Business

For Black Homeowners, Great Recession Has Not Receded

By Freddie Allen

Senior Washington Correspondent

WASHINGTON (NNPA) – Most economists agree that the Great Recession, sparked by the housing market crash, officially ended in 2009, but the fallout from the crisis will continue to hurt Black families, especially Black homeowners, for decades to come, according to a new report commissioned by the American Civil Liberties Union (ACLU).

“In 2007, median wealth excluding home equity was $14,200 for blacks as compared with over six times that amount, $92,950, for whites. Home equity, therefore, made up 51 percent of total wealth for the typical white homeowner in 2007. For the typical black homeowner this same year, on the other hand, home equity constituted a far larger 71 percent of total wealth.”

The report continued: “The fact that blacks hold the bulk of their wealth in home equity likely explains, at least in part, why black wealth, on a percentage basis, declined more than white wealth during the housing bust and subsequent Great Recession.

The report conducted by the Social Science Research Council found that even though Black families and White families lost wealth during the Great Recession, White families lost less and recovered faster than Black families.

White wealth levels, excluding home equity, showed signs of recovery between 2009 and 2011, measuring zero losses, while 40 percent of non-home-equity wealth held by the average Black family evaporated during the same period.

And while the typical Black family shed another 13 percent of their non-home-equity wealth, from 2009-2011, White families, on average, saw their home-equity wealth losses “slow to zero.”

“Not only were Black homeowners devastated by the housing market collapse, they are now being left behind,” said Rachel Goodman, a staff attorney with the ACLU’s Racial Justice Program. “It is very much a tale of two recoveries.”

The report said that between 2007 and 2009, the average White family lost 9 percent of the equity in their homes, compared to average Black homeowner who experienced a 12 percent fall in home equity.

“This disparity may stem from the fact that blacks were more exposed to predatory loans and other types of toxic mortgages and ballooning interest rates as compared to whites, leading to disparate rates of delinquency and foreclosure,” the report said.

Over the next two years, that slide in home equity would shrink to 2 percent for White families and 6 percent for Black homeowners. Further, these losses slowed to only 2 percent between 2009 and 2011 for White households, but for Blacks, home equity values continued to decline by 6 percent.

“While White home equity began to recover quickly after the housing crisis stabilized, this was not the case for Blacks,” the report said. “This difference likely emerges as a result of Blacks’ disproportionate exposure to predatory loans and other deceptive mortgage schemes.”

The Great Recession had a profound impact on the course of Black wealth and the racial wealth gap in the United States. Researchers predicted that, without the Great Recession, the ratio of White to Black median wealth would have decreased “from 4.4 times greater in 1999 to four times greater by 2031.” Instead the gap will widen and the average White family’s wealth is predicted to be 4.5 times greater than the average Black families wealth.

“By 2031, White wealth is forecast to be 31 percent below what it would have been without the Great Recession, while Black wealth is down almost 40 percent,” stated the report. “For a typical Black family, median wealth in 2031 will be almost $98,000 lower than it would have been without the Great Recession.”

Researchers also indicated that the home equity values the adult children of Black families that took losses during the recession will also suffer.

“Without the Great Recession, by 2050, home equity values for Blacks and Whites whose parents or grandparents owned a home at some point between 1999 and 2011 may have approached parity,” the report said. “As a result of discriminatory lending practices and the Great Recession, our analysis suggests that the next generations of Black families will still have home equity values only 70 percent of their white counterparts.”

Citing a joint study by the Department of Housing and Urban Development and the Treasury Department, the ACLU study noted that, “as of 2000, ‘borrowers in Black neighborhoods [were] five times as likely to refinance in the subprime market than borrowers in White neighborhoods,’ even when controlling for income.”

When Bank of America bought Countrywide Financial in 2008, the bank’s track record of troubling mortgage-lending practices and a discrimination case came with the deal. In 2011, Bank of America settled the case with the Justice Department for $355 million. The Department alleged that Countrywide had engaged in “discriminatory mortgage lending practices against more than 200,000 qualified African-American and Hispanic borrowers from 2004 through 2008.”

In 2012, the Justice Department settled a fair lending case with Wells Fargo Bank, over allegations that the financial institution, “engaged in a pattern or practice of discrimination against qualified African-American and Hispanic borrowers in its mortgage lending from 2004 through 2009,” a statement for the Justice Department said.

Investigators also found that minorities were steered into subprime mortgage loans at higher rates than similarly qualified White borrowers.

The settlement included $184.3 million for minority borrowers and another $50 million in resources for direct down payments to help residents living in communities hit the hardest during the housing crash.

But it’s going to take more than settlement money to help Black homeowners guided into subprime mortgages, who were crushed during the housing market crisis as they continue you struggle almost six years after the end of the recession.

In the press release about the report, Sarah Burd-Sharps, the co-director of the Social Science Research Council’s Measure of America project, said that, “Steps can be taken right now to help close the growing racial wealth divide, and to ensure that the next generation has the benefits of assets and savings that bring a more secure future.”

The report recommended that policymakers closely monitor current lending practices at banks to protect low-income and minority borrowers from discrimination. The report also suggested that lawmakers clarify legislation governing access to credit and that they give regulators more power to guard consumers against racially disparate practices in servicing mortgage loans.

Goodman concluded: “This study makes clear that the devastating impact of the financial crisis on Black families’ wealth will continue until policymakers address this pressing issue.”

Bay Area

State Controller Malia Cohen Keynote Speaker at S.F. Wealth Conference

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco. The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

By Carla Thomas

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco.

The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

“Our goal is to educate Black and Brown families in the masses about financial wellness, wealth building, and how to protect and preserve wealth,” said ABWA San Francisco Chapter President LaRonda Smith.

ABWA’s mission is to bring together businesswomen of diverse occupations and provide opportunities for them to help themselves and others grow personally and professionally through leadership, education, networking support, and national recognition.

“This day is about recognizing influential women, hearing from an accomplished woman as our keynote speaker and allowing women to come together as powerful people,” said ABWA SF Chapter Vice President Velma Landers.

More than 60 attendees dined on the culinary delights of Chef Sharon Lee of The Spot catering, which included a full soul food brunch of skewered shrimp, chicken, blackened salmon, and mac and cheese.

Cohen discussed the many economic disparities women and people of color face. From pay equity to financial literacy, Cohen shared not only statistics, but was excited about a new solution in motion which entailed partnering with Californians for Financial Education.

“I want everyone to reach their full potential,” she said. “Just a few weeks ago in Sacramento, I partnered with an organization, Californians for Financial Education.

“We gathered 990 signatures and submitted it to the [California] Secretary of State to get an initiative on the ballot that guarantees personal finance courses for every public school kid in the state of California.

“Every California student deserves an equal opportunity to learn about filing taxes, interest rates, budgets, and understanding the impact of credit scores. The way we begin to do that is to teach it,” Cohen said.

By equipping students with information, Cohen hopes to close the financial wealth gap, and give everyone an opportunity to reach their full financial potential. “They have to first be equipped with the information and education is the key. Then all we need are opportunities to step into spaces and places of power.”

Cohen went on to share that in her own upbringing, she was not guided on financial principles that could jump start her finances. “Communities of color don’t have the same information and I don’t know about you, but I did not grow up listening to my parents discussing their assets, their investments, and diversifying their portfolio. This is the kind of nomenclature and language we are trying to introduce to our future generations so we can pivot from a life of poverty so we can pivot away and never return to poverty.”

Cohen urged audience members to pass the initiative on the November 2024 ballot.

“When we come together as women, uplift women, and support women, we all win. By networking and learning together, we can continue to build generational wealth,” said Landers. “Passing a powerful initiative will ensure the next generation of California students will be empowered to make more informed financial decisions, decisions that will last them a lifetime.”

Business

Black Business Summit Focuses on Equity, Access and Data

The California African American Chamber of Commerce hosted its second annual “State of the California African American Economy Summit,” with the aim of bolstering Black economic influence through education and fellowship. Held Jan. 24 to Jan. 25 at the Westin Los Angeles Airport Hotel, the convention brought together some of the most influential Black business leaders, policy makers and economic thinkers in the state. The discussions focused on a wide range of economic topics pertinent to California’s African American business community, including policy, government contracts, and equity, and more.

By Solomon O. Smith, California Black Media

The California African American Chamber of Commerce hosted its second annual “State of the California African American Economy Summit,” with the aim of bolstering Black economic influence through education and fellowship.

Held Jan. 24 to Jan. 25 at the Westin Los Angeles Airport Hotel, the convention brought together some of the most influential Black business leaders, policy makers and economic thinkers in the state. The discussions focused on a wide range of economic topics pertinent to California’s African American business community, including policy, government contracts, and equity, and more.

Toks Omishakin, Secretary of the California State Transportation Agency (CALSTA) was a guest at the event. He told attendees about his department’s efforts to increase access for Black business owners.

“One thing I’m taking away from this for sure is we’re going to have to do a better job of connecting through your chambers of all these opportunities of billions of dollars that are coming down the pike. I’m honestly disappointed that people don’t know, so we’ll do better,” said Omishakin.

Lueathel Seawood, the president of the African American Chamber of Commerce of San Joaquin County, expressed frustration with obtaining federal contracts for small businesses, and completing the process. She observed that once a small business was certified as DBE, a Disadvantaged Business Enterprises, there was little help getting to the next step.

Omishakin admitted there is more work to be done to help them complete the process and include them in upcoming projects. However, the high-speed rail system expansion by the California High-Speed Rail Authority has set a goal of 30% participation from small businesses — only 10 percent is set aside for DBE.

The importance of Diversity, Equity and Inclusion (DEI) in economics was reinforced during the “State of the California Economy” talk led by author and economist Julianne Malveaux, and Anthony Asadullah Samad, Executive Director of the Mervyn Dymally African American Political and Economic Institute (MDAAPEI) at California State University, Dominguez Hills.

Assaults on DEI disproportionately affect women of color and Black women, according to Malveaux. When asked what role the loss of DEI might serve in economics, she suggested a more sinister purpose.

“The genesis of all this is anti-blackness. So, your question about how this fits into the economy is economic exclusion, that essentially has been promoted as public policy,” said Malveaux.

The most anticipated speaker at the event was Janice Bryant Howroyd known affectionately to her peers as “JBH.” She is one of the first Black women to run and own a multi-billion-dollar company. Her company ActOne Group, is one of the largest, and most recognized, hiring, staffing and human resources firms in the world. She is the author of “Acting Up” and has a profile on Forbes.

Chairman of the board of directors of the California African American Chamber of Commerce, Timothy Alan Simon, a lawyer and the first Black Appointments Secretary in the Office of the Governor of California, moderated. They discussed the state of Black entrepreneurship in the country and Howroyd gave advice to other business owners.

“We look to inspire and educate,” said Howroyd. “Inspiration is great but when I’ve got people’s attention, I want to teach them something.”

Activism

Oakland Post: Week of April 17 – 23, 2024

The printed Weekly Edition of the Oakland Post: Week of April 17 – 23, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 27 – April 2, 2024

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoFrom Raids to Revelations: The Dark Turn in Sean ‘Diddy’ Combs’ Saga

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: Lady Day and The Lights!

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBaltimore Key Bridge Catastrophe: A City’s Heartbreak and a Nation’s Alarm

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBaltimore’s Key Bridge Struck by Ship, Collapses into Water

-

#NNPA BlackPress4 weeks ago

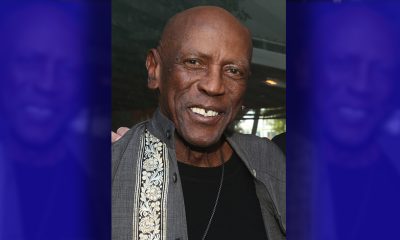

#NNPA BlackPress4 weeks agoBeloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87

Pingback: wyroby szklane piotrków trybunalski

Pingback: wyroby szklane piotrków trybunalski

Pingback: szkło piotrków

Pingback: szkło piotrków