National

Video: Police Restrained Teen After Shooting Her Brother

Demonstrators block Public Square Tuesday, Nov. 25, 2014, in Cleveland, during a protest over the weekend police shooting of Tamir Rice. (AP Photo/Tony Dejak)

MARK GILLISPIE, Associated Press

CLEVELAND (AP) — A video released by the city of Cleveland shows a police officer pushing a 14-year-old girl to the ground and handcuffing her with the help of another officer soon after a third officer fatally shot her younger brother.

The grainy surveillance video shows the officers struggling with the teen before putting her in the back seat of a patrol car parked next to the where 12-year-old Tamir Rice lay on the snowy ground bleeding.

Northeast Ohio Media Group is reporting that it obtained the nearly 30-minute-long video from the city on Wednesday after the city initially refused to release it. Other media outlets were given the video Thursday.

Patrol officer Timothy Loehmann shot Tamir in the abdomen within two seconds of a patrol car stopping near the boy on Nov. 22. He died the next day.

Tamir’s family gave the city permission to release another version of the video days after the shooting. That video shows Tamir in a park near a recreation center carrying what turned out to be an airsoft-type gun that shoots non-lethal plastic pellets. That video ends with Loehmann shooting Tamir.

Loehmann, a rookie, and his training officer and the driver of the patrol car, Frank Garmback, had responded to a report about a man with a gun. A police union official has said the officers thought the gun was real and that they didn’t know Tamir, who was 5 feet 7 and weighed 195 pounds, was so young.

The new video begins with the shooting of Tamir. About 90 seconds later, Tamir’s sister, whose name has not been released, runs toward her fallen brother and Garmback immediately pushes her to the ground. Garmback and another officer are then shown handcuffing the struggling teen and finally placing her in the back seat of Loehmann and Garmback’s patrol car.

Walter Madison, an attorney for the family, called the treatment of the 14-year-old sister, who he would not name, “the cruelest thing I’ve ever seen on video.” He also criticized the officers for not providing Tamir with medical attention. An FBI agent on a bank robbery detail nearby arrived about four minutes after the shooting and began first aid.

A city spokesman declined to comment about the video on Thursday.

The city last week turned over the investigation of the shooting to the Cuyahoga County sheriff’s department. The county prosecutor is expected to present the case to a grand jury to determine if criminal charges should be filed against Loehmann and Garmback.

Copyright 2015 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

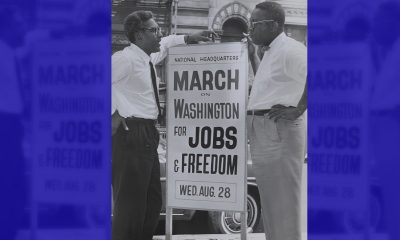

Activism

Oakland Post: Week of April 17 – 23, 2024

The printed Weekly Edition of the Oakland Post: Week of April 17 – 23, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

Barbara Lee

Congresswoman Barbara Lee Issues Statement on Deaths of Humanitarian Aid Volunteers in Gaza

On April 2, a day after an Israeli airstrike erroneously killed seven employees of World Central Kitchen (WCK), a humanitarian organization delivering aid in the Gaza Strip, a statement was release by Rep. Barbara Lee (D-CA-12). “This is a devastating and avoidable tragedy. My prayers go to the families and loved ones of the selfless members of the World Central Kitchen team whose lives were lost,” said Lee.

By California Black Media

On April 2, a day after an Israeli airstrike erroneously killed seven employees of World Central Kitchen (WCK), a humanitarian organization delivering aid in the Gaza Strip, a statement was release by Rep. Barbara Lee (D-CA-12).

“This is a devastating and avoidable tragedy. My prayers go to the families and loved ones of the selfless members of the World Central Kitchen team whose lives were lost,” said Lee.

The same day, it was confirmed by the organization that the humanitarian aid volunteers were killed in a strike carried out by Israel Defense Forces (IDF). Prior to the incident, members of the team had been travelling in two armored vehicles marked with the WCF logo and they had been coordinating their movements with the IDF. The group had successfully delivered 10 tons of humanitarian food in a deconflicted zone when its convoy was struck.

“This is not only an attack against WCK. This is an attack on humanitarian organizations showing up in the direst situations where food is being used as a weapon of war. This is unforgivable,” said Erin Gore, chief executive officer of World Central Kitchen.

The seven victims included a U.S. citizen as well as others from Australia, Poland, the United Kingdom, Canada, and Palestine.

Lee has been a vocal advocate for a ceasefire in Gaza and has supported actions by President Joe Biden to airdrop humanitarian aid in the area.

“Far too many civilians have lost their lives as a result of Benjamin Netanyahu’s reprehensible military offensive. The U.S. must join with our allies and demand an immediate, permanent ceasefire – it’s long overdue,” Lee said.

Commentary

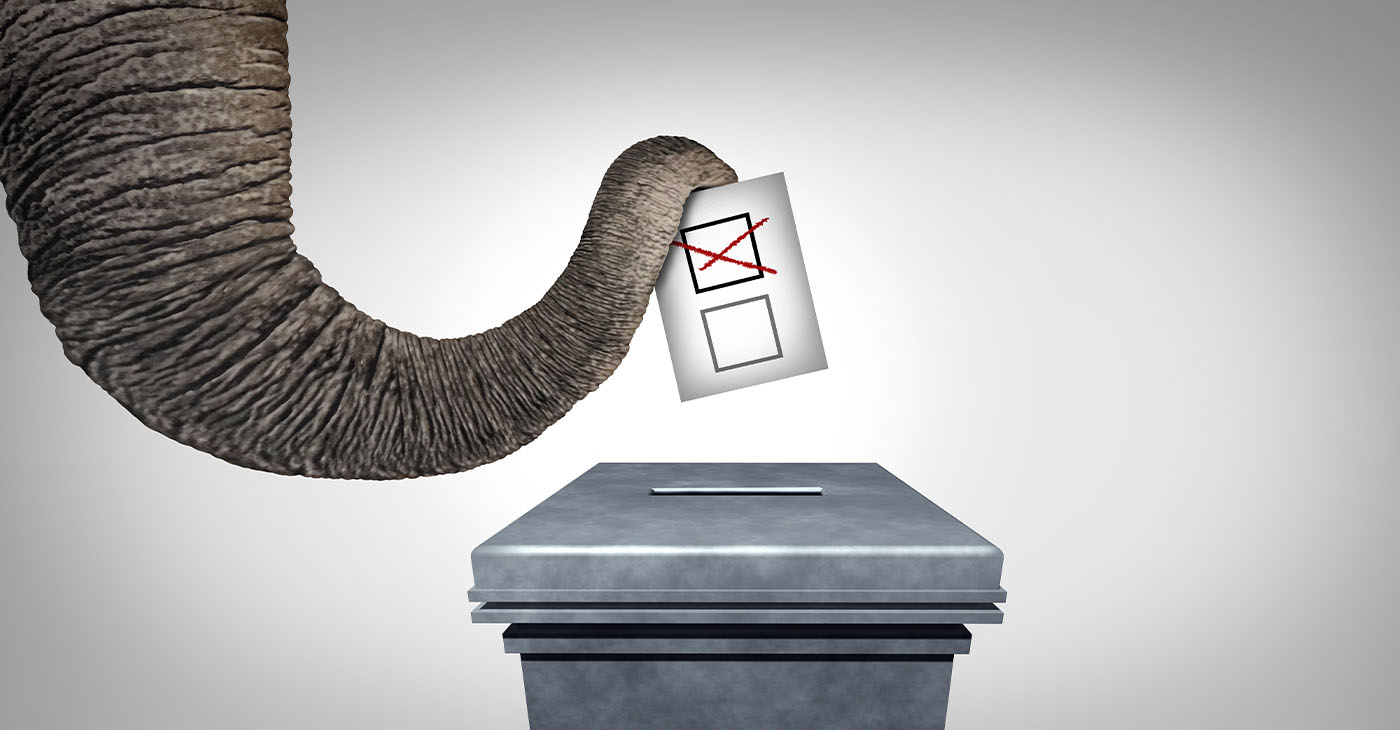

Commentary: Republican Votes Are Threatening American Democracy

In many ways, it was great that the Iowa Caucuses were on the same day as Martin Luther King Jr. Day. We needed to know the blunt truth. The takeaway message after the Iowa Caucuses where Donald Trump finished more than 30 points in front of Florida Gov. De Santis and former South Carolina Governor Nikki Haley boils down to this: Our democracy is threatened, for real.

By Emil Guillermo

In many ways, it was great that the Iowa Caucuses were on the same day as Martin Luther King Jr. Day.

We needed to know the blunt truth.

The takeaway message after the Iowa Caucuses where Donald Trump finished more than 30 points in front of Florida Gov. De Santis and former South Carolina Governor Nikki Haley boils down to this: Our democracy is threatened, for real.

And to save it will require all hands on deck.

It was strange for Iowans to caucus on MLK day. It had a self-cancelling effect. The day that honored America’s civil rights and anti-discrimination hero was negated by evening.

That’s when one of the least diverse states in the nation let the world know that white Americans absolutely love Donald Trump. No ifs, ands or buts.

No man is above the law? To the majority of his supporters, it seems Trump is.

It’s an anti-democracy loyalty that has spread like a political virus.

No matter what he does, Trump’s their guy. Trump received 51% of caucus-goers votes to beat Florida Gov. Ron DeSantis, who garnered 21.2%, and former South Carolina Gov. Nikki Haley, who got 19.1%.

The Asian flash in the pan Vivek Ramaswamy finished way behind and dropped out. Perhaps to get in the VP line. Don’t count on it.

According to CNN’s entrance polls, when caucus-goers were asked if they were a part of the “MAGA movement,” nearly half — 46% — said yes. More revealing: “Do you think Biden legitimately won in 2020?”

Only 29% said “yes.”

That means an overwhelming 66% said “no,” thus showing the deep roots in Iowa of the “Big Lie,” the belief in a falsehood that Trump was a victim of election theft.

Even more revealing and posing a direct threat to our democracy was the question of whether Trump was fit for the presidency, even if convicted of a crime.

Sixty-five percent said “yes.”

Who says that about anyone of color indicted on 91 criminal felony counts?

Would a BIPOC executive found liable for business fraud in civil court be given a pass?

How about a BIPOC person found liable for sexual assault?

Iowans have debased the phrase, “no man is above the law.” It’s a mindset that would vote in an American dictatorship.

Compare Iowa with voters in Asia last weekend. Taiwan rejected threats from authoritarian Beijing and elected pro-democracy Taiwanese vice president Lai Ching-te as its new president.

Meanwhile, in our country, which supposedly knows a thing or two about democracy, the Iowa caucuses show how Americans feel about authoritarianism.

Some Americans actually like it even more than the Constitution allows.

About the Author

Emil Guillermo is a journalist and commentator. He does a mini-talk show on YouTube.com/@emilamok1.

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 27 – April 2, 2024

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBeloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87

-

Community1 week ago

Community1 week agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 3 – 6, 2024

-

Business1 week ago

Business1 week agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 10 – 16, 2024