Business

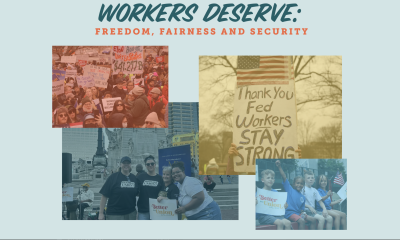

‘Right-to-Work’ Laws Depress Union and Non-Union Wages

Activism

Post Newspaper Invites NNPA to Join Nationwide Probate Reform Initiative

The Post’s Probate Reform Group meets the first Thursday of every month via Zoom and invites the public to attend. The Post is making the initiative national and will submit information from its monthly meeting to the NNPA to educate, advocate, and inform its readers.

Activism

Community Celebrates Turner Group Construction Company as Collins Drive Becomes Turner Group Drive

The event drew family, friends, and longtime supporters of Turner Group Construction, along with a host of dignitaries. The mood was joyful and warm, filled with hugs, handshakes and belated New Year’s greetings. Guests enjoyed hors d’oeuvres and a festive display of gourmet cupcakes as they conversed about the street sign reveal.

Activism

New Bill, the RIDER Safety Act, Would Support Transit Ambassadors and Safety on Public Transit

The RIDER Safety Act would allow public transit agencies to hire transit ambassadors trained in de-escalation, crisis response, and rider education and engagement. Acting as a visible, non-enforcement presence to deter low-level incidents and reduce conflict, transit ambassadors would ease the burden from law enforcement and enhance public safety.

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoJefferson County (AL) Democrats Open Qualifying for 2026 Primary Elections

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoSkater Emmanuel Savary Sharpens Routines for the 2026 U.S. Championships

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: With Gratitude and Praise for 2026

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoFrom Civil Rights to ICE Raids, Trump’s Unchecked Power Puts Every Community at Risk

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoFrom Civil Rights to ICE Raids, Trump’s Unchecked Power Puts Every Community at Risk

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoOP-ED: The Dream Cannot be Realized Without Financial Freedom

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoTravis Scott Teaches Us How to Give Forward

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoFour Stolen Futures: Will H-E-B Do The Right Thing?