a May 1 hearing, Mayor Keith Eich stressed the city was “not denying the project.” Instead, they were denying that the builder’s remedy itself even applied to the city.

The argument: The housing plan the council passed last October complies with state law. California’s Housing and Community Development department rejected that version of the plan and has yet to certify a new one. But La Canada’s city attorney, Adrian Guerra argued at the hearing that the agency’s required changes were minor enough to make the October plan “substantially” compliant.

That’s not how state regulators see it. In March, the housing department sent the city a letter of “technical assistance.”

“A local jurisdiction does not have the authority to determine that its adopted element is in substantial compliance,” the letter reads.

Not so, said Guerra: “The court would make that determination.”

A number of cities across the state have made that argument. Among them are Los Altos Hills and Sonoma. Beverly Hills is already fending off a lawsuit contending that the law applies to that city, though it recently rejected a builder’s remedy project on extensive technical grounds.

It’s a question that’s almost certain to end up in court. A recent California’s Fifth Circuit Court of Appeal ruling offers legal fodder to both sides.

The April opinion ruled against the state housing department’s certification of the City of Clovis’ housing plan. That’s a point for those arguing that the word of state regulators is not inviolate. But the ruling also noted that courts “generally” defer to the state agency unless its decision is “clearly erroneous or unauthorized.”

Down the coast, the City of Huntington Beach isn’t relying on such legal niceties. In March, the city council passed an ordinance banning all builder’s remedy projects under the argument that the law itself is invalid. Days later, the Newsom administration sued the city.

But in Santa Monica, city council members didn’t see much upside in pushing back.

“You can’t just fight a losing battle,” Brock said. “I think anybody who decides they’re gonna be an all star NIMBY is up for failure.”

Activism

Oakland Post: Week of April 24 – 30, 2024

The printed Weekly Edition of the Oakland Post: Week of April 24 – 30, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

Alameda County

DA Pamela Price Stands by Mom Who Lost Son to Gun Violence in Oakland

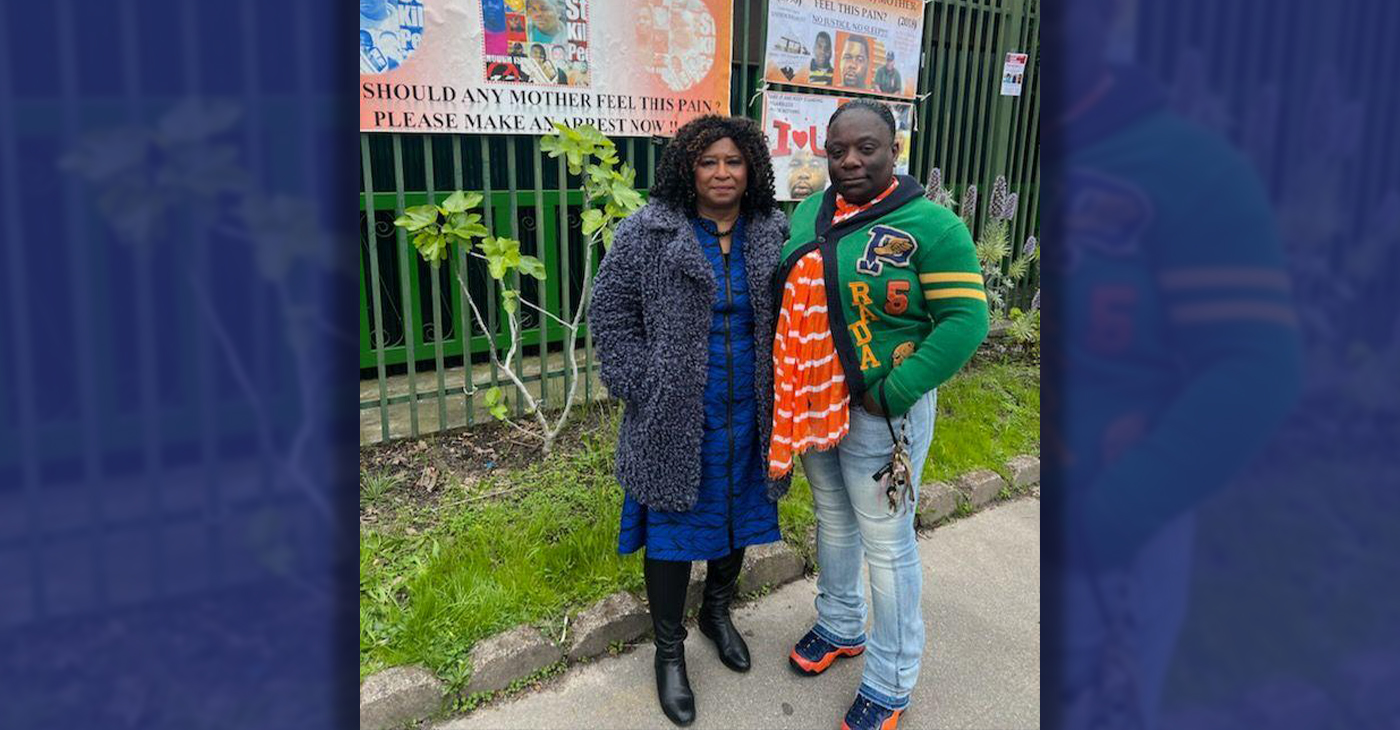

Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018.

Publisher’s note: Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018. The photo was too small for readers to see where the women were and what they were doing. Here we show Price and Jones as they complete a walk in memory of Scott. For more information and to contribute, please contact Carol Jones at 510-978-5517 at morefoundation.help@gmail.com. Courtesy photo.

Bay Area

State Controller Malia Cohen Keynote Speaker at S.F. Wealth Conference

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco. The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

By Carla Thomas

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco.

The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

“Our goal is to educate Black and Brown families in the masses about financial wellness, wealth building, and how to protect and preserve wealth,” said ABWA San Francisco Chapter President LaRonda Smith.

ABWA’s mission is to bring together businesswomen of diverse occupations and provide opportunities for them to help themselves and others grow personally and professionally through leadership, education, networking support, and national recognition.

“This day is about recognizing influential women, hearing from an accomplished woman as our keynote speaker and allowing women to come together as powerful people,” said ABWA SF Chapter Vice President Velma Landers.

More than 60 attendees dined on the culinary delights of Chef Sharon Lee of The Spot catering, which included a full soul food brunch of skewered shrimp, chicken, blackened salmon, and mac and cheese.

Cohen discussed the many economic disparities women and people of color face. From pay equity to financial literacy, Cohen shared not only statistics, but was excited about a new solution in motion which entailed partnering with Californians for Financial Education.

“I want everyone to reach their full potential,” she said. “Just a few weeks ago in Sacramento, I partnered with an organization, Californians for Financial Education.

“We gathered 990 signatures and submitted it to the [California] Secretary of State to get an initiative on the ballot that guarantees personal finance courses for every public school kid in the state of California.

“Every California student deserves an equal opportunity to learn about filing taxes, interest rates, budgets, and understanding the impact of credit scores. The way we begin to do that is to teach it,” Cohen said.

By equipping students with information, Cohen hopes to close the financial wealth gap, and give everyone an opportunity to reach their full financial potential. “They have to first be equipped with the information and education is the key. Then all we need are opportunities to step into spaces and places of power.”

Cohen went on to share that in her own upbringing, she was not guided on financial principles that could jump start her finances. “Communities of color don’t have the same information and I don’t know about you, but I did not grow up listening to my parents discussing their assets, their investments, and diversifying their portfolio. This is the kind of nomenclature and language we are trying to introduce to our future generations so we can pivot from a life of poverty so we can pivot away and never return to poverty.”

Cohen urged audience members to pass the initiative on the November 2024 ballot.

“When we come together as women, uplift women, and support women, we all win. By networking and learning together, we can continue to build generational wealth,” said Landers. “Passing a powerful initiative will ensure the next generation of California students will be empowered to make more informed financial decisions, decisions that will last them a lifetime.”

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 27 – April 2, 2024

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBeloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87

-

Community1 week ago

Community1 week agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 3 – 6, 2024

-

Business2 weeks ago

Business2 weeks agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 10 – 16, 2024

-

Community2 weeks ago

Community2 weeks agoAG Bonta Says Oakland School Leaders Should Comply with State Laws to Avoid ‘Disparate Harm’ When Closing or Merging Schools

-

Community6 days ago

Community6 days agoOakland WNBA Player to be Inducted Into Hall of Fame