Business

Caesars’ Bet on Better Days Led to Bankruptcy for Division

In this Monday, Jan. 12, 2015 photo, a man takes pictures of Caesars Palace hotel and casino, in Las Vegas. The company said Friday, Jan. 9, it has a majority of the holders of its debt on board with a pre-planned bankruptcy agreement that would reorganize Caesars Entertainment Operating Corp. into two separate companies, one to own casino-hotels and the other to lease them, and cut its existing debt by about $10 billion. (AP Photo/John Locher)

KIMBERLY PIERCEALL, Associated Press

LAS VEGAS (AP) — Financial problems plaguing Caesars Entertainment and its casino empire have the company considering a trip to bankruptcy court, possibly as early as Thursday.

It doesn’t necessarily signal the end of this faux Roman Empire, though.

If all goes according to the company’s plan, drawn up with its most senior creditors, it should be business as usual for customers — its doors will remain open, the slot machines will still sing, chips will rest atop tables.

“Caesars is, in a certain sense, a Nevada version of ‘too big to fail,'” said Michael Green, a history professor with the University of Nevada, Las Vegas.

It’s still a gamble.

U.S. casino-hotel companies are dependent on extra cash in a person’s pocket, but perhaps none more than Caesars, which waded into the recent economic downturn already burdened by more debt than any of them — a by-product of a buyout in January 2008 that was largely a wager using other people’s money.

While competitors found fortune in Asia’s casino growth as stateside gambling in Las Vegas and Atlantic City waned, Caesars missed out. And as other companies built arenas and shopping districts on the Strip or casino-hotels in newer gambling markets across the country, analysts say Caesars was reluctant to spend.

It went private, then public again to raise cash and created new related companies, shifting its properties from one to another to free them up from the debt cordoned off in one spot, its Caesars Entertainment Operating Co. That’s the company now headed to bankruptcy court.

Regardless of the maneuvers, “the fundamentals were not there to support the amount of debt that they had,” said Keith Foley, an analyst with Moody’s Investors Service.

WHAT HAPPENED

Apollo Global Management LLC and TPG Capital LP did what a lot of private equity firms were doing at the time when money and loans were easy to come by, buying companies with promise — relying mostly on debt — to add to its portfolio. The gambling industry looked promising.

The deal to buy Caesars (then known as Harrah’s) was first announced in 2006 during the heyday of Vegas tourism and development. But the deal didn’t close until January 2008, several months before Lehman Brothers would go bankrupt, shaking the economy to its core. And it was a nearly $30 billion deal with the two firms taking on more than $10 billion of existing debt and relying on several billion more in bonds to pay for the company.

In between, the company had cut about 200 people from its corporate staff. Before the year was done, Caesars was cutting more staff and looking for new cash to make its interest payments.

WHAT NOW

Among its casino peers, Caesars’ empire remains the largest, employing some 68,000 people worldwide at more than 50 casino-hotels, including Caesars Palace on the Las Vegas Strip.

While Caesars Entertainment has seen a steady $8.6 billion or so in revenue since 2009, it’s been outpaced by Las Vegas Sands Corp., which went all-in in Macau, China, and grew every year to post revenue of $14.5 billion in 2013.

Las Vegas Sands made a $2.3 billion profit that year. Caesars lost $2.9 billion.

Caesars has lost money each year for the last five years.

Still, the company unveiled its High Roller observation wheel and newly renovated hotels on the Strip: The Linq and The Cromwell. It hired headliners for shows at The Colosseum inside Caesars Palace.

All the while, it was shifting and shuttering other assets.

Last year, the company closed properties in Atlantic City, London and Mississippi and said it would cut its global workforce by less than 1 percent.

“They’re going to have to become a little leaner,” said Chris Jones, an analyst for Union Gaming Group. He added that he doesn’t expect any more properties to shut down and expects the plan will free up Caesars to reinvest where it hasn’t, including the gambling floor.

WHAT’S NEXT

The company faces irked creditors, a few who have tried to force the casino giant into bankruptcy against its will this week. Others have sued, claiming the company ransacked Caesars Entertainment Operating Co. of most of its valuable assets. Caesars called the claims meritless and alleges some of its holdout creditors are hoping for the company’s demise in order to win wagers predicting as much.

Despite the acrimony, the company says that after months of negotiations it has more than 60 percent of the holders of its first-priority debt on board with its plan.

The plan would shed $10 billion in debt from its weighed-down operations division, leaving it with $8.6 billion and winnowing its annual $1.7 billion in interest payments to $450 million. Senior creditors who OK’d the plan would get cash and new debt to make them whole.

Copyright 2015 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Business

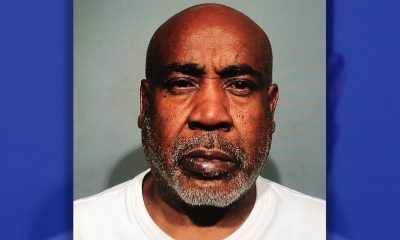

V.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

Speaking in Las Vegas on Jan. 27, Vice President Kamala Harris announced a forthcoming federal rule that will extend access to Small Business Administration (SBA) loans to Americans who have been convicted of felonies but have served their time. Small business owners typically apply for the SBA loans to start or sustain their businesses.

By California Black Media

Speaking in Las Vegas on Jan. 27, Vice President Kamala Harris announced a forthcoming federal rule that will extend access to Small Business Administration (SBA) loans to Americans who have been convicted of felonies but have served their time.

Small business owners typically apply for the SBA loans to start or sustain their businesses.

Harris thanked U.S. Rep. Steven Horsford (D-NV-04), the chair of the Congressional Black Caucus, for the work he has done in Washington to support small businesses and to invest in people.

“He and I spent some time this afternoon with business leaders and small business leaders here in Nevada. The work you have been doing to invest in community and to invest in the ambition and natural capacity of communities has been exceptional,” Harris said, speaking to a crowd of a few hundred people at the Brotherhood of Electrical Workers Hall in East Las Vegas.

On her daylong trip, Harris was joined by Horford, SBA Administrator Isabella Guzman, Interim Under Secretary of Commerce for Minority Business Development Agency (MBDA) Eric Morrissette, and Sen. Catherine Cortez Masto (D-Nev).

“Formerly incarcerated individuals face significant barriers to economic opportunity once they leave prison and return to the community, with an unemployment rate among the population of more than 27%,” the White House press release continued. “Today’s announcement builds on the Vice President’s work to increase access to capital. Research finds that entrepreneurship can reduce recidivism for unemployed formerly incarcerated individuals by as much as 30%.”

Business

G.O.P. Lawmakers: Repeal AB 5 and Resist Nationalization of “Disastrous” Contractor Law

Republican lawmakers gathered outside of the Employee Development Department in Sacramento on Jan. 23 to call for the repeal of AB5, the five-year old California law that reclassified gig workers and other independent contractors as W-2 employees under the state’s labor code.

By California Black Media

Republican lawmakers gathered outside of the Employee Development Department in Sacramento on Jan. 23 to call for the repeal of AB5, the five-year old California law that reclassified gig workers and other independent contractors as W-2 employees under the state’s labor code.

Organizers said they also held the rally to push back against current efforts in Washington to pass a similar federal law.

“We are here to talk about this very important issue – a battle we have fought for many years – to stop this disastrous AB 5 policy,” said Assembly Republican Leader James Gallagher (R-Yuba City).

Now, that threat has gone national as we have seen this new rule being pushed out of the Biden administration,” Gallagher continued.

On Jan. 10, the U.S. Department of Labor issued a new rule providing guidance on “on how to analyze who is an employee or independent contractor under the Fair Labor Standards Act (FLSA).”

“This final rule rescinds the Independent Contractor Status Under the Fair Labor Standards Act rule (2021 IC Rule), that was published on January 7, 2021, and replaces it with an analysis for determining employee or independent contractor status that is more consistent with the FLSA as interpreted by longstanding judicial precedent,” a Department of Labor statement reads.

U.S. Congressmember Kevin Kiley (R-CA-3), who is a former California Assemblymember, spoke at the rally.

“We are here today to warn against the nationalization of one of the worst laws that has ever been passed in California, which has devastated the livelihoods of folks in over 600 professions,” said Kiley, adding that the law has led to a 10.5% decline in self-employment in California.

Kiley blamed U.S Acting Secretary of Labor, July Su, who was the former secretary of the California Labor and Workforce Development Agency, for leading the effort to redefine “contract workers” at the federal level.

Kiley said two separate lawsuits have been filed against Su’s Rule – its constitutionality and the way it was enacted, respectively. He said he is also working on legislation in Congress that puts restrictions on the creation and implementation of executive branch decisions like Su’s.

Assemblymember Kate Sanchez (R-Rancho Santa Margarita) announced that she plans to introduce legislation to repeal AB 5 during the current legislative session.

“So many working moms like myself, who are also raising kids, managing households, were devastated by the effects of AB 5 because they lost access to hundreds of flexible professions,” Sanchez continued. “I’ve been told by many of these women that they have lost their livelihoods as bookkeepers, artists, family caregivers, designers, and hairstylists because of this destructive law.”

Activism

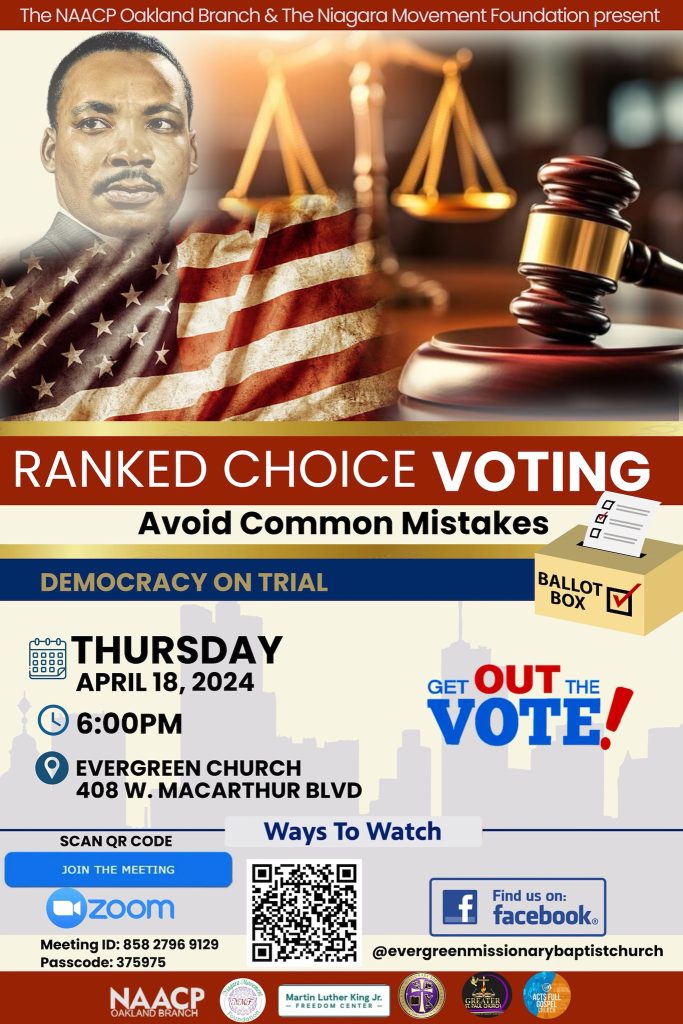

Oakland Post: Week of April 10 – 16, 2024

The printed Weekly Edition of the Oakland Post: Week of April 10 – 16, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 20 – 26, 2024

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoFrom Raids to Revelations: The Dark Turn in Sean ‘Diddy’ Combs’ Saga

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoCOMMENTARY: Lady Day and The Lights!

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoBaltimore Key Bridge Catastrophe: A City’s Heartbreak and a Nation’s Alarm

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoBaltimore’s Key Bridge Struck by Ship, Collapses into Water

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of March 27 – April 2, 2024