Bay Area

PG&E Continues to See Scams on the Rise in Bay Area

With utility scams continuing to peak during the current pandemic, PG&E urges customers to be vigilant and to know what steps to take to prevent themselves or their families from falling victim.

Courtesy of PG&E

With utility scams continuing to peak during the current pandemic, PG&E urges customers to be vigilant and to know what steps to take to prevent themselves or their families from falling victim.

Throughout the pandemic, scammers have become increasingly deceptive and have increased calls, texts, emails, and in-person tactics. They are contacting electric and gas customers asking for immediate payment to avoid service disconnection. These impostors can be convincing and often target those who are most vulnerable, including senior citizens, those with limited English proficiency and low-income communities.

There have been more than 2,700 attempted scams reported to PG&E’s customer service line since June 2021, and the most common scam is a demand of immediate payment via a pre-paid debit card to avoid shutoff.

Cities with the highest rates of reports are San Francisco (214), Santa Rosa (152), Bakersfield (133) and Fresno (100). Unfortunately, this number only represents reported scams.

However, with the right information, customers can learn to detect and report these predatory scams.

“Remember, PG&E will never ask for your financial information over the phone or via email. If you receive a call or email that demands immediate payment, please call our customer service line or visit PGE.com to access your account details,” said Matt Foley, PG&E senior corporate security specialist.

PG&E will never contact a customer for the first time within one hour of a service disconnection and will never ask customers to make payments with a pre-paid debit card, gift card, any form of cryptocurrency, or third-party digital payment mobile applications. Here are some steps customers can take to protect themselves and their families against being victimized:

Some steps people can take to protect themselves:

- Visit PGE.com and register for My Account. Signing in will provide instant access to balance information, payment history and other account details and will provide a first line of defense against scammers.

- If a customer receives a call from someone requesting immediate payment, they can log in to My Account to confirm whether their account is in good standing.

- Customers can also call PG&E Customer Service at 800-743-5000 if they think that they are being targeted by a scam.

- As an added layer of protection, customers can designate family members or another trusted individual to speak on their behalf to PG&E call center representatives.

- To designate an individual to speak to PG&E on your behalf, contact 800-743-5000.

Signs of a potential scam:

- Threat to disconnect: Scammers may aggressively demand immediate payment for an alleged past due bill. If this occurs, customers should hang up the phone, delete the email, or shut the door. Customers with delinquent accounts receive an advance disconnection notification, typically by mail and included with their regular monthly bill.

- Request for immediate payment or a prepaid card: Scammers may instruct the customer to purchase a prepaid card then call them back supposedly to make a bill payment. PG&E reminds customers that they should never purchase a prepaid card to avoid service disconnection or shutoff.

- Refund or rebate offers: Scammers may say that your utility company overbilled you and owes you a refund, or that you are entitled to a rebate. Again, customers should immediately hang up and call PG&E Customer Service to confirm details.

- “Spoofing” Authentic Numbers: Scammers are now able to create authentic looking 800 numbers which appear on your phone display. The numbers don’t lead back to PG&E if called back, however, so if you have doubts or have seen any of the above warning signs of a scam, hang up and call PG&E at 1-800-743-5000.

For more information about scams, visit www.pge.com and www.utilitiesunited.org.

Activism

S.F. Black Leaders Rally to Protest, Discuss ‘Epidemic’ of Racial Slurs Against Black Students in SF Public School System

Parents at the meeting spoke of their children as no longer feeling safe in school because of bullying and discrimination. Parents also said that reported incidents such as racial slurs and intimidation are not dealt with to their satisfaction and feel ignored.

By Carla Thomas

San Francisco’s Third Baptist Church hosted a rally and meeting Sunday to discuss hatred toward African American students of the San Francisco Unified School District (SFUSD).

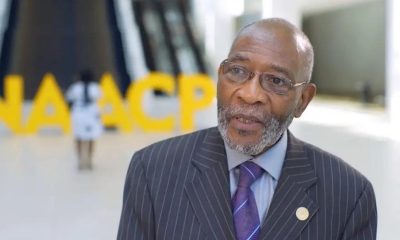

Rev. Amos C. Brown, president of the San Francisco NAACP and pastor of Third Baptist Church, along with leadership from local civil rights groups, the city’s faith-based community and Black community leadership convened at the church.

“There has been an epidemic of racial slurs and mistreatment of Black children in our public schools in the city,” said Brown. “This will not be tolerated.”

According to civil rights advocate Mattie Scott, students from elementary to high school have reported an extraordinary amount of racial slurs directed at them.

“There is a surge of overt racism in the schools, and our children should not be subjected to this,” said Scott. “Students are in school to learn, develop, and grow, not be hated on,” said Scott. “The parents of the children feel they have not received the support necessary to protect their children.”

Attendees were briefed last Friday in a meeting with SFUSD Superintendent Dr. Matt Wayne.

SFUSD states that their policies protect children and they are not at liberty to publicly discuss the issues to protect the children’s privacy.

Parents at the meeting spoke of their children as no longer feeling safe in school because of bullying and discrimination. Parents also said that reported incidents such as racial slurs and intimidation are not dealt with to their satisfaction and feel ignored.

Some parents said they have removed their students from school while other parents and community leaders called on the removal of the SFUSD superintendent, the firing of certain school principals and the need for more supportive school board members.

Community advocates discussed boycotting the schools and creating Freedom Schools led by Black leaders and educators, reassuring parents that their child’s wellbeing and education are the highest priority and youth are not to be disrupted by racism or policies that don’t support them.

Virginia Marshall, chair of the San Francisco NAACP’s education committee, offered encouragement to the parents and students in attendance while also announcing an upcoming May 14 school board meeting to demand accountability over their mistreatment.

“I’m urging anyone that cares about our students to pack the May 14 school board meeting,” said Marshall.

This resource was supported in whole or in part by funding provided by the State of California, administered by the California State Library via California Black Media as part of the Stop the Hate Program. The program is supported by partnership with California Department of Social Services and the California Commission on Asian and Pacific Islander American Affairs as part of the Stop the Hate program. To report a hate incident or hate crime and get support, go to CA vs Hate.

Bay Area

Mayor London Breed: State Awards San Francisco Over $37M for Affordable Housing

On April 30, Mayor London N. Breed announced San Francisco has been awarded more than $37.9 million in funding from the California Department of Housing and Community Development (HCD) as part of the State’s Multifamily Housing Program (MHP). The HCD loan will provide the final funding necessary for development of Casa Adelante – 1515 South Van Ness, a 168-unit affordable housing project located in San Francisco’s Mission District.

By Oakland Post Staff

On April 30, Mayor London N. Breed announced San Francisco has been awarded more than $37.9 million in funding from the California Department of Housing and Community Development (HCD) as part of the State’s Multifamily Housing Program (MHP).

The HCD loan will provide the final funding necessary for development of Casa Adelante – 1515 South Van Ness, a 168-unit affordable housing project located in San Francisco’s Mission District.

The new development at 1515 South Van Ness Ave. will provide 168 affordable homes to low-income families, formerly homeless families, and persons living with HIV earning between 25-80% of the San Francisco Area Median Income (AMI).

In addition, the project is anticipated to provide family-friendly amenities and ground floor community-serving commercial spaces that preserve the prevailing neighborhood character of the Calle 24 Latino Cultural District.

“This funding unlocks our ability to move on building affordable housing units for families in San Francisco at a crucial time. We understand the level of need for more housing that is accessible, and like the state, the city continues to face a challenging budget cycle,” said Breed. “1515 South Van Ness is a good example of what can be achieved in San Francisco when you have strong community partnerships and an unwavering commitment to deliver on critical needs for our residents.”

“From the beginning of my term as Supervisor, I have fought to bring affordable housing to 1515 South Van Ness” said Supervisor Hillary Ronen. “In the interim, the site has been utilized for homeless services and shelter, and I am thrilled that HCD has recognized the value of this development, and we are finally ready to break ground and bring 168 affordable homes to low income and formerly homeless families in the Mission.”

Owned and occupied by McMillan Electric Company until 2015, the City and County of San Francisco purchased 1515 South Van Ness Avenue in June 2019 with the intent of developing new affordable housing.

In November 2020, the San Francisco Mayor’s Office of Housing and Community Development (MOHCD) released a Multi-site Request for Qualifications (RFQ) seeking qualified developers to build affordable housing on the site, and subsequently selected Chinatown Community Development Corporation (CCDC) and Mission Economic Development Agency (MEDA) in May 2021 to develop the site.

The project is expected to begin construction in winter 2025.

“A strong, long-term push by Mission advocates to make this site 100% affordable is now paying off, with 168 family units that include services and childcare. People of color communities know what they need, and we are excited to be in partnership with a team, consisting of MEDA, CCDC, and MOHCD, that listens,” said Malcolm Yeung, Executive Director at CCDC.

“We are excited to be in partnership with CCDC, yet again, and for the opportunity to develop intergenerational affordable housing in the City’s Mission District,” said Luis Granados, executive director at MEDA.

Increasing housing affordable to lower-income and vulnerable residents is a key priority in the City’s Housing Element which calls for additional funding for affordable housing production and preservation, as well as Mayor Breed’s Housing for All Executive Directive that sets out the steps the City will take to meet the bold goal of allowing for 82,000 new homes to be built over the next eight years.

Tuesday’s funding announcement emphasizes the importance of regional and state collaboration in order to reach our housing and climate goals.

“We are thrilled—not just to bring a project of this size to a community with great need — but to do so with community-based developers and their partners who understand the neighborhood and sensitivities around cultural preservation,” said HCD Director Gustavo Velasquez.

Bay Area

East Bay Regional Park District Issues Rattlesnake Advisory

The East Bay Regional Park District released an advisory today on rattlesnakes, which emerge from winter hibernation in early spring and become more active. Warm weather can bring more potential for rattlesnake encounters with humans and dogs, particularly along trails and roads.

The Richmond Standard

The East Bay Regional Park District released an advisory today on rattlesnakes, which emerge from winter hibernation in early spring and become more active.

Warm weather can bring more potential for rattlesnake encounters with humans and dogs, particularly along trails and roads.

Visitors are encouraged to avoid hiking alone in case of an emergency, to scan the ground ahead as they walk, jog or ride, stay on trails avoiding tall grass, and to look carefully around and under logs and rocks before sitting down. Keep your dog on your leash to be extra safe, park officials said.

If you encounter a rattlesnake, leave it alone – it is unlawful to capture or harm one. Move carefully and slowly away or around it and give it plenty of space, park officials said.

Those who are bitten by a rattlesnake are instructed to stay calm by lying down with the affected limb lower than the heart, then having someone call 911.

Getting medical attention is critical.

Those bitten should not use tourniquets, “sucking,” or snake bite kits. If you are by yourself, walk calmly to the nearest source of help to dial 911, do not run.

If bitten by any other type of snake, wash the wound with soap and water or an antiseptic and seek medical attention.

Not sure what bit you? Check the bite for two puncture marks (in rare cases one) associated with intense, burning pain, which is typical of a rattlesnake bite. Other snakebites can leave marks without associated burning pain.

The Northern Pacific rattlesnake is the species found in East Bay Regional Parks. Snakes are important to the natural environment, helping to control rodents and other reptile populations. But enjoy them from afar.

For more information, download the Park District’s Common Snakes brochure or watch our Gopher Snake or Rattlesnake video to learn how to tell the difference between rattlesnakes and gopher snakes. Additional information is available at ebparks.org/safety/wildlife-encounters.

-

Community3 weeks ago

Community3 weeks agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Business3 weeks ago

Business3 weeks agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of April 10 – 16, 2024

-

City Government4 days ago

City Government4 days agoCourt Throws Out Law That Allowed Californians to Build Duplexes, Triplexes and RDUs on Their Properties

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 24 – 30, 2024

-

Community3 weeks ago

Community3 weeks agoAG Bonta Says Oakland School Leaders Should Comply with State Laws to Avoid ‘Disparate Harm’ When Closing or Merging Schools

-

Community3 weeks ago

Community3 weeks agoRichmond Nonprofit Helps Ex-Felons Get Back on Their Feet

-

Community3 weeks ago

Community3 weeks agoOakland WNBA Player to be Inducted Into Hall of Fame