Business

Advocates: Internet Companies Must Partner With Ethnic Media to Close Digital Divide

Last week, Newsom signed Senate Bill (SB) 156 into law. That legislation requires the state to make a multi-billion dollar investment into the construction of a state-owned open access network of internet cable with several offshoot lines that will connect unserved households and businesses mostly in urban and rural areas.

Digital equity advocates – people who have been working for decades now to come up with solutions to narrow the divide between people who are connected to broadband and those who still aren’t – say Internet Service Providers (ISPs) must partner with the ethnic media to reach people in California who remain unconnected and under-connected to broadband service.

“We have focused on the importance of community and Ethnic Media. We think that the Internet Service Providers should be advertising with (ethnic media), reaching out to you and connecting with you,” said Sunne McPeak, CEO of the California Emerging Technology Fund (CETF) a statewide non-profit with offices in Concord and Los Angeles dedicated to closing the digital divide.

McPeak says, with its 91% broadband adoption rate, California has done a remarkable job getting people online with stable access to high-speed internet connections that can improve their quality of life. That number has skyrocketed from 55% in 2008.

However, there are still 6 million Californians, she says, who are not connected or under-connected (those with only smartphone access) to broadband. Most of those people live in low-income households.

Among Californians who are not connected to high-speed internet, 8% — more than half of them – are Black, according to CETF.

“There is still clearly a divide among groups that are most digitally disadvantaged socioeconomically,” McPeak said. “No state has more low-income people than California. Fifteen percent of our population is low income.”

McPeak was speaking during a news briefing organized by Ethnic Media Services last week titled “Trapped by the Digital Divide: Demanding Universal Broadband as a Basic Right.”

McPeak was joined on the online conference by Angela Siefer, executive director of the Cleveland-based National Digital Inclusion Alliance (NDIA).

Siefer shared national numbers that reflect that the vast majority of people who are still not connected to the internet live in urban areas, challenging a widely held notion that rural areas remain the regions most unconnected to broadband in the United States.

“Prior to the pandemic, 36 million U.S. households did not have an internet connection in their home,” said Seifer. “Of that number, 26 million are urban and 10 million are rural. I want to confirm the bigger number piece of this is urban.”

In addition to having a high broadband adoption rate, California continues to take a number of steps to make sure there is universal connectivity to broadband.

Last week, Newsom signed Senate Bill (SB) 156 into law. That legislation requires the state to make a multi-billion dollar investment into the construction of a state-owned open access network of internet cable with several offshoot lines that will connect unserved households and businesses mostly in urban and rural areas.

“As we work to build California back stronger than before, the state is committed to addressing the challenges laid bare by the pandemic, including the digital divide holding back too many communities in a state renowned for its pioneering technology and innovation economy,” said Newsom at a rural elementary school in Tulare County.

“This $6 billion investment will make broadband more accessible than ever before, expanding opportunity across the spectrum for students, families and businesses – from enhanced educational supports to job opportunities to health care and other essential services,’ the governor continued.

Also continuing to ensure as many Californians as possible not only have access to broadband but also have reliable equipment to connect to it, California State University announced that it will give all incoming students and transfers at eight of its campuses across the state new iPad air tablets. The package includes accessories, including smart keyboards. The only requirement for the students is to register at a website called CSUSUCCESS (CSU Connectivity Contributing to Equity and Student Success)

“CSUCCESS will assure that students have immediate access to innovative, new mobile tools they need to support their learning, particularly when faced with the lingering effects of the pandemic,” CSU Chancellor Joseph Castro said, announcing the initiative.

McPeak says while there are a number of programs like the federal Emergency Benefit Broadband program that can help Americans connect to high-speed internet more affordably, many people are just not aware of them.

“We have to ask, what are (the ISPs) doing to work with ethnic media and community organizations?” asked McPeak.

Bay Area

Mayor Breed Proposes Waiving City Fees for Night Markets, Block Parties, Farmers’ Markets, Other Outdoor Community Events

Mayor London N. Breed introduced legislation on April 26 to encourage and expand outdoor community events. The first will waive City fees for certain events, making them less costly to produce. The second will simplify the health permitting for special event food vendors through the creation of an annual permit. Both pieces of legislation are part of the Mayor’s broader initiative to bring vibrancy and entertainment to San Francisco’s public right of ways and spaces.

Mayor’s Press Office

Mayor London N. Breed introduced legislation on April 26 to encourage and expand outdoor community events.

The first will waive City fees for certain events, making them less costly to produce. The second will simplify the health permitting for special event food vendors through the creation of an annual permit. Both pieces of legislation are part of the Mayor’s broader initiative to bring vibrancy and entertainment to San Francisco’s public right of ways and spaces.

Outdoor community events are integral to San Francisco’s vibrant culture and sense of community. These events include night markets, neighborhood block parties and farmers markets, and bolster the City’s economy by supporting local businesses and attracting tourists eager to experience San Francisco’s unique charm and food scene.

They offer residents, workers and visitors, opportunities to engage with local artists, musicians, and food vendors while enjoying the San Francisco’s stunning outdoor spaces and commercial corridors.

The legislation will allow for more and new community gatherings and for local food vendors to benefit from the City’s revitalization.

“San Francisco is alive when our streets are filled with festivals, markets, and community events,” said Breed. “As a city we can cut fees and streamline rules so our communities can bring joy and excitement into our streets and help revitalize San Francisco.”

Fee Waiver Legislation

The events that can take advantage of the new fee waivers are those that are free and open to the public, occupy three or fewer city blocks, take place between 8 a.m. and 10 p.m., and have the appropriate permitting from the ISCOTT and the Entertainment Commission.

The applicant must be a San Francisco based non-profit, small business, Community Benefit District, Business Improvement District, or a neighborhood or merchant association. Fees eligible for waiver include any application, permit, and inspection/staffing fees from San Francisco Municipal Transportation Agency, Department of Public Health, Fire Department, Entertainment Commission, and Police Department.

Currently, it can cost roughly anywhere between $500-$10,000 to obtain permits for organized events or fairs, depending on its size and scope. Organizations and businesses are limited to a maximum of 12 events in one calendar year for which they can receive these fee waivers.

Food Vendor Streamlining Legislation

The second piece of legislation introduced will help special event food vendors easily participate in multiple events throughout the year with a new, cost-effective annual food permit. Food vendors who participate in multiple events at multiple locations throughout the year will no longer need to obtain a separate permit for each event. Instead, special event food vendors will be able to apply and pay for a single annual permit all at once.

“Many successful food businesses either begin as pop-up vendors or participate in special events to grow their business,” says Katy Tang, Director of the Office of Small Business. “Giving them the option for an annual special event food permit saves them time and money.”

Currently, food vendors are required to get a Temporary Food Facility (TFF) permit from the Department of Public Health (DPH) in order to participate in a special event, among permits from other departments.

Currently, each special event requires a new permit from DPH ranging from $124-$244, depending on the type of food being prepared and sold. Last year, DPH issued over 1,500 individual TFF permits. With the new annual permit, food vendors selling at more than four to six events each year will benefit from hundreds of dollars in savings and time saved from fewer bureaucratic processes.

“This legislation is a step in the right direction to make it easier for food vendors like me to participate in citywide events,” said Dontaye Ball, owner of Gumbo Social. “It saves on time, money and makes it more effective. It also creates a level of equity.”

Bay Area

Faces Around the Bay: Sidney Carey

Sidney Carey was born in Dallas, Texas. He moved with his family to West Oakland as a baby. His sister is deceased; one brother lives in Oakland. Carey was the Choir Director at Trinity Missionary Baptist Church for 18 years.

By Barbara Fluhrer

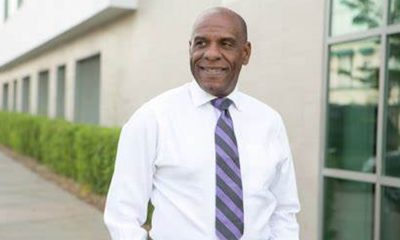

Sidney Carey was born in Dallas, Texas. He moved with his family to West Oakland as a baby. His sister is deceased; one brother lives in Oakland.

Carey was the Choir Director at Trinity Missionary Baptist Church for 18 years.

He graduated from McClymonds High with a scholarship in cosmetology and was the first African American to complete a nine-month course at the first Black Beauty School in Oakland: Charm Beauty College.

He earned his License, and then attended U.C., earning a secondary teaching credential. With his Instructors License, he went on to teach at Laney College, San Mateo College, Skyline and Universal Beauty College in Pinole, among others.

Carey was the first African American hair stylist at Joseph and I. Magnin department store in Oakland and in San Francisco, where he managed the hair stylist department, Shear Heaven.

In 2009, he quit teaching and was diagnosed with Congestive Heart Failure. He was 60 and “too old for a heart transplant”. His doctors at California Pacific Medical Center (CPMC) went to court and fought successfully for his right to receive a transplant. One day, he received a call from CPMC, “Be here in one hour.” He underwent a transplant with a heart from a 25-year- old man in Vienna, Austria

Two years later, Carey resumed teaching at Laney College, finally retiring in 2012.

Now, he’s slowed down and comfortable in a Senior Residence in Berkeley, but still manages to fit his 6/4” frame in his 2002 Toyota and drive to family gatherings in Oakland and San Leandro and an occasional Four Seasons Arts concert.

He does his own shopping and cooking and uses Para Transit to keep constant doctor appointments while keeping up with anti-rejection meds. He often travels with doctors as a model of a successful heart-transplant plant recipient: 14 years.

Carey says, “I’m blessed” and, to the youth, “Don’t give up on your dreams!”

Business

Maximizing Your Bank Branch Experience

In a world of online tools that let you make banking transactions with the touch of a button, the idea of visiting a branch might seem unnecessary. However, if you haven’t visited your local branch recently, you might be surprised by what it has to offer. Your branch is much more than a place to deposit and withdraw money – it can offer the opportunity to build valuable relationships with people who can help you achieve financial independence.

Sponsored by JPMorgan Chase & Co.

In a world of online tools that let you make banking transactions with the touch of a button, the idea of visiting a branch might seem unnecessary.

However, if you haven’t visited your local branch recently, you might be surprised by what it has to offer. Your branch is much more than a place to deposit and withdraw money – it can offer the opportunity to build valuable relationships with people who can help you achieve financial independence.

Diedra Porché, Head of Community and Business Development at Chase, talks about how the bank model has evolved to maximize the branch experience for customers; how connecting with your local branch team can help you think differently about money and investing for your future.

How can a customer feel connected to a bank branch?

I love that question because we ask ourselves the same thing every day. Being part of the community means meeting with local leaders to find out what they need from us and then designing our branches around that. For example, at some of our community branches we have what we call a living room where we can host financial workshops, small business pop-up shops or nonprofit organization meetings. We also hire locally. You feel much more connected talking about financial aspirations with people from your community who went to the same high school, place of worship or maybe frequented the same recreation center down the street when they grew up.

How can I build a relationship with my bank?

Customers should feel comfortable sharing their goals, needs and wants with their banker. Also, it helps to remember the Community Manager is there to help solve your finance challenges and build a roadmap for success. You might have a short-term or long-term goal to open a business, build your credit, become debt-free, buy a home, or save for retirement, and our community team can help. At Chase, we strive to make dreams possible for everyone, everywhere, every day. Your financial future starts with building those relationships.

How can customers change negative perceptions they have about managing their money?

Far too often, customers are intimidated when they visit a bank. Our goal is to demystify banking and money myths empowering people to make the right decisions. For example, a big myth is assuming you need a lot of money to have a bank account. You don’t! Another myth is you need to carry a balance on your credit card to build credit — actively using your credit card can demonstrate that you can use credit responsibly but carrying a balance won’t necessarily improve your credit score. Finally, understanding mobile and online banking safety is key. There are so many safeguards and protections in place to guard your personal information and funds.

What’s an easy step one can take to shift their financial behavior right now?

Cultivating self-awareness is a good first step. Start by taking inventory of your spending. Be honest with yourself about what you need and what you want. Too often, people confuse the two, which leads to bad decisions. Rent is something you need to pay. An extra pair of shoes is something you may want but before you buy them ask yourself if that’s the best use of your hard-earned money. Too often, our beliefs and our fears shape our financial realities. If any of those beliefs are limiting your financial behavior, it’s important to question and examine them, and then decide you’re open to learning something different.

What’s one perception about banking that you’d like to change?

I think folks are surprised there are so many resources available and accessible both at our branches and online, it’s always a good idea to visit a nearby branch and speak to a Community Manager or banker. Outside of what we offer in-branch, our teams also work with local neighborhood partners who provide a variety of services to support the community, businesses and residents. I received a unique piece of feedback from an employee who started with the bank and had lived in the same community his whole life. When he visited his local community branch, he said, “Diedra, when I walked in, I felt dignified.” Every time I recount that story, it warms my heart because that’s what we want — we want our centers to belong to the community.

-

Community3 weeks ago

Community3 weeks agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Business3 weeks ago

Business3 weeks agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of April 10 – 16, 2024

-

Community3 weeks ago

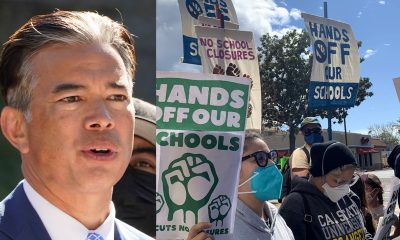

Community3 weeks agoAG Bonta Says Oakland School Leaders Should Comply with State Laws to Avoid ‘Disparate Harm’ When Closing or Merging Schools

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 24 – 30, 2024

-

Community2 weeks ago

Community2 weeks agoRichmond Nonprofit Helps Ex-Felons Get Back on Their Feet

-

Community2 weeks ago

Community2 weeks agoOakland WNBA Player to be Inducted Into Hall of Fame

-

Community2 weeks ago

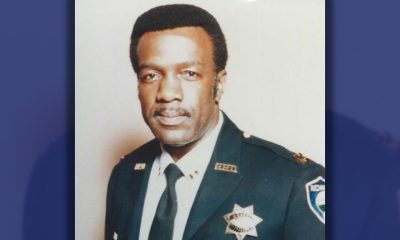

Community2 weeks agoRPAL to Rename Technology Center for Retired Police Captain Arthur Lee Johnson