#NNPA BlackPress

Bank of America Offers Zero Down-Payment Mortgages to Black, Latino Borrowers

NNPA NEWSWIRE — According to a news release, the Community Affordable Loan Solution aims to help eligible individuals and families obtain an affordable loan to purchase a home. “The Community Affordable Loan Solution is a Special Purpose Credit Program which uses credit guidelines based on factors such as timely rent, utility bill, phone and auto insurance payments,” officials stated in the release.

The post Bank of America Offers Zero Down-Payment Mortgages to Black, Latino Borrowers first appeared on BlackPressUSA.

By Stacy M. Brown, NNPA Newswire Senior National Correspondent

@StacyBrownMedia

Bank of America announced a new zero down payment, zero closing cost mortgage solution for first-time homebuyers, which will be available in designated markets, including certain African American and Hispanic neighborhoods in Charlotte, Dallas, Detroit, Los Angeles, and Miami.

According to a news release, the Community Affordable Loan Solution aims to help eligible individuals and families obtain an affordable loan to purchase a home.

“The Community Affordable Loan Solution is a Special Purpose Credit Program which uses credit guidelines based on factors such as timely rent, utility bill, phone and auto insurance payments,” officials stated in the release.

“It requires no mortgage insurance or minimum credit score. Individual eligibility is based on income and home location.”

Prospective buyers must complete a homebuyer certification course provided by select Bank of America and HUD-approved housing counseling partners prior to application.

Officials said the new program is in addition to and complements Bank of America’s existing $15 billion Community Homeownership Commitment to offer affordable mortgages, industry leading grants and educational opportunities to help 60,000 individuals and families purchase affordable homes by 2025.

Through this commitment, Bank of America has already helped more than 36,000 people and families become homeowners, having provided more than $9.5 billion in low down payment loans and over $350 million in non-repayable down payment and/or closing cost grants.

To date, two-thirds of the loans and grants made through the Community Homeownership Commitment has helped multicultural clients to achieve homeownership.

Bank of America also has a 26-year relationship with the Neighborhood Assistance Corporation of America (NACA), through which the Bank has committed to providing an additional $15 billion in mortgages to low-to-moderate income homebuyers through May 2027.

According to the National Association of Realtors, today there is a nearly 30-percentage-point gap in homeownership between White and Black Americans; for Hispanic buyers, the gap is nearly 20 percent.

And the competitive housing market has made it even more difficult for potential homebuyers, especially people of color, to buy homes.

“Homeownership strengthens our communities and can help individuals and families to build wealth over time,” said AJ Barkley, head of neighborhood and community lending for Bank of America.

“Our Community Affordable Loan Solution will help make the dream of sustained homeownership attainable for more Black and Hispanic families, and it is part of our broader commitment to the communities that we serve.”

In addition to expanding access to credit and down payment assistance, Bank of America said it provides educational resources to help homebuyers navigate the homebuying process, including:

- First-Time Homebuyer Online Edu-Series, a five-part, easy-to-understand video roadmap for buying and financing a home, available in English and Spanish.

- BetterMoneyHabits.com free financial education content, including videos about managing finances and how to prepare for buying a new home.

- Bank of America Down Payment Center – site to help homebuyers find state and local down payment and closing cost assistance programs in their area. Bank of America participates in more than 1,300 state and local down payment and closing cost assistance programs.

- Bank of America Real Estate Center – site to help homebuyers find properties with flags to identify properties that may qualify for Bank of America grant programs and Community Affordable Loan Solution

.

.

For more information, contact Bank of America at 1-800-641-8362.

The post Bank of America Offers Zero Down-Payment Mortgages to Black, Latino Borrowers first appeared on BlackPressUSA.

#NNPA BlackPress

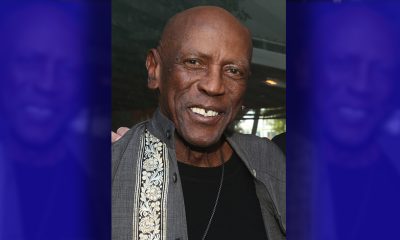

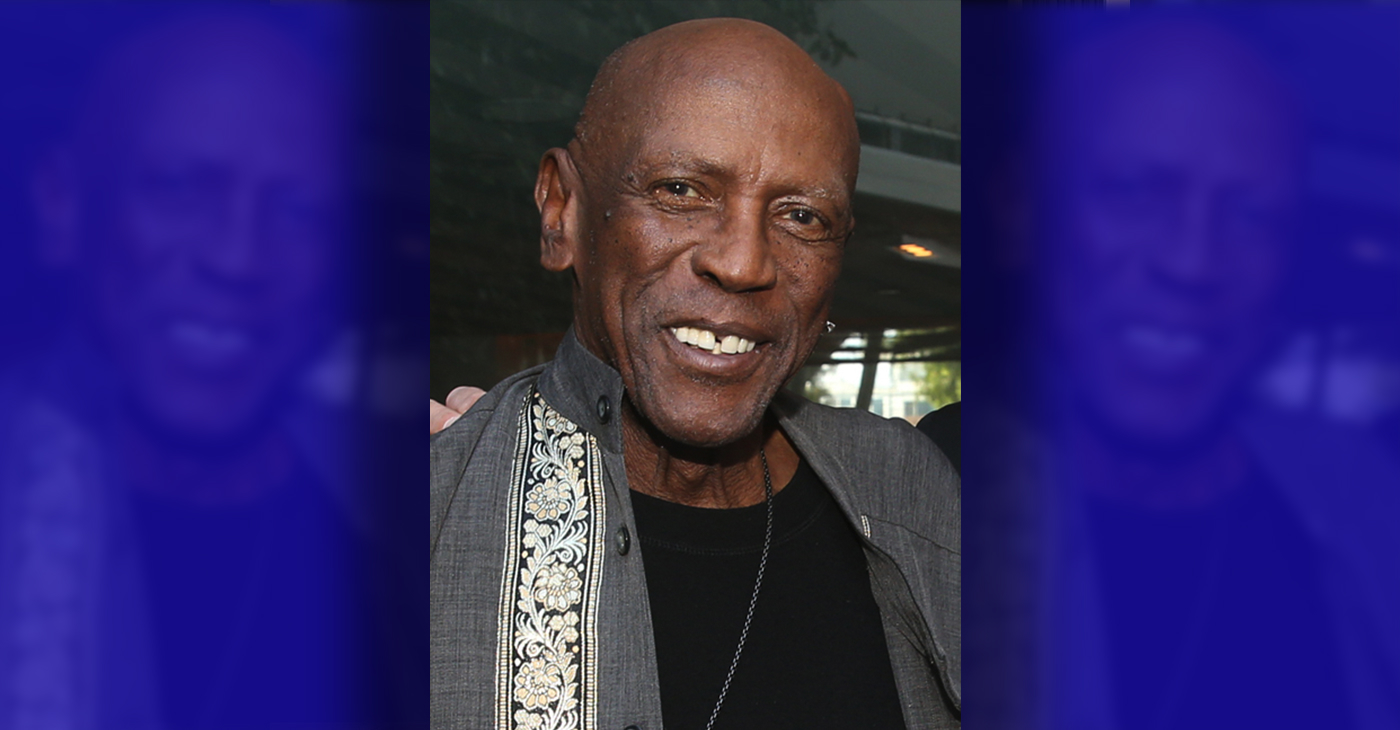

Beloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87

NNPA NEWSWIRE — Louis Gossett Jr., the groundbreaking actor whose career spanned over five decades and who became the first Black actor to win an Academy Award as Best Supporting Actor for his memorable role in “An Officer and a Gentleman,” has died. Gossett, who was born on May 27, 1936, in Brooklyn, N.Y., was 87. Recognized early on for his resilience and nearly unmatched determination, Gossett arrived in Los Angeles in 1967 after a stint on Broadway.

The post Beloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87 first appeared on BlackPressUSA.

By Stacy M. Brown

NNPA Newswire Senior National Correspondent

@StacyBrownMedia

Louis Gossett Jr., the groundbreaking actor whose career spanned over five decades and who became the first Black actor to win an Academy Award as Best Supporting Actor for his memorable role in “An Officer and a Gentleman,” has died. Gossett, who was born on May 27, 1936, in Brooklyn, N.Y., was 87. Recognized early on for his resilience and nearly unmatched determination, Gossett arrived in Los Angeles in 1967 after a stint on Broadway.

He sometimes spoke of being pulled over by law enforcement en route to Beverly Hills, once being handcuffed to a tree, which he remembered as a jarring introduction to the racial tensions of Hollywood. In his memoir “An Actor and a Gentleman,” Gossett recounted the ordeal, noting the challenges faced by Black artists in the industry. Despite the hurdles, Gossett’s talent shone brightly, earning him acclaim in groundbreaking productions such as “A Raisin in the Sun” alongside Sidney Poitier. His Emmy-winning portrayal of Fiddler in “Roots” solidified his status as a trailblazer, navigating a landscape fraught with racial prejudice.

According to the HistoryMakers, which interviewed him in 2005, Gossett’s journey into the limelight began during his formative years at PS 135 and Mark Twain Junior High School, where he demonstrated early leadership as the student body president. His passion for the arts blossomed when he starred in a “You Can’t Take It With You” production at Abraham Lincoln High School, catching the attention of talent scouts who propelled him onto Broadway’s stage in “Take A Giant Step.” His stellar performance earned him the prestigious Donaldson Award for Best Newcomer to Theatre in 1952. Though initially drawn to sports, Gossett’s towering 6’4” frame and athletic prowess led him to receive a basketball scholarship at New York University. Despite being drafted by the New York Knicks in 1958, Gossett pursued his love for acting, honing his craft at The Actors Studio under the tutelage of luminaries like John Sticks and Peggy Fury.

In 1961, Gossett’s talent caught the eye of Broadway directors, leading to roles in acclaimed productions such as “Raisin in the Sun” and “The Blacks,” alongside legends like James Earl Jones, Cicely Tyson, Roscoe Lee Brown, and Maya Angelou. Transitioning seamlessly to television, Gossett graced small screens with appearances in notable shows like “The Bush Baby” and “Companions in Nightmare.” Gossett’s silver screen breakthrough came with his role in “The Landlord,” paving the way for a prolific filmography that spanned over 50 movies and hundreds of television shows. From “Skin Game” to “Lackawanna Blues,” Gossett captivated audiences with his commanding presence and versatile performances.

However, his portrayal of “Fiddler” in Alex Haley’s groundbreaking miniseries “Roots” earned Gossett critical acclaim, including an Emmy Award. The HistoryMakers noted that his golden touch extended to the big screen, where his role as Sergeant Emil Foley in “An Officer and a Gentleman” earned him an Academy Award for Best Supporting Actor, making him a trailblazer in Hollywood history.

Beyond the glitz and glamour of Hollywood, Gossett was deeply committed to community activism. In 1964, he co-founded a theater group for troubled youth alongside James Earl Jones and Paul Sorvino, setting the stage for his lifelong dedication to mentoring and inspiring the next generation. Gossett’s tireless advocacy for racial equality culminated in the establishment of Eracism, a nonprofit organization dedicated to combating racism both domestically and abroad. Throughout his illustrious career, Gossett remained a beacon of strength and resilience, using his platform to uplift marginalized voices and champion social change. Gossett is survived by his children, Satie and Sharron.

The post Beloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87 first appeared on BlackPressUSA.

#NNPA BlackPress

COMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

WASHINGTON INFORMER — The D.C. crime bill and so many others like it are reminiscent of the ‘94 crime bill, which produced new and harsher criminal sentences, helped deploy thousands of police and surveilling methods in Black and brown communities, and incentivized more states to build prisons through a massive infusion of federal funding. While it is not at the root of mass incarceration, it significantly accelerated it, forcing a generation of Black and brown families into a never-ending cycle of state-sanctioned violence and incarceration.

The post COMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration first appeared on BlackPressUSA.

By Kaili Moss and Jillian Burford | Washington Informer

Mayor Bowser has signed the “Secure DC” omnibus bill passed by the D.C. Council last month. But we already know that this bill will be disastrous for all of D.C., especially for Black and brown residents.

While proponents claim that this legislation “will make D.C. residents safer and more secure,” it actually does nothing to address the root of the harm in the first place and instead maintains a cycle of violence, poverty, and broken community ties. The omnibus bill calls for increased surveillance, drug-free zones, and will expand pre-trial detention that will incarcerate people at a significantly higher rate and for an indeterminate amount of time before they are even tried. This bill will roll back decades of nationwide policy reform efforts and initiatives to keep our communities safe and whole, which is completely contradictory to what the “Secure” D.C. bill claims it will do.

What is unfolding in Washington, D.C., is part of a dangerous national trend. We have seen a resurrection of bad crime bills in several jurisdictions across the country — a phenomenon policy experts have named “zombie laws,” which are ineffective, costly, dangerous for communities of color and, most importantly, will not create public safety. Throwing more money into policing while failing to fund preventative measures does not keep us safe.

The D.C. crime bill and so many others like it are reminiscent of the ‘94 crime bill, which produced new and harsher criminal sentences, helped deploy thousands of police and surveilling methods in Black and brown communities, and incentivized more states to build prisons through a massive infusion of federal funding. While it is not at the root of mass incarceration, it significantly accelerated it, forcing a generation of Black and brown families into a never-ending cycle of state-sanctioned violence and incarceration. Thirty years later, despite spending billions each year to enforce these policies with many of these provisions remaining in effect, it has done very little to create long-term preventative solutions. Instead, it placed a permanent moving target on the backs of Black people, and the D.C. crime bill will do the same.

The bill calls for more pretrial detention. When our loved ones are held on pretrial detention, they are held on the presumption of guilt for an indeterminate amount of time before ever seeing a judge, which can destabilize people and their families. According to experts at the Malcolm Weimer Center for Social Policy at Harvard University, just one day in jail can have “devastating consequences.” On any given day, approximately 750,000 people are held in jails across the nation — a number that beats our nation’s capital population by about 100,000. Once detained, people run the risk of losing wages, jobs, housing, mental and health treatments, and time with their families. Studies show that pretrial detention of even a couple of days makes it more likely for that person to be rearrested.

The bill also endangers people by continuing a misguided and dangerous War on Drugs, which will not get drugs off the street, nor will it deter drug use and subsequent substance use disorders (SUDs). Drug policies are a matter of public health and should be treated as such. Many states such as Alabama, Iowa and Wisconsin are treating the current fentanyl crisis as “Crack 2.0,” reintroducing a litany of failed policies that have sent millions to jails and prisons instead of prioritizing harm reduction. Instead, we propose a simple solution: listen to members of the affected communities. Through the Decrim Poverty D.C. Coalition, community members, policy experts and other stakeholders formed a campaign to decriminalize drugs and propose comprehensive legislation to do so.

While there are many concerning provisions within the omnibus bill, car chases pose a direct physical threat to our community members. In July 2023, NBC4 reported that the D.C. Council approved emergency legislation that gave MPD officers the ability to engage in vehicular pursuits with so-called “limited circumstances.” Sgt. Val Barnes, the head of MPD’s carjacking task force, even expressed concern months before the decision, saying, “The department has a pretty strict no-chase policy, and obviously for an urban setting and a major metropolitan city, that’s understandable.” If our law enforcement officers themselves are operating with more concern than our elected officials, what does it say about the omnibus bill’s purported intention to keep us safe?

And what does it mean when the risk of bodily harm is posed by the pursuit itself? On Saturday, Feb. 10, an Eckington resident had a near-miss as a stolen car barreled towards her and her dog on the sidewalk with an MPD officer in pursuit. What responsibility does the city hold if this bystander was hit? What does restitution look like? Why are our elected officials pushing for MPD officers to contradict their own policies?

Just a few summers ago during the uprisings of 2020, we saw a shift in public perspectives on policing and led to legislation aimed at limiting police power after the highly-publicized murders of loved ones Breonna Taylor and George Floyd — both victims of War on Drugs policing and the powers gained from the ’94 crime bill. And yet here we are. These measures do not keep us safe and further endanger the health of our communities. Studies show that communities that focus on harm reduction and improving material conditions have a greater impact on public safety and community health. What’s missing in mainstream conversations about violent crime is the violence that stems from state institutions and structures that perpetuate racial and class inequality. The people of D.C. deserve to feel safe, and that includes feeling safe from the harms enacted by the police.

Kaili Moss is a staff attorney at Advancement Project, a national racial justice and legal organization, and Jillian Burford is a policy organizer at Harriet’s Wildest Dreams.

The post COMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration first appeared on BlackPressUSA.

#NNPA BlackPress

Mayor, City Council President React to May 31 Closing of Birmingham-Southern College

THE BIRMINGHAM TIMES — “This is a tragic day for the college, our students, our employees, and our alumni, and an outcome so many have worked tirelessly to prevent,” Rev. Keith Thompson, chairman of the BSC Board of Trustees said in an announcement to alumni. “We understand the devastating impact this has on each of you, and we will now direct our efforts toward ensuring the smoothest possible transition for everyone involved.”

The post Mayor, City Council President React to May 31 Closing of Birmingham-Southern College first appeared on BlackPressUSA.

By Barnett Wright | The Birmingham Times

Birmingham-Southern College will close on May 31, after more than a century as one of the city’s most respected institutions.

“This is a tragic day for the college, our students, our employees, and our alumni, and an outcome so many have worked tirelessly to prevent,” Rev. Keith Thompson, chairman of the BSC Board of Trustees said in an announcement to alumni. “We understand the devastating impact this has on each of you, and we will now direct our efforts toward ensuring the smoothest possible transition for everyone involved.”

There are approximately 700 students enrolled at BSC this semester.

“Word of the decision to close Birmingham Southern College is disappointing and heartbreaking to all of us who recognize it as a stalwart of our community,” Birmingham Mayor Randall Woodfin said in a statement. “I’ve stood alongside members of our City Council to protect this institution and its proud legacy of shaping leaders. It’s frustrating that those values were not shared by lawmakers in Montgomery.”

Birmingham City Council President Darrell O’Quinn said news of the closing was “devastating” on multiple levels.

“This is devastating for the students, faculty members, families and everyone affiliated with this historic institution of higher learning,” he said. “It’s also profoundly distressing for the surrounding community, who will now be living in close proximity to an empty college campus. As we’ve seen with other institutions that have shuttered their doors, we will be entering a difficult chapter following this unfortunate development … We’re approaching this with resilience and a sense of hope that something positive can eventually come from this troubling chapter.”

The school first started as the merger of Southern University and Birmingham College in 1918.

The announcement comes over a year after BSC officials admitted the institution was $38 million in debt. Looking to the Alabama Legislature for help, BSC did not receive any assistance.

This past legislative session, Sen. Jabo Waggoner sponsored a bill to extend a loan to BSC. However, the bill subsequently died on the floor.

Notable BSC alumni include former New York Times editor-in-chief Howell Raines, former U.S. Sen. Howell Heflin and former Alabama Supreme Court Chief Justice Perry O. Hooper Sr.

This story will be updated.

The post Mayor, City Council President React to May 31 Closing of Birmingham-Southern College first appeared on BlackPressUSA.

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 20 – 26, 2024

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoFrom Raids to Revelations: The Dark Turn in Sean ‘Diddy’ Combs’ Saga

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoCOMMENTARY: Lady Day and The Lights!

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoBaltimore Key Bridge Catastrophe: A City’s Heartbreak and a Nation’s Alarm

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoBaltimore’s Key Bridge Struck by Ship, Collapses into Water

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of March 27 – April 2, 2024