Bay Area

Grants Available for Pandemic-Stressed Microbusinesses

The Marin Microbusiness Grant Program is funded by the State of California’s Office of the Small Business Advocate, known as CalOSBA. The County of Marin, the Marin Small Business Development Center (SBDC), and Dominican University of California are partnering on program oversight. The local partners have been working with nonprofits, community organizations, and local municipalities to reach underserved business owners in the area.

Online application period is open for $2,500 grants for businesses with gross revenue of less than $50,000

Courtesy of Marin County

Marin County microbusinesses with fewer than five full-time employees may now apply for $2,500 grants through a partnership dedicated to assisting the economy through the lingering COVID-19 pandemic.

The Marin Microbusiness Grant Program is funded by the State of California’s Office of the Small Business Advocate, known as CalOSBA. The County of Marin, the Marin Small Business Development Center (SBDC), and Dominican University of California are partnering on program oversight. The local partners have been working with nonprofits, community organizations, and local municipalities to reach underserved business owners in the area.

As an example, those who might be eligible for the grants include artists and musicians, childcare providers, construction workers, food vendors, hair stylists, nail technicians, “handyman” providers, house cleaners, gardeners and landscapers.

“Many of these microbusiness owners faced access challenges and did not qualify for other forms of COVID-19 support,” said Miriam Karell of the Marin SBDC. “This program is a focused effort to offer support to underserved populations who are still struggling with the impacts of the pandemic shutdowns.”

The support is in the form of tax-free grants, not loans that need to be repaid. The funds must be used for payment of business debts, new equipment, costs from business interruptions and other criteria listed on the program website. Microbusiness owners do not need to be U.S. citizens to apply, and a tax return is not mandatory. Businesses that received pandemic economic assistance such as the EIDL Loan or Paycheck Protection Program remain eligible for the Marin Microbusiness Grant Program.

A Marin business is eligible to apply if it is:

- located in Marin

- been in business since December 2019

- made less than $50,000 gross revenue in 2019

- serving as the owner’s primary source of income

- significantly Impacted by the COVID-19 pandemic

- currently open or plans to reopen

- has less than five full-time equivalent employees

- did not receive a California grant through Lendistry

The first round of applications — available in English, Spanish and Vietnamese — is open from May 23 through June 30. The Marin SBDC team is ready to provide application support for anyone with technology or language needs. The program will distribute 105 grants of $2,500. The application period will remain open until all funds are distributed. A lottery system will be employed if there are more than 105 eligible applications.

The second of two online informational sessions is scheduled for:

11 a.m., Wednesday, June 8

For more information or to apply, visit MarinSBDC.org/microbizgrants, call 415.482.1819 or email Team@MarinSBDC.org.

Activism

Oakland Post: Week of April 24 – 30, 2024

The printed Weekly Edition of the Oakland Post: Week of April 24 – 30, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

Alameda County

DA Pamela Price Stands by Mom Who Lost Son to Gun Violence in Oakland

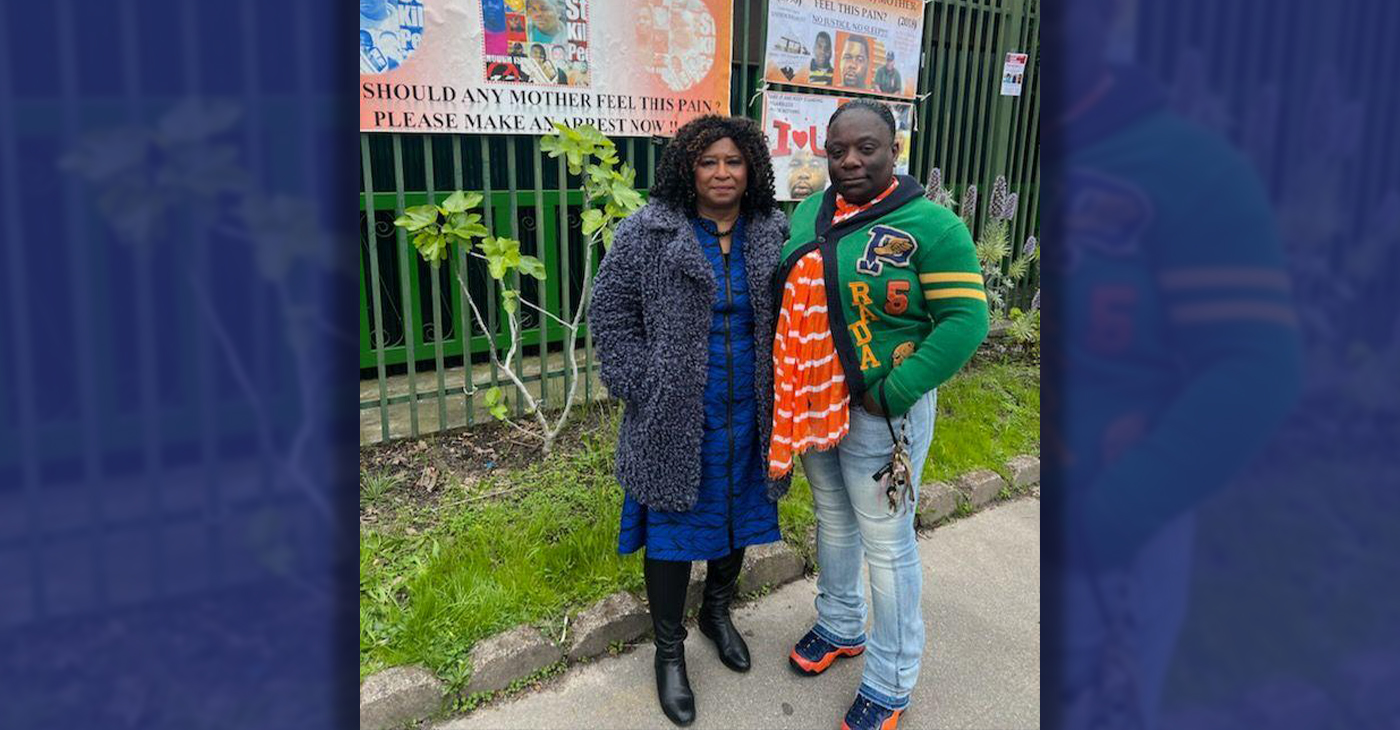

Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018.

Publisher’s note: Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018. The photo was too small for readers to see where the women were and what they were doing. Here we show Price and Jones as they complete a walk in memory of Scott. For more information and to contribute, please contact Carol Jones at 510-978-5517 at morefoundation.help@gmail.com. Courtesy photo.

Bay Area

State Controller Malia Cohen Keynote Speaker at S.F. Wealth Conference

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco. The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

By Carla Thomas

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco.

The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

“Our goal is to educate Black and Brown families in the masses about financial wellness, wealth building, and how to protect and preserve wealth,” said ABWA San Francisco Chapter President LaRonda Smith.

ABWA’s mission is to bring together businesswomen of diverse occupations and provide opportunities for them to help themselves and others grow personally and professionally through leadership, education, networking support, and national recognition.

“This day is about recognizing influential women, hearing from an accomplished woman as our keynote speaker and allowing women to come together as powerful people,” said ABWA SF Chapter Vice President Velma Landers.

More than 60 attendees dined on the culinary delights of Chef Sharon Lee of The Spot catering, which included a full soul food brunch of skewered shrimp, chicken, blackened salmon, and mac and cheese.

Cohen discussed the many economic disparities women and people of color face. From pay equity to financial literacy, Cohen shared not only statistics, but was excited about a new solution in motion which entailed partnering with Californians for Financial Education.

“I want everyone to reach their full potential,” she said. “Just a few weeks ago in Sacramento, I partnered with an organization, Californians for Financial Education.

“We gathered 990 signatures and submitted it to the [California] Secretary of State to get an initiative on the ballot that guarantees personal finance courses for every public school kid in the state of California.

“Every California student deserves an equal opportunity to learn about filing taxes, interest rates, budgets, and understanding the impact of credit scores. The way we begin to do that is to teach it,” Cohen said.

By equipping students with information, Cohen hopes to close the financial wealth gap, and give everyone an opportunity to reach their full financial potential. “They have to first be equipped with the information and education is the key. Then all we need are opportunities to step into spaces and places of power.”

Cohen went on to share that in her own upbringing, she was not guided on financial principles that could jump start her finances. “Communities of color don’t have the same information and I don’t know about you, but I did not grow up listening to my parents discussing their assets, their investments, and diversifying their portfolio. This is the kind of nomenclature and language we are trying to introduce to our future generations so we can pivot from a life of poverty so we can pivot away and never return to poverty.”

Cohen urged audience members to pass the initiative on the November 2024 ballot.

“When we come together as women, uplift women, and support women, we all win. By networking and learning together, we can continue to build generational wealth,” said Landers. “Passing a powerful initiative will ensure the next generation of California students will be empowered to make more informed financial decisions, decisions that will last them a lifetime.”

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 27 – April 2, 2024

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBeloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87

-

Community1 week ago

Community1 week agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 3 – 6, 2024

-

Business1 week ago

Business1 week agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 10 – 16, 2024