#NNPA BlackPress

Celebrating Financial Literacy Month: Lendistry CEO Everett Sands Pioneers with Scientific Brilliance

NNPA NEWSWIRE — Lendistry CEO Everett K. Sands is motivated to do more than just get the word out; “One of the things that’s been part of my career is thinking about access to capital as skill and thinking about access to capital that for underserved communities. I think about it in three different ways. I think about it as Product, a process and a policy question, and those are the three things that I am typically working on.”

The post Celebrating Financial Literacy Month: Lendistry CEO Everett Sands Pioneers with Scientific Brilliance first appeared on BlackPressUSA.

By Kenneth Miller, Inglewood Today

“Bringing the gifts that my ancestors gave,

I am the dream and the hope of the slave.

I rise”—I Rise (last verse) Maya Angelou

Everett K. Sands, the Chief Executive Officer of Lendistry, life began as a small child with a brain that imagined a lot of what ifs.

What if his grandfather had the money to keep his tailor shop open? What if his parents did not start college at Howard University in Washington, DC when they were older?

And so, when a young Everett set off on a path to solve complicated financial puzzles that drive most people crazy, it tuned his competitive mind similar to the way a Michael Jordan or a LeBron James trained their body to become the greatest basketball players in history.

The wisdom he accumulated would lead this son of a doctor to earn a scholarship to a prestigious boarding school in the Washington DC area where he met the heir twin granddaughters of the Walmart Family, the richest family in America. The by chance meeting was enough for him to realize that he belonged.

His mother prayed for him to become a trailblazer and while he admitted that he does sometimes think about what causes him to think the way he does, he has not fully embraced pioneer status.

On Zoom, he sat isolated on a multicolored striped couch, wearing a purple polo with Lendistry stitched across his heart and a white Nike check on the left sleeve, expanding on how he became arguably one of the most impactful men in finance and lending for 58 minutes.

His laser eyes adjusted the computer for better concentration and his mind races to perfect his illustration of the next question.

Where does the foundation of Everett K. Sands begin?

“I don’t think there is a single thing. Like anybody else. We are all a series of events. The way I best describe it which is probably not perfect, but is what’s in my mind. I grew up as a kid with a lot of what ifs. I have parents that went to Howard, but they went late. They went to undergrad on time and went to graduate school kind of late. But you see your parents go late and you say oh that’s interesting, and then we drive past buildings and my mom would say that was your grandfather’s shop. The question is why isn’t it the shop now. And then you start to kind of just put the pieces together.”

He started to assemble the puzzle when he attended that boarding school and met really affluent people which also included the Walton granddaughters with whom he had a casual acquaintance.

They came to school in a limo, Sands did not show up in a limousine. When his friend asked if he knew who the twins were, he did not. He wasn’t poor, but certainly not as wealthy as his classmates. It didn’t take long for him to discover their grandfather is the founder of Walmart.

Sands got close enough to the twins to ask questions and discovered their grandfather got a loan for $30,000, but his grandfather did not gain access to capital and theirs did.

“I then started to put the pieces together. My parents went to school late because the money wasn’t there. We don’t have that building anymore because something happened with the business. Those moments and thoughts led me to ponder what if they had the access to capital?”

Sands contemplated what if he was there and what could he have done, his competitive juices flowing.

Lendistry, which he founded in 2015, is a byproduct of Sands looking at every business as if it was his grandfather’s, and it didn’t matter whether you were Black or white.

“I am a scientist by nature. I grew up Premed, my dad’s a doctor and so in science what you learn is A B testing. You learn how to look at a problem with multiple solutions because most scientist are trying to discover a cure for something, but I brought that into lending and that’s my process policy conversation,” he elaborated

Sands genius is a rare combination of renown scientist George Washington Carver and historical financier Maggie Lena Walker who was the first Black woman to establish and serve as president of a bank in the United States in 1903.

“I am a scientist and I am an individual who is extremely competitive and when you push all three of those together and you have me focus on underserved and undercapitalized communities that’s what you get. You get this guy that’s extremely determined to figure it out.” he said.

From the boarding school, Sands went on to University of Pennsylvania where he served as a board member for the Penn Institute for Urban Research and the Center for Strategic Economic Studies and Institutional Development.

While at Penn he met a mentor who tasked him to create a mortgage company. He was the person who did all of the research and did all of the things to figure it out. Although he and his mentor went their separate ways, Sands joined forces with a fraternity brother and the two of them developed one of the top 10 mortgage companies in America. Eventually, they earned a board seat on the first Black-owned bank in Maryland, Ideal Federal Savings.

That’s was at just 26-years of age and the two frat brothers have remained business partners since 1999.

The Ideal Federal Savings experience sparked something in him. He understood financing and subsequently sold the mortgage company and went to another Black bank as a leader.

“Those two experiences of sitting on the board of the bank are real life experiences that teach you things you don’t learn at Penn.”

By the time he went to Wells Fargo he was like an outlier because he could do almost everything.

“I ended up becoming the top one percent at Wells in terms of revenue and you name the stat from profitability which matters most to all of the other stuff.”

Although he was in the top one percent, he was just a token. Nonetheless what he managed to obtain levels of knowledge at Wells that he could not at the community bank.

The light bulb went on when he was introduced Corresponding banking which is the group that lends money to community banks.

He defined National Financial Literacy Month by merely prescribing solutions to the community it plagues.

“I think it means a couple of things. How do we think about deploying education and resources out to those who are looking to either expand their future, somewhat get a hold of their future and our lay the foundation,” he stated eloquently.

Sands is motivated to do more than just get the word out; “One of the things that’s been part of my career is thinking about access to capital as skill and thinking about access to capital that for underserved communities. I think about it in three different ways. I think about it as Product, a process and a policy question, and those are the three things that I am typically working on.”

When he thinks about financial literacy as a whole, process is the one that comes up.

“We’ve all said, hey… I wish would have learned more about credit in high school or how to balance my check book when I was a kid. I think where we have a challenge is we don’t always meet the user where they are at. The average kid is spending about two hours on Tic Toc right now, so are we creating a financial literacy that’s on Tic Toc? or, are we saying hey you should read this book? I am not saying there is anything wrong with reading, I am a reader, but I am also saying you have to have multiple ways to reach an audience and you have find ways to reach an audience where they are at.”

Sands admits that there are some structural issues, particularly legislatively, that seems to be stacked against Blacks and minorities.

“I think the first thing we need to look at is, have there been a higher number of Black politicians, and I think the answer to that question is yes. Are we, people on the ground helping them execute. At an eye level it’s about voting, but on a secondary level it’s about having conversations no different than if you were as going to address your neighborhood,” Sands added.

He educates politicians when he meets with them, and ask what the goal is from a legislative stand point and then he shares with them what’s happening from the street to bring about a resolution that benefits both the public servant and the community they serve.

Sands believes reason that Black communities suffer is because we are behind in the steps; “That doesn’t mean you don’t go through the evolution of the steps, that means you’re behind in the race, those are two separate things.”

The first step was to get our voices heard, then to elect officials who served our best interest and now, the responsibility of this generation is execution, which is what Lendistry did during the COVID pandemic.

“When it came time for the pandemic, we raised our hand and said let us be in the ball game of programming so that we could be the deployers of capital.”

That wasn’t easy because Lendistry had to assemble themselves very quickly and do all of the things the government required.

Lendistry became a one of the stars for the SBA during the pandemic, granting loans up to $10 million nationwide, and then because of determination and client focus, Lendistry lent upwards of $8 billion to more than half a million businesses across all 50 states.

Additionally, he was instrumental in the State of California non-profits receiving funding, the only state to do so.

Family is super important for Sands, most of them are here in Southern California but his mother is still in D.C.

“I work hard for them so that they don’t have to work as hard as I have to work,” he concluded.

Sands is very sensitive and protective of his family, especially his twin daughters.

“Like any parent I feel most helpless when they are sick or not feeling well.”

At his core he is a revolutionary teacher who has the uncanny ability to elucidate complicated financial widgets so the everyday consumer can comprehend.

Lendistry has mega clients as Amazon on its roster in addition to the myriad of banks and other financial institutions that relies on their services.

Everett K. Sands is a renaissance man, a revolutionary responsible for billions of dollars, also lives and futures of people like his grandfather.

Paving the way for perhaps another likeminded genius to evolve.

The post Celebrating Financial Literacy Month: Lendistry CEO Everett Sands Pioneers with Scientific Brilliance first appeared on BlackPressUSA.

#NNPA BlackPress

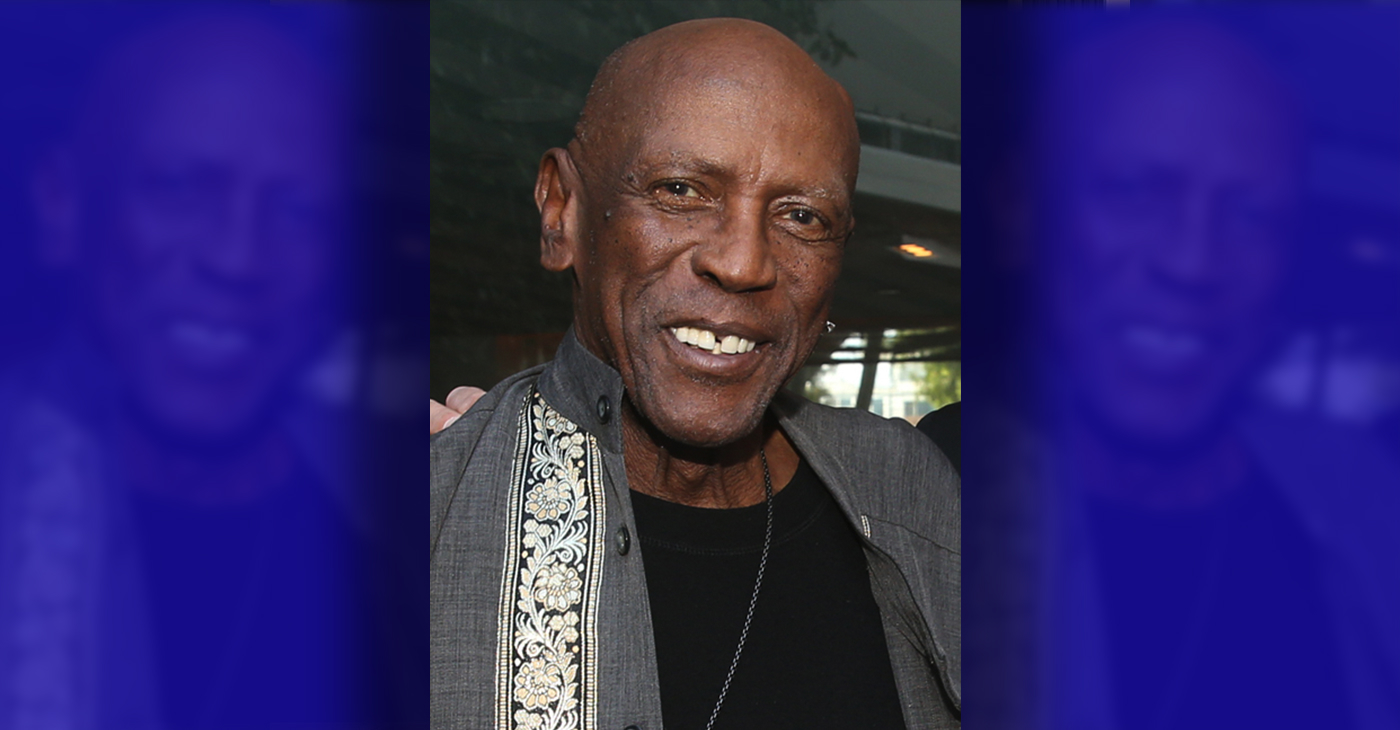

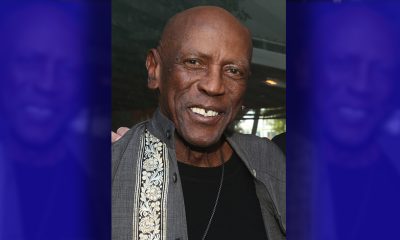

Beloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87

NNPA NEWSWIRE — Louis Gossett Jr., the groundbreaking actor whose career spanned over five decades and who became the first Black actor to win an Academy Award as Best Supporting Actor for his memorable role in “An Officer and a Gentleman,” has died. Gossett, who was born on May 27, 1936, in Brooklyn, N.Y., was 87. Recognized early on for his resilience and nearly unmatched determination, Gossett arrived in Los Angeles in 1967 after a stint on Broadway.

The post Beloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87 first appeared on BlackPressUSA.

By Stacy M. Brown

NNPA Newswire Senior National Correspondent

@StacyBrownMedia

Louis Gossett Jr., the groundbreaking actor whose career spanned over five decades and who became the first Black actor to win an Academy Award as Best Supporting Actor for his memorable role in “An Officer and a Gentleman,” has died. Gossett, who was born on May 27, 1936, in Brooklyn, N.Y., was 87. Recognized early on for his resilience and nearly unmatched determination, Gossett arrived in Los Angeles in 1967 after a stint on Broadway.

He sometimes spoke of being pulled over by law enforcement en route to Beverly Hills, once being handcuffed to a tree, which he remembered as a jarring introduction to the racial tensions of Hollywood. In his memoir “An Actor and a Gentleman,” Gossett recounted the ordeal, noting the challenges faced by Black artists in the industry. Despite the hurdles, Gossett’s talent shone brightly, earning him acclaim in groundbreaking productions such as “A Raisin in the Sun” alongside Sidney Poitier. His Emmy-winning portrayal of Fiddler in “Roots” solidified his status as a trailblazer, navigating a landscape fraught with racial prejudice.

According to the HistoryMakers, which interviewed him in 2005, Gossett’s journey into the limelight began during his formative years at PS 135 and Mark Twain Junior High School, where he demonstrated early leadership as the student body president. His passion for the arts blossomed when he starred in a “You Can’t Take It With You” production at Abraham Lincoln High School, catching the attention of talent scouts who propelled him onto Broadway’s stage in “Take A Giant Step.” His stellar performance earned him the prestigious Donaldson Award for Best Newcomer to Theatre in 1952. Though initially drawn to sports, Gossett’s towering 6’4” frame and athletic prowess led him to receive a basketball scholarship at New York University. Despite being drafted by the New York Knicks in 1958, Gossett pursued his love for acting, honing his craft at The Actors Studio under the tutelage of luminaries like John Sticks and Peggy Fury.

In 1961, Gossett’s talent caught the eye of Broadway directors, leading to roles in acclaimed productions such as “Raisin in the Sun” and “The Blacks,” alongside legends like James Earl Jones, Cicely Tyson, Roscoe Lee Brown, and Maya Angelou. Transitioning seamlessly to television, Gossett graced small screens with appearances in notable shows like “The Bush Baby” and “Companions in Nightmare.” Gossett’s silver screen breakthrough came with his role in “The Landlord,” paving the way for a prolific filmography that spanned over 50 movies and hundreds of television shows. From “Skin Game” to “Lackawanna Blues,” Gossett captivated audiences with his commanding presence and versatile performances.

However, his portrayal of “Fiddler” in Alex Haley’s groundbreaking miniseries “Roots” earned Gossett critical acclaim, including an Emmy Award. The HistoryMakers noted that his golden touch extended to the big screen, where his role as Sergeant Emil Foley in “An Officer and a Gentleman” earned him an Academy Award for Best Supporting Actor, making him a trailblazer in Hollywood history.

Beyond the glitz and glamour of Hollywood, Gossett was deeply committed to community activism. In 1964, he co-founded a theater group for troubled youth alongside James Earl Jones and Paul Sorvino, setting the stage for his lifelong dedication to mentoring and inspiring the next generation. Gossett’s tireless advocacy for racial equality culminated in the establishment of Eracism, a nonprofit organization dedicated to combating racism both domestically and abroad. Throughout his illustrious career, Gossett remained a beacon of strength and resilience, using his platform to uplift marginalized voices and champion social change. Gossett is survived by his children, Satie and Sharron.

The post Beloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87 first appeared on BlackPressUSA.

#NNPA BlackPress

COMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

WASHINGTON INFORMER — The D.C. crime bill and so many others like it are reminiscent of the ‘94 crime bill, which produced new and harsher criminal sentences, helped deploy thousands of police and surveilling methods in Black and brown communities, and incentivized more states to build prisons through a massive infusion of federal funding. While it is not at the root of mass incarceration, it significantly accelerated it, forcing a generation of Black and brown families into a never-ending cycle of state-sanctioned violence and incarceration.

The post COMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration first appeared on BlackPressUSA.

By Kaili Moss and Jillian Burford | Washington Informer

Mayor Bowser has signed the “Secure DC” omnibus bill passed by the D.C. Council last month. But we already know that this bill will be disastrous for all of D.C., especially for Black and brown residents.

While proponents claim that this legislation “will make D.C. residents safer and more secure,” it actually does nothing to address the root of the harm in the first place and instead maintains a cycle of violence, poverty, and broken community ties. The omnibus bill calls for increased surveillance, drug-free zones, and will expand pre-trial detention that will incarcerate people at a significantly higher rate and for an indeterminate amount of time before they are even tried. This bill will roll back decades of nationwide policy reform efforts and initiatives to keep our communities safe and whole, which is completely contradictory to what the “Secure” D.C. bill claims it will do.

What is unfolding in Washington, D.C., is part of a dangerous national trend. We have seen a resurrection of bad crime bills in several jurisdictions across the country — a phenomenon policy experts have named “zombie laws,” which are ineffective, costly, dangerous for communities of color and, most importantly, will not create public safety. Throwing more money into policing while failing to fund preventative measures does not keep us safe.

The D.C. crime bill and so many others like it are reminiscent of the ‘94 crime bill, which produced new and harsher criminal sentences, helped deploy thousands of police and surveilling methods in Black and brown communities, and incentivized more states to build prisons through a massive infusion of federal funding. While it is not at the root of mass incarceration, it significantly accelerated it, forcing a generation of Black and brown families into a never-ending cycle of state-sanctioned violence and incarceration. Thirty years later, despite spending billions each year to enforce these policies with many of these provisions remaining in effect, it has done very little to create long-term preventative solutions. Instead, it placed a permanent moving target on the backs of Black people, and the D.C. crime bill will do the same.

The bill calls for more pretrial detention. When our loved ones are held on pretrial detention, they are held on the presumption of guilt for an indeterminate amount of time before ever seeing a judge, which can destabilize people and their families. According to experts at the Malcolm Weimer Center for Social Policy at Harvard University, just one day in jail can have “devastating consequences.” On any given day, approximately 750,000 people are held in jails across the nation — a number that beats our nation’s capital population by about 100,000. Once detained, people run the risk of losing wages, jobs, housing, mental and health treatments, and time with their families. Studies show that pretrial detention of even a couple of days makes it more likely for that person to be rearrested.

The bill also endangers people by continuing a misguided and dangerous War on Drugs, which will not get drugs off the street, nor will it deter drug use and subsequent substance use disorders (SUDs). Drug policies are a matter of public health and should be treated as such. Many states such as Alabama, Iowa and Wisconsin are treating the current fentanyl crisis as “Crack 2.0,” reintroducing a litany of failed policies that have sent millions to jails and prisons instead of prioritizing harm reduction. Instead, we propose a simple solution: listen to members of the affected communities. Through the Decrim Poverty D.C. Coalition, community members, policy experts and other stakeholders formed a campaign to decriminalize drugs and propose comprehensive legislation to do so.

While there are many concerning provisions within the omnibus bill, car chases pose a direct physical threat to our community members. In July 2023, NBC4 reported that the D.C. Council approved emergency legislation that gave MPD officers the ability to engage in vehicular pursuits with so-called “limited circumstances.” Sgt. Val Barnes, the head of MPD’s carjacking task force, even expressed concern months before the decision, saying, “The department has a pretty strict no-chase policy, and obviously for an urban setting and a major metropolitan city, that’s understandable.” If our law enforcement officers themselves are operating with more concern than our elected officials, what does it say about the omnibus bill’s purported intention to keep us safe?

And what does it mean when the risk of bodily harm is posed by the pursuit itself? On Saturday, Feb. 10, an Eckington resident had a near-miss as a stolen car barreled towards her and her dog on the sidewalk with an MPD officer in pursuit. What responsibility does the city hold if this bystander was hit? What does restitution look like? Why are our elected officials pushing for MPD officers to contradict their own policies?

Just a few summers ago during the uprisings of 2020, we saw a shift in public perspectives on policing and led to legislation aimed at limiting police power after the highly-publicized murders of loved ones Breonna Taylor and George Floyd — both victims of War on Drugs policing and the powers gained from the ’94 crime bill. And yet here we are. These measures do not keep us safe and further endanger the health of our communities. Studies show that communities that focus on harm reduction and improving material conditions have a greater impact on public safety and community health. What’s missing in mainstream conversations about violent crime is the violence that stems from state institutions and structures that perpetuate racial and class inequality. The people of D.C. deserve to feel safe, and that includes feeling safe from the harms enacted by the police.

Kaili Moss is a staff attorney at Advancement Project, a national racial justice and legal organization, and Jillian Burford is a policy organizer at Harriet’s Wildest Dreams.

The post COMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration first appeared on BlackPressUSA.

#NNPA BlackPress

Mayor, City Council President React to May 31 Closing of Birmingham-Southern College

THE BIRMINGHAM TIMES — “This is a tragic day for the college, our students, our employees, and our alumni, and an outcome so many have worked tirelessly to prevent,” Rev. Keith Thompson, chairman of the BSC Board of Trustees said in an announcement to alumni. “We understand the devastating impact this has on each of you, and we will now direct our efforts toward ensuring the smoothest possible transition for everyone involved.”

The post Mayor, City Council President React to May 31 Closing of Birmingham-Southern College first appeared on BlackPressUSA.

By Barnett Wright | The Birmingham Times

Birmingham-Southern College will close on May 31, after more than a century as one of the city’s most respected institutions.

“This is a tragic day for the college, our students, our employees, and our alumni, and an outcome so many have worked tirelessly to prevent,” Rev. Keith Thompson, chairman of the BSC Board of Trustees said in an announcement to alumni. “We understand the devastating impact this has on each of you, and we will now direct our efforts toward ensuring the smoothest possible transition for everyone involved.”

There are approximately 700 students enrolled at BSC this semester.

“Word of the decision to close Birmingham Southern College is disappointing and heartbreaking to all of us who recognize it as a stalwart of our community,” Birmingham Mayor Randall Woodfin said in a statement. “I’ve stood alongside members of our City Council to protect this institution and its proud legacy of shaping leaders. It’s frustrating that those values were not shared by lawmakers in Montgomery.”

Birmingham City Council President Darrell O’Quinn said news of the closing was “devastating” on multiple levels.

“This is devastating for the students, faculty members, families and everyone affiliated with this historic institution of higher learning,” he said. “It’s also profoundly distressing for the surrounding community, who will now be living in close proximity to an empty college campus. As we’ve seen with other institutions that have shuttered their doors, we will be entering a difficult chapter following this unfortunate development … We’re approaching this with resilience and a sense of hope that something positive can eventually come from this troubling chapter.”

The school first started as the merger of Southern University and Birmingham College in 1918.

The announcement comes over a year after BSC officials admitted the institution was $38 million in debt. Looking to the Alabama Legislature for help, BSC did not receive any assistance.

This past legislative session, Sen. Jabo Waggoner sponsored a bill to extend a loan to BSC. However, the bill subsequently died on the floor.

Notable BSC alumni include former New York Times editor-in-chief Howell Raines, former U.S. Sen. Howell Heflin and former Alabama Supreme Court Chief Justice Perry O. Hooper Sr.

This story will be updated.

The post Mayor, City Council President React to May 31 Closing of Birmingham-Southern College first appeared on BlackPressUSA.

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 27 – April 2, 2024

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBeloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87

-

Community1 week ago

Community1 week agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 3 – 6, 2024

-

Business1 week ago

Business1 week agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 10 – 16, 2024