Business

First-Time Buyers Face Hurdles to Homeownership This Spring

In this May 11, 2015 photo, Brett Singley, upper right, poses for a picture in front of their condo with his wife, Angelynn, 28, Isla 5, middle, Isaiah 3, right, Ben, 2, and Aria 1 month, in Santa Clarita, Calif. Singley bought the three-bedroom home for just under $300,000 $100,000 less than what he was prepared to pay for a house. (AP Photo/Chris Carlson)

ALEX VEIGA, AP Business Writers

JOSH BOAK, AP Business Writers

Young people aspiring to buy their first home are already facing disappointment this year.

Rising prices are putting more homes out of reach, and pickings are slim because few properties have come onto the market this spring, when sales are supposed to take off.

Millennials are also burdened by heavy school debt and depleted savings that hurt their ability to qualify for a mortgage. Until their incomes start to rise meaningfully, many will be forced to keep hunting for a home while delaying the dream of ownership. This has weighed on overall home sales and economic growth throughout the rebound in housing the past three years.

“People need to see more money in their paychecks before they’ll take the plunge into homeownership,” said Greg McBride, chief financial analyst at Bankrate.

If early signs are any indication, there won’t a noticeable jump in new homeowners during the spring.

Amy Arnold and her husband began looking at listings in Denver late last year. The 28-year-old apparel buyer quickly found that the few homes in the couple’s price range got snapped up for more than asking price, leaving her exasperated at how “crazy” the market seemed.

For now, the couple has decided to keep renting a two-bedroom, one-bath house for $1,300 a month, hoping to have more money and find a better selection of homes once they jump back into the market.

“It’s very discouraging,” said Arnold. “Hopefully next year we will be able to buy, but there’s a chance we may have to rent again.”

Home prices nationwide have risen at more than double the pace of average hourly wages, making it harder for buyers to find the extra funds to save for a down payment.

In Denver, a limited roster of homes has fueled the rising prices and given sellers the upper hand. Forty percent of homes that sold in February went for more than the asking price, according to online real estate broker Redfin. That’s up from 21 percent a year earlier. In addition, half of the homes on the market went under contract in eight days or fewer.

“Typically, January, February even March are not quite as highly competitive as when you go into the spring months,” said Ilona Botton, a Redfin agent in Denver. “That’s not how it was this year. It has been multiple offer situations every single month.”

The limited supply of homes is widespread. In March, one measure showed it would take fewer than five months to sell all the previously occupied homes in the U.S. In a market more balanced between buyers and sellers, it would take about six, according to the National Association of Realtors.

What’s more, heavy demand for low-priced homes means their prices are rising faster. Homes priced at $135,000 or less jumped 9 percent for the year ending in February, according to data from CoreLogic. Homes that priced at $226,800 or more climbed 5 percent over the same period.

Beyond offering more money, some buyers are willing to waive home inspection or give sellers several weeks to move out following a sale, said Redfin’s Botton.

In general, areas with fewer homes for sale have stronger job growth that eclipses the pace of construction. Areas with larger inventories tend to keep the availability of housing in line with job growth.

In Columbus, Ohio, aviation company executive Ryan Holtmann had plenty of options. He and his wife started shopping for their first home at the end of last year. The couple visited about 15 to 20 houses before buying a three-bedroom home for $154,900 at the end of February.

“I was really surprised at how much was out there for the time of year,” said Holtmann, 33. “There were three or four we liked and would have been more than happy to go with.”

One factor preventing more houses from hitting the market is that many homeowners still owe more on their mortgage than their home is worth. That’s known as an underwater mortgage, or being in negative equity.

While millions of homes have returned to positive equity as values come back, some 5.4 million, or 10.8 percent of all homes with a mortgage, remained underwater as of the October-December quarter, according to CoreLogic. Nevada topped the list. Nearly a quarter of its homes with a mortgage were underwater.

More construction would help buyers, but activity has recovered slowly since 2010. That’s one reason a recent report by mortgage buyer Freddie Mac forecast that the U.S. housing market will continue to see low levels of homes for sale for the next several years.

As a result, even successful buyers are settling for less.

Brett Singley, a first-time buyer in Los Angeles and a father of four, knew the kind of house he wanted and how much he could afford. But after six months of searching, the civil engineer shifted his sights to smaller and less expensive townhomes. In March, he bought one in Santa Clarita, a northern suburb. He got a three-bedroom for just under $300,000 — $100,000 less than what he was prepared to pay for a house.

“We were originally looking for a four-bedroom house,” said Singley. “But we didn’t have a lot of options.”

___

Veiga reported from Los Angeles. Boak reported from Washington.

Copyright 2015 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Bay Area

State Controller Malia Cohen Keynote Speaker at S.F. Wealth Conference

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco. The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

By Carla Thomas

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco.

The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

“Our goal is to educate Black and Brown families in the masses about financial wellness, wealth building, and how to protect and preserve wealth,” said ABWA San Francisco Chapter President LaRonda Smith.

ABWA’s mission is to bring together businesswomen of diverse occupations and provide opportunities for them to help themselves and others grow personally and professionally through leadership, education, networking support, and national recognition.

“This day is about recognizing influential women, hearing from an accomplished woman as our keynote speaker and allowing women to come together as powerful people,” said ABWA SF Chapter Vice President Velma Landers.

More than 60 attendees dined on the culinary delights of Chef Sharon Lee of The Spot catering, which included a full soul food brunch of skewered shrimp, chicken, blackened salmon, and mac and cheese.

Cohen discussed the many economic disparities women and people of color face. From pay equity to financial literacy, Cohen shared not only statistics, but was excited about a new solution in motion which entailed partnering with Californians for Financial Education.

“I want everyone to reach their full potential,” she said. “Just a few weeks ago in Sacramento, I partnered with an organization, Californians for Financial Education.

“We gathered 990 signatures and submitted it to the [California] Secretary of State to get an initiative on the ballot that guarantees personal finance courses for every public school kid in the state of California.

“Every California student deserves an equal opportunity to learn about filing taxes, interest rates, budgets, and understanding the impact of credit scores. The way we begin to do that is to teach it,” Cohen said.

By equipping students with information, Cohen hopes to close the financial wealth gap, and give everyone an opportunity to reach their full financial potential. “They have to first be equipped with the information and education is the key. Then all we need are opportunities to step into spaces and places of power.”

Cohen went on to share that in her own upbringing, she was not guided on financial principles that could jump start her finances. “Communities of color don’t have the same information and I don’t know about you, but I did not grow up listening to my parents discussing their assets, their investments, and diversifying their portfolio. This is the kind of nomenclature and language we are trying to introduce to our future generations so we can pivot from a life of poverty so we can pivot away and never return to poverty.”

Cohen urged audience members to pass the initiative on the November 2024 ballot.

“When we come together as women, uplift women, and support women, we all win. By networking and learning together, we can continue to build generational wealth,” said Landers. “Passing a powerful initiative will ensure the next generation of California students will be empowered to make more informed financial decisions, decisions that will last them a lifetime.”

Business

Black Business Summit Focuses on Equity, Access and Data

The California African American Chamber of Commerce hosted its second annual “State of the California African American Economy Summit,” with the aim of bolstering Black economic influence through education and fellowship. Held Jan. 24 to Jan. 25 at the Westin Los Angeles Airport Hotel, the convention brought together some of the most influential Black business leaders, policy makers and economic thinkers in the state. The discussions focused on a wide range of economic topics pertinent to California’s African American business community, including policy, government contracts, and equity, and more.

By Solomon O. Smith, California Black Media

The California African American Chamber of Commerce hosted its second annual “State of the California African American Economy Summit,” with the aim of bolstering Black economic influence through education and fellowship.

Held Jan. 24 to Jan. 25 at the Westin Los Angeles Airport Hotel, the convention brought together some of the most influential Black business leaders, policy makers and economic thinkers in the state. The discussions focused on a wide range of economic topics pertinent to California’s African American business community, including policy, government contracts, and equity, and more.

Toks Omishakin, Secretary of the California State Transportation Agency (CALSTA) was a guest at the event. He told attendees about his department’s efforts to increase access for Black business owners.

“One thing I’m taking away from this for sure is we’re going to have to do a better job of connecting through your chambers of all these opportunities of billions of dollars that are coming down the pike. I’m honestly disappointed that people don’t know, so we’ll do better,” said Omishakin.

Lueathel Seawood, the president of the African American Chamber of Commerce of San Joaquin County, expressed frustration with obtaining federal contracts for small businesses, and completing the process. She observed that once a small business was certified as DBE, a Disadvantaged Business Enterprises, there was little help getting to the next step.

Omishakin admitted there is more work to be done to help them complete the process and include them in upcoming projects. However, the high-speed rail system expansion by the California High-Speed Rail Authority has set a goal of 30% participation from small businesses — only 10 percent is set aside for DBE.

The importance of Diversity, Equity and Inclusion (DEI) in economics was reinforced during the “State of the California Economy” talk led by author and economist Julianne Malveaux, and Anthony Asadullah Samad, Executive Director of the Mervyn Dymally African American Political and Economic Institute (MDAAPEI) at California State University, Dominguez Hills.

Assaults on DEI disproportionately affect women of color and Black women, according to Malveaux. When asked what role the loss of DEI might serve in economics, she suggested a more sinister purpose.

“The genesis of all this is anti-blackness. So, your question about how this fits into the economy is economic exclusion, that essentially has been promoted as public policy,” said Malveaux.

The most anticipated speaker at the event was Janice Bryant Howroyd known affectionately to her peers as “JBH.” She is one of the first Black women to run and own a multi-billion-dollar company. Her company ActOne Group, is one of the largest, and most recognized, hiring, staffing and human resources firms in the world. She is the author of “Acting Up” and has a profile on Forbes.

Chairman of the board of directors of the California African American Chamber of Commerce, Timothy Alan Simon, a lawyer and the first Black Appointments Secretary in the Office of the Governor of California, moderated. They discussed the state of Black entrepreneurship in the country and Howroyd gave advice to other business owners.

“We look to inspire and educate,” said Howroyd. “Inspiration is great but when I’ve got people’s attention, I want to teach them something.”

Activism

Oakland Post: Week of April 17 – 23, 2024

The printed Weekly Edition of the Oakland Post: Week of April 17 – 23, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 27 – April 2, 2024

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoFrom Raids to Revelations: The Dark Turn in Sean ‘Diddy’ Combs’ Saga

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: Lady Day and The Lights!

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBaltimore Key Bridge Catastrophe: A City’s Heartbreak and a Nation’s Alarm

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBaltimore’s Key Bridge Struck by Ship, Collapses into Water

-

#NNPA BlackPress4 weeks ago

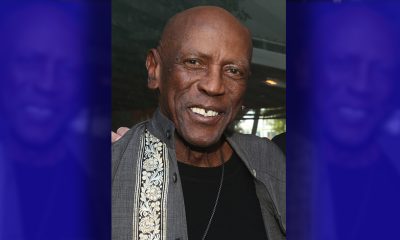

#NNPA BlackPress4 weeks agoBeloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87