Business

Questions and Answers About the Expiring Export-Import Bank

Secretary of State John Kerry addresses a gathering of the Export-Import Bank at the Omni-Shoreham Hotel in Washington, Thursday, April 24, 2014. (AP Photo)

ERICA WERNER, Associated Press

WASHINGTON (AP) — The Export-Import Bank expires Tuesday at midnight for the first time since the small federal agency was created during the Depression to help U.S. businesses export their products. Congress failed to renew the bank’s charter because of opposition from Republicans who say it amounts to corporate welfare. However, the shutdown may end up being only temporary.

Some questions and answers about the Export-Import Bank, and its future:

___

Q: What does the Export-Import Bank do?

A: The federal Export-Import Bank’s principal role is to guarantee commercial bank loans made to foreign businesses and governments to buy U.S. products. That means U.S. taxpayers would pick up the tab if, say, a company in South America defaulted on a commercial bank loan it got to buy a Caterpillar tractor.

The Export-Import Bank also makes direct loans and provides export credit insurance to protect against losses to companies from non-repayment of loans.

The bank says that last year it authorized $20 billion worth of transactions which supported $27.5 billion of U.S. exports and 164,000 U.S. jobs. And it says it has a default rate of less than 1 percent.

___

Q: Why is the Export-Import Bank needed?

A: That’s the question at the heart of the current debate in Congress.

Opponents, including conservative lawmakers, groups like the Heritage Foundation and the GOP’s presidential candidates, say it isn’t needed at all. They point out that the vast majority of U.S. exporting is conducted without government support. They argue that the Export-Import Bank primarily supports big businesses that don’t really need the help, such as Boeing and GE. And they say the bank amounts to “crony capitalism” and the government picking winners and losers.

“Where is the fairness in giving Washington politicians and bureaucrats the power to pick who gets helped and who gets hurt?” asked GOP Rep. Jeb Hensarling of Texas, chairman of the House Financial Services Committee and a leading opponent of the bank.

But supporters like the U.S. Chamber of Commerce and National Association of Manufacturers say the Export-Import Bank plays a critical role in stepping in where commercial lenders can’t. Government backing can be needed because of the huge amounts of money involved in big purchases such as aircraft, or to help U.S. companies protect against the risk of default from a little-known buyer in a foreign country.

Supporters also note that foreign competitors such as China have foreign credit agencies more generous than the Export-Import Bank, and so U.S. businesses would be at a competitive disadvantage without it.

“We ought to reauthorize the bank and provide certainty to businesses and their workers who depend on it to level the playing field against foreign competitors,” said House Minority Whip Steny Hoyer, D-Md.

___

Q: Whom does the Export-Import Bank help?

A: Opponents argue that the bank primarily helps big businesses — and that is true if you measure its spending in dollars. Of the $20.5 billion in financing and insurance authorized by the bank in 2014, just over $5 billion of that was for small business exporters, according to bank officials.

However, supporters note that if you count the number of transactions, many more small businesses are helped than big ones. It’s just that the amounts spent on them are much smaller.

___

Q: What will happen when the Export-Import Bank’s charter expires?

A: The bank will lose its ability to make new loans when its charter expires Tuesday at midnight. However, it will stay in business to service outstanding loans. Supporters warn that even a short-term shutdown could disrupt some deals that are in the pipeline, but any impacts would likely go unnoticed by the vast majority of the public.

___

Q: Why is Congress letting the Export-Import Bank’s charter expire, and will lawmakers revive it?

A: Congress has renewed the Export-Import Bank’s charter on a bipartisan basis with little controversy over the years. But recently, the obscure agency has become something of a conservative purity test, with tea party-backed lawmakers and groups attacking it and rallying fellow Republicans to defy the business community and turn against it. That’s caused leading Republicans who once supported the bank, such as House Majority Leader Kevin McCarthy, R-Calif., to oppose it. The GOP’s presidential candidates also have lined up against it. Amid that opposition, it was easier for congressional leaders to let the bank expire than to try to take action to renew it.

However, lawmakers of both parties say the bank commands enough support to pass Congress, and it looks like it could do just that in July. Supporters plan to try to attach it to must-pass highway legislation in the Senate, which could also get it through the House.

“Looks to me like they have the votes, and I’m going to give them the opportunity,” Senate Majority Leader Mitch McConnell, R-Ky., told The Associated Press on Monday.

___

Associated Press writer Laurie Kellman contributed to this report.

Copyright 2015 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Activism

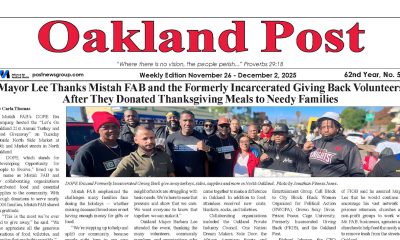

Oakland Post: Week of December 24 – 30, 2025

The printed Weekly Edition of the Oakland Post: Week of – December 24 – 30, 2025

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window.

Activism

Lu Lu’s House is Not Just Toying Around with the Community

Wilson and Lambert will be partnering with Mayor Barbara Lee on a toy giveaway on Dec. 20. Young people, like Dremont Wilkes, age 15, will help give away toys and encourage young people to stay in school and out of trouble. Wilkes wants to go to college and become a specialist in financial aid. Sports agent Aaron Goodwin has committed to giving all eight young people from Lu Lu’s House a fully paid free ride to college, provided they keep a 3.0 grade point average and continue the program. Lu Lu’s House is not toying around.

Special to the Post

Lu Lu’s House is a 501c3 organization based in Oakland, founded by Mr. Zirl Wilson and Mr. Tracy Lambert, both previously incarcerated. After their release from jail, they wanted to change things for the better in the community — and wow, have they done that!

The duo developed housing for previously incarcerated people, calling it “Lu Lu’s House,” after Wilson’s wonderful wife. At a time when many young people were robbing, looting, and involved in shootings, Wilson and Lambert took it upon themselves to risk their lives to engage young gang members and teach them about nonviolence, safety, cleanliness, business, education, and the importance of health and longevity.

Lambert sold hats and T-shirts at the Eastmont Mall and was visited by his friend Wilson. At the mall, they witnessed gangs of young people running into the stores, stealing whatever they could get their hands on and then rushing out. Wilson tried to stop them after numerous robberies and finally called the police, who Wilson said, “did not respond.” Having been incarcerated previously, they realized that if the young people were allowed to continue to rob the stores, they could receive multiple criminal counts, which would take their case from misdemeanors to felonies, resulting in incarceration.

Lu Lu’s House traveled to Los Angeles and obtained more than 500 toys

for a Dec. 20 giveaway in partnership with Oakland Mayor Barbara

Lee. Courtesy Oakland Private Industry,

Wilson took it upon himself to follow the young people home and when he arrived at their subsidized homes, he realized the importance of trying to save the young people from violence, drug addiction, lack of self-worth, and incarceration — as well as their families from losing subsidized housing. Lambert and Wilson explained to the young men and women, ages 13-17, that there were positive options which might allow them to make money legally and stay out of jail. Wilson and Lambert decided to teach them how to wash cars and they opened a car wash in East Oakland. Oakland’s Initiative, “Keep the town clean,” involved the young people from Lu Lu’s House participating in more than eight cleanup sessions throughout Oakland. To assist with their infrastructure, Lu Lu’s House has partnered with Oakland’s Private Industry Council.

For the Christmas season, Lu Lu’s House and reformed young people (who were previously robbed) will continue to give back.

Lu Lu’s House traveled to Los Angeles and obtained more than 500 toys.

Wilson and Lambert will be partnering with Mayor Barbara Lee on a toy giveaway on Dec. 20. Young people, like Dremont Wilkes, age 15, will help give away toys and encourage young people to stay in school and out of trouble. Wilkes wants to go to college and become a specialist in financial aid. Sports agent Aaron Goodwin has committed to giving all eight young people from Lu Lu’s House a fully paid free ride to college, provided they keep a 3.0 grade point average and continue the program. Lu Lu’s House is not toying around.

Activism

Desmond Gumbs — Visionary Founder, Mentor, and Builder of Opportunity

Gumbs’ coaching and leadership journey spans from Bishop O’Dowd High School, Oakland High School, Stellar Prep High School. Over the decades, hundreds of his students have gone on to college, earning academic and athletic scholarships and developing life skills that extend well beyond sports.

Special to the Post

For more than 25 years, Desmond Gumbs has been a cornerstone of Bay Area education and athletics — not simply as a coach, but as a mentor, founder, and architect of opportunity. While recent media narratives have focused narrowly on challenges, they fail to capture the far more important truth: Gumbs’ life’s work has been dedicated to building pathways to college, character, and long-term success for hundreds of young people.

A Career Defined by Impact

Gumbs’ coaching and leadership journey spans from Bishop O’Dowd High School, Oakland High School, Stellar Prep High School. Over the decades, hundreds of his students have gone on to college, earning academic and athletic scholarships and developing life skills that extend well beyond sports.

One of his most enduring contributions is his role as founder of Stellar Prep High School, a non-traditional, mission-driven institution created to serve students who needed additional structure, belief, and opportunity. Through Stellar Prep numerous students have advanced to college — many with scholarships — demonstrating Gumbs’ deep commitment to education as the foundation for athletic and personal success.

NCAA football history was made this year when Head Coach from

Mississippi Valley State, Terrell Buckley and Head Coach Desmond

Gumbs both had starting kickers that were women. This picture was

taken after the game.

A Personal Testament to the Mission: Addison Gumbs

Perhaps no example better reflects Desmond Gumbs’ philosophy than the journey of his son, Addison Gumbs. Addison became an Army All-American, one of the highest honors in high school football — and notably, the last Army All-Americans produced by the Bay Area, alongside Najee Harris.

Both young men went on to compete at the highest levels of college football — Addison Gumbs at the University of Oklahoma, and Najee Harris at the University of Alabama — representing the Bay Area on a national level.

Building Lincoln University Athletics From the Ground Up

In 2021, Gumbs accepted one of the most difficult challenges in college athletics: launching an entire athletics department at Lincoln University in Oakland from scratch. With no established infrastructure, limited facilities, and eventually the loss of key financial aid resources, he nonetheless built opportunities where none existed.

Under his leadership, Lincoln University introduced:

- Football

- Men’s and Women’s Basketball

- Men’s and Women’s Soccer

Operating as an independent program with no capital and no conference safety net, Gumbs was forced to innovate — finding ways to sustain teams, schedule competition, and keep student-athletes enrolled and progressing toward degrees. The work was never about comfort; it was about access.

Voices That Reflect His Impact

Desmond Gumbs’ philosophy has been consistently reflected in his own published words:

- “if you have an idea, you’re 75% there the remaining 25% is actually doing it.”

- “This generation doesn’t respect the title — they respect the person.”

- “Greatness is a habit, not a moment.”

Former players and community members have echoed similar sentiments in public commentary, crediting Gumbs with teaching them leadership, accountability, confidence, and belief in themselves — lessons that outlast any single season.

Context Matters More Than Headlines

Recent articles critical of Lincoln University athletics focus on logistical and financial hardships while ignoring the reality of building a new program with limited resources in one of the most expensive regions in the country. Such narratives are ultimately harmful and incomplete, failing to recognize the courage it takes to create opportunity instead of walking away when conditions are difficult.

The real story is not about early struggles — it is about vision, resilience, and service.

A Legacy That Endures

From founding Stellar PREP High School, to sending hundreds of students to college, to producing elite athletes like Addison Gumbs, to launching Lincoln University athletics, Desmond Gumbs’ legacy is one of belief in young people and relentless commitment to opportunity.

His work cannot be reduced to headlines or records. It lives on in degrees earned, scholarships secured, leaders developed, and futures changed — across the Bay Area and beyond.

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoLIHEAP Funds Released After Weeks of Delay as States and the District Rush to Protect Households from the Cold

-

Alameda County3 weeks ago

Alameda County3 weeks agoSeth Curry Makes Impressive Debut with the Golden State Warriors

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of November 26 – December 2, 2025

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoSeven Steps to Help Your Child Build Meaningful Connections

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoSeven Steps to Help Your Child Build Meaningful Connections

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoTrinidad and Tobago – Prime Minister Confirms U.S. Marines Working on Tobago Radar System

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoTeens Reject Today’s News as Trump Intensifies His Assault on the Press

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoThanksgiving Celebrated Across the Tri-State