Government

Rep. Terri Sewell: Democrats introduce sweeping Democracy Reform Package

GREENE COUNTY DEMOCRAT —

WASHINGTON, D.C. – On Friday, January 4, House Democrats introduced the For the People Act, a package of democracy bills including sweeping election, campaign finance, and ethics reforms designed to give American voters a stronger voice in government.

The package also includes a commitment to passing legislation to restore the Voting Rights Act (VRA) of 1965, which was gutted in the Supreme Court’s Shelby County v. Holder decision. Congresswoman Terri A. Sewell (D-AL) is the lead sponsor of the Voting Rights Advancement Act, a bill to restore the VRA and strengthen protections against discrimination in elections.

“The American people asked for reforms that give everyone a fair voice in our elections, and Democrats are delivering,” said Rep. Terri Sewell. “In Alabama’s 7th District, our families marched, bled, and died for their right to have a fair voice in our democracy, but today new strategies for disenfranchisement are keeping eligible voters from engaging in our elections.

The For the People Act fights back with reforms to stop gerrymandering, strengthen campaign finance laws, and close ethics loopholes. As we begin work in the House to investigate voter discrimination and the state of voter protections in our elections, I am proud to see a commitment in the For the People Act to restoring the vote. There is much work left to do, but today’s introduction takes a big step towards building a government of, by, and for the people.”

Congresswoman Terri A. Sewell (D-AL) was sworn in to the 116th Congress on January 3, 2019, beginning her fifth term in the House of Representatives.

Sewell is one of 102 women who were sworn into the House on January 3 who are a testament to the power of the women who have marched, protested, and voted for their seat at the table.

Alameda County

DA Pamela Price Stands by Mom Who Lost Son to Gun Violence in Oakland

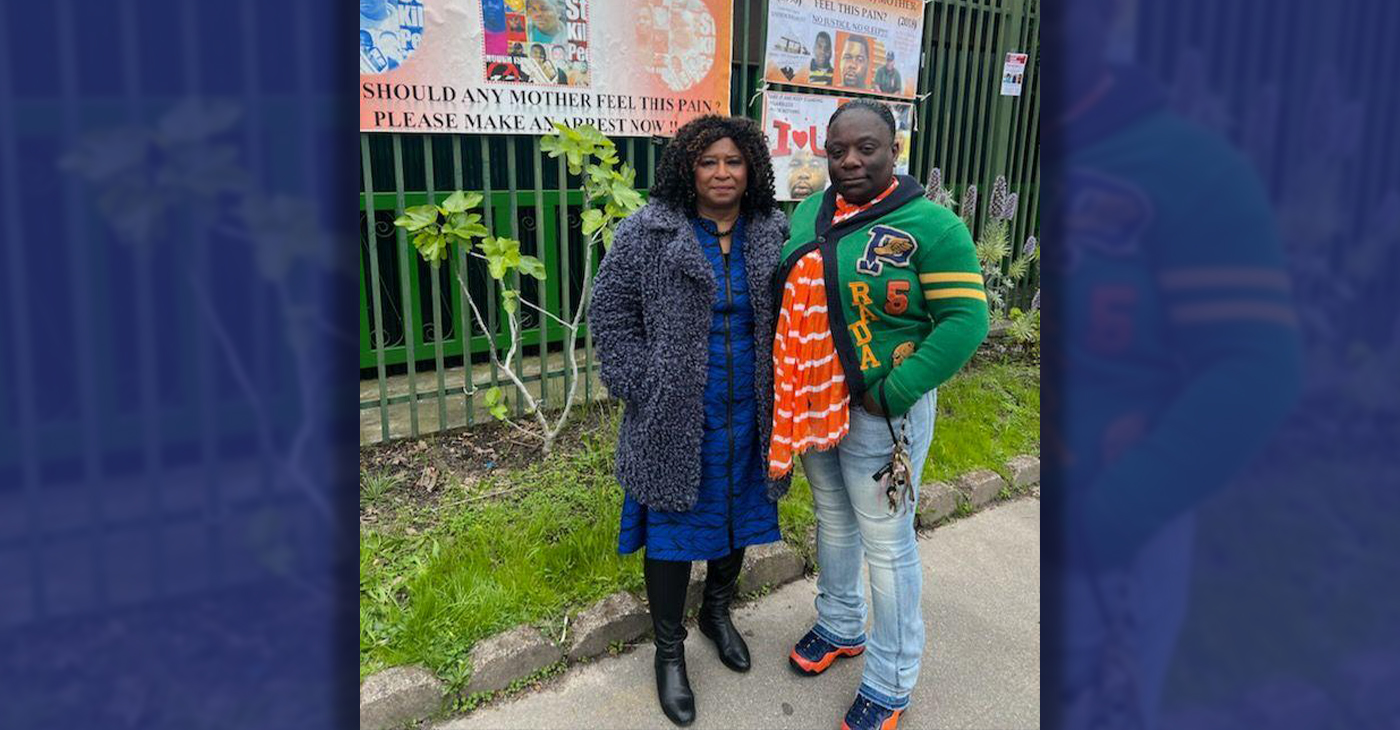

Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018.

Publisher’s note: Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018. The photo was too small for readers to see where the women were and what they were doing. Here we show Price and Jones as they complete a walk in memory of Scott. For more information and to contribute, please contact Carol Jones at 510-978-5517 at morefoundation.help@gmail.com. Courtesy photo.

Bay Area

MAYOR BREED ANNOUNCES $53 MILLION FEDERAL GRANT FOR SAN FRANCISCO’S HOMELESS PROGRAMS

San Francisco, CA – Mayor London N. Breed today announced that the U.S. Department of Housing and Urban Development (HUD) has awarded the city a $53.7 million grant to support efforts to renew and expand critical services and housing for people experiencing homelessness in San Francisco.

FOR IMMEDIATE RELEASE:

Wednesday, January 31, 2024

Contact: Mayor’s Office of Communications, mayorspressoffice@sfgov.org

***PRESS RELEASE***

MAYOR BREED ANNOUNCES $53 MILLION FEDERAL GRANT FOR SAN FRANCISCO’S HOMELESS PROGRAMS

HUD’s Continuum of Care grant will support the City’s range of critical services and programs, including permanent supportive housing, rapid re-housing, and improved access to housing for survivors of domestic violence

San Francisco, CA – Mayor London N. Breed today announced that the U.S. Department of Housing and Urban Development (HUD) has awarded the city a $53.7 million grant to support efforts to renew and expand critical services and housing for people experiencing homelessness in San Francisco.

HUD’s Continuum of Care (CoC) program is designed to support local programs with the goal of ending homelessness for individuals, families, and Transitional Age Youth.

This funding supports the city’s ongoing efforts that have helped more than 15,000 people exit homelessness since 2018 through City programs including direct housing placements and relocation assistance. During that time San Francisco has also increased housing slots by 50%. San Francisco has the most permanent supportive housing of any county in the Bay Area, and the second most slots per capita than any city in the country.

“In San Francisco, we have worked aggressively to increase housing, shelter, and services for people experiencing homelessness, and we are building on these efforts every day,” said Mayor London Breed. “Every day our encampment outreach workers are going out to bring people indoors and our City workers are connecting people to housing and shelter. This support from the federal government is critical and will allow us to serve people in need and address encampments in our neighborhoods.”

The funding towards supporting the renewal projects in San Francisco include financial support for a mix of permanent supportive housing, rapid re-housing, and transitional housing projects. In addition, the CoC award will support Coordinated Entry projects to centralize the City’s various efforts to address homelessness. This includes $2.1 million in funding for the Coordinated Entry system to improve access to housing for youth and survivors of domestic violence.

“This is a good day for San Francisco,” said Shireen McSpadden, executive director of the Department of Homelessness and Supportive Housing. “HUD’s Continuum of Care funding provides vital resources to a diversity of programs and projects that have helped people to stabilize in our community. This funding is a testament to our work and the work of our nonprofit partners.”

The 2024 Continuum of Care Renewal Awards Include:

- $42.2 million for 29 renewal PSH projects that serve chronically homeless, veterans, and youth

- $318,000 for one new PSH project, which will provide 98 affordable homes for low-income seniors in the Richmond District

- $445,00 for one Transitional Housing (TH) project serving youth

- $6.4 million dedicated to four Rapid Rehousing (RRH) projects that serve families, youth, and survivors of domestic violence

- $750,00 for two Homeless Management Information System (HMIS) projects

- $2.1 million for three Coordinated Entry projects that serve families, youth, chronically homeless, and survivors of domestic violence

In addition, the 2023 CoC Planning Grant, now increased to $1,500,000 from $1,250,000, was also approved. Planning grants are submitted non-competitively and may be used to carry out the duties of operating a CoC, such as system evaluation and planning, monitoring, project and system performance improvement, providing trainings, partner collaborations, and conducting the PIT Count.

“We are very appreciative of HUD’s support in fulfilling our funding request for these critically important projects for San Francisco that help so many people trying to exit homelessness,” said Del Seymour, co-chair of the Local Homeless Coordinating Board. “This funding will make a real difference to people seeking services and support in their journey out of homelessness.”

In comparison to last year’s competition, this represents a $770,000 increase in funding, due to a new PSH project that was funded, an increase in some unit type Fair Market Rents (FMRs) and the larger CoC Planning Grant. In a year where more projects had to compete nationally against other communities, this represents a significant increase.

Nationally, HUD awarded nearly $3.16 billion for over 7,000 local homeless housing and service programs including new projects and renewals across the United States.

Business

Black Business Summit Focuses on Equity, Access and Data

The California African American Chamber of Commerce hosted its second annual “State of the California African American Economy Summit,” with the aim of bolstering Black economic influence through education and fellowship. Held Jan. 24 to Jan. 25 at the Westin Los Angeles Airport Hotel, the convention brought together some of the most influential Black business leaders, policy makers and economic thinkers in the state. The discussions focused on a wide range of economic topics pertinent to California’s African American business community, including policy, government contracts, and equity, and more.

By Solomon O. Smith, California Black Media

The California African American Chamber of Commerce hosted its second annual “State of the California African American Economy Summit,” with the aim of bolstering Black economic influence through education and fellowship.

Held Jan. 24 to Jan. 25 at the Westin Los Angeles Airport Hotel, the convention brought together some of the most influential Black business leaders, policy makers and economic thinkers in the state. The discussions focused on a wide range of economic topics pertinent to California’s African American business community, including policy, government contracts, and equity, and more.

Toks Omishakin, Secretary of the California State Transportation Agency (CALSTA) was a guest at the event. He told attendees about his department’s efforts to increase access for Black business owners.

“One thing I’m taking away from this for sure is we’re going to have to do a better job of connecting through your chambers of all these opportunities of billions of dollars that are coming down the pike. I’m honestly disappointed that people don’t know, so we’ll do better,” said Omishakin.

Lueathel Seawood, the president of the African American Chamber of Commerce of San Joaquin County, expressed frustration with obtaining federal contracts for small businesses, and completing the process. She observed that once a small business was certified as DBE, a Disadvantaged Business Enterprises, there was little help getting to the next step.

Omishakin admitted there is more work to be done to help them complete the process and include them in upcoming projects. However, the high-speed rail system expansion by the California High-Speed Rail Authority has set a goal of 30% participation from small businesses — only 10 percent is set aside for DBE.

The importance of Diversity, Equity and Inclusion (DEI) in economics was reinforced during the “State of the California Economy” talk led by author and economist Julianne Malveaux, and Anthony Asadullah Samad, Executive Director of the Mervyn Dymally African American Political and Economic Institute (MDAAPEI) at California State University, Dominguez Hills.

Assaults on DEI disproportionately affect women of color and Black women, according to Malveaux. When asked what role the loss of DEI might serve in economics, she suggested a more sinister purpose.

“The genesis of all this is anti-blackness. So, your question about how this fits into the economy is economic exclusion, that essentially has been promoted as public policy,” said Malveaux.

The most anticipated speaker at the event was Janice Bryant Howroyd known affectionately to her peers as “JBH.” She is one of the first Black women to run and own a multi-billion-dollar company. Her company ActOne Group, is one of the largest, and most recognized, hiring, staffing and human resources firms in the world. She is the author of “Acting Up” and has a profile on Forbes.

Chairman of the board of directors of the California African American Chamber of Commerce, Timothy Alan Simon, a lawyer and the first Black Appointments Secretary in the Office of the Governor of California, moderated. They discussed the state of Black entrepreneurship in the country and Howroyd gave advice to other business owners.

“We look to inspire and educate,” said Howroyd. “Inspiration is great but when I’ve got people’s attention, I want to teach them something.”

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 27 – April 2, 2024

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoFrom Raids to Revelations: The Dark Turn in Sean ‘Diddy’ Combs’ Saga

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: Lady Day and The Lights!

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBaltimore Key Bridge Catastrophe: A City’s Heartbreak and a Nation’s Alarm

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBaltimore’s Key Bridge Struck by Ship, Collapses into Water

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBeloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87