Government

NAREB Takes Fight for Black Homeownership to Congressional Hearing

WASHINGTON INFORMER — The rate of Black homeownership in America – now at 41.1 percent, according to 2019 census numbers – is even lower than it was when the Fair Housing Act was signed into law 51 years ago on April 11, 1968.

By Hazel Trice Edney

The rate of Black homeownership in America – now at 41.1 percent, according to 2019 census numbers – is even lower than it was when the Fair Housing Act was signed into law 51 years ago on April 11, 1968.

This means Black homeownership is 32.1 percentage points lower than that of Whites, which stands at 73.2 percent. It also means Black homeownership is 6.3 percentage points lower than that of Latino-Americans, which stands at 47.4 percent.

These are just a few of the facts presented to a recent Congressional hearing by homeownership advocates. The hearing, held by the House Finance Committee’s Subcommittee on Housing, Community Development and Insurance, was the first modern day hearing of its kind — intended to discover the barriers to homeownership for people of color.

“Federal housing regulators and agencies have aggressively pursued lending practices and policies that make access to homeownership more challenging for Black Americans. It is against this backdrop that I give my testimony,” Jeff Hicks, president/CEO of the National Association of Black Real Estate Brokers (NAREB), testified to lawmakers at the hearing. “Our nation has a very complicated and checkered history with providing equal and equitable access to homeownership to Black Americans. At the end of World War II, when Black Americans sacrificed their lives for the cause of freedom, dignity and human rights, the United States federal government created an economic divide between Blacks and Whites.”

Hicks described how Black veterans and their families were “denied the multigenerational, enriching impact of home ownership and economic security that the G.I. Bill conferred on a majority of White veterans, their children, and their grandchildren.”

He concluded that the “unequal implementation of the G.I. Bill, along with federal government policies and practices at the Federal Housing Administration (FHA), including the redlining of Black neighborhoods, were leveled against Black veterans” while at the same time the government financed the construction of suburbs and provided subsidized mortgage financing for Whites-only. This scenario “set the stage for today’s wealth and homeownership gap statistics,” Hicks said.

The hearing, led by Housing Subcommittee Chair Rep. Lacy Clay (D-Mo.), marked the anniversary of the passage of the Fair Housing Act (FHA), signed into law one week after the April 4 assassination of Dr. Martin Luther King Jr.

President Lyndon B. Johnson described the road to the 1968 passage as a “long and stormy trip” after it failed three times. Together, the testimony of the 72-year-old NAREB — the oldest organization represented — and the string of witnesses at the 21st century congressional hearing, revealed that the storm is not nearly over.

“We have not simply failed to make progress; we are losing ground. And we cannot continue to go backward,” Alanna McCargo, vice president for Housing Finance Policy, Urban Institute, stressed the urgency of the moment.

The Urban Institute was founded by President Johnson in 1968 to focus on “the problems of America’s cities and their people and to inform social and economic policy interventions that would help fight the War on Poverty,” she described.

The witnesses gave facts and anecdotes describing why new legislation and homeownership policies are needed. Among the proposals:

The passage of The American Dream Down Payment Savings Plan, a proposal with bipartisan support, which would allow prospective homebuyers to save money in an authorized account, where the savings could grow and be removed for the specified purpose of a tax-free down payment for purchasing a home.

A fairer mortgage and underwriting process in which borrowers meet a minimum threshold for approval and all interest rates and costs are the same for everyone; regardless of race; including loan level equality, approval rates, pricing and terms for borrowers — without adjustments for neighborhoods, zip codes or census tracts.

Accountability for non-bank financial institutions such as the examination their lending practices to ensure fair, equitable, and non-discriminatory origination, pricing, and terms. This would also include greater accountability and modernization of the Community Reinvestment Act to eliminate loopholes that limit access to mortgage credit to existing and potential Black homeowners.

Overall promotion of homeownership as a High Priority for Public Policymakers.

Equal and equitable access to mainstream mortgage credit as prospective Black homeowners have been trapped in predatory mortgage schemes or by an absolute denial of access to home loans.

Historically unequal access to credit for people of color was repeated as a key problem during the hearing.

“Wide access to credit is critical for building family wealth, closing the racial wealth gap, and for the housing market overall, which in turn, contributes significantly to our overall economy,” Nikitra Bailey, executive vice president of the Center for Responsible Lending, told the Committee. “Today’s hearing is a good step toward acknowledging this history and presents the potential to create opportunities to address it.”

The other four witnesses were Joseph Nery, president, National Association of Hispanic Real Estate Professionals; Carmen Castro, managing housing counselor, Housing Initiative Partnership; Joanne Poole, liaison for the National Association of Realtors and Joel Griffith, research fellow, Financial Regulations, The Heritage Foundation.

Bi-partisan lawmakers on the subcommittee listened intently then fired questions and remarks.

When Rep. Al Green (D-Texas) asked the witnesses to raise their hands if they “believe that invidious discrimination has been a significant reason for the inability for African-Americans to achieve wealth in this country … to this very day,” all seven witnesses extended their hands into the air.

“I’m grateful that you’ve done this because we’ve been trying to build a record to let the world know that we still have discrimination,” Green said. “Our original sin was discrimination. To be more specific racism … institutionalized racism.”

Chairman Clay saw eye to eye with the witnesses.

“It is clear by the evidence in front of us that 51 years later, there is still much work to be done to promote and assure fair housing in America,” he said, adding that Congress must bear the responsibility to end the discrimination largely because of its failure to continue to make and maintain fair housing policies.

“Although many private actors were complicit, research has shown that the government played a significant role,” Clay said.

Rep. Maxine Waters, chair of the House Financial Services Committee, which oversees the Housing Subcommittee, pressed the lawmakers, saying many of the oppressive policies are still used by banks and are “taken for granted.”

Waters described interest rates that are so high that homeowners – paying both interest and principal – have faced foreclosure because they can no longer afford the loan. She also described banks that won’t do loan modifications until two payments are missed making it difficult to catch up on the payments.

“We need to scrub this market and all the rules and practices and come up with a laundry list of what we think needs to be taken out of the way,” Waters said.

The congressional hearing was held on launch day for NAREB’s 2019 Spring Policy Conference May 8. NAREB, founded to fight for civil rights in order to win economic justice for its members and the people they serve, has set a goal of at least two million new Black homeowners within five years. They view working with Congress as their next best hope.

“Together with Congress, we must overcome the discrimination that continues to limit Black homeownership,” Hicks said. “The reason for this “dismal reality,” as stated in NAREB’s most recent SHIBA (State of Housing in Black America) report, is “that Blacks have never enjoyed equal and equitable access to mainstream mortgage credit. Rather, Black families attempting to become homeowners have largely been trapped in a vicious cycle of predatory mortgage schemes or by an absolute denial of access to home loans…We need to vigorously renew the importance of homeownership to all families, regardless of their race or ethnicity.”

This article originally appeared in the Washington Informer.

Activism

Oakland Post: Week of April 24 – 30, 2024

The printed Weekly Edition of the Oakland Post: Week of April 24 – 30, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

Alameda County

DA Pamela Price Stands by Mom Who Lost Son to Gun Violence in Oakland

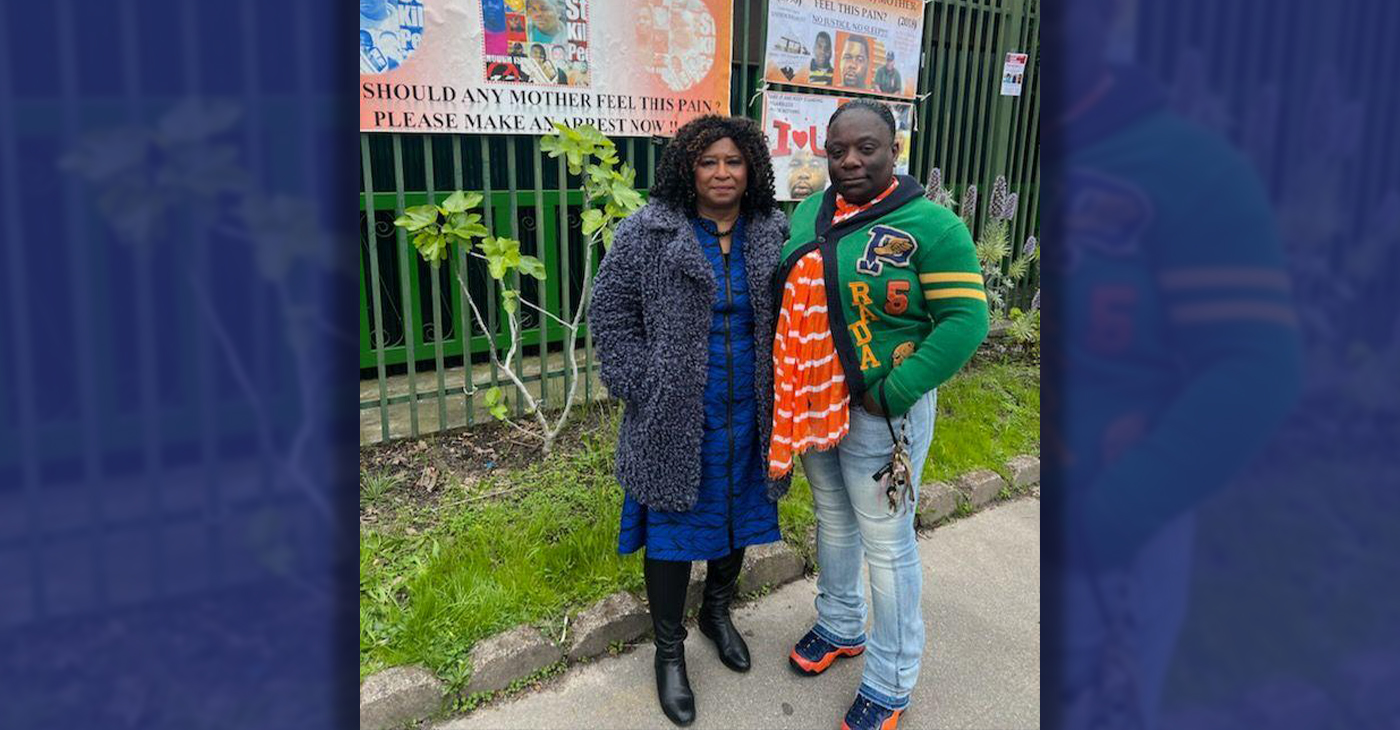

Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018.

Publisher’s note: Last week, The Post published a photo showing Alameda County District Attorney Pamela Price with Carol Jones, whose son, Patrick DeMarco Scott, was gunned down by an unknown assailant in 2018. The photo was too small for readers to see where the women were and what they were doing. Here we show Price and Jones as they complete a walk in memory of Scott. For more information and to contribute, please contact Carol Jones at 510-978-5517 at morefoundation.help@gmail.com. Courtesy photo.

Bay Area

MAYOR BREED ANNOUNCES $53 MILLION FEDERAL GRANT FOR SAN FRANCISCO’S HOMELESS PROGRAMS

San Francisco, CA – Mayor London N. Breed today announced that the U.S. Department of Housing and Urban Development (HUD) has awarded the city a $53.7 million grant to support efforts to renew and expand critical services and housing for people experiencing homelessness in San Francisco.

FOR IMMEDIATE RELEASE:

Wednesday, January 31, 2024

Contact: Mayor’s Office of Communications, mayorspressoffice@sfgov.org

***PRESS RELEASE***

MAYOR BREED ANNOUNCES $53 MILLION FEDERAL GRANT FOR SAN FRANCISCO’S HOMELESS PROGRAMS

HUD’s Continuum of Care grant will support the City’s range of critical services and programs, including permanent supportive housing, rapid re-housing, and improved access to housing for survivors of domestic violence

San Francisco, CA – Mayor London N. Breed today announced that the U.S. Department of Housing and Urban Development (HUD) has awarded the city a $53.7 million grant to support efforts to renew and expand critical services and housing for people experiencing homelessness in San Francisco.

HUD’s Continuum of Care (CoC) program is designed to support local programs with the goal of ending homelessness for individuals, families, and Transitional Age Youth.

This funding supports the city’s ongoing efforts that have helped more than 15,000 people exit homelessness since 2018 through City programs including direct housing placements and relocation assistance. During that time San Francisco has also increased housing slots by 50%. San Francisco has the most permanent supportive housing of any county in the Bay Area, and the second most slots per capita than any city in the country.

“In San Francisco, we have worked aggressively to increase housing, shelter, and services for people experiencing homelessness, and we are building on these efforts every day,” said Mayor London Breed. “Every day our encampment outreach workers are going out to bring people indoors and our City workers are connecting people to housing and shelter. This support from the federal government is critical and will allow us to serve people in need and address encampments in our neighborhoods.”

The funding towards supporting the renewal projects in San Francisco include financial support for a mix of permanent supportive housing, rapid re-housing, and transitional housing projects. In addition, the CoC award will support Coordinated Entry projects to centralize the City’s various efforts to address homelessness. This includes $2.1 million in funding for the Coordinated Entry system to improve access to housing for youth and survivors of domestic violence.

“This is a good day for San Francisco,” said Shireen McSpadden, executive director of the Department of Homelessness and Supportive Housing. “HUD’s Continuum of Care funding provides vital resources to a diversity of programs and projects that have helped people to stabilize in our community. This funding is a testament to our work and the work of our nonprofit partners.”

The 2024 Continuum of Care Renewal Awards Include:

- $42.2 million for 29 renewal PSH projects that serve chronically homeless, veterans, and youth

- $318,000 for one new PSH project, which will provide 98 affordable homes for low-income seniors in the Richmond District

- $445,00 for one Transitional Housing (TH) project serving youth

- $6.4 million dedicated to four Rapid Rehousing (RRH) projects that serve families, youth, and survivors of domestic violence

- $750,00 for two Homeless Management Information System (HMIS) projects

- $2.1 million for three Coordinated Entry projects that serve families, youth, chronically homeless, and survivors of domestic violence

In addition, the 2023 CoC Planning Grant, now increased to $1,500,000 from $1,250,000, was also approved. Planning grants are submitted non-competitively and may be used to carry out the duties of operating a CoC, such as system evaluation and planning, monitoring, project and system performance improvement, providing trainings, partner collaborations, and conducting the PIT Count.

“We are very appreciative of HUD’s support in fulfilling our funding request for these critically important projects for San Francisco that help so many people trying to exit homelessness,” said Del Seymour, co-chair of the Local Homeless Coordinating Board. “This funding will make a real difference to people seeking services and support in their journey out of homelessness.”

In comparison to last year’s competition, this represents a $770,000 increase in funding, due to a new PSH project that was funded, an increase in some unit type Fair Market Rents (FMRs) and the larger CoC Planning Grant. In a year where more projects had to compete nationally against other communities, this represents a significant increase.

Nationally, HUD awarded nearly $3.16 billion for over 7,000 local homeless housing and service programs including new projects and renewals across the United States.

-

Community2 weeks ago

Community2 weeks agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of April 3 – 6, 2024

-

Business2 weeks ago

Business2 weeks agoV.P. Kamala Harris: Americans With Criminal Records Will Soon Be Eligible for SBA Loans

-

Community2 weeks ago

Community2 weeks agoAG Bonta Says Oakland School Leaders Should Comply with State Laws to Avoid ‘Disparate Harm’ When Closing or Merging Schools

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 10 – 16, 2024

-

Community2 weeks ago

Community2 weeks agoOakland WNBA Player to be Inducted Into Hall of Fame

-

Community2 weeks ago

Community2 weeks agoRichmond Nonprofit Helps Ex-Felons Get Back on Their Feet

-

Community2 weeks ago

Community2 weeks agoRPAL to Rename Technology Center for Retired Police Captain Arthur Lee Johnson

1 Comment