National

Selma Civil Rights March Still Vivid for US Rep John Lewis

In this March 7, 1965 file photo, John Lewis, center, of the Student Nonviolent Coordinating Committee, is forced to the ground by a trooper as state troopers break up the demonstration on what has become known as “Bloody Sunday” in Selma, Ala. (AP Photo)

ALEX SANZ, Associated Press

ATLANTA (AP) — Forty-nine years after John Lewis and fellow marchers tried to cross the Edmund Pettus Bridge in Selma, Alabama, the memories of “Bloody Sunday” are still vivid in his mind. It was one of the defining moments of the civil rights era.

“We were beaten, tear gassed, trampled and chased by men on horseback,” said Lewis, a civil rights activist and longtime Democratic congressman from Georgia. “Many of us accepted the way of non-violence as a way of life, as a way of living. We were willing to be arrested, to be jailed. We accepted the beatings. And we never gave up.”

In a recent interview with The Associated Press, Lewis — who is portrayed by the actor Stephan James in the historical drama “Selma” — said the timing of the film’s release was fitting and appropriate after protests of grand jury decisions not to indict white police officers in the deaths of black men in Ferguson, Missouri; and New York.

“Selma,” the film co-written and directed by Ava DuVernay, is based on the 1965 marches from the Alabama cities of Selma to Montgomery, led by the Rev. Dr. Martin Luther King, Jr.

“It is very powerful. It is very moving. It is real. It is so real,” Lewis said. “It says something about the distance we’ve come in laying down the burden of race.”

The son of sharecroppers, Lewis grew up on a family farm outside Troy, Alabama, and attended segregated public schools. During the civil rights movement, he organized sit-in demonstrations at segregated lunch counters in Nashville, Tennessee.

In 1963, he addressed the historic March on Washington — two years before he and hundreds of others marched on “Bloody Sunday.”

On March 7, 1965, Lewis and others were beaten by state troopers as they began to march to Montgomery.

The march is credited with helping build momentum for passage that year of the landmark Voting Rights Act, which opened polling places to millions of blacks and ended all-white governments in the South.

“We broke down those signs that said, ‘White Waiting,’ ‘Colored Waiting,’ ‘White Men,’ ‘Colored Men,’ ‘White Women,’ ‘Colored Women.’ We got a Voting Rights Act passed 50 years ago, a Civil Rights Act passed. But, we still have a distance to go,” said Lewis.

“In many communities today, the question of race is still very real. You can feel it. You can almost taste it. But, you cannot deny the fact that America is a different America. Even in the heart of the Deep South, those signs are gone. And, they will not return. People registered. And, they are voting.”

Lewis was first elected to Congress in 1986. He was re-elected to a 15th term in November.

Copyright 2015 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Activism

Oakland Post: Week of April 17 – 23, 2024

The printed Weekly Edition of the Oakland Post: Week of April 17 – 23, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

Barbara Lee

Congresswoman Barbara Lee Issues Statement on Deaths of Humanitarian Aid Volunteers in Gaza

On April 2, a day after an Israeli airstrike erroneously killed seven employees of World Central Kitchen (WCK), a humanitarian organization delivering aid in the Gaza Strip, a statement was release by Rep. Barbara Lee (D-CA-12). “This is a devastating and avoidable tragedy. My prayers go to the families and loved ones of the selfless members of the World Central Kitchen team whose lives were lost,” said Lee.

By California Black Media

On April 2, a day after an Israeli airstrike erroneously killed seven employees of World Central Kitchen (WCK), a humanitarian organization delivering aid in the Gaza Strip, a statement was release by Rep. Barbara Lee (D-CA-12).

“This is a devastating and avoidable tragedy. My prayers go to the families and loved ones of the selfless members of the World Central Kitchen team whose lives were lost,” said Lee.

The same day, it was confirmed by the organization that the humanitarian aid volunteers were killed in a strike carried out by Israel Defense Forces (IDF). Prior to the incident, members of the team had been travelling in two armored vehicles marked with the WCF logo and they had been coordinating their movements with the IDF. The group had successfully delivered 10 tons of humanitarian food in a deconflicted zone when its convoy was struck.

“This is not only an attack against WCK. This is an attack on humanitarian organizations showing up in the direst situations where food is being used as a weapon of war. This is unforgivable,” said Erin Gore, chief executive officer of World Central Kitchen.

The seven victims included a U.S. citizen as well as others from Australia, Poland, the United Kingdom, Canada, and Palestine.

Lee has been a vocal advocate for a ceasefire in Gaza and has supported actions by President Joe Biden to airdrop humanitarian aid in the area.

“Far too many civilians have lost their lives as a result of Benjamin Netanyahu’s reprehensible military offensive. The U.S. must join with our allies and demand an immediate, permanent ceasefire – it’s long overdue,” Lee said.

Commentary

Commentary: Republican Votes Are Threatening American Democracy

In many ways, it was great that the Iowa Caucuses were on the same day as Martin Luther King Jr. Day. We needed to know the blunt truth. The takeaway message after the Iowa Caucuses where Donald Trump finished more than 30 points in front of Florida Gov. De Santis and former South Carolina Governor Nikki Haley boils down to this: Our democracy is threatened, for real.

By Emil Guillermo

In many ways, it was great that the Iowa Caucuses were on the same day as Martin Luther King Jr. Day.

We needed to know the blunt truth.

The takeaway message after the Iowa Caucuses where Donald Trump finished more than 30 points in front of Florida Gov. De Santis and former South Carolina Governor Nikki Haley boils down to this: Our democracy is threatened, for real.

And to save it will require all hands on deck.

It was strange for Iowans to caucus on MLK day. It had a self-cancelling effect. The day that honored America’s civil rights and anti-discrimination hero was negated by evening.

That’s when one of the least diverse states in the nation let the world know that white Americans absolutely love Donald Trump. No ifs, ands or buts.

No man is above the law? To the majority of his supporters, it seems Trump is.

It’s an anti-democracy loyalty that has spread like a political virus.

No matter what he does, Trump’s their guy. Trump received 51% of caucus-goers votes to beat Florida Gov. Ron DeSantis, who garnered 21.2%, and former South Carolina Gov. Nikki Haley, who got 19.1%.

The Asian flash in the pan Vivek Ramaswamy finished way behind and dropped out. Perhaps to get in the VP line. Don’t count on it.

According to CNN’s entrance polls, when caucus-goers were asked if they were a part of the “MAGA movement,” nearly half — 46% — said yes. More revealing: “Do you think Biden legitimately won in 2020?”

Only 29% said “yes.”

That means an overwhelming 66% said “no,” thus showing the deep roots in Iowa of the “Big Lie,” the belief in a falsehood that Trump was a victim of election theft.

Even more revealing and posing a direct threat to our democracy was the question of whether Trump was fit for the presidency, even if convicted of a crime.

Sixty-five percent said “yes.”

Who says that about anyone of color indicted on 91 criminal felony counts?

Would a BIPOC executive found liable for business fraud in civil court be given a pass?

How about a BIPOC person found liable for sexual assault?

Iowans have debased the phrase, “no man is above the law.” It’s a mindset that would vote in an American dictatorship.

Compare Iowa with voters in Asia last weekend. Taiwan rejected threats from authoritarian Beijing and elected pro-democracy Taiwanese vice president Lai Ching-te as its new president.

Meanwhile, in our country, which supposedly knows a thing or two about democracy, the Iowa caucuses show how Americans feel about authoritarianism.

Some Americans actually like it even more than the Constitution allows.

About the Author

Emil Guillermo is a journalist and commentator. He does a mini-talk show on YouTube.com/@emilamok1.

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 27 – April 2, 2024

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoFrom Raids to Revelations: The Dark Turn in Sean ‘Diddy’ Combs’ Saga

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: Lady Day and The Lights!

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBaltimore Key Bridge Catastrophe: A City’s Heartbreak and a Nation’s Alarm

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBaltimore’s Key Bridge Struck by Ship, Collapses into Water

-

#NNPA BlackPress4 weeks ago

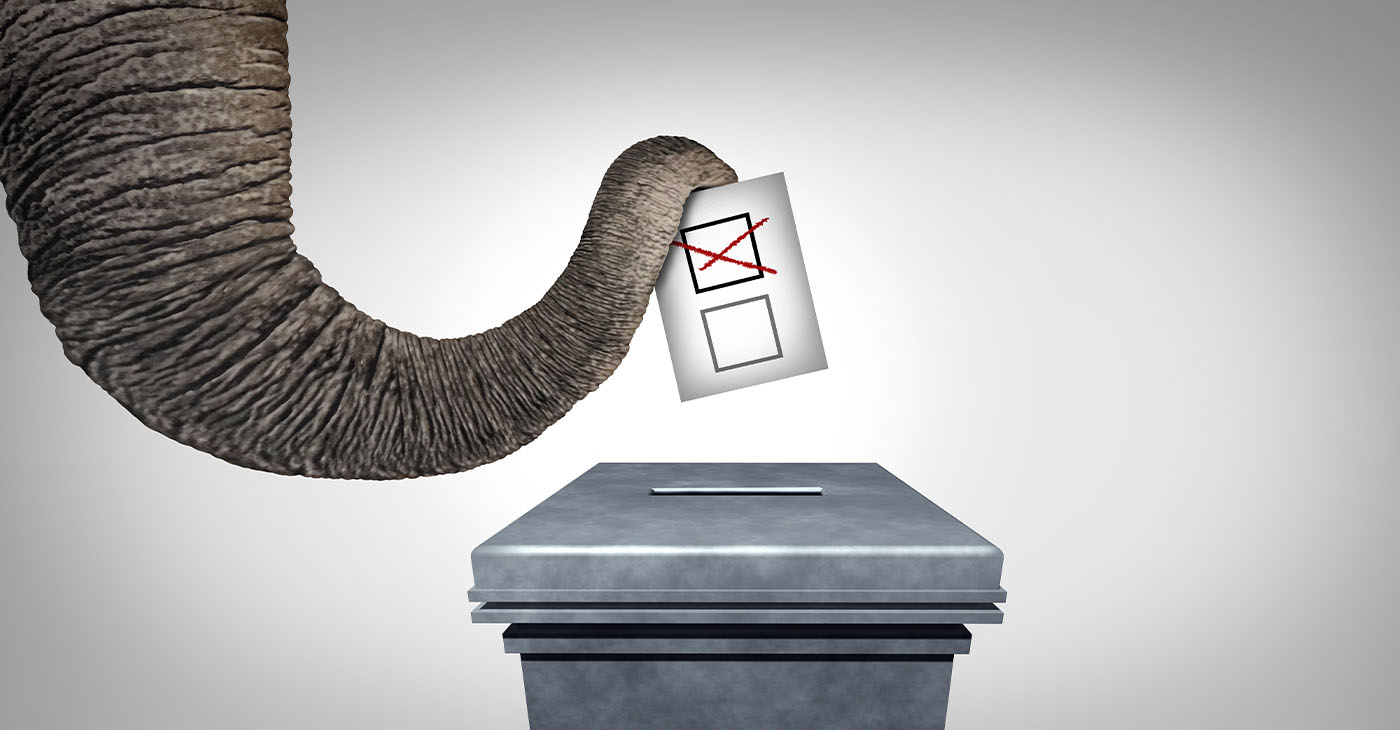

#NNPA BlackPress4 weeks agoBeloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87