Bay Area

American Kidney Fund to Pull Plug on Aid For 3,700 California Dialysis Patients

Russell Desmond received a letter a few weeks ago from the American Kidney Fund (AKF) that he said felt like “a smack on the face.”

The organization informed Desmond, who has kidney failure and needs dialysis three times a week, that it will no longer help him pay for his private health insurance plan – to the tune of about $800 a month.

“I am depressed about the whole situation,” said the 58-year-old Sacramento resident. “I have no clue what I’m going to do.”

Desmond has Medicare, but it doesn’t cover the entire cost of his care. So. with assistance from AKF. he pays for a private plan to cover the difference.

Now. the fund, which helps about 3.700 Californians pay their premiums and out-of- pocket costs, is threatening to pull out of California because of a new state law that is expected to cut into the dialysis industry’s profits – leaving patients like Desmond scrambling.

The letter portrayed the fund as helpless. “We are heartbroken at this outcome,” it read. “Ending assistance in California is the last thing we want to do”

But supporters of the new law are calling the threat a scare tactic. State Assembly- man Jim Wood (D- Healds- burg). the author of AB-290, said there is nothing in the measure that prohibits the fund from continuing to provide financial assistance to patients.

“AKF has simply made a conscious decision, without merit, to leave the state despite the many accommodations I made by amending the bill in the Senate to ensure that it can continue to operate in California,” Wood said in a written statement.

What’s behind this dispute, critics of AKF say, is the tight relationship between the fund and the companies that provide dialysis, which filters the blood of people whose kidneys are no longer doing the job.

People on dialysis usually qualify for Medicare, the federal health insurance program for people 65 and older, and those with kidney failure and certain disabilities. If they’re low income, they may also qualify for Medicaid, which is called Medi-Cal in California.

But dialysis companies can get higher reimbursements from private insurers than from public coverage. And one way to keep dialysis patients on private insurance is by giving them financial assistance from AKF, which helps nearly 75,000 low-income dialysis patients across the country.

The fund gets most of its money from DaVita and Fresenius Medical Care, the two largest dialysis companies in the country. The fund does not disclose its donors, but an independent audit of its finances conducted by the accounting firm CliftonLarsenAllen, LLP, reveals that 82% of its funding in 2018 – nearly $250 million – came from two companies.

Insurance plans, consumer advocacy groups and unions have accused AKF of helping dialysis providers steer patients into private insurance plans in exchange for donations from the dialysis industry. Wood said his bill is intended to discourage that practice.

AKF’s CEO LaVarne Burton denied the accusations and said her group plays no role in patients’ coverage choices.

Starting in 2022, the new law will limit the private-insurance reimbursement rate that dialysis companies receive for patients who get assistance from groups such as AKF to the rate that Medicare pays. The rate change won’t apply to patients who are currently receiving assistance as long as they keep the same health plans. The bill will also address a similar dynamic in drug treatment programs.

To determine which patients receive financial aid, the law will require third-party groups to disclose patients’ names to health insurers starting July 1, 2020.

These disclosure requirements are spurring AKF’s decision to leave, Burton said. She argues that they conflict with federal rules and violate patient privacy.

“AKF has no choice but to leave or seek legal relief,” Burton said.

In mid-October, the fund started sending letters to its financial aid recipients in California warning of its departure. And November 1, it joined two dialysis patients in filing suit against the state, asking a U.S. District Court to rule the law unconstitutional.

Gov. Gavin Newsom cautioned against such actions when he signed the bill, and urged “both opponents and supporters to put patients first.”

Activism

Oakland Post: Week of April 24 – 30, 2024

The printed Weekly Edition of the Oakland Post: Week of April 24 – 30, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

Alameda County

DA Pamela Price Stands by Mom Who Lost Son to Gun Violence in Oakland

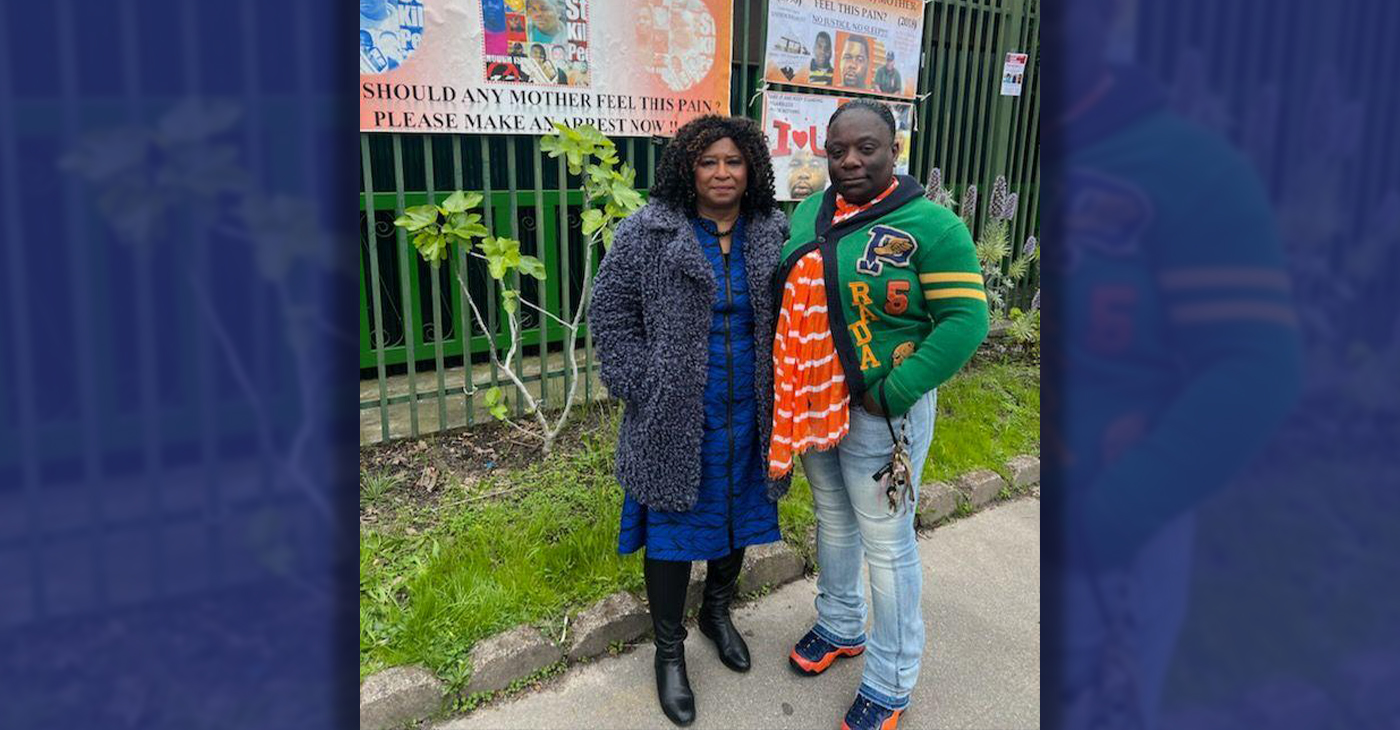

Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018.

Publisher’s note: Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018. The photo was too small for readers to see where the women were and what they were doing. Here we show Price and Jones as they complete a walk in memory of Scott. For more information and to contribute, please contact Carol Jones at 510-978-5517 at morefoundation.help@gmail.com. Courtesy photo.

Bay Area

State Controller Malia Cohen Keynote Speaker at S.F. Wealth Conference

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco. The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

By Carla Thomas

California State Controller Malia Cohen delivered the keynote speech to over 50 business women at the Black Wealth Brunch held on March 28 at the War Memorial and Performing Arts Center at 301 Van Ness Ave. in San Francisco.

The Enterprising Women Networking SF Chapter of the American Business Women’s Association (ABWA) hosted the Green Room event to launch its platform designed to close the racial wealth gap in Black and Brown communities.

“Our goal is to educate Black and Brown families in the masses about financial wellness, wealth building, and how to protect and preserve wealth,” said ABWA San Francisco Chapter President LaRonda Smith.

ABWA’s mission is to bring together businesswomen of diverse occupations and provide opportunities for them to help themselves and others grow personally and professionally through leadership, education, networking support, and national recognition.

“This day is about recognizing influential women, hearing from an accomplished woman as our keynote speaker and allowing women to come together as powerful people,” said ABWA SF Chapter Vice President Velma Landers.

More than 60 attendees dined on the culinary delights of Chef Sharon Lee of The Spot catering, which included a full soul food brunch of skewered shrimp, chicken, blackened salmon, and mac and cheese.

Cohen discussed the many economic disparities women and people of color face. From pay equity to financial literacy, Cohen shared not only statistics, but was excited about a new solution in motion which entailed partnering with Californians for Financial Education.

“I want everyone to reach their full potential,” she said. “Just a few weeks ago in Sacramento, I partnered with an organization, Californians for Financial Education.

“We gathered 990 signatures and submitted it to the [California] Secretary of State to get an initiative on the ballot that guarantees personal finance courses for every public school kid in the state of California.

“Every California student deserves an equal opportunity to learn about filing taxes, interest rates, budgets, and understanding the impact of credit scores. The way we begin to do that is to teach it,” Cohen said.

By equipping students with information, Cohen hopes to close the financial wealth gap, and give everyone an opportunity to reach their full financial potential. “They have to first be equipped with the information and education is the key. Then all we need are opportunities to step into spaces and places of power.”

Cohen went on to share that in her own upbringing, she was not guided on financial principles that could jump start her finances. “Communities of color don’t have the same information and I don’t know about you, but I did not grow up listening to my parents discussing their assets, their investments, and diversifying their portfolio. This is the kind of nomenclature and language we are trying to introduce to our future generations so we can pivot from a life of poverty so we can pivot away and never return to poverty.”

Cohen urged audience members to pass the initiative on the November 2024 ballot.

“When we come together as women, uplift women, and support women, we all win. By networking and learning together, we can continue to build generational wealth,” said Landers. “Passing a powerful initiative will ensure the next generation of California students will be empowered to make more informed financial decisions, decisions that will last them a lifetime.”

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 27 – April 2, 2024

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: D.C. Crime Bill Fails to Address Root Causes of Violence and Incarceration

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoMayor, City Council President React to May 31 Closing of Birmingham-Southern College

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoBeloved Actor and Activist Louis Cameron Gossett Jr. Dies at 87

-

Community1 week ago

Community1 week agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 3 – 6, 2024

-

Business1 week ago

Business1 week agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 10 – 16, 2024