Bay Area

California Small Businesses Struggle While Waiting for Stimulus Aid

M’Dears Bakery & Bistro fills the air in its South Los Angeles neighborhood with smells of fried chicken, French toast, and homemade desserts. “It was very serendipitous,” said 66-year-old restaurant owner Carrie Reese about how she transitioned from a vendor at jazz festivals to opening a dine-in restaurant at 77th and Western Avenue.

“You could see through the window, piles of chicken. And people started saying, ‘can I just buy a plate,’” said Reese.

Eighteen years later, M’dears recently renovated dining room is empty during what would normally be its busy lunchtime rush, and Reese is struggling to come up with the money to pay her staff.

“I was a little bit slow to do the furloughs and the layoffs. I was hoping against hope that I wouldn’t have to do that. I kept people on longer than I should have. Everybody has kids to support. It’s a really big burden for me to have to make those decisions,” said Reese.

Since mid-March, Reese estimates that her business has slowed by 65% – 70%. She’s had to furlough most of her staff. This comes during nationwide efforts to slow the spread of the novel coronavirus. LA Mayor Eric Garcetti closed the city’s restaurants and bars; only takeout, and delivery are allowed. This is happening as authorities issue daily reminders for people to follow the state’s stay-at-home order.

Reese said she’s paying her remaining employees order-by-order and when that’s not enough she pulls money from her retirement savings. At the same time, she notices more customers are paying with credit cards. That means it takes days before sales of smothered pork chops or plates of wings and waffles make them money. “It’s embarrassing. It breaks my heart when people say ‘hey the check didn’t go through,’” said Reese.

M’dears Bakery & Bistro is one of nearly 4 million small businesses in California. About 1.6 million of them are minority-owned. The restaurant industry as a whole has been hit hard by the COVID-19 social distancing policies. By April 9, the National Restaurant Association estimated more than 3 million restaurant employees across the country have lost their jobs; 560,000 here in California.

Reese employs about 40 people at M’dears LA and M’Dears Lakewood near Long Beach. She wants to bring all her employees back when restaurants can return to full operation. But Reese says it is nearly impossible for a business such as hers with “razor thin profit margins” to survive this prolonged slowdown. Reese has decided to focus on meeting payroll while everything else falls behind. She described earning “just enough to get through the day.”

Reese applied for the Paycheck Protection Program (PPP) intended to help small business owners stay afloat. But on Thursday April16, The US Small Business Administration (SBA) announced it is “unable to accept new applications” due to a lack of funding. The $349 billion program was nearly out of money. “Without that money how am I going to pay off debt,” she said.

As of April 13, SBA said it had approved more than 1.3 million PPP loans totaling more than $296 billion. Reese has not heard from her bank JPMorgan Chase about her application. “ I feel so helpless and disheartened,” said Reese. Chase was one of the banks that received criticism for delays in launching its online PPP application platform.

The President requested another $250 billion to replenish the COVID-19 small business relief funds, but members of Congress have not reached an agreement. This deadlock comes about two weeks after lawmakers passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The $2 trillion stimulus package included $377 trillion to help small businesses survive and to keep people employed. The bulk of the funding was divided into two types of loans. The PPP loan and the Economic Injury Disaster Loan (EIDL). Reese applied for both stalled programs.

The Paycheck Protection Program (PPP)

This is a forgivable loan of up to $10 million with a 1% interest rate. “The max amount a business can apply for is 2.5x the business’s average monthly payroll costs, not exceeding $10 million. Under specific circumstances, PPP Loans can be forgiven. The amount a business spent on payroll, rent, utilities and other eligible costs within the 8-week period upon receiving the loan is forgiven. The remaining amount turns into a fixed-rate loan with the SBA,” adds Lieberman.

Economic Injury Disaster Loan (EIDL)

Businesses can receive as much as $2 million in assistance from the federal government. This is a fixed-rate loan with a 3.75% interest rate for small businesses and a 2.75% interest rate for private non-profits. “However, applicants are also eligible for a $10,000 forgivable advance on the loan immediately after applying, even if the business does not ultimately receive the loan,” said Rebecca Lieberman, Policy Advisor and Research Manager with the San Diego Regional Chamber of Commerce. The SBA has also stopped processing new EIDL loans, citing a lack of funding.

As California small business owners left out of the first wave of loan approvals wait to find out if these federal programs will resume, there is small business aid at the state and city levels.

California COVID-19 Small Business IBank Loan Program

Earlier this month, Gov. Gavin Newsom announced $50 million in loan guarantees for small businesses that may not be eligible for federal relief. The State is also allowing small businesses to defer payment of sales and use taxes of up to $50,000, for up to 12 months. In a move said to help workers and small businesses, people receiving unemployment benefits are temporarily being paid an extra $600 on top of their weekly amount.

California City level COVID-19 Small Business Aid

Small business owners in San Francisco are being encouraged to apply for the San Francisco Hardship Emergency Loan Program (SF HELP). The loans have a 0 percent interest rate and are administered by Main Street Launch in partnership with the city of San Francisco. Small businesses can make loans of up to $50,000 for terms of up to six years.

Additionally, through the City of Los Angeles Small Business Emergency Microloan Program, businesses and microenterprises in Los Angeles that are responsible for providing low-income jobs can apply for emergency microloans in an amount between $5,000 and $20,000. Reese hopes Congress reaches an agreement to fund the loan programs soon and that more applications in the queue are approved. In the meantime, three days a week she and her scaled-down team cook M’dears signature soul food for about 50 seniors who are shut-in during this pandemic.

The emergency meal delivery program was launched by LA City Councilmember Marqueece Harris-Dawson. Reese says compensation for the heartwarming cause has been slow. In fact, on the Friday leading into the Easter holiday weekend, Reese couldn’t afford to pay some of her staff. “Up to today, we have provided 300 meals and haven’t gotten a penny for it,” she said, “You wanted me to keep them on staff to do this, but you’re not giving me the money to pay them, so I can’t pay them.”

Reese does not have a financial parachute. M’dears Bakery & Bistro is her retirement plan. A plan she sees being threatened every day that potential customers are told to stay inside, “All I see is my retirement flashing before my eyes. I am going to be so far in debt trying to dig my way out of this. I’ll be 75 years old before I can think about retiring. ”

The National Restaurant Association has launched RestaurantsAct.com to share the latest COVID-19 relief information.

Alameda County

DA Pamela Price Stands by Mom Who Lost Son to Gun Violence in Oakland

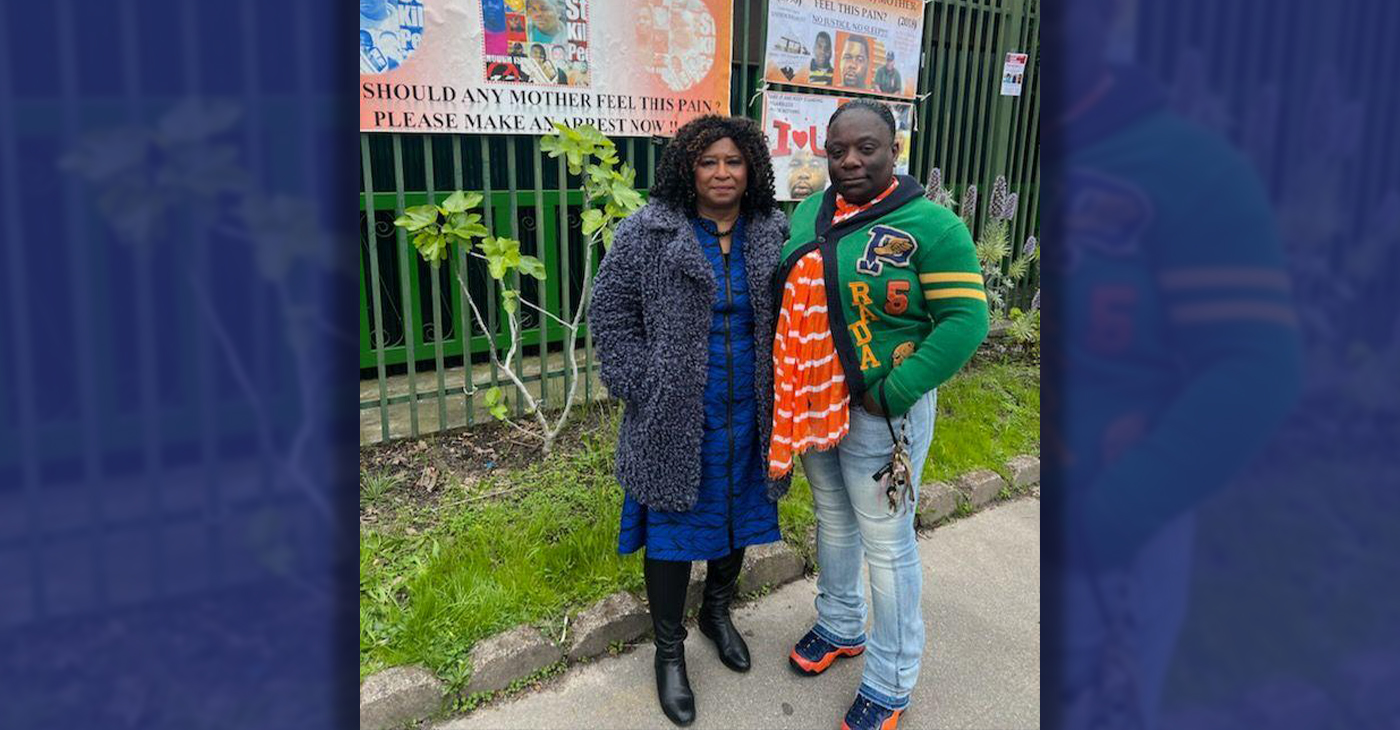

Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018.

Publisher’s note: Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018. The photo was too small for readers to see where the women were and what they were doing. Here we show Price and Jones as they complete a walk in memory of Scott. For more information and to contribute, please contact Carol Jones at 510-978-5517 at morefoundation.help@gmail.com. Courtesy photo.

Bay Area

State Controller Malia Cohen Keynote Speaker at S.F. Wealth Conference

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco. The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

By Carla Thomas

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco.

The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

“Our goal is to educate Black and Brown families in the masses about financial wellness, wealth building, and how to protect and preserve wealth,” said ABWA San Francisco Chapter President LaRonda Smith.

ABWA’s mission is to bring together businesswomen of diverse occupations and provide opportunities for them to help themselves and others grow personally and professionally through leadership, education, networking support, and national recognition.

“This day is about recognizing influential women, hearing from an accomplished woman as our keynote speaker and allowing women to come together as powerful people,” said ABWA SF Chapter Vice President Velma Landers.

More than 60 attendees dined on the culinary delights of Chef Sharon Lee of The Spot catering, which included a full soul food brunch of skewered shrimp, chicken, blackened salmon, and mac and cheese.

Cohen discussed the many economic disparities women and people of color face. From pay equity to financial literacy, Cohen shared not only statistics, but was excited about a new solution in motion which entailed partnering with Californians for Financial Education.

“I want everyone to reach their full potential,” she said. “Just a few weeks ago in Sacramento, I partnered with an organization, Californians for Financial Education.

“We gathered 990 signatures and submitted it to the [California] Secretary of State to get an initiative on the ballot that guarantees personal finance courses for every public school kid in the state of California.

“Every California student deserves an equal opportunity to learn about filing taxes, interest rates, budgets, and understanding the impact of credit scores. The way we begin to do that is to teach it,” Cohen said.

By equipping students with information, Cohen hopes to close the financial wealth gap, and give everyone an opportunity to reach their full financial potential. “They have to first be equipped with the information and education is the key. Then all we need are opportunities to step into spaces and places of power.”

Cohen went on to share that in her own upbringing, she was not guided on financial principles that could jump start her finances. “Communities of color don’t have the same information and I don’t know about you, but I did not grow up listening to my parents discussing their assets, their investments, and diversifying their portfolio. This is the kind of nomenclature and language we are trying to introduce to our future generations so we can pivot from a life of poverty so we can pivot away and never return to poverty.”

Cohen urged audience members to pass the initiative on the November 2024 ballot.

“When we come together as women, uplift women, and support women, we all win. By networking and learning together, we can continue to build generational wealth,” said Landers. “Passing a powerful initiative will ensure the next generation of California students will be empowered to make more informed financial decisions, decisions that will last them a lifetime.”

Bay Area

MAYOR BREED ANNOUNCES $53 MILLION FEDERAL GRANT FOR SAN FRANCISCO’S HOMELESS PROGRAMS

San Francisco, CA – Mayor London N. Breed today announced that the U.S. Department of Housing and Urban Development (HUD) has awarded the city a $53.7 million grant to support efforts to renew and expand critical services and housing for people experiencing homelessness in San Francisco.

FOR IMMEDIATE RELEASE:

Wednesday, January 31, 2024

Contact: Mayor’s Office of Communications, mayorspressoffice@sfgov.org

***PRESS RELEASE***

MAYOR BREED ANNOUNCES $53 MILLION FEDERAL GRANT FOR SAN FRANCISCO’S HOMELESS PROGRAMS

HUD’s Continuum of Care grant will support the City’s range of critical services and programs, including permanent supportive housing, rapid re-housing, and improved access to housing for survivors of domestic violence

San Francisco, CA – Mayor London N. Breed today announced that the U.S. Department of Housing and Urban Development (HUD) has awarded the city a $53.7 million grant to support efforts to renew and expand critical services and housing for people experiencing homelessness in San Francisco.

HUD’s Continuum of Care (CoC) program is designed to support local programs with the goal of ending homelessness for individuals, families, and Transitional Age Youth.

This funding supports the city’s ongoing efforts that have helped more than 15,000 people exit homelessness since 2018 through City programs including direct housing placements and relocation assistance. During that time San Francisco has also increased housing slots by 50%. San Francisco has the most permanent supportive housing of any county in the Bay Area, and the second most slots per capita than any city in the country.

“In San Francisco, we have worked aggressively to increase housing, shelter, and services for people experiencing homelessness, and we are building on these efforts every day,” said Mayor London Breed. “Every day our encampment outreach workers are going out to bring people indoors and our City workers are connecting people to housing and shelter. This support from the federal government is critical and will allow us to serve people in need and address encampments in our neighborhoods.”

The funding towards supporting the renewal projects in San Francisco include financial support for a mix of permanent supportive housing, rapid re-housing, and transitional housing projects. In addition, the CoC award will support Coordinated Entry projects to centralize the City’s various efforts to address homelessness. This includes $2.1 million in funding for the Coordinated Entry system to improve access to housing for youth and survivors of domestic violence.

“This is a good day for San Francisco,” said Shireen McSpadden, executive director of the Department of Homelessness and Supportive Housing. “HUD’s Continuum of Care funding provides vital resources to a diversity of programs and projects that have helped people to stabilize in our community. This funding is a testament to our work and the work of our nonprofit partners.”

The 2024 Continuum of Care Renewal Awards Include:

- $42.2 million for 29 renewal PSH projects that serve chronically homeless, veterans, and youth

- $318,000 for one new PSH project, which will provide 98 affordable homes for low-income seniors in the Richmond District

- $445,00 for one Transitional Housing (TH) project serving youth

- $6.4 million dedicated to four Rapid Rehousing (RRH) projects that serve families, youth, and survivors of domestic violence

- $750,00 for two Homeless Management Information System (HMIS) projects

- $2.1 million for three Coordinated Entry projects that serve families, youth, chronically homeless, and survivors of domestic violence

In addition, the 2023 CoC Planning Grant, now increased to $1,500,000 from $1,250,000, was also approved. Planning grants are submitted non-competitively and may be used to carry out the duties of operating a CoC, such as system evaluation and planning, monitoring, project and system performance improvement, providing trainings, partner collaborations, and conducting the PIT Count.

“We are very appreciative of HUD’s support in fulfilling our funding request for these critically important projects for San Francisco that help so many people trying to exit homelessness,” said Del Seymour, co-chair of the Local Homeless Coordinating Board. “This funding will make a real difference to people seeking services and support in their journey out of homelessness.”

In comparison to last year’s competition, this represents a $770,000 increase in funding, due to a new PSH project that was funded, an increase in some unit type Fair Market Rents (FMRs) and the larger CoC Planning Grant. In a year where more projects had to compete nationally against other communities, this represents a significant increase.

Nationally, HUD awarded nearly $3.16 billion for over 7,000 local homeless housing and service programs including new projects and renewals across the United States.

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 27 – April 2, 2024

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBeloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87

-

Community1 week ago

Community1 week agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 3 – 6, 2024

-

Business1 week ago

Business1 week agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 10 – 16, 2024