Bay Area

Dream Fund: Entrepreneurs Can Apply for $10,000 Grants Through $35M State Program

Although a number of reports suggest that the outlook has begun to be more positive as the U.S. economy continues to bounce back defying the odds, and many Black businessowners have also become more optimistic, access to credit and technical support remain a challenge for many who had to dip into their own finances to keep their lights on.

By Tanu Henry, California Black Media

Since 2017, there has been a 9.8% increase of new small businesses — firms with less than 500 employees — in the United States. Over the past two years alone, over 10 million applications were submitted to start new small businesses across the country, according to the Small Business Administration.

That growth trend is true for California, too, where there are about 4.1 million small businesses, the most in the country. Those companies make up 99.8% of all business in California and employ about 7.2 million people.

But for Black-owned and other minority owned small businesses across the country, there was a steep decline in numbers, almost 41%, due to the pandemic, a Census Population Survey found in 2020. During that same time, nearly 44% of minority-owned small businesses were at risk of shutting down, a Small Business Majority report found.

Although a number of reports suggest that the outlook has begun to be more positive as the U.S. economy continues to bounce back defying the odds, and many Black businessowners have also become more optimistic, access to credit and technical support remain a challenge for many who had to dip into their own finances to keep their lights on.

Recognizing the outsized contribution small businesses make to the health of the California economy and the hit many of the smallest of small business have taken during the pandemic, the California Office of the Small Business Advocate (CalOSBA) has been making grants of up to $25,000 to small business in the state.

In its latest round of funding called the Dream Fund, which is now accepting applications on a rolling basis, CalOSBA has partnered with Lendistry, a Los Angeles-based, minority-led small business and commercial real estate lender to administer the $35 million grant portion of its program. The fund provides $10,000 to each small business that qualifies.

To become eligible, California-based small business owners will have to complete training at one of the centers run by the state’s Technical Assistance Expansion Program (TAEP) and receive a certificate.

“For the millions of Californians that have dreams of owning their own business, this grant coupled with one-on-one counseling and business expertise from hundreds of counselors at our eighty-seven Technical Assistance Centers, has the power to jumpstart their dreams,” says Tara Lynn Gray, director of CalOSBA.

Jay King, president and CEO of the Sacramento-based California Black Chamber of Commerce, says he applauds Gov. Gavin Newsom for understanding the historic systemic challenges minority businesses face and for “doing something about it.”

But giving Black businesses grants are not a “cure-all,” he says.

“It is like putting a Band-Aid on a bullet wound if we don’t do more to really fix the problems small businesses face,” King explains. “Ninety-six percent of Black businesses are mini- or micro- that means they make less than $100,000 or less than $35,000 a year, respectively,” King continued. “Only 4% of our businesses earn more than $100,000 annually. We have to put more resources and technical support around these businesses.”

King says informing Black business owners about opportunities like the Dream Fund and making sure they know how to apply for or access the funding is critical to making sure the people who need the help gets it.

“You have to get down into our communities,” he said. “You have to reach people through groups that are plugged into our communities to get the word out. We do not hear about these kinds of programs enough. We definitely don’t benefit from them enough.”

Everett K. Sands, the CEO of Lendistry, says he is excited to help California’s new businesses access the capital they need to “begin on their journeys.

“Over the past two years, almost 10 million new businesses have been created in the U.S.,” he says. “With record numbers of new small businesses entering the marketplace, many of which are owned by women and minorities, programs like California Dream Fund pave the way for a more robust and equitable economy as these new businesses make the leap from employing just their founders to employing their communities.”

Activism

Oakland Post: Week of April 24 – 30, 2024

The printed Weekly Edition of the Oakland Post: Week of April 24 – 30, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

Alameda County

DA Pamela Price Stands by Mom Who Lost Son to Gun Violence in Oakland

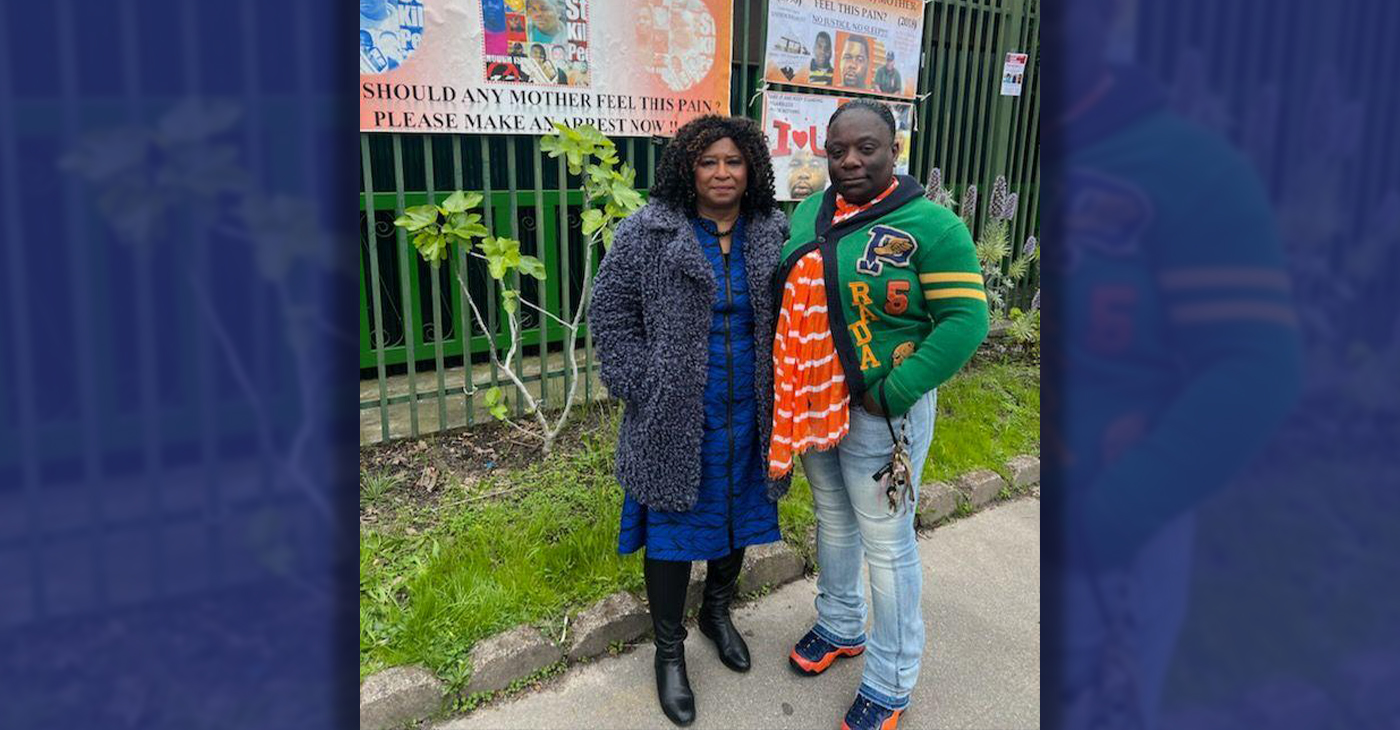

Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018.

Publisher’s note: Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018. The photo was too small for readers to see where the women were and what they were doing. Here we show Price and Jones as they complete a walk in memory of Scott. For more information and to contribute, please contact Carol Jones at 510-978-5517 at morefoundation.help@gmail.com. Courtesy photo.

Bay Area

State Controller Malia Cohen Keynote Speaker at S.F. Wealth Conference

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco. The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

By Carla Thomas

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco.

The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

“Our goal is to educate Black and Brown families in the masses about financial wellness, wealth building, and how to protect and preserve wealth,” said ABWA San Francisco Chapter President LaRonda Smith.

ABWA’s mission is to bring together businesswomen of diverse occupations and provide opportunities for them to help themselves and others grow personally and professionally through leadership, education, networking support, and national recognition.

“This day is about recognizing influential women, hearing from an accomplished woman as our keynote speaker and allowing women to come together as powerful people,” said ABWA SF Chapter Vice President Velma Landers.

More than 60 attendees dined on the culinary delights of Chef Sharon Lee of The Spot catering, which included a full soul food brunch of skewered shrimp, chicken, blackened salmon, and mac and cheese.

Cohen discussed the many economic disparities women and people of color face. From pay equity to financial literacy, Cohen shared not only statistics, but was excited about a new solution in motion which entailed partnering with Californians for Financial Education.

“I want everyone to reach their full potential,” she said. “Just a few weeks ago in Sacramento, I partnered with an organization, Californians for Financial Education.

“We gathered 990 signatures and submitted it to the [California] Secretary of State to get an initiative on the ballot that guarantees personal finance courses for every public school kid in the state of California.

“Every California student deserves an equal opportunity to learn about filing taxes, interest rates, budgets, and understanding the impact of credit scores. The way we begin to do that is to teach it,” Cohen said.

By equipping students with information, Cohen hopes to close the financial wealth gap, and give everyone an opportunity to reach their full financial potential. “They have to first be equipped with the information and education is the key. Then all we need are opportunities to step into spaces and places of power.”

Cohen went on to share that in her own upbringing, she was not guided on financial principles that could jump start her finances. “Communities of color don’t have the same information and I don’t know about you, but I did not grow up listening to my parents discussing their assets, their investments, and diversifying their portfolio. This is the kind of nomenclature and language we are trying to introduce to our future generations so we can pivot from a life of poverty so we can pivot away and never return to poverty.”

Cohen urged audience members to pass the initiative on the November 2024 ballot.

“When we come together as women, uplift women, and support women, we all win. By networking and learning together, we can continue to build generational wealth,” said Landers. “Passing a powerful initiative will ensure the next generation of California students will be empowered to make more informed financial decisions, decisions that will last them a lifetime.”

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 27 – April 2, 2024

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBeloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87

-

Community1 week ago

Community1 week agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 3 – 6, 2024

-

Business1 week ago

Business1 week agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 10 – 16, 2024

-

Community1 week ago

Community1 week agoAG Bonta Says Oakland School Leaders Should Comply with State Laws to Avoid ‘Disparate Harm’ When Closing or Merging Schools

-

Community6 days ago

Community6 days agoOakland WNBA Player to be Inducted Into Hall of Fame