National

Building Tiny Houses Into Big Help for Los Angeles’ Homeless

Los Angeles resident Elvis Summers poses with his tiny house on wheels he built for a woman who had been sleeping on the streets in his South Los Angeles neighborhood on Thursday, May 7, 2015. Summers never thought more than 5.6 million people would watch a YouTube video of him constructing the 8-foot-long house for Irene “Smokie” McGhee, 60, a grandmother who’s been homeless for more than a decade. He estimates he spent less than $500 on plywood, shingles, a window and a door. (AP Photo/Damian Dovarganes)

CHRISTOPHER WEBER, Associated Press

LOS ANGELES (AP) — Shortly after Elvis Summers befriended Irene McGhee, he learned she was sleeping on the streets of South Los Angeles.

So the man with the blue mohawk and wraparound shades decided to build the grandmother nicknamed “Smokie” a tiny house on wheels. Summers estimates he spent less than $500 on plywood, shingles, a window and a door for the 8-foot-long structure that can be moved around by one person.

It turned out so well that Summers launched a crowdfunding campaign to construct similar shelters for other homeless people in his neighborhood. He had no grand ambitions beyond lending a helping hand in a city with thousands of residents without roofs over their heads.

“Honestly, I thought I’d raise enough money to help a dozen people, call it a day, and then go back to stressing about my job,” said the 38-year-old, who runs an online apparel store.

Summers never thought more than 5.6 million people would watch a YouTube video of him constructing the house for McGhee, who’s been homeless for more than a decade. It ends with McGhee doing a little jig and hanging up a “Home Sweet Home” sign.

The GoFundMe campaign — called Tiny House, Huge Purpose — has brought in nearly $60,000 in less than a month. And Summers’ inbox is overflowing with offers for help from carpenters, homeless advocates, retirees and children as young as 6.

Summers suddenly considers himself a man with a mission. He has started a nonprofit and reached out to Los Angeles officials to get the city involved in his plan to build more tiny homes for transients.

“People are calling it a movement,” he said Thursday. “I’m humbled. But now I can’t turn my back on it.”

Builders said they would donate materials, contractors offered to help in the design of the small, wheeled structures, and chefs said they would bring food to the construction sites.

Summers said he wants to hire homeless people to help with the construction. McGhee, 61, said she would be the first person to sign up.

“I’m ready to start building,” she said. “Give people a good night’s rest. Someplace warm.”

It is unclear if the city would enforce rules for these homes. McGhee said police have told her she won’t be bothered as long as she moves the home, which is small enough to fit in a parking space, every three days.

And the structure is so small that it wouldn’t require permits if built on private property, said Luke Zamperini, spokesman for the city Building and Safety Department.

“We do not consider it a dwelling or a building as it does not meet the definition of either,” Zamperini said.

Copyright 2015 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Barbara Lee

Congresswoman Barbara Lee Issues Statement on Deaths of Humanitarian Aid Volunteers in Gaza

On April 2, a day after an Israeli airstrike erroneously killed seven employees of World Central Kitchen (WCK), a humanitarian organization delivering aid in the Gaza Strip, a statement was release by Rep. Barbara Lee (D-CA-12). “This is a devastating and avoidable tragedy. My prayers go to the families and loved ones of the selfless members of the World Central Kitchen team whose lives were lost,” said Lee.

By California Black Media

On April 2, a day after an Israeli airstrike erroneously killed seven employees of World Central Kitchen (WCK), a humanitarian organization delivering aid in the Gaza Strip, a statement was release by Rep. Barbara Lee (D-CA-12).

“This is a devastating and avoidable tragedy. My prayers go to the families and loved ones of the selfless members of the World Central Kitchen team whose lives were lost,” said Lee.

The same day, it was confirmed by the organization that the humanitarian aid volunteers were killed in a strike carried out by Israel Defense Forces (IDF). Prior to the incident, members of the team had been travelling in two armored vehicles marked with the WCF logo and they had been coordinating their movements with the IDF. The group had successfully delivered 10 tons of humanitarian food in a deconflicted zone when its convoy was struck.

“This is not only an attack against WCK. This is an attack on humanitarian organizations showing up in the direst situations where food is being used as a weapon of war. This is unforgivable,” said Erin Gore, chief executive officer of World Central Kitchen.

The seven victims included a U.S. citizen as well as others from Australia, Poland, the United Kingdom, Canada, and Palestine.

Lee has been a vocal advocate for a ceasefire in Gaza and has supported actions by President Joe Biden to airdrop humanitarian aid in the area.

“Far too many civilians have lost their lives as a result of Benjamin Netanyahu’s reprehensible military offensive. The U.S. must join with our allies and demand an immediate, permanent ceasefire – it’s long overdue,” Lee said.

Commentary

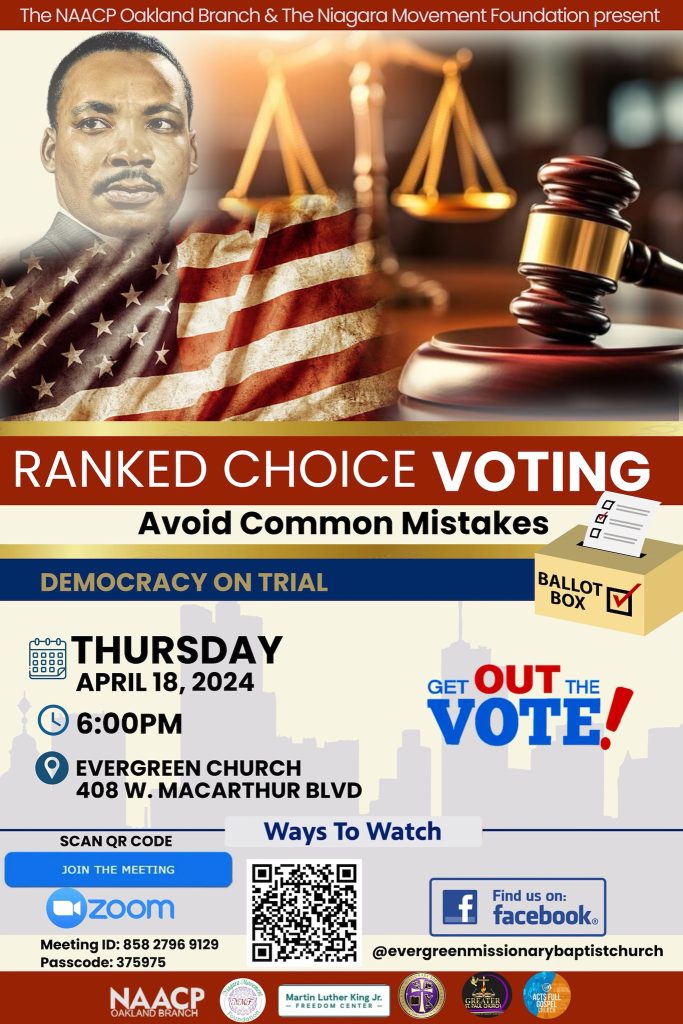

Commentary: Republican Votes Are Threatening American Democracy

In many ways, it was great that the Iowa Caucuses were on the same day as Martin Luther King Jr. Day. We needed to know the blunt truth. The takeaway message after the Iowa Caucuses where Donald Trump finished more than 30 points in front of Florida Gov. De Santis and former South Carolina Governor Nikki Haley boils down to this: Our democracy is threatened, for real.

By Emil Guillermo

In many ways, it was great that the Iowa Caucuses were on the same day as Martin Luther King Jr. Day.

We needed to know the blunt truth.

The takeaway message after the Iowa Caucuses where Donald Trump finished more than 30 points in front of Florida Gov. De Santis and former South Carolina Governor Nikki Haley boils down to this: Our democracy is threatened, for real.

And to save it will require all hands on deck.

It was strange for Iowans to caucus on MLK day. It had a self-cancelling effect. The day that honored America’s civil rights and anti-discrimination hero was negated by evening.

That’s when one of the least diverse states in the nation let the world know that white Americans absolutely love Donald Trump. No ifs, ands or buts.

No man is above the law? To the majority of his supporters, it seems Trump is.

It’s an anti-democracy loyalty that has spread like a political virus.

No matter what he does, Trump’s their guy. Trump received 51% of caucus-goers votes to beat Florida Gov. Ron DeSantis, who garnered 21.2%, and former South Carolina Gov. Nikki Haley, who got 19.1%.

The Asian flash in the pan Vivek Ramaswamy finished way behind and dropped out. Perhaps to get in the VP line. Don’t count on it.

According to CNN’s entrance polls, when caucus-goers were asked if they were a part of the “MAGA movement,” nearly half — 46% — said yes. More revealing: “Do you think Biden legitimately won in 2020?”

Only 29% said “yes.”

That means an overwhelming 66% said “no,” thus showing the deep roots in Iowa of the “Big Lie,” the belief in a falsehood that Trump was a victim of election theft.

Even more revealing and posing a direct threat to our democracy was the question of whether Trump was fit for the presidency, even if convicted of a crime.

Sixty-five percent said “yes.”

Who says that about anyone of color indicted on 91 criminal felony counts?

Would a BIPOC executive found liable for business fraud in civil court be given a pass?

How about a BIPOC person found liable for sexual assault?

Iowans have debased the phrase, “no man is above the law.” It’s a mindset that would vote in an American dictatorship.

Compare Iowa with voters in Asia last weekend. Taiwan rejected threats from authoritarian Beijing and elected pro-democracy Taiwanese vice president Lai Ching-te as its new president.

Meanwhile, in our country, which supposedly knows a thing or two about democracy, the Iowa caucuses show how Americans feel about authoritarianism.

Some Americans actually like it even more than the Constitution allows.

About the Author

Emil Guillermo is a journalist and commentator. He does a mini-talk show on YouTube.com/@emilamok1.

Activism

Oakland Post: Week of April 10 – 16, 2024

The printed Weekly Edition of the Oakland Post: Week of April 10 – 16, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 20 – 26, 2024

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoFrom Raids to Revelations: The Dark Turn in Sean ‘Diddy’ Combs’ Saga

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoCOMMENTARY: Lady Day and The Lights!

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoBaltimore Key Bridge Catastrophe: A City’s Heartbreak and a Nation’s Alarm

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoBaltimore’s Key Bridge Struck by Ship, Collapses into Water

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of March 27 – April 2, 2024