Op-Ed

Despite Stellar Record, CFPB Remains Under Attack

By Charlene Crowell

NNPA Columnist

In everyday life, birthdays and anniversaries of many sorts are observed and celebrated. When it comes to consumer finance, there are two more anniversaries worth celebrating.

Congress enacted the Dodd-Frank Wall Street Reform Act on July 21, 2010 in response to the largest national economic challenge since the Great Depression. A key goal was and remains to protect the nation and its taxpayers from ever again bearing the financial burdens of risky deals by Wall Street and other private financial players. The following year, the Consumer Financial Protection Bureau (CFPB) opened its doors to serve the needs of America’s consumers.

Before the CFPB, no single federal agency had consumers as its sole priority and focus. To date, the Bureau has benefited 17 million consumers through a total of $10.1 billion in financial relief. More than 650,000 consumers have chosen to use its flexible complaint system that includes the options of online, written and telephone complaints in multiple languages.

On the enforcement side, CFPB’s actions have addressed multiple violations in different lending areas:

• In 2013 Chase Bank USA, N.A. and JPMorgan Chase Bank, N.A. was ordered to refund an estimated $309 million to more than 2.1 million customers for illegal credit card practices.

• The following year, Flagstar Bank was fined $37.5 million for violating the CFPB’s mortgage servicing rules by illegally blocking 6,500 borrowers’ attempts to save their homes.

• That same year, Colfax Capital Corporation and Culver Capital, LLC, also collectively known as “Rome Finance,” was ordered to pay $92 million in debt relief to 17,000 service members and other consumers for masking high-cost financing charges on artificially-inflated costs for goods and services.

• ACE Cash Express, operating over 1,500 storefront payday locations in 36 states, was ordered in 2014 to pay $10 million in restitution and penalties for its threats of criminal prosecution and intimidating phone calls that “create a sense of urgency” when contacting delinquent borrowers.

• Earlier this year, $480 million in debt relief to student loan borrowers who were wronged by the now-defunct Corinthian Colleges.

In recent days, the CFPB announced two additional enforcement actions involving illegal and deceptive credit card violations, and another for illegal private student loan servicing practices. As a result, Citigroup was ordered to refund $700 million to 8.8 million consumers and pay separate fines totaling $35 million. Discover Bank and its affiliates will refund $16 million to consumers, pay a $2.5 million penalty and improve its billing, student loan interest reporting and collection practices.

Additionally, 30 million consumers plagued by debt collectors now have the chance to be treated fairly because of CFPB’s first-time ever supervision of debt collection companies. The 12 million consumers who borrow payday loans will soon have more protection by a CFPB rule that addresses the myriad abuses wrought by triple-digit interest rates.

This and other abundant data suggest that America’s consumers are well-served by its four-year old consumer cop-on-the-beat.

Despite CFPB’s productivity, its critics have remained steadfastly opposed. Dozens of bills have been introduced to undermine its independence, its rules to protect against unfair deceptive and discriminatory practices, and its authority to oversee financial services such as payday lenders and auto finance companies.

When the Bureau took action against auto lenders who participated in pricing schemes that charged Black and Latino borrowers more for their loans, congressional critics organized threatening letters questioning their rationale and motives. And when the Bureau adopted new rules to rein in abuses in mortgage lending, those same critics rushed to file bills to weaken the rules and return to the very practices that lead up to the foreclosure crisis.

Fortunately, none of the attacks have made it into law.

At a July 8 Brookings forum that focused on the Wall Street reform law, Treasury Secretary Jack Lew was asked by a reporter about the effort to abolish CFPB.

“I will say, for all of the concerns that a lot of people had early in its history, as they’ve taken action there’s been broad, overwhelming support for the fact that they’ve done things in a careful and sensible way, listening to all sides,” said Secretary Lew. “So I think if you kind of step away from the debate that took place before the CFPB was created and look at the track record, it should put to rest a lot of that controversy.”

Others who agree with Treasury Secretary have also spoken up in its defense.

“The Consumer Financial Protection Bureau has built an unprecedented record of success protecting our nation’s consumers and service members who have been victimized by unscrupulous corporations and financial institutions, noted Congresswoman Maxine Waters, the Ranking Member on the House Financial Services Committee and a member of the Congressional Black Caucus.

“The CFPB has been, and continues to be, party to a wide array of enforcement actions related to practices that disproportionately affect communities of color, including deceptive marketing, unlawful debt collection, discrimination, unlawful fees and fraudulent mortgage relief schemes,” continued Waters.

A recent consumer survey by the Center for Responsible Lending and Americans for Financial Reform found that although anger at banks and other financial services companies has moderated over their role in the housing crisis, broad and bipartisan support for CFPB remains. When consumers self-identified as likely 2016 voters were asked to choose between more and less regulation of financial companies 71 percent side with more, and 20 percent with less. Additionally, 64 percent of these voters saw a need for an agency charged with protecting consumers against dangerous financial products.

So it seems that public sentiment sides with CFPB continuing its important work to protect consumer credit and finances.

“I’m truly proud of the CFPB’s outstanding success on behalf of our nation’s active-duty military, restoring tens of millions to service members. And I applaud the Bureau for the work it’s doing to rein in payday lenders that have turned a business intended to help hard working consumers stay out of financial trouble into one that often creates trouble instead,” added Congresswoman Waters.

“I am hopeful that soon, the CFPB will eventually yield a strong and simple rule that protects our low-income and minority communities from unaffordable rates and unfair terms,” she concluded.

Charlene Crowell is a communications manager with the Center for Responsible Lending. She can be reached at 919-313-8523.

###

Commentary

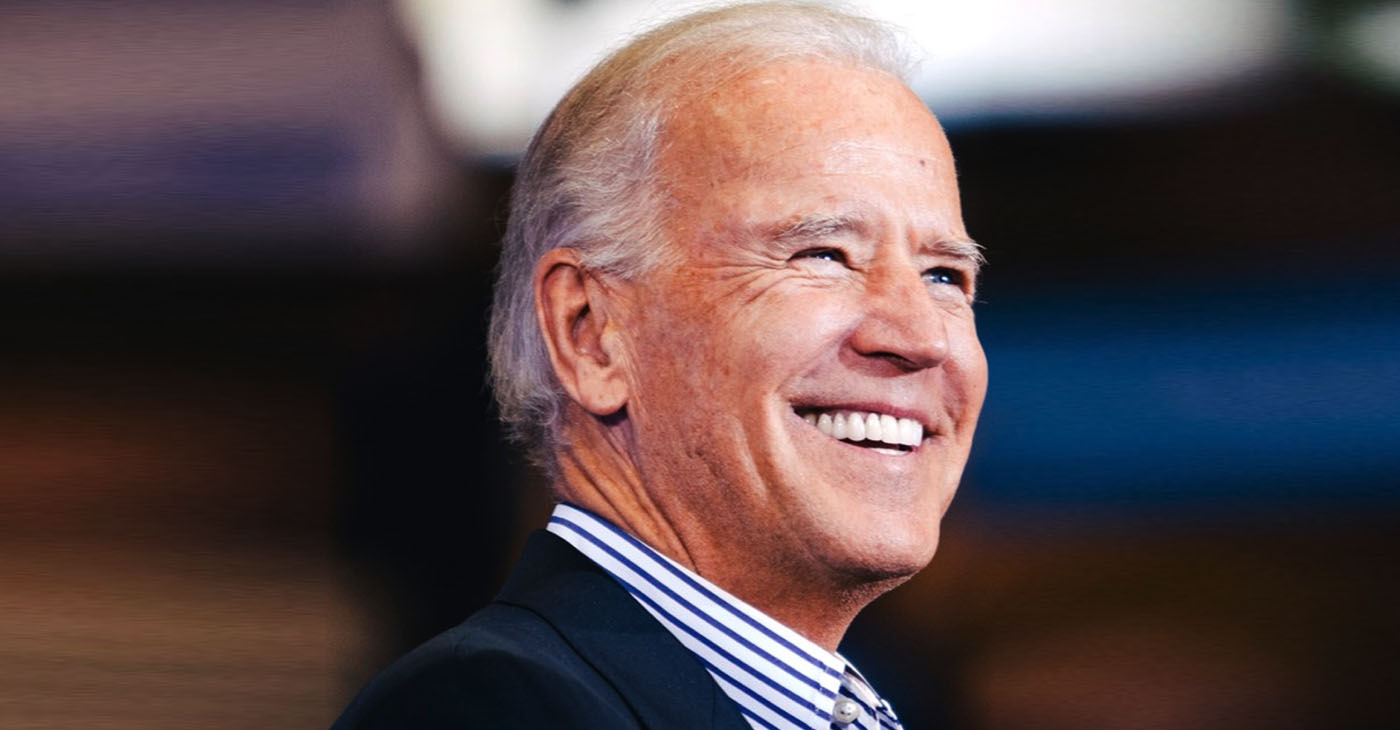

Commentary: Racism? Sexism? Ageism Is Worse. Ask Joe Biden

Don’t worry about President Joe Biden’s age or memory. Worry about how he has to confront ageism. Thanks to a certain Asian American special prosecutor named Robert Hur.

By Emil Guillermo

Don’t worry about President Joe Biden’s age or memory.

Worry about how he has to confront ageism. Thanks to a certain Asian American special prosecutor named Robert Hur.

Hur went beyond and below the call of duty in political slander of the President.

Hur’s investigation concluded: there would be no prosecution against Biden for any mishandling of classified documents. So why wasn’t that the big headline last week?

Once it was determined there was not enough evidence to prosecute the president, Hur’s work was done.

Instead, Hur took a year to finish a nearly 400-page report that many mainstream news outlets have since mischaracterized. For example, CNBC’s headline quoted Hur: “Biden ‘willfully’ kept classified materials, had ‘poor memory’: Special counsel.”

Unfortunately, it’s misleading. By how much? On the Just Security website, two prominent law professors found Hur’s report actually described Biden’s statements as “innocent explanations.”

“Unrefuted innocent explanations,” say Prof. Andrew Weissmann and Prof. Ryan Goodman, doesn’t just mean the “case does not meet the standard for criminal prosecution — it means innocence.”

But no one walks away from the mainstream headlines about the report thinking Biden is innocent; Only that he “willfully” retained something classified, and he has a “poor memory.”

None of it adds up to a prosecution. Just a public persecution.

Is this the game being played by Hur, a Trump appointee to the Justice Department, who was named special prosecutor last year by Attorney General Merrick Garland?

Garland must have thought it was a stroke of genius to appoint a Trump Republican in a political year to investigate his Democratic boss. That would be a sign of unity in the fight for truth and justice, right?

It wasn’t.

Hur, the son of South Korean immigrants and a Harvard grad, has said all the right things in public statements: that he’d be “fair, impartial and dispassionate,” and would “follow the facts swiftly and thoroughly, without fear or favor.”

Right.

Or is that right-wing?

Hur’s speculative comments about Biden’s memory were challenged last Sunday by Biden’s personal attorney, Bob Bauer who witnessed Hur’s deposing of Biden.

On CBS’ “Face the Nation,” Bauer called Hur’s report a “shabby piece of work,” that reached the right legal conclusion, but then was loaded with hundreds of pages of “misstatements of facts and totally inappropriate and pejorative comments that are unfounded and not supported by the record.”

Hur appears to have padded the report to buttress his own standing among Republicans. He makes memory a relevant issue when he uses it as an excuse to not prosecute Biden.

With no basis for a legal prosecution, Hur made sure to go for the political kill and let loose the virus that is ageism.

I once thought ageism would unite us all. We may not all be the same race, ethnicity, or gender, but we all fight time and the aging process.

But how naïve I was. Ageism can also inspire division, creating generation gaps, all charged with emotions that fuel a discrimination harder to fight than racism.

Of course, it cuts both ways. Last weekend, Donald Trump, 77, said Russia should be able to do “whatever the hell they want” to NATO members who don’t meet their defense spending targets.

The man who wants to be president again is backing our enemy Putin against our allies.

Is that Trump showing off his anti-democracy bent or his senility?

That’s why ageism has become a dominant theme for both parties and is likely to hang around.

It won’t age well, unless we all know the truth about Hur’s misleading report.

The controversy has thrust Vice President Kamala Harris into the limelight, as she defended Biden and called Hur’s report “clearly politically motivated (and) gratuitous.”

Harris’ detractors have been sniping at her from day one with healthy doses of racism and sexism. Now, you can add ageism to the Republican tool set, a nasty political trifecta, as the GOP continues to hammer Biden and the Democrats with the misleading Hur report.

About the Author

Emil Guillermo is a journalist and commentator. See him on YouTube.com/@emilamok1

Activism

Will New City Leaders End Oakland’s Long-Time Cozy Relationship with Corporate Developers?

Geoffrey Pete’s building at 410 14th St. is a Registered National Resource Building on the State of California Register as well as a contributing building to the Historic Downtown Oakland District on the State of California Register and the National Department of Interior historic registers.

By Ken Epstein

New research, produced by supporters of Geoffrey’s Inner Circle and the Black Arts Movement and Business District, has provided powerful evidence against giving a greenlight to Tidewater Capital’s 40-story luxury apartment building at 1431 Franklin St., inches from owner Geoffrey Pete’s historic venue.

According to the research, which has been shared with Mayor Sheng Thao, arguments in favor of Tidewater Capital’s proposal seem to be based on inaccurate facts, which some believe have their origin among past mayoral administrations and city administrators, the planning commission and city staff who for years allowed corporate development to ravage Oakland’s diverse communities while trying to convince residents that there is no alternative to gentrification.

State does not require project’s approval

Some who support allowing Tidewater’s project to be built have maintained that the state would likely revoke Oakland’s affordable housing funds if the city does not approve this high-end real estate project.

However, this interpretation does not seem to be based on an accurate reading of the law. The state’s “Prohousing Designation Program is what is believed by city officials to prevent Oakland from denying new residential development at the risk of losing their designation” and related funding, according to the research document.

The new research has found instead that “Oakland’s housing element is considered to be in ‘full compliance’ with state law, (and) the city no longer has to worry about losing important revenue, such as the Prohousing Designation Program or triggering rules that could have limited its ability to regulate development.”

The mission statement of the state pro-housing program says it is not designed to force cities to build more high-end housing but is meant to pressure cities and counties that are not building sufficient housing for very low and extremely low-income families. The goal is “creating more affordable homes in places that historically or currently exclude households earning lower incomes and households of color,” the mission statement of the state’s program said.

“This (Tidewater) proposal isn’t remotely connected” to a low-income development and, therefore, would not be impacted by state regulations protecting low-income projects, says the new research.

City failed to seek historical preservation funds

The second major point is that Oakland, unlike neighboring cities, has failed to apply for funding that would have protected its national resource buildings and districts from luxury developers like Tidewater.

Geoffrey Pete’s building at 410 14th St. is a Registered National Resource Building on the State of California Register and a contributing building to the Historic Downtown Oakland District on the State of California Register and the National Department of Interior historic registers.

If Oakland had applied for available grants from the state’s Office of Historic Preservation, it could have received millions of dollars. For example, the city and county of San Francisco applied and received millions of dollars more than six times since 2012.

“The City of Oakland has never even applied for this grant once,” the research said. “Our neighboring and surrounding cities in San Francisco, Berkeley, and Richmond have all applied and been awarded. Just not Oakland.”

“If Oakland had applied and received these funds, then Geoffrey’s Inner Circle, a National Registered Resource Building, would have been protected. There would be zero conversation with Tidewater Capital. This situation would not exist.”

Because the Black Arts Movement & Business District is a registered cultural district, Tidewater Capital’s proposal is in a geographic area with cultural affiliations, and the proposed development will, in fact, cause harm to a cultural resource, Geoffrey’s Inner Circle.

Project designed for luxury housing

The third major point in the research holds that, while the project’s backers claim that many units would be reserved for very low-income residents, the city’s staff report says that only 38 units (10%) out of a total of 381 units would be reserved for low-income residents. Further, there is evidence that none of the units would be available to those whose incomes do not put them among the affluent.

The City of Oakland considers “low-income” to be $112,150 a year for a family of four. What this means is MOST Oakland families do not earn enough to live in the Tidewater Capital’s building. Current data shows that median income for a family of four in Oakland is $85,628, well below the $112,150 that is considered low-income by the city’s unusual standard.

The research shows that the planning commission and city staff’s systematic bias toward high end development has resulted in massive overbuilding of market rate housing, while the city is way behind its goals to build affordable housing.

City statistics show that between 2015 and 2022, the city pledged to build 14,765 units at various income levels. In fact, the city created many more — 18,880 units. Of these, they had pledged to build 4,134 units for residents at the lowest income levels but failed to reach their goal by 1,776 units.

Yet at the same, time, the city built 16,522 high end units, though officials had only pledged 10,631 units for affluent tenants.

“The Oakland Planning Commission catered to developers, such as Tidewater Capital, who solely created luxury housing, so aggressively that they overshot their obligation by 5,891 extra and unnecessary (luxury) units approved,” according to Geoffrey’s supporters’ research.

“Yet low-income housing goals are nearly two thousand units in arrears with no clear remedy or solution at hand,” the research said.

“For the eighth year in a row, Oakland’s Housing Element progress report shows that while the city has permitted an abundance of market rate housing, we are not building enough affordable homes,” said Jeff Levin of East Bay Housing Organizations (EBHO), quoted in Oaklandside.

“The trend in Oakland has been to build high-end units that attract new, higher-income residents,” doing little for low-income residents and Oakland natives, he said.

Project does not fit the landscape

Finally, the real facts show that Tidewater’s market-rate luxury skyscraper, doggedly supported by city staff, does not fit the landscape, dramatically overshadowing surrounding buildings in the downtown Black Arts Movement and Business District.

Tidewater’s design would become the tallest building in Oakland at 413 feet tall (40 stories), taller than the Atlas building at 400 feet, which was built several years ago directly across the street from Geoffrey’s.

The Post gave council members supporting the Tidewater project an opportunity to be interviewed for this article.

Activism

Open Letter to Mayor Thao: Reject Tidewater Development’s Construction Next to Geoffrey’s Inner Circle

Tidewater’s proposed development will harm Geoffrey’s Inner Circle through its very construction, in much the same way that another nearby Black business, Uncle Willie’s Original Bar-B-Que and Fish, was devastated by construction of a 27-story hotel tower adjacent to the historic building that housed this venerated Black business.

Special to The Post

We respectfully request that you vote “No” on the City Council resolution regarding Tidewater Franklin Street development due to be scheduled on the Jan. 16 City Council agenda.

Tidewater’s proposed development will harm Geoffrey’s Inner Circle through its very construction, in much the same way that another nearby Black business, Uncle Willie’s Original Bar-B-Que and Fish, was devastated by the construction of a 27-story hotel tower adjacent to the historic building that housed this venerated Black business.

Further, the Planning Commission made many errors in its approval process, including but not limited to the following:

- Its members acknowledged that they were not even aware that the Black Arts Movement and Business District existed.

- It ignored the fact that Geoffrey’s was entitled to critical protections as a recognized historic resource.

- It ignored the fact that Tidewater had not sought permits or permission to alter Mr. Pete’s building, although such alterations are an integral part of Tidewater’s proposal.

- The Planning Department did not provide, in a timely manner, relevant Public Records Act information requested by the appellant.

In addition, the Planning Department staff has refused to meet with Mr. Geoffrey Pete throughout the appeal process. Sadly, it also appears that the City’s own Department of Race and Equity has been bypassed on a matter with significant equity implications.

It should also be noted that there are dozens of studies indicating that residential construction like Tidewater’s drives out live entertainment venues. Many cities have laws to regulate such potential conflicts.

Geoffrey’s is a critical business to the Oakland community as a whole, and particularly to the African American community.

It has been a place of comfort and camaraderie for thousands of people who have listened to music, held celebrations, funeral repasts, and community meetings. And, Pete hosts an incubator program which has provided a haven for business owners who would not have had success if not housed in his building with below market-rate rent and other amenities, thus enabling them to survive in the ever-more costly downtown area.

The African American population in Oakland has decreased from 47% in the 1980s to 22% currently. A large part of the reason has been City policies which privilege the desires of wealthy developers over the needs of the Black community.

There are questions about housing and other matters which are too lengthy for this letter; we would be happy to discuss all of these with you.

We urge you in the strongest terms to support Geoffrey’s and refuse to vote in support of any measure presented to you that would allow Tidewater’s construction next to Geoffrey’s.

Signers (partial list):

Organizations

Black Women Organized for Political Action, Oakland Berkeley Chapter

Oakland East Bay Democratic Club

Block by Block Organizing Network

John George Democratic Club, Steering Committee

Niagara Movement Democratic Club

Everett and Jones Bar-B-Que

Uncle Willie’s Bar-b-Que and Fish

Joyce Gordon Gallery

Pastors:

Pastor Phyllis Scott, president, Pastors of Oakland

Rev. Dr. Lawrence Van Hook, Community Church

Rev. Dr. Jasper Lowery, International Outreach Ministries

Pastor Cornell Wheeler, Greater Whittington Temple, COGIC

Rev. Dr. Joe Smith, Good Hope MBC

Bishop Brandon Rheems, Center of Hope Community Church

Pastor Daniel Stevens, GreaterNew Life COGIC

Pastor Joseph Thomas, New Hope COGIC

Bishop Joseph Nobles, Dancey Memorial COGIC

Pastor Edwin Brown, Market Street Seventh Day Adventist

Bishop J.E. Watkins, Jack London Square Chapel COGIC

Rev. Kenneth Anderson, Williams Chapel MBC

Rev. Germaine Anderson, People’s MBC

Bishop Marcel Robinson, Perfecting Ministries

Pastor K J Williams, New Beginnings Church

Rev. Dr. Jeremiah Captain, Glad Tidings

Bishop George Matthews, Genesis Worship Center

Rev. Dr. David Franklin, Wings of Love SDA Church

Bishop Anthony Willis, Lily of the Valley Christian Center

Bishop L E Franklin, Starlight Cathedral

Rev. Dr. Sylvester Rutledge, North Oakland MBC

Pastor Raymond Lankford, MSW, Voices of Hope Community Church

Minister Candi Thornton, Arsola House Ministries

Rev. Dr. Joseph Jones, Alpha and Omega Ministries

Superintendent Dan Phillips, Greater Grace Temple, COGIC

Individuals:

Walter Riley, Attorney at Law

Corrina Gould, Tribal chair of Confederated Villages of Lisjan/Ohlone

Zach Norris, Open Society Foundation Fellow

Raymond Bobbitt, Business

Doug Blacksher

Terryn Niles Buxton, business

Lauren Cherry, School Administrator

Allene Warren

Nirali Jani, PhD, Professor of Education

Frankie Ramos, PhD, community organizer

Henry Hitz, Educator

Sheryl Walton, Community Organizer

Vincent Tolliver, Musician

Eleanor Stovall, Educator

Kitty Kelly Epstein, PhD, Professor of Urban Studies, and Education

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 27 – April 2, 2024

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoFrom Raids to Revelations: The Dark Turn in Sean ‘Diddy’ Combs’ Saga

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: Lady Day and The Lights!

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBaltimore Key Bridge Catastrophe: A City’s Heartbreak and a Nation’s Alarm

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBaltimore’s Key Bridge Struck by Ship, Collapses into Water

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBeloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87