Business

First-Time Buyers Face Hurdles to Homeownership This Spring

In this May 11, 2015 photo, Brett Singley, upper right, poses for a picture in front of their condo with his wife, Angelynn, 28, Isla 5, middle, Isaiah 3, right, Ben, 2, and Aria 1 month, in Santa Clarita, Calif. Singley bought the three-bedroom home for just under $300,000 $100,000 less than what he was prepared to pay for a house. (AP Photo/Chris Carlson)

ALEX VEIGA, AP Business Writers

JOSH BOAK, AP Business Writers

Young people aspiring to buy their first home are already facing disappointment this year.

Rising prices are putting more homes out of reach, and pickings are slim because few properties have come onto the market this spring, when sales are supposed to take off.

Millennials are also burdened by heavy school debt and depleted savings that hurt their ability to qualify for a mortgage. Until their incomes start to rise meaningfully, many will be forced to keep hunting for a home while delaying the dream of ownership. This has weighed on overall home sales and economic growth throughout the rebound in housing the past three years.

“People need to see more money in their paychecks before they’ll take the plunge into homeownership,” said Greg McBride, chief financial analyst at Bankrate.

If early signs are any indication, there won’t a noticeable jump in new homeowners during the spring.

Amy Arnold and her husband began looking at listings in Denver late last year. The 28-year-old apparel buyer quickly found that the few homes in the couple’s price range got snapped up for more than asking price, leaving her exasperated at how “crazy” the market seemed.

For now, the couple has decided to keep renting a two-bedroom, one-bath house for $1,300 a month, hoping to have more money and find a better selection of homes once they jump back into the market.

“It’s very discouraging,” said Arnold. “Hopefully next year we will be able to buy, but there’s a chance we may have to rent again.”

Home prices nationwide have risen at more than double the pace of average hourly wages, making it harder for buyers to find the extra funds to save for a down payment.

In Denver, a limited roster of homes has fueled the rising prices and given sellers the upper hand. Forty percent of homes that sold in February went for more than the asking price, according to online real estate broker Redfin. That’s up from 21 percent a year earlier. In addition, half of the homes on the market went under contract in eight days or fewer.

“Typically, January, February even March are not quite as highly competitive as when you go into the spring months,” said Ilona Botton, a Redfin agent in Denver. “That’s not how it was this year. It has been multiple offer situations every single month.”

The limited supply of homes is widespread. In March, one measure showed it would take fewer than five months to sell all the previously occupied homes in the U.S. In a market more balanced between buyers and sellers, it would take about six, according to the National Association of Realtors.

What’s more, heavy demand for low-priced homes means their prices are rising faster. Homes priced at $135,000 or less jumped 9 percent for the year ending in February, according to data from CoreLogic. Homes that priced at $226,800 or more climbed 5 percent over the same period.

Beyond offering more money, some buyers are willing to waive home inspection or give sellers several weeks to move out following a sale, said Redfin’s Botton.

In general, areas with fewer homes for sale have stronger job growth that eclipses the pace of construction. Areas with larger inventories tend to keep the availability of housing in line with job growth.

In Columbus, Ohio, aviation company executive Ryan Holtmann had plenty of options. He and his wife started shopping for their first home at the end of last year. The couple visited about 15 to 20 houses before buying a three-bedroom home for $154,900 at the end of February.

“I was really surprised at how much was out there for the time of year,” said Holtmann, 33. “There were three or four we liked and would have been more than happy to go with.”

One factor preventing more houses from hitting the market is that many homeowners still owe more on their mortgage than their home is worth. That’s known as an underwater mortgage, or being in negative equity.

While millions of homes have returned to positive equity as values come back, some 5.4 million, or 10.8 percent of all homes with a mortgage, remained underwater as of the October-December quarter, according to CoreLogic. Nevada topped the list. Nearly a quarter of its homes with a mortgage were underwater.

More construction would help buyers, but activity has recovered slowly since 2010. That’s one reason a recent report by mortgage buyer Freddie Mac forecast that the U.S. housing market will continue to see low levels of homes for sale for the next several years.

As a result, even successful buyers are settling for less.

Brett Singley, a first-time buyer in Los Angeles and a father of four, knew the kind of house he wanted and how much he could afford. But after six months of searching, the civil engineer shifted his sights to smaller and less expensive townhomes. In March, he bought one in Santa Clarita, a northern suburb. He got a three-bedroom for just under $300,000 — $100,000 less than what he was prepared to pay for a house.

“We were originally looking for a four-bedroom house,” said Singley. “But we didn’t have a lot of options.”

___

Veiga reported from Los Angeles. Boak reported from Washington.

Copyright 2015 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

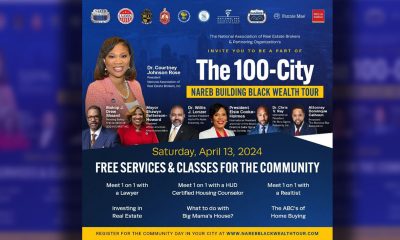

Activism

Oakland Post: Week of May 8 – 14, 2024

The printed Weekly Edition of the Oakland Post: Week of May May 8 – 14, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

Bay Area

Mayor Breed Proposes Waiving City Fees for Night Markets, Block Parties, Farmers’ Markets, Other Outdoor Community Events

Mayor London N. Breed introduced legislation on April 26 to encourage and expand outdoor community events. The first will waive City fees for certain events, making them less costly to produce. The second will simplify the health permitting for special event food vendors through the creation of an annual permit. Both pieces of legislation are part of the Mayor’s broader initiative to bring vibrancy and entertainment to San Francisco’s public right of ways and spaces.

Mayor’s Press Office

Mayor London N. Breed introduced legislation on April 26 to encourage and expand outdoor community events.

The first will waive City fees for certain events, making them less costly to produce. The second will simplify the health permitting for special event food vendors through the creation of an annual permit. Both pieces of legislation are part of the Mayor’s broader initiative to bring vibrancy and entertainment to San Francisco’s public right of ways and spaces.

Outdoor community events are integral to San Francisco’s vibrant culture and sense of community. These events include night markets, neighborhood block parties and farmers markets, and bolster the City’s economy by supporting local businesses and attracting tourists eager to experience San Francisco’s unique charm and food scene.

They offer residents, workers and visitors, opportunities to engage with local artists, musicians, and food vendors while enjoying the San Francisco’s stunning outdoor spaces and commercial corridors.

The legislation will allow for more and new community gatherings and for local food vendors to benefit from the City’s revitalization.

“San Francisco is alive when our streets are filled with festivals, markets, and community events,” said Breed. “As a city we can cut fees and streamline rules so our communities can bring joy and excitement into our streets and help revitalize San Francisco.”

Fee Waiver Legislation

The events that can take advantage of the new fee waivers are those that are free and open to the public, occupy three or fewer city blocks, take place between 8 a.m. and 10 p.m., and have the appropriate permitting from the ISCOTT and the Entertainment Commission.

The applicant must be a San Francisco based non-profit, small business, Community Benefit District, Business Improvement District, or a neighborhood or merchant association. Fees eligible for waiver include any application, permit, and inspection/staffing fees from San Francisco Municipal Transportation Agency, Department of Public Health, Fire Department, Entertainment Commission, and Police Department.

Currently, it can cost roughly anywhere between $500-$10,000 to obtain permits for organized events or fairs, depending on its size and scope. Organizations and businesses are limited to a maximum of 12 events in one calendar year for which they can receive these fee waivers.

Food Vendor Streamlining Legislation

The second piece of legislation introduced will help special event food vendors easily participate in multiple events throughout the year with a new, cost-effective annual food permit. Food vendors who participate in multiple events at multiple locations throughout the year will no longer need to obtain a separate permit for each event. Instead, special event food vendors will be able to apply and pay for a single annual permit all at once.

“Many successful food businesses either begin as pop-up vendors or participate in special events to grow their business,” says Katy Tang, Director of the Office of Small Business. “Giving them the option for an annual special event food permit saves them time and money.”

Currently, food vendors are required to get a Temporary Food Facility (TFF) permit from the Department of Public Health (DPH) in order to participate in a special event, among permits from other departments.

Currently, each special event requires a new permit from DPH ranging from $124-$244, depending on the type of food being prepared and sold. Last year, DPH issued over 1,500 individual TFF permits. With the new annual permit, food vendors selling at more than four to six events each year will benefit from hundreds of dollars in savings and time saved from fewer bureaucratic processes.

“This legislation is a step in the right direction to make it easier for food vendors like me to participate in citywide events,” said Dontaye Ball, owner of Gumbo Social. “It saves on time, money and makes it more effective. It also creates a level of equity.”

Bay Area

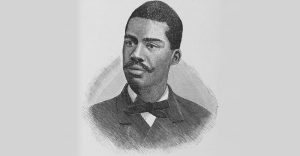

Faces Around the Bay: Sidney Carey

Sidney Carey was born in Dallas, Texas. He moved with his family to West Oakland as a baby. His sister is deceased; one brother lives in Oakland. Carey was the Choir Director at Trinity Missionary Baptist Church for 18 years.

By Barbara Fluhrer

Sidney Carey was born in Dallas, Texas. He moved with his family to West Oakland as a baby. His sister is deceased; one brother lives in Oakland.

Carey was the Choir Director at Trinity Missionary Baptist Church for 18 years.

He graduated from McClymonds High with a scholarship in cosmetology and was the first African American to complete a nine-month course at the first Black Beauty School in Oakland: Charm Beauty College.

He earned his License, and then attended U.C., earning a secondary teaching credential. With his Instructors License, he went on to teach at Laney College, San Mateo College, Skyline and Universal Beauty College in Pinole, among others.

Carey was the first African American hair stylist at Joseph and I. Magnin department store in Oakland and in San Francisco, where he managed the hair stylist department, Shear Heaven.

In 2009, he quit teaching and was diagnosed with Congestive Heart Failure. He was 60 and “too old for a heart transplant”. His doctors at California Pacific Medical Center (CPMC) went to court and fought successfully for his right to receive a transplant. One day, he received a call from CPMC, “Be here in one hour.” He underwent a transplant with a heart from a 25-year- old man in Vienna, Austria

Two years later, Carey resumed teaching at Laney College, finally retiring in 2012.

Now, he’s slowed down and comfortable in a Senior Residence in Berkeley, but still manages to fit his 6/4” frame in his 2002 Toyota and drive to family gatherings in Oakland and San Leandro and an occasional Four Seasons Arts concert.

He does his own shopping and cooking and uses Para Transit to keep constant doctor appointments while keeping up with anti-rejection meds. He often travels with doctors as a model of a successful heart-transplant plant recipient: 14 years.

Carey says, “I’m blessed” and, to the youth, “Don’t give up on your dreams!”

-

City Government1 week ago

City Government1 week agoCourt Throws Out Law That Allowed Californians to Build Duplexes, Triplexes and RDUs on Their Properties

-

Community4 weeks ago

Community4 weeks agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 24 – 30, 2024

-

Business4 weeks ago

Business4 weeks agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Community3 weeks ago

Community3 weeks agoOakland WNBA Player to be Inducted Into Hall of Fame

-

Community4 weeks ago

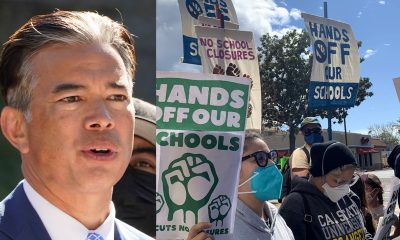

Community4 weeks agoAG Bonta Says Oakland School Leaders Should Comply with State Laws to Avoid ‘Disparate Harm’ When Closing or Merging Schools

-

Community3 weeks ago

Community3 weeks agoRichmond Nonprofit Helps Ex-Felons Get Back on Their Feet

-

Community3 weeks ago

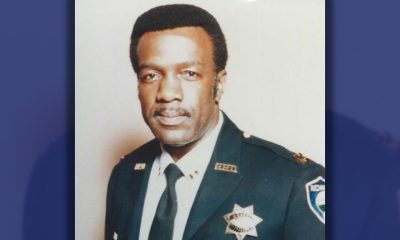

Community3 weeks agoRPAL to Rename Technology Center for Retired Police Captain Arthur Lee Johnson