Business

Report Shows HSBC Helped Rich Clients Dodge Taxes

In this Feb. 27, 2012 file photo, a pedestrian passes a branch of HSBC bank in London. The chair of parliament’s Public Accounts Committee says the former chief of HSBC must face serious questions after once-secret papers outlined how the bank helped the wealthy dodge taxes. Margaret Hodge told the BBC on Monday, Feb. 9, 2015 that Stephen Green, HSBCs former CEO, was either “asleep at the wheel, or he did know and he was therefore involved in dodgy tax practices.” (AP Photo/Kirsty Wigglesworth, File)

DANICA KIRKA, Associated Press

LONDON (AP) — A trove of leaked documents shows that HSBC’s Swiss private bank turned a blind eye to illegal activities of arms dealers and blood diamond traders while helping rich people evade taxes, according to a report based on the documents that was published Monday.

The data relate to accounts worth $100 billion held by more than 100,000 people and legal entities around the world.

___

WHAT HAPPENED

A former HSBC employee-turned-whistleblower, Herve Falciani, gave the data to French tax authorities in 2008. France shared it with other governments and launched investigations.

The French newspaper Le Monde obtained a version of the data and shared the material with the International Consortium of Investigative Journalists, which analyzed the material together with The Guardian and the BBC in Britain.

___

WHAT THE FILES SHOW

The leaked documents mainly cover the years 2005 to 2007.

HSBC, which is based in London but has operations globally, served those close to the regimes of former Egyptian President Hosni Mubarak, former Tunisian leader Ben Ali and Syria’s Bashar Assad.

The consortium said clients include former and current politicians from Britain, Russia, Ukraine, Kenya, India, Mexico, Lebanon, the Democratic Republic of the Congo, Zimbabwe, and Algeria.

Switzerland had the greatest number of clients of the data examined, followed by France, the United Kingdom, Brazil and Italy. In terms of ranking by value, Switzerland was first with $31.2 billion, followed by the United Kingdom with $21.7 billion; Venezuela with $14.8 billion; the U.S. with $13.4 billion; and France with $12.5 billion.

___

WHY IT MATTERS

Though some of the details of such operations were disclosed previously, when HSBC was fined in 2012 by the U.S. for allowing criminals to use its branches for money laundering, Monday’s information suggests HSBC took an active role in assisting the wealthy in hiding their money from authorities.

“The bank repeatedly reassured clients that it would not disclose details of accounts to national authorities, even if evidence suggested that the accounts were undeclared to tax authorities in the client’s home country,” the consortium said. “Bank employees also discussed with clients a range of measures that would ultimately allow clients to avoid paying taxes in their home countries.”

Crawford Spence, a professor of accounting at the University of Warwick, said this case was different than other recent tax scandals.

“HSBC has been complicit in clear tax evasion and law breaking rather than legitimate tax avoidance,” he said.

___

POTENTIAL FALLOUT

The disclosures could see governments step up their efforts to prosecute tax evaders and the bank itself.

Governments are looking to crack down on tax evasion to bolster their coffers depleted by the financial crisis and amid criticism that the rich aren’t paying their fair share.

In Britain, the report sparked criticism of tax authorities. The national tax agency clawed back 135 million pounds ($236 million) from some of the 3,600 Britons identified as using the Geneva branch of HSBC, but only one person has been prosecuted. France, by contrast, launched 103 legal actions.

“You are left wondering, as you see the enormity of what has been going on, what it actually takes to bring a tax cheat to court,” Margaret Hodge, chair of Parliament’s Public Accounts Committee, told the BBC.

Hodge said the former chairman of HSBC, Stephen Green, must face questions about whether he was “asleep at the wheel, or he did know and he was therefore involved in dodgy tax practices.”

In Belgium, an investigating judge is considering arrest warrants against some former and current officials of the HSBC bank if cooperation in an investigation on the Swiss operations does not improve.

___

WHAT HSBC SAYS

HSBC stressed that the documents were from eight years ago and said it has since implemented initiatives designed to prevent its banking services from being used to evade taxes or launder money.

Franco Morra, CEO of HSBC’s Swiss subsidiary, said the new management had shut down accounts from clients who “did not meet our high standards.”

“These disclosures about historical business practices are a reminder that the old business model of Swiss private banking is no longer acceptable,” he said in a statement.

__

Frank Jordans in Berlin and Greg Keller in Paris contributed to this story.

Copyright 2015 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Activism

Oakland Post: Week of May 8 – 14, 2024

The printed Weekly Edition of the Oakland Post: Week of May May 8 – 14, 2024

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window. ![]()

Bay Area

Mayor Breed Proposes Waiving City Fees for Night Markets, Block Parties, Farmers’ Markets, Other Outdoor Community Events

Mayor London N. Breed introduced legislation on April 26 to encourage and expand outdoor community events. The first will waive City fees for certain events, making them less costly to produce. The second will simplify the health permitting for special event food vendors through the creation of an annual permit. Both pieces of legislation are part of the Mayor’s broader initiative to bring vibrancy and entertainment to San Francisco’s public right of ways and spaces.

Mayor’s Press Office

Mayor London N. Breed introduced legislation on April 26 to encourage and expand outdoor community events.

The first will waive City fees for certain events, making them less costly to produce. The second will simplify the health permitting for special event food vendors through the creation of an annual permit. Both pieces of legislation are part of the Mayor’s broader initiative to bring vibrancy and entertainment to San Francisco’s public right of ways and spaces.

Outdoor community events are integral to San Francisco’s vibrant culture and sense of community. These events include night markets, neighborhood block parties and farmers markets, and bolster the City’s economy by supporting local businesses and attracting tourists eager to experience San Francisco’s unique charm and food scene.

They offer residents, workers and visitors, opportunities to engage with local artists, musicians, and food vendors while enjoying the San Francisco’s stunning outdoor spaces and commercial corridors.

The legislation will allow for more and new community gatherings and for local food vendors to benefit from the City’s revitalization.

“San Francisco is alive when our streets are filled with festivals, markets, and community events,” said Breed. “As a city we can cut fees and streamline rules so our communities can bring joy and excitement into our streets and help revitalize San Francisco.”

Fee Waiver Legislation

The events that can take advantage of the new fee waivers are those that are free and open to the public, occupy three or fewer city blocks, take place between 8 a.m. and 10 p.m., and have the appropriate permitting from the ISCOTT and the Entertainment Commission.

The applicant must be a San Francisco based non-profit, small business, Community Benefit District, Business Improvement District, or a neighborhood or merchant association. Fees eligible for waiver include any application, permit, and inspection/staffing fees from San Francisco Municipal Transportation Agency, Department of Public Health, Fire Department, Entertainment Commission, and Police Department.

Currently, it can cost roughly anywhere between $500-$10,000 to obtain permits for organized events or fairs, depending on its size and scope. Organizations and businesses are limited to a maximum of 12 events in one calendar year for which they can receive these fee waivers.

Food Vendor Streamlining Legislation

The second piece of legislation introduced will help special event food vendors easily participate in multiple events throughout the year with a new, cost-effective annual food permit. Food vendors who participate in multiple events at multiple locations throughout the year will no longer need to obtain a separate permit for each event. Instead, special event food vendors will be able to apply and pay for a single annual permit all at once.

“Many successful food businesses either begin as pop-up vendors or participate in special events to grow their business,” says Katy Tang, Director of the Office of Small Business. “Giving them the option for an annual special event food permit saves them time and money.”

Currently, food vendors are required to get a Temporary Food Facility (TFF) permit from the Department of Public Health (DPH) in order to participate in a special event, among permits from other departments.

Currently, each special event requires a new permit from DPH ranging from $124-$244, depending on the type of food being prepared and sold. Last year, DPH issued over 1,500 individual TFF permits. With the new annual permit, food vendors selling at more than four to six events each year will benefit from hundreds of dollars in savings and time saved from fewer bureaucratic processes.

“This legislation is a step in the right direction to make it easier for food vendors like me to participate in citywide events,” said Dontaye Ball, owner of Gumbo Social. “It saves on time, money and makes it more effective. It also creates a level of equity.”

Bay Area

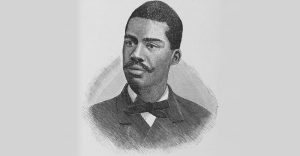

Faces Around the Bay: Sidney Carey

Sidney Carey was born in Dallas, Texas. He moved with his family to West Oakland as a baby. His sister is deceased; one brother lives in Oakland. Carey was the Choir Director at Trinity Missionary Baptist Church for 18 years.

By Barbara Fluhrer

Sidney Carey was born in Dallas, Texas. He moved with his family to West Oakland as a baby. His sister is deceased; one brother lives in Oakland.

Carey was the Choir Director at Trinity Missionary Baptist Church for 18 years.

He graduated from McClymonds High with a scholarship in cosmetology and was the first African American to complete a nine-month course at the first Black Beauty School in Oakland: Charm Beauty College.

He earned his License, and then attended U.C., earning a secondary teaching credential. With his Instructors License, he went on to teach at Laney College, San Mateo College, Skyline and Universal Beauty College in Pinole, among others.

Carey was the first African American hair stylist at Joseph and I. Magnin department store in Oakland and in San Francisco, where he managed the hair stylist department, Shear Heaven.

In 2009, he quit teaching and was diagnosed with Congestive Heart Failure. He was 60 and “too old for a heart transplant”. His doctors at California Pacific Medical Center (CPMC) went to court and fought successfully for his right to receive a transplant. One day, he received a call from CPMC, “Be here in one hour.” He underwent a transplant with a heart from a 25-year- old man in Vienna, Austria

Two years later, Carey resumed teaching at Laney College, finally retiring in 2012.

Now, he’s slowed down and comfortable in a Senior Residence in Berkeley, but still manages to fit his 6/4” frame in his 2002 Toyota and drive to family gatherings in Oakland and San Leandro and an occasional Four Seasons Arts concert.

He does his own shopping and cooking and uses Para Transit to keep constant doctor appointments while keeping up with anti-rejection meds. He often travels with doctors as a model of a successful heart-transplant plant recipient: 14 years.

Carey says, “I’m blessed” and, to the youth, “Don’t give up on your dreams!”

-

City Government2 weeks ago

City Government2 weeks agoCourt Throws Out Law That Allowed Californians to Build Duplexes, Triplexes and RDUs on Their Properties

-

Community4 weeks ago

Community4 weeks agoFinancial Assistance Bill for Descendants of Enslaved Persons to Help Them Purchase, Own, or Maintain a Home

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 24 – 30, 2024

-

Community4 weeks ago

Community4 weeks agoOakland WNBA Player to be Inducted Into Hall of Fame

-

Community4 weeks ago

Community4 weeks agoRichmond Nonprofit Helps Ex-Felons Get Back on Their Feet

-

Community4 weeks ago

Community4 weeks agoRPAL to Rename Technology Center for Retired Police Captain Arthur Lee Johnson

-

Alameda County2 weeks ago

Alameda County2 weeks agoAn Oakland Homeless Shelter Is Showing How a Housing and Healthcare First Approach Can Work: Part 1

-

Business4 weeks ago

Business4 weeks agoBlack Business Summit Focuses on Equity, Access and Data