Energy

LEWIS/MOORE: Solar, Powered by the People

WASHINGTON INFORMER — Solar power is abundant, affordable, and accessible in the District of Columbia

By Kimberly Lewis and Michelle Moore

Solar power is abundant, affordable, and accessible in the District of Columbia. Every single solar panel that is installed with the projected $300 million that will go to build solar projects in our nation’s capital over the next five years will cut utility bills, create jobs, and build wealth – but for whom? There are only three certified minority and woman-owned solar businesses operating in D.C. The problem with our new green economy is that it’s propagating the same old inequities instead of reflecting the beautiful diversity of the places we live. That’s why we’re celebrating Black History Month by calling for a new chapter in the story of the solar industry in America, starting right here in Washington, D.C.

We see the disparities first hand as part of the leadership team of Groundswell, a D.C.-based nonprofit that builds community power. When we issued our first RFP for a community solar project, there were few to no minority or woman-owned solar businesses and hardly any woman or people of color on the leadership teams of the companies that responded. We wanted to know why and what we could do about it, so we reached out to NYMBUS Holdings, a local minority-owned research firm, for answers. Their new report is a wake-up call that includes immediate and measurable steps we can take together to close the gap and make sure that solar is delivering on the promise of being power to, for, and by the people.

It’s the right thing to do. The District of Columbia is a richly diverse community that is blessed with some of the most progressive solar energy policies in the country. Not only is our city committed to using 100% clean energy, we have the nation’s biggest solar incentives and a Solar for All program that delivers free solar power to our low-income neighbors who are struggling to pay utility bills. The policies that make D.C. a great place for solar are enabled by the people of Washington, D.C. Our thriving local solar industry should look like Washington, D.C., too.

We’re not alone. These same inequities are tragically common themes at every level within the green movement. A new report about diversity in the environmental field by Green 2.0 shows that it is still predominantly male and increasingly white. The solar sector is no exception. Nationally, fewer than 30% of the people working in the solar industry are female. But when you look at who pays the most for energy, more than half of families paying disproportionately high electricity bills across the United States are African American. It’s not fair.

We’ve got to do better. The growth of the solar industry generates more than clean power – it creates jobs and builds wealth. It holds the promise of lifting more lives beyond financial stability towards greater ease. If more solar power just makes the same people richer, we’ve failed.

We can’t wait. We’ve got to get serious, set goals, and keep score. As the NYMBUS report highlights, while all the data sources tell the same story about the sad state of solar industry when it comes to diversity, there are no comprehensive, consistently measured and validated annual reports. Equitable economic participation belongs right next to 100% renewable energy on Washington, D.C.’s clean energy scorecard. To win, we’ve got to recognize that the technical, regulatory, and financial complexity of the solar industry presents significant barriers to new people and businesses entering the field. Taking a page from the tech industry’s playbook, launching a clean energy incubator could support local entrepreneurs with the knowledge and networks they need to succeed.

That’s just the beginning of what turning Washington, D.C.’s solar leadership into equitable economic empowerment could mean. The opportunity is now, and Washington’s got what it takes. Let’s put the people in solar power and make it Made in D.C.

Kimberly Lewis is a senior vice president of community advancement at the U.S. Green Building Council and Michelle Moore is CEO of community solar nonprofit Groundswell.

This article originally appeared in the Washington Informer.

Business

Biden’s ‘Hydrogen Hub’ Plan Set to Generate Thousands of Clean Energy Jobs in California

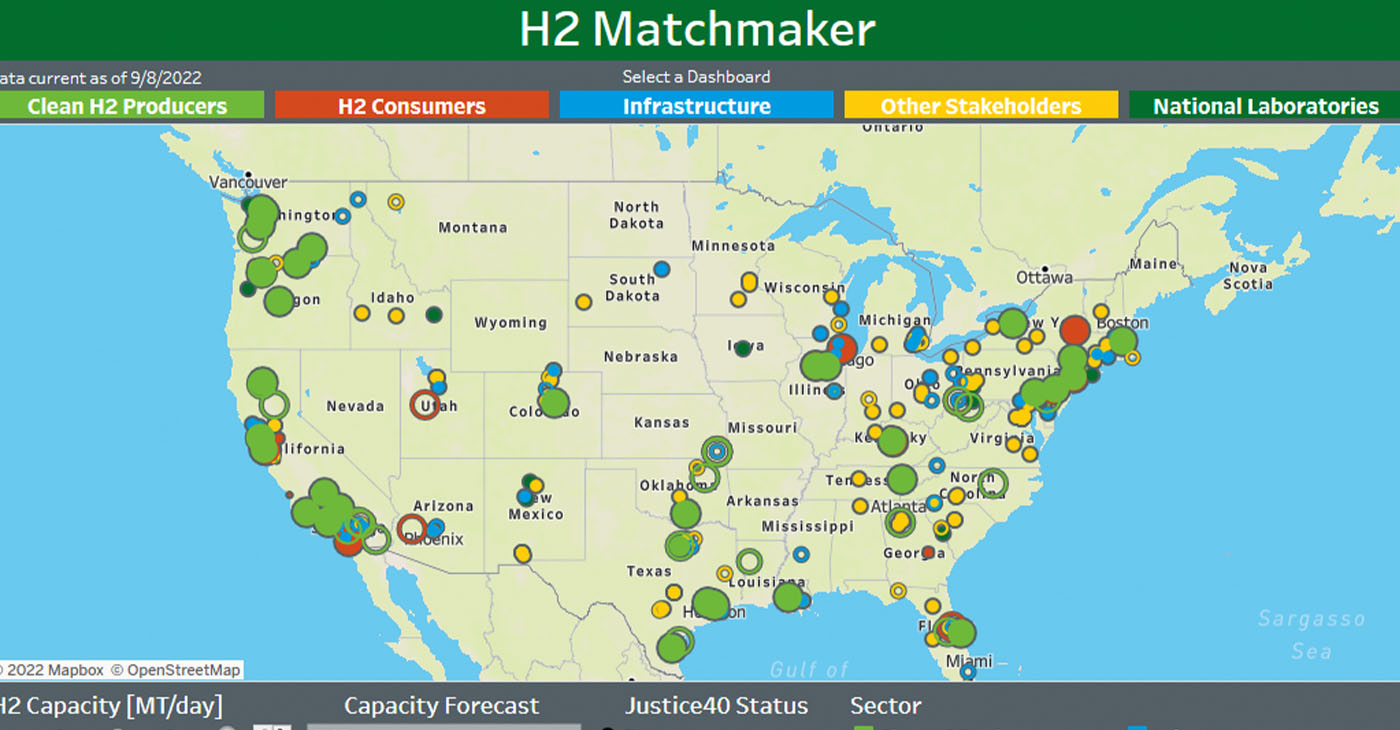

As part of President Biden’s Investing in America agenda, a key pillar of Bidenomics — the President’s economic plan — the U.S. Department of Energy (DOE) launched the $7 billion Regional Clean Hydrogen Hubs (H2Hubs) program across the nation on Oct. 13.

By California Black Media

Last week, clean energy advocates and industry experts praised a new federal government program that is expected to bring thousands of jobs to California.

As part of President Biden’s Investing in America agenda, a key pillar of Bidenomics — the President’s economic plan — the U.S. Department of Energy (DOE) launched the $7 billion Regional Clean Hydrogen Hubs (H2Hubs) program across the nation on Oct. 13.

The program, which creates seven regional hubs in seven states, including California, is expected to be a boon for Black and other minority communities.

It is part of the federal government’s Justice40 initiative, which requires that 40% of the “overall benefits” of the program will be used to invest in marginalized communities and places that have been disproportionately impacted by pollution.

“The seven selected regional clean hydrogen hubs will catalyze more than $40 billion in private investment and create tens of thousands of good-paying jobs – bringing the total public and private investment in hydrogen hubs to nearly $50 billion,” the Biden-Harris administration said in a statement.

The program is designed to accelerate the commercial-scale deployment of low-cost, clean hydrogen — a valuable energy product that can be produced with zero or near-zero carbon emissions and is crucial to meeting Biden’s climate and energy security goals, according to the White House.

“Unlocking the full potential of hydrogen—a versatile fuel that can be made from almost any energy resource in virtually every part of the country—is crucial to achieving Biden’s goal of American industry powered by American clean energy, ensuring less volatility and more affordable energy options for American families and businesses,” stated U.S. Secretary of Energy Jennifer M. Granholm.

“This federal investment is significant because it complements and it unlocks so much private investment and investment from the states,” said Chris Hannan, president of ARCHES partner State Building and Construction Trades Council of California, in a statement.

California Black Media

Biden’s ‘Hydrogen Hub’ Plan Set to Generate Thousands of Clean Energy Jobs in California

Last week, clean energy advocates and industry experts praised a new federal government program that is expected to bring thousands of jobs to California. As part of President Biden’s Investing in America agenda, a key pillar of Bidenomics — the President’s economic plan — the U.S. Department of Energy (DOE) launched the $7 billion Regional Clean Hydrogen Hubs (H2Hubs) program across the nation on Oct. 13.

By California Black Media

Last week, clean energy advocates and industry experts praised a new federal government program that is expected to bring thousands of jobs to California.

As part of President Biden’s Investing in America agenda, a key pillar of Bidenomics — the President’s economic plan — the U.S. Department of Energy (DOE) launched the $7 billion Regional Clean Hydrogen Hubs (H2Hubs) program across the nation on Oct. 13.

The program, which creates seven regional hubs in seven states, including California, is expected to be a boon for Black and other minority communities.

It is part of the federal government’s Justice40 initiative, which requires that 40% of the “overall benefits” of the program will be used to invest in marginalized communities and places that have been disproportionately impacted by pollution.

“The seven selected regional clean hydrogen hubs will catalyze more than $40 billion in private investment and create tens of thousands of good-paying jobs — bringing the total public and private investment in hydrogen hubs to nearly $50 billion,” the Biden-Harris administration said in a statement.

The program is designed to accelerate the commercial-scale deployment of low-cost, clean hydrogen — a valuable energy product that can be produced with zero or near-zero carbon emissions and is crucial to meeting Biden’s climate and energy security goals, according to the White House.

“Unlocking the full potential of hydrogen — a versatile fuel that can be made from almost any energy resource in virtually every part of the country — is crucial to achieving Biden’s goal of American industry powered by American clean energy, ensuring less volatility and more affordable energy options for American families and businesses,” stated U.S. Secretary of Energy Jennifer M. Granholm.

“This federal investment is significant because it complements and it unlocks so much private investment and investment from the states,” said Chris Hannan, president of ARCHES partner State Building and Construction Trades Council of California, in a statement.

Activism

Minority Environmental Justice Groups Want to Connect to Millions in EPA Funding for California

The California Environmental Justice Alliance (CEJA) says the programs they have in place to restore decades of environmental devastation and neglect in minority communities can play a key role in achieving the state and federal green goals to enforce regulations and distribute resources more fairly and equitably.

By Lila Brown, California Black Media

Environmental justice advocates in California petitioned Gov. Gavin Newsom this past summer, asking the state to direct a portion of the millions in federal and state dollars California is investing in cleaning and greening communities to Black and other minority organizations.

The California Environmental Justice Alliance (CEJA) says the programs they have in place to restore decades of environmental devastation and neglect in minority communities can play a key role in achieving the state and federal green goals to enforce regulations and distribute resources more fairly and equitably.

“There’s systemic racism that we are trying to dismantle that is beyond the usual American concepts of environmentalism and there’s a lot of interrelated and intersecting issues that we’re trying to fix on the ground, Mari Rose Taruc, CEJA’s energy director, told California Black Media.

Taruc says environmental groups recognizing the harm done to communities of color in the past — and their implication on the local level — is a critical part of the environmental justice movement.

“Environmental justice was born out of the Civil Rights Movement, and that is to the credit of Black organizers that came out of the South to raise consciousness of environmental pollution and destruction of dumping grounds primarily located in BIPOC communities,” she said.

CEJA is a coalition of the 10 biggest environmental justice organizations that coordinate efforts to protect the health and well-being of Black, Indigenous, Latino, and Asian Pacific Islander communities in California. The organization also develops programs and raises money to tackle some of the new challenges communities are facing due to the climate crisis.

In July, Environmental Protection Agency (EPA) Regional Administrator Martha Guzman presented $2 million to Los Angeles Mayor Karen Bass to revitalize the Taylor Yard along the Los Angeles River, turning a former freight railyard into urban green space.

The project reinforces President Biden’s goal for environmental justice to restore the damage that has been done from previous administrations ranging from decades of neglect to the lack of enforcement as it pertains to environmental laws, regulations, and policies.

Historically, railyards contaminated nearby ground and waters with petroleum and other dangerous contaminants.

Guzman spoke with California Black Media about policies that led to disadvantaged and low-income communities being the areas where toxic and hazardous wastes were disposed, as opposed to more affluent neighborhoods.

“This can be traced to many of our origins, be it slavery or the taking of indigenous lands here in the West,” she said. “We see where all these facilities are, and we know that race is the largest determinant of pollution.”

Guzman says the Biden administration is keeping equity and environmental justice front of mind.

“We have to invest in these communities because we have to be intentional about dealing with those generations of neglect and land use decisions that led to a disparate impact to our communities,” says Guzman who leads the EPA efforts to protect public health and the environment for the Pacific Southwest region spanning Arizona, California, Hawaii, Nevada, the U.S. Pacific Islands territories, and 148 Tribal Nations.

The investment strategy, she says, intends to heal legacy issues and now the EPA’s No. 1 priority is enforcement.

According to Bass’ office, the City of Los Angeles plans to restore this site as part of a greater L.A. River initiative to restore ecosystems and habitats, form walkable trails along 52 miles of the river, and create easy access points for residents to enjoy what the river has to offer.

Throughout California, EPA awarded $9,299,566 in total funding from the Fiscal Year 2023 Brownfields Multipurpose, Assessment, Revolving Loan Fund, and Cleanup (MARC) Grant Funding through 12 separate grants.

According to the EPA, a brownfield is a property, the expansion, redevelopment, or reuse of which may be complicated by the presence or potential presence of a hazardous substance, pollutant or contaminant. It is estimated that there are more than 450,000 brownfields in the U.S.

“This funding provides unprecedented resources and highlights how President Biden’s Investing in America agenda and the Bipartisan Infrastructure Law are delivering environmental and economic benefits for California,” according to a press release from Guzman’s office.

The EPA is investing nearly $100 billion nationwide to deliver clean water and clean air, advance our transition to clean transportation, and enact environmental justice (EJ), especially in communities that have been disadvantaged and underserved, many of which are low-income communities or communities of color.

In addition, President Biden’s Executive Order 14008 — Tackling the Climate Crisis at Home and Abroad announced Justice40, which mandates that at least 40% of the benefits of specific federal programs — including brownfields and those created by BIL and IRA — must flow to disadvantaged communities. In April 2022, EPA committed to meeting and exceeding this mandate.

Taruc says CEJA has not received any of the EPA funds, but the organization continues to find opportunities for different organizations throughout the state to be able to connect to funding programs focused on environmental justice.

One of the ways that CEJA ensures communities are recipients of funds is through programs such as “Solar for All” so that low-income households receive solar panels to improve their homes and lower their fossil fuel consumption, which reduces emissions.

Taruc says one focus of CEJA is ensuring people — particularly disadvantaged minorities who have been disproportionately impacted — live in safe and clean environments.

“Most environmental justice groups believe we should not build housing next to oil drilling sites and there should be a buffer zone of where you build new housing. We’ve been fighting to close these oil wells because housing should be built in places that are not only affordable but safe,” Taruc concluded.

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 20 – 26, 2024

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoCOMMENTARY: Lady Day and The Lights!

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoFrom Raids to Revelations: The Dark Turn in Sean ‘Diddy’ Combs’ Saga

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoBaltimore Key Bridge Catastrophe: A City’s Heartbreak and a Nation’s Alarm

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoBaltimore’s Key Bridge Struck by Ship, Collapses into Water

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of March 27 – April 2, 2024