Politics

FACT CHECK: Estate Tax Hits Fewer Than 1 Percent of Estates

In this March 17, 2015 file photo, Sen. John Thune, R-S.D. speaks to reporters on Capitol Hill in Washington. (AP Photo/Molly Riley, File)

STEPHEN OHLEMACHER, Associated Press

WASHINGTON (AP) — The federal estate tax inspires a lot of heated political rhetoric for a tax that very few people actually pay.

The House is scheduled to vote this week on a bill to repeal the estate tax, part of a package of bills highlighting Wednesday’s deadline to file income tax returns.

The federal tax on estates has been around in various forms since 1916. Republicans have long called for repealing it; they refer to it as the “death tax.” They claim it prevents small business owners and family farmers from passing businesses on to their heirs.

Democrats say repealing the tax is a giveaway to the rich, since the only families that pay it have many millions in assets.

The bill has little chance of becoming law. Senate Democrats appear to have enough votes to block it and President Barack Obama wants to increase the estate tax, not eliminate it. The White House threatened to veto the bill Tuesday.

Nevertheless, the House is expected to easily pass the bill, providing both political parties with a campaign issue in the 2016 elections for Congress and president.

___

THE CLAIMS: “The death tax is the wrong tax at the wrong time and hurts the wrong people. It’s the number one reason why family-owned businesses aren’t passed down to the next generation. It is Washington’s most immoral and calculated attack on the American Dream.” — Rep. Kevin Brady, R-Texas, sponsor of a House bill repealing the estate tax.

“For too long the federal government has forced grieving families to pay a tax on their loved one’s life savings that has been built from income already taxed when originally earned. Currently more than 70 percent of family businesses do not survive to the second generation, and 90 percent of family businesses do not survive to the third generation.” —Sen. John Thune, R-S.D., sponsor of a Senate bill repealing the estate tax.

“One of the laws that my friends on the other side of the aisle are trying to pass right now is a new, deficit-busting tax cut for a fraction of the top one-tenth of 1 percent. That’s fewer than 50 people here in Kentucky who would, on average, get a couple million dollars in tax breaks.” — Obama, speaking April 2 in Louisville.

___

THE FACTS: The federal tax rate on estates is 40 percent, but big exemptions limit the share of estates that pay it to fewer than 1 percent.

This year, the exemption is $5.43 million for a single person. Married couples can exempt up to $10.9 million. Larger estates pay taxes only on the amounts above these thresholds.

A total of 5,400 estates are expected to pay the tax this year — out of about 2.6 million deaths, according to the nonpartisan Joint Committee on Taxation, which provides official estimates for Congress. That’s 0.2 percent of all deaths in the U.S.

The exemption amounts increase with inflation, so the number of estates paying the tax each year is expected to grow slowly, reaching 5,500 in 2020 and staying there through 2024, according to JCT.

Each year, the estate tax generates less than 1 percent of federal tax receipts. But over time, it adds up.

Repealing the estate tax would reduce federal tax revenues by $269 billion over the next decade, according to JCT. The House bill does not include spending cuts to offset the lost revenue, so it would be added the deficit.

___

BACKDROP: Republicans say that some business owners get hit with the tax because they have valuable assets that don’t necessarily generate a lot of cash. They cite family farms, which may sit on valuable land but don’t generate enough money to pay hefty estate taxes unless heirs sell some or all the land.

“The appreciated value of land is phantom income. The value is locked in the asset, so if there’s no intent to sell the land, there’s no real income to tax other than the income the land actually produces, and that’s already taxed,” said Sen. Charles Grassley, R-Iowa.

Democrats counter that eliminating the estate tax would enable investors to amass vast sums of wealth that might never be taxed as long as they held it until they died and passed it to their heirs, who could receive it tax-free.

“The principle here is not to create a permanent aristocracy,” said Rep. Richard Neal, D-Mass.

___

Follow Stephen Ohlemacher on Twitter: http://twitter.com/stephenatap

Copyright 2015 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Activism

Oakland Post: Week of December 24 – 30, 2025

The printed Weekly Edition of the Oakland Post: Week of – December 24 – 30, 2025

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window.

Alameda County

Oakland Council Expands Citywide Security Cameras Despite Major Opposition

In a 7-1 vote in favor of the contract, with only District 3 Councilmember Carroll Fife voting no, the Council agreed to maintain its existing network of 291 cameras and add 40 new “pan-tilt-zoom cameras.”

By Post Staff

The Oakland City Council this week approved a $2.25 million contract with Flock Safety for a mass surveillance network of hundreds of security cameras to track vehicles in the city.

In a 7-1 vote in favor of the contract, with only District 3 Councilmember Carroll Fife voting no, the Council agreed to maintain its existing network of 291 cameras and add 40 new “pan-tilt-zoom cameras.”

In recent weeks hundreds of local residents have spoken against the camera system, raising concerns that data will be shared with immigration authorities and other federal agencies at a time when mass surveillance is growing across the country with little regard for individual rights.

The Flock network, supported by the Oakland Police Department, has the backing of residents and councilmembers who see it as an important tool to protect public safety.

“This system makes the Department more efficient as it allows for information related to disruptive/violent criminal activities to be captured … and allows for precise and focused enforcement,” OPD wrote in its proposal to City Council.

According to OPD, police made 232 arrests using data from Flock cameras between July 2024 and November of this year.

Based on the data, police say they recovered 68 guns, and utilizing the countywide system, they have found 1,100 stolen vehicles.

However, Flock’s cameras cast a wide net. The company’s cameras in Oakland last month captured license plate numbers and other information from about 1.4 million vehicles.

Speaking at Tuesday’s Council meeting, Fife was critical of her colleagues for signing a contract with a company that has been in the national spotlight for sharing data with federal agencies.

Flock’s cameras – which are automated license plate readers – have been used in tracking people who have had abortions, monitoring protesters, and aiding in deportation roundups.

“I don’t know how we get up and have several press conferences talking about how we are supportive of a sanctuary city status but then use a vendor that has been shown to have a direct relationship with (the U.S.) Border Control,” she said. “It doesn’t make sense to me.”

Several councilmembers who voted in favor of the contract said they supported the deal as long as some safeguards were written into the Council’s resolution.

“We’re not aiming for perfection,” said District 1 Councilmember Zac Unger. “This is not Orwellian facial recognition technology — that’s prohibited in Oakland. The road forward here is to add as many amendments as we can.”

Amendments passed by the Council prohibit OPD from sharing camera data with any other agencies for the purpose of “criminalizing reproductive or gender affirming healthcare” or for federal immigration enforcement. California state law also prohibits the sharing of license plate reader data with the federal government, and because Oakland’s sanctuary city status, OPD is not allowed to cooperate with immigration authorities.

A former member of Oakland’s Privacy Advisory Commission has sued OPD, alleging that it has violated its own rules around data sharing.

So far, OPD has shared Flock data with 50 other law enforcement agencies.

Activism

Families Across the U.S. Are Facing an ‘Affordability Crisis,’ Says United Way Bay Area

United Way’s Real Cost Measure data reveals that 27% of Bay Area households – more than 1 in 4 families – cannot afford essentials such as food, housing, childcare, transportation, and healthcare. A family of four needs $136,872 annually to cover these basic necessities, while two adults working full time at minimum wage earn only $69,326.

By Post Staff

A national poll released this week by Marist shows that 61% of Americans say the economy is not working well for them, while 70% report that their local area is not affordable. This marks the highest share of respondents expressing concern since the question was first asked in 2011.

According to United Way Bay Area (UWBA), the data underscores a growing reality in the region: more than 600,000 Bay Area households are working hard yet still cannot afford their basic needs.

Nationally, the Marist Poll found that rising prices are the top economic concern for 45% of Americans, followed by housing costs at 18%. In the Bay Area, however, that equation is reversed. Housing costs are the dominant driver of the affordability crisis.

United Way’s Real Cost Measure data reveals that 27% of Bay Area households – more than 1 in 4 families – cannot afford essentials such as food, housing, childcare, transportation, and healthcare. A family of four needs $136,872 annually to cover these basic necessities, while two adults working full time at minimum wage earn only $69,326.

“The national numbers confirm what we’re seeing every day through our 211 helpline and in communities across the region,” said Keisha Browder, CEO of United Way Bay Area. “People are working hard, but their paychecks simply aren’t keeping pace with the cost of living. This isn’t about individual failure; it’s about policy choices that leave too many of our neighbors one missed paycheck away from crisis.”

The Bay Area’s affordability crisis is particularly defined by extreme housing costs:

- Housing remains the No. 1 reason residents call UWBA’s 211 helpline, accounting for 49% of calls this year.

- Nearly 4 in 10 Bay Area households (35%) spend at least 30% of their income on housing, a level widely considered financially dangerous.

- Forty percent of households with children under age 6 fall below the Real Cost Measure.

- The impact is disproportionate: 49% of Latino households and 41% of Black households struggle to meet basic needs, compared to 15% of white households.

At the national level, the issue of affordability has also become a political flashpoint. In late 2025, President Donald Trump has increasingly referred to “affordability” as a “Democrat hoax” or “con job.” While he previously described himself as the “affordability president,” his recent messaging frames the term as a political tactic used by Democrats to assign blame for high prices.

The president has defended his administration by pointing to predecessors and asserting that prices are declining. However, many Americans remain unconvinced. The Marist Poll shows that 57% of respondents disapprove of Trump’s handling of the economy, while just 36% approve – his lowest approval rating on the issue across both terms in office.

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoLIHEAP Funds Released After Weeks of Delay as States and the District Rush to Protect Households from the Cold

-

Activism4 weeks ago

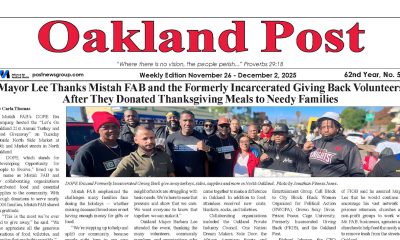

Activism4 weeks agoOakland Post: Week of November 26 – December 2, 2025

-

Alameda County3 weeks ago

Alameda County3 weeks agoSeth Curry Makes Impressive Debut with the Golden State Warriors

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoSeven Steps to Help Your Child Build Meaningful Connections

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoSeven Steps to Help Your Child Build Meaningful Connections

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoTrinidad and Tobago – Prime Minister Confirms U.S. Marines Working on Tobago Radar System

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoTeens Reject Today’s News as Trump Intensifies His Assault on the Press

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoThanksgiving Celebrated Across the Tri-State